Vijaya Diagnostic Centre opens its initial public offering on September 1, the second diagnostic chain to launch an IPO in a month after Krsnaa Diagnostics.

Here are 10 key things to know before subscribing to the public issue:1) IPO Dates

2) Price Band

3) Public Issue Details

The IPO is a complete offer for sale of up to 35.68 million shares by the promoter and investors – up to 5.09 million shares by promoter S Surendranath Reddy, 29.48 million shares by investor Karakoram, and 1.1 million shares by Kedaara Capital Alternative Investment Fund – Kedaara Capital AIF 1.

4) Fund Rising and Objectives of Issue

5) Lot Size and Investors' Reserved Portion

Retail investors can bid for a minimum of 28 shares and in multiples of 28 shares thereafter. They can invest a minimum of Rs 14,868 per lot and a maximum of Rs 1,93,284 for 13 lots as they are allowed to invest up to Rs 2 lakh in an IPO.

Half of the total offer is reserved for qualified institutional buyers, 15 percent for non-institutional investors, and the remaining 35 percent for retail investors. All potential bidders, barring anchor investors, are required to mandatorily utilise the Application Supported by Blocked Amount (ASBA).

6) Company Profile and Industry Outlook

Vijaya Diagnostic is the largest integrated diagnostic chain in southern India by operating revenue and one of the fastest-growing diagnostic chains by revenue for FY20. It offers pathology and radiology testing services through 81 centres and 11 reference laboratories across 13 cities and towns in Telangana and Andhra Pradesh as well as in the National Capital Region and Kolkata.

The company offers a comprehensive range of about 740 routine and 870 specialised pathology tests and 220 basic and 320 advanced radiology tests covering a range of specialties and disciplines.

Its individual consumer business contributed to 92 percent of revenue from operations in FY21.

According to a CRISIL report, the Indian diagnostics market was valued at Rs 71,000 crore to Rs 73,000 crore in FY21 and is projected to expand at a CAGR of 12-13 percent to Rs 92,000-98,000 crore by FY23, driven by a rise in health awareness and disposable incomes, increase in demand for better healthcare facilities and quality of care, and an increase in spending on preventive healthcare and wellness.

The diagnostics market in Telangana and Andhra Pradesh, the states in which it has a significant presence, is projected to grow to Rs 12,000-13,000 crore by FY23.

7) Competitive Strengths, and Strategies

a) The largest and fastest-growing diagnostic chain with a dominant position in south India. Well-positioned to leverage the high growth in India’s diagnostics segment.

b) An integrated diagnostics provider offering one-stop solutions at affordable prices with focus on superior quality standards.

c) High brand recall, driving high individual consumer business share and customer stickiness.

d) Strong technical capabilities, quality infrastructure and state-of-the-art technology with strong IT infrastructure.

e) Track record of consistent profitable growth, with strong cash generation and return metrics.

f) Dedicated management team with significant experience.

Strategies

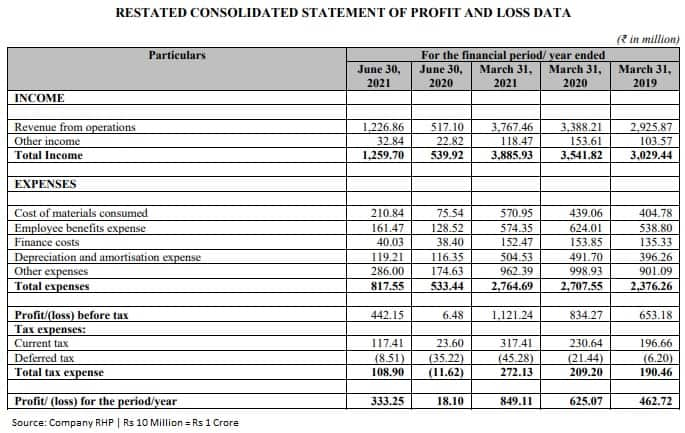

8) Financials

Profit in Q1 of FY22 increased to Rs 33.32 crore from Rs 1.8 crore a year earlier while revenue jumped to Rs 122.68 crore from Rs 51.71 crore.

The company’s profit has grown consistently to Rs 84.91 crore in FY21 from Rs 62.5 crore in FY20 and Rs 46.3 crore in FY19. Revenue increased to Rs 376.75 crore in FY21 from Rs 338.82 crore a year earlier and Rs 292.6 crore in FY19.

9) Promoters and Management

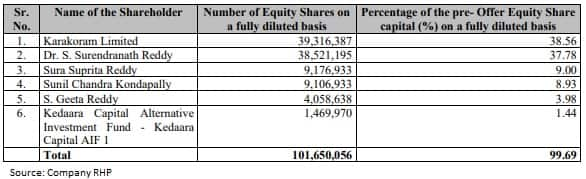

S Surendranath Reddy, the promoter of the company, holds a 37.78 percent stake in Vijaya Diagnostic and the promoter group holds 22 percent. Karakoram holds 38.56 percent in the company and Kedaara Capital Alternative Investment Fund – Kedaara Capital AIF 1 has a 1.44 percent stake.

Major Shareholders

S Surendranath Reddy is the executive chairman of Vijaya Diagnostic. He holds a bachelor’s degree in medicine from Shri Venkatesvara University and a provisional degree of Doctor of Medicine in radiology from Osmania Medical College, Hyderabad. He has over 19 years of experience with the company.

Sunil Chandra Kondapally is executive director. He has a bachelor’s degree in electrical engineering from Florida State University. He has over 17 years of experience in the pharmaceutical industry. He founded a pharmaceutical services company Trikona Pharmaceuticals in 2016 and QPS Bioserve India in 2004, which focuses on the development of innovative pharma-chemical products.

S Geeta Reddy is non-executive director, while Nishant Sharma, D Nageshwar Reddy, Shekhar Prasad Singh, Manjula Anagani and Satyanaryana Murthy Chavali are non-executive and independent directors.

Sura Suprita Reddy is CEO of the company and has been associated with the company since its incorporation. She holds a bachelor’s degree in commerce from Osmania University. She manages the strategy, clinical excellence and operational aspects of the company and its expansion. She was previously a director of Medinova Diagnostic Services, Namrata Diagnostic Centre, Park Health Systems and Doctorslab Medical Services.

Narasimha Raju KA is the chief financial officer. He holds a bachelor’s degree in commerce from Osmania University and is a member of the Institute of Chartered Accountants of India. He was associated with the company from June 2017 to November 2020 and was part of the finance, MIS and strategy department. He re-joined the company on March 15, 2021, and was appointed as CFO with effect from May 1, 2021. He previously worked with SR Batliboi & Co., NSL Renewable Power, and PBEL Property Development (India). He has over 14 years of professional experience.

10) Allotment, refunds and listing dates

Vijaya Diagnostic will finalise the IPO share allotment on September 8 and refund will be issued from September 9.

Eligible investors will get shares in their demat accounts on September 13. Trading in shares will start on the BSE and the NSE from September 14.

ICICI Securities, Edelweiss Financial Services and Kotak Mahindra Capital Company are the bookrunning lead managers to the issue.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!