Jitendra Kumar Gupta

Moneycontrol Research

It is difficult to find an engineering company operating with a negative working capital, and state-owned RITES is one such company.

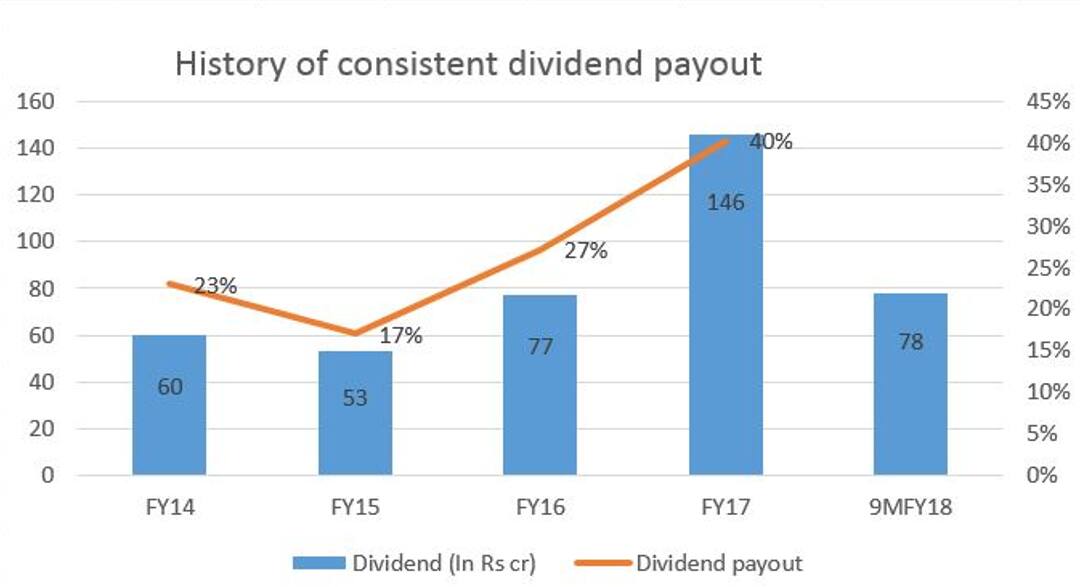

The company requires a bare minimum amount of capital to operate because its business generates free cash flow consistently, which is distributed in the form of divided.

This is also the reason why the issue is comprised entirely of an offer for sale by the government. The company is currently sitting on idle cash of around Rs 1,131 crore.

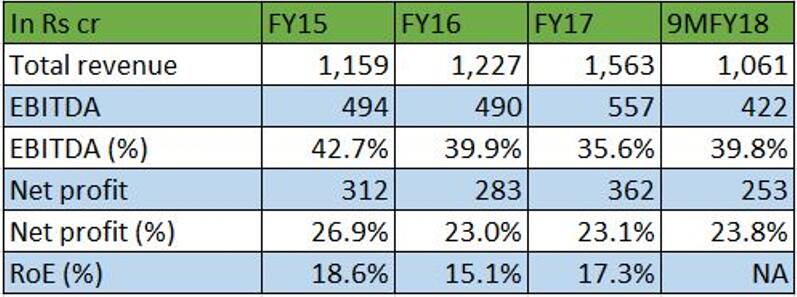

Businesses that can compound or grow without much capital expenditure or reinvestment tend to create value for shareholders in the long run. RITES' return ratios are among the best in the industry; the company has a net profit margin of around 24 percent and a core return on equity of close to 40 percent.

Core business: Backed by strong foundation

RITES, which has close to 44 years of operational experience, was incorporated under the Ministry of Railways and originally started as an engineering consultant for Indian Railways.

Gradually, the company started managing projects on behalf of the government in segments like railways, highways, metro projects, urban infrastructure, and ports.

The company mostly acts as a consultant where the execution and financing risks rests with the clients and the executor. The government and various ministries would typically specify their requirements and the scope of the project to RITES, and would rest assured that the work would be done.

The company is well diversified in terms of segments and geographies. It has undertaken projects in over 55 countries and remains the preferred choice for government-led projects.

Today, it is sitting on an order book of close to Rs 5,000 crore, around 4 times its revenue, and offers decent revenue visibility.

While the strong order book should support growth in the coming years, RITES is looking to leverage its capabilities in segments like renewable energy, railway electrification, and power procurement, and expand its international operations in segments like engineering services and exporting railways' rolling stock.

Valuations: Attractively priced

At a price of Rs 180-185 a share, the issue is priced at 11 times RITES' FY18 earnings, which is attractive for a company that has strong return ratios and reports good growth in earnings, backed by a robust order book.

Its listed peers like Engineers India and NBCC are trading at 20-40 times their FY18 earnings. The company's cash equivalent of close to Rs 1,130 crore is around 30 percent of its post-issue market capitalisation. On top of this, there is a 4 percent dividend yield and a discount of Rs 6 per share for retail investors.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!