BUSINESS

India must double down on domestic growth to sustain momentum amid global uncertainty: CEA

Private sector is also starting to deploy its capital, and that will continue. Capital formation as a share of GDP is likely to be 35 percent in five years from 30.8 percent, says Anantha Nageswaran

BUSINESS

Dont hinder innovation, but be more conscious of cost, benefits of crypto, online gaming: CEA

Regulators need to be cautious of their unelected powers, they need to be accountable, says CEA

BUSINESS

Inflation, debt, supply chain hurdles call for integrated action from govt, industry: FM

FM Nirmala Sitharaman said that the agri stack will be the next big thing from India after digital public infrastructure

BUSINESS

Rate changes not a part of the Income-Tax Act review, says govt official

The income tax review committee is to looking to finalise and submit all the 23 reports by mid-December

BUSINESS

Aim to earn 5 times of stipend cost from Bima Sakhi scheme: LIC MD & CEO

In the first year, the cost of stipend will be at Rs 840 crore. But we expect five times of the stipend cost as premium income in the first year, says Siddhartha Mohanty

BUSINESS

Shift policy focus from revenue maximisation to fostering growth, economists tell FM in pre-budget meet: Sources

The economists sought a relook at the current trajectory of fiscal consolidation and urged a re-evaluation of key taxation policies in order to boost growth

BUSINESS

Warmer winter could impact crop yields, delay moderation in food inflation: Experts

Former Agriculture Secretary Siraj Hussain told Moneycontrol that delayed wheat sowing, particularly in Punjab due to the harvesting of paddy, could amplify the impact of high winter temperatures.

BUSINESS

No cut in repo rate by RBI was expected amid high inflation: Economists

"However, the cut in the CRR by 50 bps would help support growth, after the sharp downward revision in the forecast for FY2025."

BUSINESS

Centre may seek higher share in tax devolution from 16th Finance Commission

The Centre’s demand for a larger chunk in the devolution pie could very well be at crosshairs with states, with some seeking a hike in their stakes in the divisible pool of taxes to as much as 50 percent

