Ruchi Agrawal

Moneycontrol Research

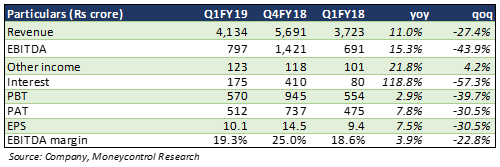

UPL reported a steady quarter with an 11 percent year-on-year (YoY) growth in revenue driven by a healthy growth in volumes and price hike during the quarter.

Earnings before interest tax depreciation and amortisation (EBITDA) improved 15.3 percent YoY with a 70 basis point margin expansion. Interest costs more than doubled YoY majorly due to higher working capital requirements.

This was also partly due to the forex gain of around Rs 50 crore in the year-ago quarter. However, the impact of higher interest cost was nullified to some extent by lower tax outgo.

Volumes drive growth

UPL saw a healthy 8 percent YoY growth in volumes, driven by LatAm (+17 percent yoy), India (+12 percent YoY) and Europe (+11 percent YoY). North America and rest of the world segment reported a 9 percent and a 6 percent YoY growth in volumes respectively.

The company was able to take price hike which helped in improving the realizations (+1 percent) and margins during the quarter. Currency movement was favorable and aided topline growth (+3 percent).

Domestic business

Domestic business reported a healthy 12 percent growth with a good performance across main brands of the company. With a normal monsoon prediction and reservoir levels, we expect the current slowness in Kharif acreages to pick up. The company has a growing portfolio of products which will help drive volumes.

International business

LatAM – Latin America which is a key operating region for UPL, reported a healthy volume growth. Inventory pile which was an issue in previous quarter seems to be getting cleared making way for price hike and healthy volumes. UPL has received registrations for several new products which are lined up to be launched in this region and would drive growth.

Europe: Higher acreages of beet helped bring in an 11 percent growth in the topline. Hot and dry weather played on volumes in the northern part. With low inventory takeover to the current quarter, volumes are set to grow.

North America: Cotton acreages improved in North America which will help drive the 8 percent topline growth in the region. However due to dry weather in some regions, the plant herbicide business was impacted. The region is now witnessing some inventory pile up which might have an impact in the upcoming quarter.

Rest of the world: New product launches drove better volumes in Asia. Rice, which is an important crop in this region saw improving acreages which helped in improving volumes in this region. With a decent rainfall the insecticide and fungicide portfolio is positioned for growth.

Outlook

With predictions of a normal monsoon, healthy line up of product portfolio, clearing up of inventory channels and various government incentives to promote rural demand, we see healthy growth for the company in the upcoming quarter.

In the longer run we see the Arysta deal to bring in significant synergies which would help in improving the margins and would push up UPL in the global big league. Though the acquisition alters the capital structure substantially, the deal seems a favorable one in the longer run. Despite the increase in the interest cost in the future the deal is EPS accretive in the long run.

Even with the volatility in the currency market, UPL remains a worthy pick given the steep correction in the stock in the past weeks and attractive valuations. Post the uptick in the last week, the stock is now trading at a 2019e PE of 12.7x and we believe the stock should be kept on the radar and it is a good time to enter.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!