India is home to 90 percent of the world’s diamond cutting and polishing units, making it the largest exporter of diamonds. The country ships diamonds worth $25 billion every year to countries such as China, the U.S. and the United Arab Emirates.

Taking note of India’s thriving gems and jewellery sector, finance minister Nirmala Sitharaman declared lab-grown diamonds (LGDs) as a focus area for export promotion while reducing basic customs duty on seeds used in their manufacture. This move aims to help boost exports and make India a world leader in the LGD market, which can become a key alternative to natural diamonds as diamond mines deplete.

LGDs are manufactured by subjecting carbon to high temperatures and pressure, mimicking how they are formed naturally and have the same physical, chemical and optical attributes as their mined counterparts. The seed used in the manufacture is a single crystal diamond slice about the width of human hair.

“The LGD market share within the entire diamond industry is estimated to grow steadily and command 10 percent of the diamond market worldwide by 2030,” said Sabyasachi Ray executive director, Gem and Jewellery Export Promotion Council (GJEPC), noting that this sector has the potential to contribute significantly to the country’s GDP in the form of $7-8 billion towards exports.

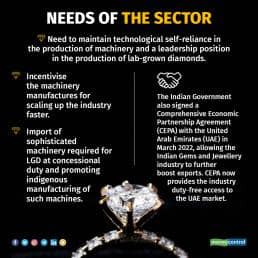

“With depleting mines, the future of the diamond industry is lab-grown diamonds and if India can produce the machines including the magnetron, a vital component for LGD growing, and the seeds by itself, it can seize the throne to become the world’s LGD leader,” Ray told Moneycontrol.

Sitharaman also announced the setting up of a research and development grant to encourage indigenous production of LGD seeds and machines and to reduce import dependency.

Following the announcements, a research grant of Rs 242 crore over five years to IIT Madras was approved. This has been based on nearly two decades of work experience in diamond research by the institution, having developed many technologies for industry, space and defence sectors. The recommendation was made by the Department of Commerce.

Further, the custom duty on seeds used in manufacturing rough lab-grown diamonds has been reduced from 5 percent to zero, which will promote export competitiveness and boost domestic manufacturing.

Research in technology, homegrown seeds and documented process parameters will encourage new entrepreneurs to enter the LGD business, making it easier and more cost-effective to boost exports and establish market dominance.

| Year | Exports of Polished LGD | Exports of Rough LGD |

| Million Carats US$ Million | Million Carats US$ Million | |

| 2017-18 | 1.21 216.07 | 0.21 14.3 |

| 2018-19 | 1.09 224.55 | 0.41 16.5 |

| 2019-20 | 4.02 421.09 | 0.38 7.5 |

| 2020-21 | 4.41 636.44 | 0.56 26.45 |

| 2021-22 | 5.52 1313.99 | 1.60 75.57 |

What would the R&D focus on?

There are two processes via which LGDs can be produced—High-Pressure, high-temperature (HPHT) and Chemical Vapor Deposition (CVD).

HPHT is a process where LGDs are produced from carbon material in apparatuses that mimic the conditions of natural diamond formation within the earth.

CVD involves filling a vacuum chamber with carbon-containing gas that crystallises on a synthetic diamond seed. This method uses lower temperatures and pressures than HPHT.

CVD is predominantly the technology used in India while HPHT is prevalent in China.

MS Ramachandra Rao, a professor at the department of physics, IIT Madras, who will be the principal investigator for this initiative, pointed out that "the growing demand for LGDs requires dedicated research to realise not only gem-quality diamonds but also to realise a plethora of electronic applications (5G/6G telephony, magnetometry, thermal management, sensors and quantum technologies."

He added that CVD reactor manufacturers in India import critical components like microwave generators, vacuum pumps and sensors. Even good-quality diamond seeds are imported.

"There is a need for indigenously developing these critical components, technologies and seed substrates (mother-seed) to make India self-sustainable in the sector," Rao said.

Research is also needed to conduct studies to optimise the process parameters to grow pure, large-volume and scalable diamond crystals.

