Radico Khaitan, a spirits company known for selling low-priced brands, is now increasing focus on its premium and luxury alcohol products to keep margins intact, analysts said.

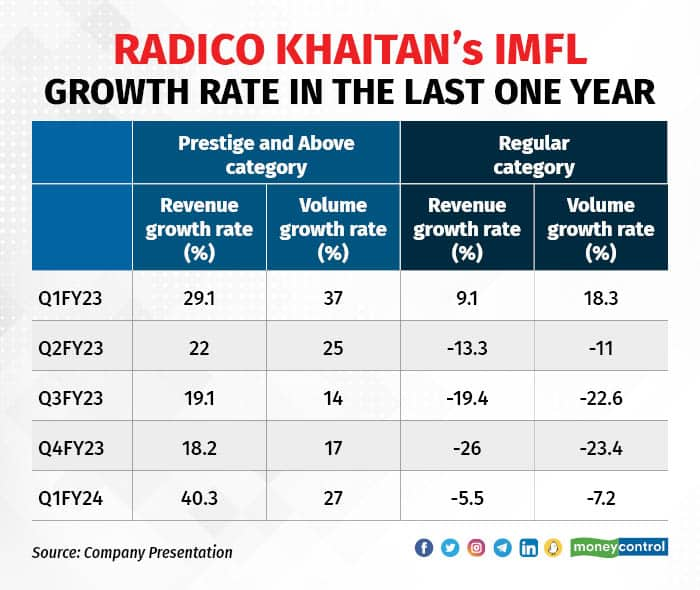

The prestige and above (PA) category for Radico Khaitan grew faster than its regular category last year, gaining traction in terms of revenue and volumes. Radico Khaitan's prestige and above category has brands like Rampur Indian Single Malt Whiskey, Royal Ranthambore Whiskey, Magic Moments Dazzle Gold Vodka, and others.

Analysts told Moneycontrol that escalating input costs have plagued the spirits industry. In the regular category, where products are already priced low, there is little scope for Radico Khaitan to earn when raw material costs rise. The premium category, with higher price tags, offers a safety net against rising production costs, they said.

“Radico Khaitan’s PA segment would be making a decent margin as compared to the regular segment even if glass and ENA (extra neutral alcohol) costs are high,” said Ajay Thakur, lead analyst for consumer staples at Anand Rathi Shares and Stock Brokers.

Another analyst said it is not easy for Radico Khaitan to increase prices of its regular brands and boost profit margins when raw material costs are elevated.

“Since alcohol is a regulated industry, companies cannot raise prices of their brands without considering it with the state government,” said the analyst, who did not want to be identified.

Better than industry leader

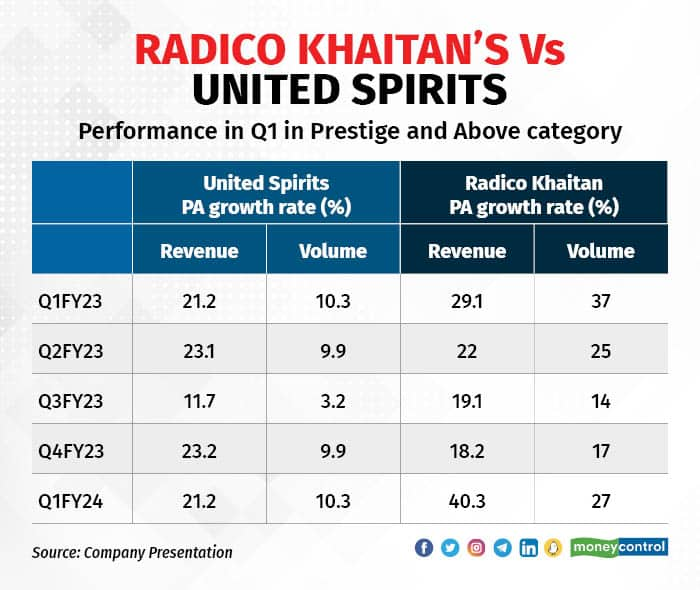

Growth in Radico Khaitan’s premium category spirits outperformed that of industry leader United Spirits in the April-June quarter. The reason was Radico Khaitan’s stream of new launches which were accepted by consumers.

“Radico Khaitan is not only launching new products but also scaling up these products, which in turn would bring revenues for the company,” said Kaustubh Pawaskar, DVP Fundamental Research at Sharekhan.

However, in terms of the EBITDA margin for FY23, United Spirits at 13.5 percent was ahead of Radico Khaitan at 11.4 percent.

What’s next?

Analysts said the share of Radico Khaitan’s premium category in total revenue and volumes is expected to grow. The category contributed 37.5 percent to volumes in FY23 compared with 30.2 percent in FY22 and 29 percent in FY20.

“Radico Khaitan’s PA category is estimated to contribute 40 percent to its total IMFL volumes by FY25,” said Pawaskar.

India’s alcohol market is dominated by whiskey, followed by beer, and then wine. According to a Nuvama Institutional Equities report in August, the prestige segment holds the dominant position in the Indian whisky market, with 50 percent of the market share by volume. The number is expected to reach 53 percent by FY25.

In terms of value, the premium whisky market is expected to grow 33 percent by FY25 compared with 31 percent in FY21.

The growing share of premium brands in the whisky-dominated alcohol market has compelled companies to focus more on this segment

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!