Explained | The PMC Bank crisis and why customers are panicking

If you have an account with Punjab and Maharashtra Cooperative Bank, here's are some important things you should know.

1/6

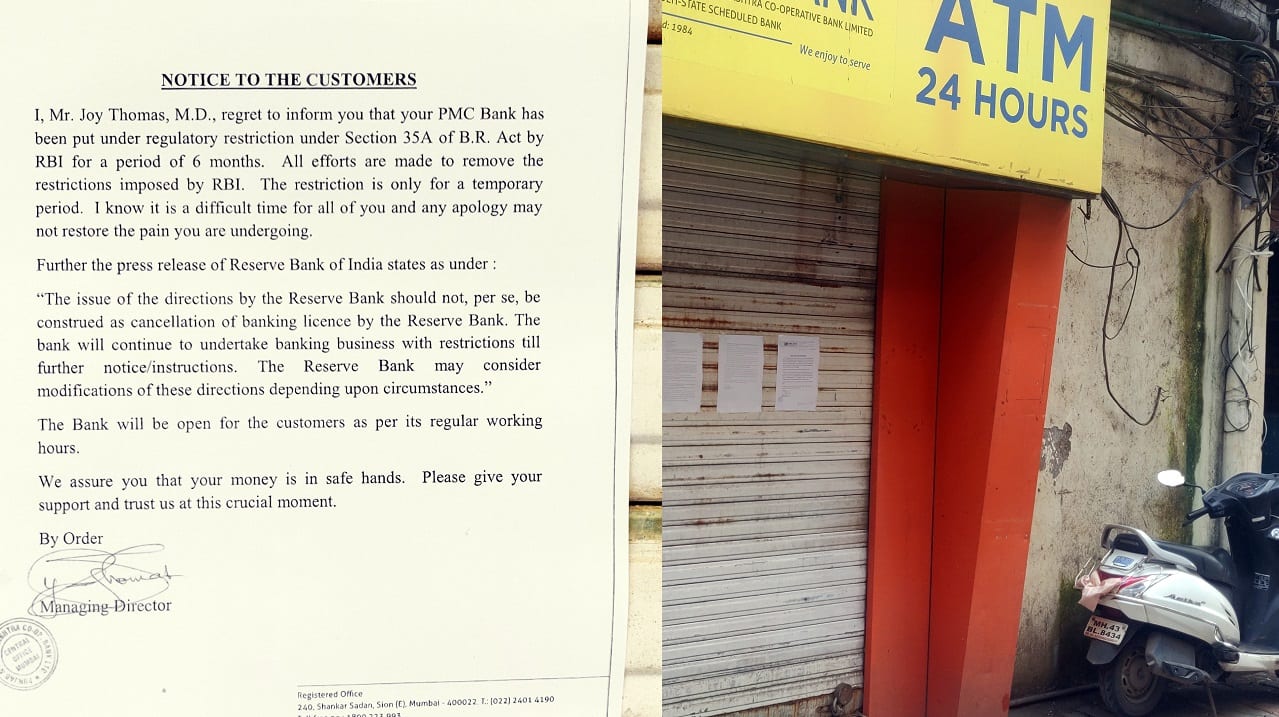

What happened on September 24? | Customers of Punjab and Maharashtra Cooperative Bank (PMC Bank) woke up to a shocker, when a message from the bank revealed that it has been put under directions by Reserve Bank of India (RBI) for six months. Within minutes, angry customers stormed to various branches demanding an explanation from the staff. Police officers were deployed at the branches to keep things in order. In some places, branch officials were not present, further leaving customers in the lurch. Shutters were downed on the bank's ATMs and security guards were seen putting up an apology from the managing director. (Image: Moneycontrol)

2/6

What happens when RBI imposes "directions" on a bank? | When RBI puts a bank under its directions, it is practically taking over the bank's operations. The bank's management is superseded and the board is dissolved. This happens when the regulator is not satisfied with the bank's functioning and takes the step to safeguard the interest of borrowers. In PMC Bank's case, it is said that the regulator found irregularities in lending. Under reporting of non-performing assets or higher than permitted exposure to same group accounts could have led RBI to take the step. An inspection is currently underway. (Image: Reuters)

3/6

What's PMC Bank take? | In a letter to customers, MD of PMC Bank, Joy Thomas, said that all efforts are being made to remove restrictions imposed by RBI. The restrictions are only for a temporary period. "I know it is a difficult time for all of you and any apology may not restore the pain you are undergoing," Thomas said. "The bank will be open for the customers as per its regular working hours. We assure you that your money is in safe hands," he added. (Image: Moneycontrol)

4/6

What customers can do? | You can withdraw only up to Rs 1,000 from the bank, irrespective of the type, total balance or the number of accounts. You can also offset your loan with your deposits only if both accounts are held with PMC Bank. You can renew existing term deposits on maturity in the same name and same capacity. In case of an emergency expense like hospitalisation etc, the RBI may grant an exception on a case-by-case basis, though chances are still low to access more money from the bank. (Image: Moneycontrol)

5/6

What the bank cannot do and how will it impact customers? | The bank cannot accept fresh deposits nor grant new loans without prior approval from RBI. Your EMIs from a PMC Bank account towards loans with other banks will not be honoured. If your account is linked to monthly utility services, the payments will not go through. ATMs have been taken off the payment network to avoid withdrawal from other ATMs. Online banking has been stopped so no funds can be transferred online. The norms apply to all customers, including senior citizens awaiting pension. (Image: Moneycontrol)

6/6

What is the way forward? | After six months, RBI will take a call on whether to relax some restrictions or extend the period based on the bank's books. If the discrepancies found can be corrected over the course of time, by sale of assets or other measures, the bank's functions will be reinstated. The RBI will try to clean up the bank's balance sheet and fix its asset-liability mismatch. However, if RBI believes that it is not in the interest of the bank's customers to keep it running, it may lead to complete closure of the bank. In such a scenario, the bank's arrangement with the Deposit Insurance and Credit Guarantee Corporation (DICGC) will kick in and customers will be eligible to claim up to Rs 1 lakh of their deposits with the bank. Until further orders from RBI, customers can only wait and watch whether they would receive their money or not. (Image: PTI)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!