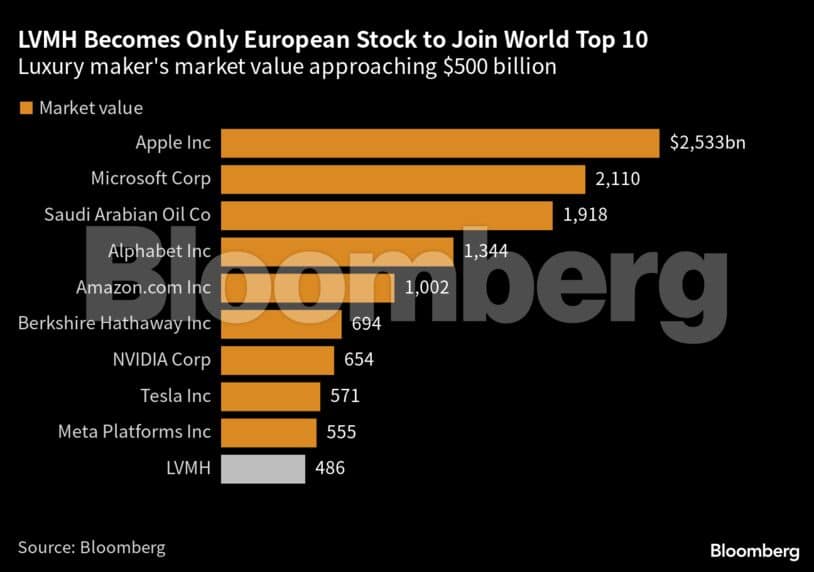

LVMH, Europe’s largest company by market value, has now made it to the world’s top 10.

A first-quarter sales beat sparked a 5 percent increase in the share price Thursday, giving the luxury powerhouse a 29 percent rally for the year. That, along with a gain in the euro against the dollar, lifted LVMH’s market capitalization to $486 billion, briefly ranking it as the world’s 10th-biggest company. Should it reach $500 billion, it would become the first European company to achieve that milestone.

“This illustrates the rise of wealthy people across the world, of a polarized society,” said Gilles Guibout, head of European equity strategies at AXA Investment Managers. “The luxury sector is therefore experiencing strong growth.”

For a growing crowd of investors, LVMH and its French luxury rivals are to the European stock market what Big Tech has been to the US: Dominant businesses whose growth holds up even as the economy waxes and wanes.

Shares of LVMH and Hermes International have on average returned more than 20 percent annually over the past decade and Kering has returned 16 percent. The Stoxx Europe 600 Index lags far behind at 8.3 percent annually.

“We have always invested in tech and in luxury, but the advantage of luxury on tech is that, while there are risks, disruption and obsolescence are lower,” said Guibout.

The robust sales of Louis Vuitton handbags and Moet Chandon champagne that have lifted LVMH’s share price also have bolstered the wealth of its founder, Bernard Arnault. He’s the world’s richest person, with a $198 billion fortune, according to the Bloomberg Billionaires Index.

The catalyst for this year’s luxury gains, as in many recent years, is China. Coming out of the world’s strictest lockdowns, Chinese shoppers are splurging on luxury handbags and jewellery. LVMH’s soaring sales show that demand for higher-priced goods remains unabated even as a global economic slowdown looms.

The rally in luxury shares has cemented Paris’s standing as Europe’s biggest stock market, eclipsing London. The benchmark CAC 40 Index is on a record-setting spree, with gains of more than 15 percent this year, outpacing other major markets.

The recent gains have taken LVMH’s valuation to 26 times forward earnings, twice that of the CAC 40. That doesn’t bother Nicolas Domont, a fund manager at Optigestion in Paris.

“It has become a must-have stock,” said Domont. “If it continues to deliver, I don’t have any problem paying the premium.”

LVMH shares closed 5.7 percent higher at 883.9 euros on Thursday.

Skeptics say the durability of luxury sales has yet to be tested in recent years by a long economic downturn. In a recession, all but the wealthiest of shoppers are likely to curb their spending, they say.

“I have been dead wrong advising clients to stay away from luxury but I am convinced (and stubborn) that something has to give in and that the risk-reward is still unfavourable,” Laurent Lamagnere, equity sales at Alphavalue in Paris, wrote in a note to clients on Thursday. “I still don’t buy the idea that luxury is immune to consumption.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!