BUSINESS

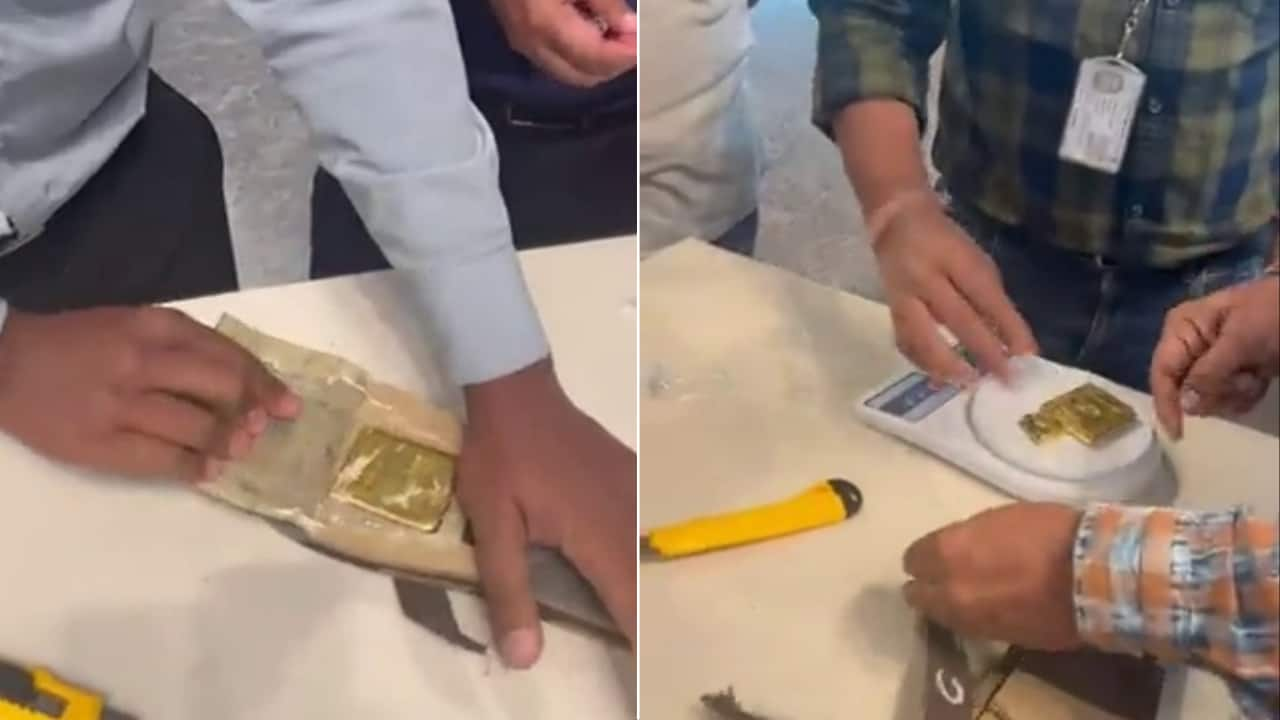

4,869 kg of smuggled gold seized in FY24, Myanmar border major smuggling route

Smugglers, who are getting increasingly smart, are making the most of porous borders in the Northeast and India’s voracious appetite for gold

ECONOMY

FM Nirmala Sitharaman holds meet for ‘big ticket’ budget reforms

Internal discussions and pre-budget meetings are underway in the Finance Ministry.

BUSINESS

GST GoM on cess likely to seek extension from Council, examining legal aspects

The GoM was initially scheduled to submit its report by December 31, 2023. However, its deliberations are ongoing, with additional legal and procedural complexities to address.

BUSINESS

MC Exclusive: GST GoM proposes rate tweaks on 148 items, Textile sector braces for major rejig

The GoM has recommended increasing the rate to 28 percent for several luxury goods which are highly priced in textiles, wrist watches, etc.

BUSINESS

Balanced approach to retrospective taxation needed for online gaming: Pinki Anand

She was speaking at the Skoch Summit on ‘New Dimension in Inclusive Growth,’ held on November 30.

BUSINESS

Time to simplify GST with fewer rates to curb misclassification, boost compliance: Govinda Rao

"Catering is taxed at 18 percent, but non-star hotel restaurants face a 5 percent tax. If the restaurant is providing catering service, it leads to scope for mis-classification and tax evasion."

BUSINESS

Expect capex push to revive momentum in GDP growth: CEA

"The global developments have shown up, export orders have moderated. There is a spillover of global factors on domestic manufacturing. We should be realistic about growth in a global context."

BUSINESS

Customs duties to soon be payable via UPI, debit and credit cards: Revenue Secretary

Currently, customs duties in India can be paid through net banking, over-the-counter payments, etc.

BUSINESS

India talks to Japan, South Africa to expand trade ties through AEO programme: CBIC chairman

The clearance time for AEO-certified businesses is approximately 40 percent lower compared to non-certified entities

BUSINESS

GST collection in Nov may scale 2nd highest level on the back of robust festive sales: Official

GST collections for November may exceed Rs 1.87 lakh crore. Collections from Maharashtra and Jharkhand are delayed in November due to elections

BUSINESS

CBDT black money report flags repeat penalties for non-disclosure of foreign assets

The internal report also suggests focusing on large evasions for better use of resources while calling for clarity on repeated penalties for non-disclosure of foreign assets

BUSINESS

UPI transactions in April-September grow 35% to Rs 122 lakh crore

Volume up 46 percent at 8,566.52 crore. There 6.32 lakh case of UPI frauds during the period valued at Rs 485 crore

BUSINESS

MC Interview I NFRA may extend global audit norms to PSUs, unlisted firms after 2026, says Ajay Bhushan Pandey

Among major fraud cases like DHFL, Cafe Coffee Day, Reliance Home Finance, and Reliance Capital, in some, the losses exceeded Rs 50,000 crore. Had they been flagged in the initial stages, the losses could have been significantly lower, said the NFRA board chairman

ECONOMY

Solicitor General backs NFRA’s authority to issue audit Standards on quality management

The legal opinion says that ICAI Act, 1949, does not provide Institute of Chartered Accountants of India with the authority to issue standards related to auditing or quality management

BUSINESS

Finance ministry likely to launch digital credit assessment model for MSMEs in December

The model captures MSMEs’ digital footprints to assess their creditworthiness, moving away from the earlier requirement of external ratings, which will help save costs for these businesses