BUSINESS

Why India wins in an 'America First' world: Pinetree's Ritesh Jain on Trump's tariff gambit and the global reset

The US-based hedge fund manager believes Trump’s policies are likely to hurt the dollar and US equities.

BUSINESS

MC Explainer: Why Stock Markets Are Crashing. Understanding Trump's Tariff Policy and Impact. What Investors Should Do.

US equities have reacted violently to Trump’s tariff re-adjustments. What it means for global investors and how Indian investors should deal with it

BUSINESS

We are likely in recovery mode, market sentiment isn't as weak as it looks: Indiacharts' Rohit Srivastava

Mid- and small-cap indices, along with Bank Nifty, are holding up well, said Rohit Srivastava

BUSINESS

In no rush to invest heavily in IT stocks; valuations alone not enough, need growth prospects: Vallum's Manish Bhandari

The Director and Principal Officer of Vallum Capital Advisors believes that India could benefit from White House's tariff regime, and that that the Indian mid cap story is still going strong

MARKETS

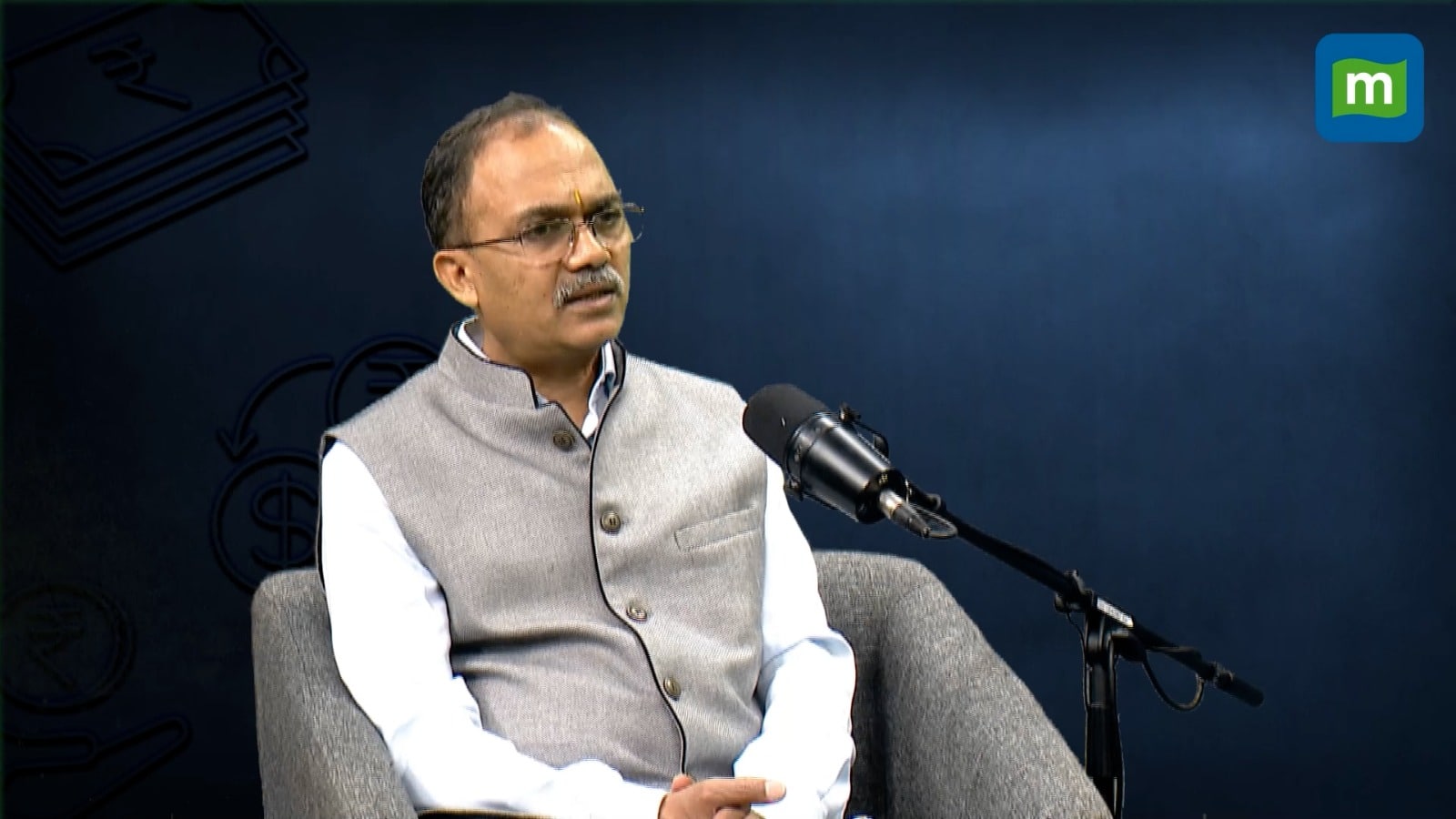

Trump tariffs won’t impact India, barring some sectors and stocks, says Prashant Jain

