Quick-service restaurant chain Burger King India is set to open its maiden public issue for subscription on December 2.

The issue will close on December 4 and the listing of equity shares is expected to be on December 14.

This would be the fourteenth IPO in the current year. Other public issues this year were SBI Card, Rossari Biotech, Mindspace Business Parks REIT, Route Mobile, Happiest Minds Technologies, Angel Broking, Chemcon Speciality Chemicals, Computer Age Management Services, Mazagon Dock Shipbuilders, UTI AMC, Likhitha Infrastructure, Equitas Small Finance Bank and Gland Pharma.

Kotak Mahindra Capital Company, CLSA India, Edelweiss Financial Services and JM Financial are book running lead managers to the Burger King issue.

Here are 10 key things you should know before deciding on the issue:

1) About IPO

The public issue consists of a fresh issue of Rs 450 crore and an offer for sale of 6 crore equity shares by promoter QSR Asia.

The fresh issue size was reduced to Rs 450 crore from Rs 600 crore earlier as company has undertaken a Pre-IPO placement by way of rights issue of Rs 58.08 crore to promoter selling shareholder at Rs 44 per equity share and preferential allotment of Rs 91.92 crore to Amansa Investments at a price of Rs 58.50 per share.

One can put bids for a minimum of 250 equity shares and in multiples of 250 equity shares thereafter, which means retail investors can apply for maximum up to 3,250 equity shares at higher price band.

Burger King trades at over 40% premium in grey market ahead of IPO

2) IPO Price Band

The company in consultation with merchant bankers has fixed IPO price band at Rs 59-60 per share, which is 5.9-6 times of its face value of equity shares.

3) Total Fund Raising

Burger King targets to raise Rs 804 crore at lower price band and Rs 810 crore at higher price band.

4) Objects of Issue

The company will utilise net fresh issue proceeds for funding roll out of owned Burger King Restaurants by way of repayment or prepayment of outstanding borrowings obtained for setting up of new owned Burger King Restaurants (Rs 165 crore) and capital expenditure incurred for setting up of new owned Burger King Restaurants (Rs 177 crore), and general corporate purposes.

But company will not receive any proceeds from the offer for sale. All the money will go to promoter selling shareholder.

5) Company Profile

As the national master franchisee of the BURGER KING brand in India, Burger King India has exclusive rights to develop, establish, operate and franchise Burger King branded restaurants in India.

Founded in 1954 in the United States, the Burger King brand (also known as the 'HOME OF THE WHOPPER') is owned by Burger King Corporation, a subsidiary of Restaurant Brands International Inc, which holds a portfolio of fast food brands - BURGER KING, POPEYES and TIM HORTONS. The Burger King brand is the second largest fast food burger brand globally as measured by the total number of restaurants, with a global network of 18,675 restaurants in more than 100 countries and US territories as at September 2020.

Technopak report says Burger King India is one of the fastest growing QSR brands to reach 200 restaurants among international QSR brands in India during the first five years of operations.

As of November 25, Company had 259 its owned Burger King restaurants and nine sub-franchised Burger King restaurants, of which 249 were operational, including two sub-franchised restaurants.

Growth in restaurants since March 31, 2016:

6) Financials, Peers and Market Share

Its revenue from operations grew from Rs 378.1 crore in FY18 to Rs 632.7 crore in FY19 and to Rs 841.2 crore in FY20, but it was just Rs 135.2 crore in first half of FY21 impacted significantly by the COVID-19 crisis.

In addition, although its same-store sales grew at 29.21 percent in FY19 and 6.11 percent in the nine months ended December 2019, same-store sales decreased by 0.30 percent in FY20 and by 56.9 percent in the six months ended September 2020 primarily due to the impact of the COVID-19 crisis.

Company continued to report losses in last every year but gross margin remained stable around 63.6 percent in first half of FY21 against 64.2 percent in FY20 and 63.6 percent in FY19.

Company has availed credit facilities of Rs 210 crore from ICICI Bank for the purpose of undertaking expenditure for opening new restaurants and renovation/ refurbishment of existing restaurants, expenses pertaining to the proposed initial public offering, and meeting working capital requirements. Of which, principal outstanding was Rs 181 crore as of November 16 this year.

Peer Comparison

Market Share by Revenue

7) Key Strengths

7) Key Strengths

Burger King believes following competitive strengths will enable it to continue growing business while delivering value to shareholders:

a) Exclusive national master franchise rights in India;

b) Strong customer proposition;

c) Brand positioned for millennials;

d) Vertically managed and scalable supply chain

e) Operational quality, a people-centric operating culture and effective technology systems;

f) Well defined restaurant roll out and development process;

G) Experienced, passionate and professional management team.

8) Key Strategies

Its strategy is to leverage competitive strengths to continue to grow business while delivering value to shareholders. Company will seek to achieve this by:

a) Increase the pace of expansion of restaurant network;

b) Continue to build on value leadership;

c) Continue to grow brand awareness and loyalty;

d) Actively manage unit economics and achieve economies of scale through operational leverage;

e) Leverage technologies across business

9) Promoters

Promoter of Burger King is QSR Asia Pte. Ltd. As of November 25, 2020, promoter held 28,93,11,110 equity shares representing 94.34 percent of the paid-up equity capital of company. QSR Asia is promoted by F&B Asia Ventures (Singapore) Pte. Ltd.

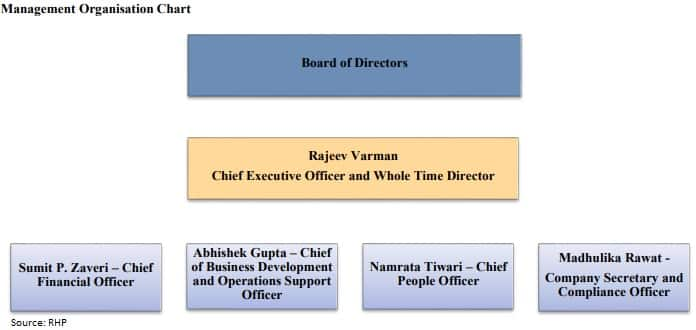

10) Management

Shivakumar Pullaya Dega is the Chairman and Independent Director of the company, while Rajeev Varman is the Chief Executive Officer and Whole Time Director.

Shivakumar Pullaya Dega was appointed as an Independent Director of company in October 2019. He is also currently serving as the

Group Executive President for corporate strategy and business development of Aditya Birla Management Corporation. He previously served as the Chairman and Chief Executive Officer (India region) of PepsiCo India Holdings and as a Managing Director of Nokia India.

Rajeev Varman, the Chief Executive Officer and Whole Time Director, is responsible for management and running of business of Burger King both at strategic and operational level and overview innovation in company across all areas including operations and production. He has over 20 years of work experience in food and beverage industry. Earlier, he worked with Tricon/Taco Bell brand, Lal Enterprises Inc., and Burger King Corporation where he held the positions of franchisee business manager, national manager –franchise operations, senior director of franchise operations, general manager, vice president and general manager, Canada and vice president & general manager, Northwest Europe.

Ajay Kaul, Amit Manocha, Jaspal Singh Sabharwal and Peter Perdue are Non-Executive Directors on the board, while Sandeep Chaudhary and Tara Subramaniam are Independent Directors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!