How will LGDs play in the economy?

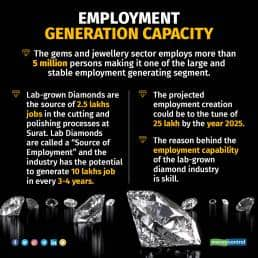

The gems and jewellery sector plays a significant role in the Indian economy, with a contribution of around 7 percent to GDP and 10-12 percent to the country’s total merchandise export, according to the Ministry of Commerce and Industry. It is one of the leading sectors in terms of job creation, providing employment to approximately 5 million skilled and semi-skilled workers, the ministry added. As per Economic Survey 2023, the sector was among the leading contributors to export in India in FY22.

India is already the world’s largest producer of CVD diamonds, despite its limits in the sector, and holds the potential to become the largest LGD supplier with the recent announcements. “We have a tremendous opportunity. We are only 10 percent of market share yet and have space to take over the remaining 90 percent,” said Prasad Kapre, a sector analyst and task force member of the gems and jewellery sector for the Confederation of Indian Industries.

As of 2019, China was by far the world’s largest producer, producing 56 percent of the global LGD production volume that year. India was the world’s second-largest producer, with a distant 15 percent share of LGD production, followed by the US at 13 percent and Singapore at 10 percent, said a report by GJEPC.

Globally estimated at $1 billion in 2020, the lab-grown diamond jewellery market is estimated to rise to $5 billion by 2025 and may exceed $15 billion by 2035, added Ray. According to Allied Market Research, the global lab-grown diamonds market size is projected to reach $49.9 billion by 2030 at a CAGR of 9.4% from 2021 to 2030.

There has been an impressive 80 percent growth in exports of LGDs in recent years.

| Commodities | 2018-2019(US$ Billion) | 2019-2020(US$ Billion) | 2020-2021(US$ Billion) | 2021-2022(US$ Billion) |

| Cut & Polished Diamonds – Natural | 23.82 | 18.66 | 16.29 | 24.23 |

| Polished Lab Grown Diamonds | 0.24 | 0.42 | 0.64 | 1.3 |

What is their current consumption in the country vs outside?

Still at a nascent stage, LGD demand is expected to gradually scale up in India, while in other parts of the world like the U.S., the commercial marketing of LGDs is already going on in full force for the past few years.

“The US is currently the biggest consumer with a consumption of over 80 percent of LGDs in the world,” said Kapre, adding that it will be the affordability factor that will get the Indian market involved.

“With the mining cost gone, the price of a diamond decreases significantly, making it much more affordable. The Indian market, though currently small, will suddenly open up and grow as India is a price-conscious market,” he said.

He pointed out a huge gap in the market that will be filled by the LGDs in the near future. “Diamond acquisition in India is hardly 4 percent. So basically, 96 percent of our potential target audience is still not buying diamonds. That is because the sweet spot for consumers in India is price affordability, which lies under Rs 30,000. They thus end up buying plain gold as that is what is available in that price range. But with LGD, adding another Rs 5,000- 10,000 will get the consumer a solitaire (0.5 carat) ring. That is a huge aspiration for the balance 96 percent,” he said.

With the world's largest youth population, analysts are hopeful that India will become one of the largest LGD consumer markets.

Challenges that remain

While everything looks hunky-dory, there still are challenges that are staring at the sector. The first will be the availability of scientists to oversee the growth of LGDs and the second will be the resistance the market might put up.

“Growing a diamond is a sensitive process and even a second of electricity failure can change the structure of the diamond and it may not be a diamond anymore. Good scientists will be needed in abundance if the industry is to grow to cater to the needs of the world,” said Kapre.

Vasudha Nagpal, a third-generation owner of a premium jewellery store in Delhi’s Karol Bagh, Jewels by Yogmaya, said that while their store has seen demand for LGDs increasing in the past few months, they are still unsure if they would be going down that path.

“We as a company are still resistant to keep and sell such jewellery at our store. We are known for our brand, people trust us. We fear this might affect the reputation we have spent decades to build,” she said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!