In a free-wheeling interview on The Wealth Formula with Mahalakshmi, the veteran fund manager shares his take on the market and how he is approaching investments

BUSINESS

$500 billion wealth hit will outweigh benefits from tax breaks, curbing consumption: Prashant Jain

Optimism on consumer stocks is just another “narrative,” according to the veteran fund manager

BUSINESS

Seven in 10 mid- and small-cap stocks overvalued; pace of rapid fall over, says Prashant Jain

Excesses built over years will take time to normalise, Jain noted

BUSINESS

Narrative-driven phase in markets is over; rebounds don’t signal a reversal in momentum stocks, says Prashant Jain

Stock price performance within narrative-driven sectors will show sharp divergences going forward, Jain noted

BUSINESS

Prashant Jain says FPI selling is opportunity, not risk

Jain expects Nifty to compound in the low double digits over the next three to five years

BUSINESS

Stick to domestic-focused businesses to beat Trump uncertainty, says Nippon India’s Sailesh Raj Bhan

Even if there is no significant increase in tariffs on India directly, companies with export exposure will remain vulnerable to potential tariff hikes in the regions they supply to

BUSINESS

Forgotten bluechips will be the next big winners: Nippon India’s Sailesh Raj Bhan

The fund managers believes companies across consumer, industrials and sectors like cement will emerge as the top 10% winners over the next three years

BUSINESS

India’s largest small-cap fund manager says mid- and small-caps still overvalued, will continue to correct

Sailesh Raj Bhan, CIO of Nippon India Mutual Fund, said two-thirds of mid- and small-caps continue to be in overvalued territory, but continued flows will prevent any sharp sell-off. Nippon India manages the largest small-cap fund with Rs 50,826 crore

BUSINESS

Trump Tariff, FII Selling Small-cap Correction – what’s next for investors? A star fund manager breaks it down

Sailesh Raj Bhan, CIO – Equity Investments at Nippon India Mutual Fund, feels two-thirds of the small-and mid-cap stocks still are overvalued but it may take time for these to correct

BUSINESS

Why defence stocks are firing – three catalysts and a warning shot

Defense stocks have staged a sharp rebound, surging up to 30 percent in a week, driven by domestic order momentum and global military spending.

BUSINESS

Markets Rebound: Sell, Hold, Double Down? Strategies for a post-correction market

What to do, what not to do in order to stay in the game – and win

BUSINESS

China is a good cyclical market to play; India still most expensive relative to other EMs

Arjun Divecha, Partner and Head of Emerging Markets for GMO, thinks India is still expensive while China is well-placed for a cyclical rebound

BUSINESS

Identifying multi-baggers: Chris Mayer, author of 100-Baggers, shares the key metrics that drive his investment decisions

Finding 100-baggers in today’s market is both easier and more difficult than in the past, says Mayer

BUSINESS

Time to be constructive; small, midcap correction clears market excesses, says one of India’s best mid-cap fund managers

Pankaj Tibrewal, Founder, Ikigai Asset Manager Holdings says that value seems to be emerging in pockets, across the mid cap space.

BUSINESS

Trump tariff, Fed stance, DeepSeek: The CEO of this global investment research company breaks it down

Morningstar’s Kunal Kapoor thinks the biggest wild card for global markets over the next few months is Donald Trump’s tariff plan, which has the potential to ripple across most markets and sectors.

BUSINESS

'Incredibly happy and here forever', says CEO of Europe’s top AMC on India exposure

Valerie Baudson, CEO of Amundi Asset Management on how she views the JV with SBI, her take on Indian markets, Trump trade, ESG theme.

BUSINESS

MC Explains: Banks facing liquidity challenges – but what exactly are these and what is the RBI doing about it

Market experts are unhappy that the RBI did not announce any further “liquidity easing measures” as part of the policy announcements today

BUSINESS

MPC impact on stock markets: Key takeaways on rates, growth, risks

RBI MPC Meet: The 25 basis point repo rate cut was in line with market expectations

BUSINESS

What to expect Post-Fed: Between Powell’s playbook, FII exodus, and the Budget balancing act, markets may go nowhere

The Federal Reserve’s “patient” approach to effecting rate cuts may keep FIIs selling in Indian markets at a time when earnings growth and valuations provide little comfort

BUSINESS

MC Exclusive: Markets according to Mishra -- Neelkanth Mishra. On capex, consumption, deficit, dollar, earnings, valuations and returns

Mishra expects stocks prices to remain flat this year even as earnings will continue to growth