Enterprise communication services provider Route Mobile is set to launch its Rs 600-crore initial public offering for subscription on September 9, with a price band at Rs 345-350 per share.

The issue, which will remain open till September 11 consists of a fresh issue of Rs 240 crore and an offer for sale of Rs 360 crore by promoters - Sandipkumar Gupta and Rajdipkumar Gupta.

The company plans to utilise the fresh issue proceeds for repayment of certain borrowings, acquisitions and other strategic initiatives, purchase of office premises in Mumbai, and general corporate purposes.

Majority of analysts recommend subscribing to the issue for listing gains as well as long term given the diversification in service offerings with one-stop solution provider to enterprise clients and mobile network operators, expected growth opportunity in cloud communication space, good financial performance, expected strong digital growth post COVID-19 world and no major competition in the space.

"The company is bringing the issue at p/e multiple of approximately 19x at higher end of price band of Rs 345-350 per share on post issue Q1FY21 EPS basis. Company with diversified service offerings for enterprise client base across a broad range of industries including social media companies, banks, financial institutions, e-commerce entities, travel etc has strong distribution reach. Also company’s established presence in all major geographies provides it an opportunity to leverage the growth in the cloud-communications space," said Hem Securities report written by Ashta Jain, Senior Research Analyst, while advising to subscribe the issue for listing gains and long term.

Route Mobile IPO to open on September 9: 10 key things you must know before subscribing

"The continuous investment in technology enabled company to expand its product and service offerings to include major mobile communication channels, including messaging, email, OTT and voice. With company intending to capitalize on the growth opportunity in cloud-communications space and endeavour to become onestop communications solution provider to enterprise clients and MNOs, the future prospects of company looks strong," the brokerage added.

Route Mobile provides cloud-communication platform as a service (CPaaS) to enterprises, over-the-top (OTT) players and mobile network operators (MNOs).

As of June 30, 2020, company had direct relationships with over 240 MNOs and four short messaging service centres hosted in various geographies across the globe. Company is able to access more than 800 networks across the world.

The company had served over 30,150 clients by June 2020, cumulatively since inception globally through its offices across Africa, Asia Pacific, Europe, Middle East and North America.

Happiest Minds IPO to open on September 7: Should you subscribe?

There are no listed domestic peers, whose business operations are comparable to Route Mobile.

"Peers like Tata Communications and Tanla Solutions are the proxy peers and have small presence in the services offered by Route Mobile. Most of its international peers are loss making. At the higher price band, the demanded P/E valuation is 28.8x, which we believe is attractive for a company engaged in mobile technology services," said Choice Broking in its report made by Research Analyst, Rajnath Yadav.

"A2P messaging services are most widely used by the enterprise and post-COVID world, migration to digital world will accelerate. Route Mobile has certain business moat like scale, collaboration with MNOs etc., which may act as an entry barrier for a new player," the brokerage added.

Over FY18-20, the company’s business has grown organically and inorganically, but profitability declined. During the period, it has made couple of acquisitions (365squared and Call2Connect) to boost its product offerings. Decline in EBITDA margin was mainly due to its focus on emerging markets enterprise business, said Choice Broking.

Over FY18-20, the company reported a 37.6 percent CAGR rise in consolidated topline to Rs 956.25 crore in FY20. EBITDA increased by 14.9 percent CAGR with 453bps contraction in margin from 15 percent in FY18 to 10.4 percent in FY20. PAT increased by 20.2 percent CAGR to stand at Rs 69.17 crore in FY20. The company had a positive operating cash flow over FY18-20, which increased by 70.4 percent CAGR. Average RoIC and RoE during the period stood at 30 percent and 27.2 percent, respectively.

Based on quick conservative estimate, Choice Broking expects 17.9 percent CAGR rise in topline over FY20-23 to Rs 1,567.01 crore in FY23. "EBITDA and PAT are anticipated to grow by 21.7 percent and 27.4 percent, respectively. EBITDA and PAT margins are likely to expand by 104bps and 190bps, respectively."

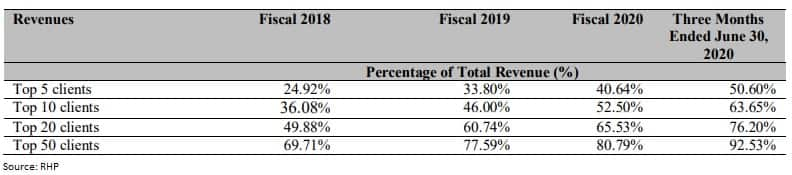

Company's diverse global client base helps limit its dependency on a specific client, industry or geography and reduces financial risk. Company's leadership position as a cloud-communication service provider is supported by global operations with 18 locations, & allowing to serve clients locally in the jurisdiction they operate.

"Management has till now infused only Rs 6 lakh capital in the company, and it will command a market cap of Rs 1,990 crore at the higher price band. This shows that it is a scalable business model, which can grow without capital infusion. At the upper end of the price band, company demands PE multiple of 25.3x on FY20 EPS, which we believe is quite reasonable considering the future prospects of the company," said Keshav Lahoti - Associate Equity Analyst at Angel Broking.

Lahoti is positive on the future outlook for the industry as well as the company. Hence, he recommended to subscribe to the issue for long term as well as for listing gains.

However, only Nirali Shah, Senior Research Analyst at Samco Securities believes that long term investors should avoid this IPO for the moment.

"Route Mobile has seen plausible growth in revenues and profits over the last 2 years however, there are some factors which might hurt the company's long-term growth prospects. Firstly, its core business being communication services, it faces stiff competition from peers which devoids it of any significant competitive advantage or strong moat. The company also reports high current liabilities on its books comprising around 55 percent of its balance sheet. This along with a low current ratio of 1.17 compared to the peer average of around 2 puts it in a weak spot. Additionally, Route Mobile has witnessed sharp growth in trade receivables which is growing faster than the revenues of the company. This could lead to working capital stress in the future. The company is also valued at the higher end of industry average at 25x P/E," she reasoned.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!