The Government of India is set to receive a total dividend of Rs 82,995 crore in fiscal year 2025 from listed public sector enterprises including banks and finance firms, marking a decline of nearly one percent compared to Rs 83,749 crore in the previous year, according to Moneycontrol ‘s calculations. This marginal dip was largely driven by reduced payouts from around 15 public sector companies, including Indian Oil Corporation, Bharat Petroleum Corporation Ltd (BPCL), and Power Grid Corporation of India.

In FY25, 52 listed public sector undertakings (PSUs) declared dividends, up from 50 a year earlier. However, the overall dividend payout to shareholders will be around Rs 1.33 lakh crore, lower than Rs 1.38 lakh crore in the previous fiscal. The combined net profit of these firms rose modestly to Rs 4.32 lakh crore from Rs 4.2 lakh crore, but the overall payout ratio declined to 30.7 percent from 32.8 percent a year ago. The dividend payout ratio indicates the proportion of a company's net profit distributed to shareholders as dividends. Only those PSU firms are considered which have government holdings.

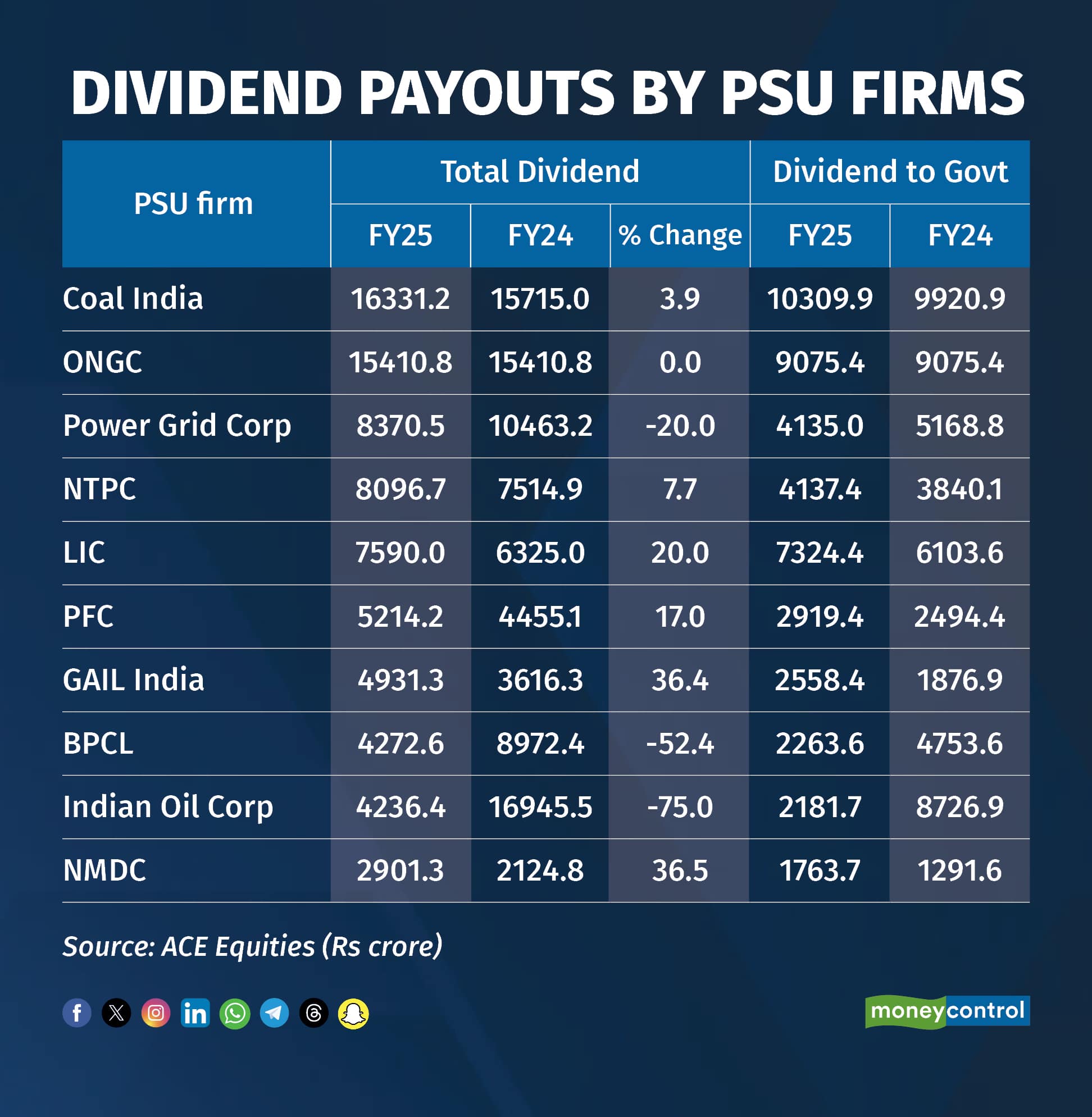

Among the most notable reductions, Indian Oil Corporation’s dividend to the government fell sharply by 75 percent to Rs 2,182 crore from Rs 8,727 crore, primarily due to a significant drop in its net profit. The fall was attributed to inventory losses, lower refining margins, and under-recoveries in the LPG segment.

Punjab & Sind Bank also recorded a 65 percent decline in dividend to Rs 47 crore from Rs 133 crore, while BPCL’s dividend dropped by 53 percent to Rs 2,264 crore compared to Rs 4,754 crore last year. Power Grid Corporation of India and Steel Authority of India posted reductions of nearly 20 percent each, while SJVN and Rail Vikas Nigam Ltd saw their payouts fall by over 18 percent.

Despite these declines, several PSUs delivered robust dividends. Coal India led the pack with a payout of over Rs 10,300 crore, up from Rs 9,920 crore in the previous year. ONGC followed with an unchanged dividend of Rs 9,075 crore, and State Bank of India raised its payout to Rs 8,150 crore from Rs 7,035 crore. LIC contributed Rs 7,324 crore, up from Rs 6,104 crore, while NTPC paid Rs 4,137 crore, compared to Rs 3,840 crore last year.

Dividend Surge from Public Lenders

Public sector banks (PSBs) also contributed significantly, reflecting improved financial performance across the sector. PSBs declared a total dividend of Rs 34,995 crore in FY25, a 25.7 percent increase from Rs 27,853 crore in the previous year. Of this, Rs 22,775 crore—roughly 65 percent—was paid to the government based on its shareholding, up from Rs 18,092 crore received in FY24.

The surge in bank dividends was driven by stronger payouts from institutions such as Punjab National Bank, Bank of India, and UCO Bank, which reported year-on-year increases ranging from 30 to 100 percent.

Additionally, the record dividend of Rs 2.7 lakh crore announced by the Reserve Bank of India (RBI) last week will further bolster government revenues. The combined dividend inflow from PSUs and the central bank is expected to provide a fiscal cushion, enabling higher capital expenditure without significantly straining the fiscal deficit targets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.