BUSINESS

FinMin may cut rates on small savings schemes in FY26, says govt source

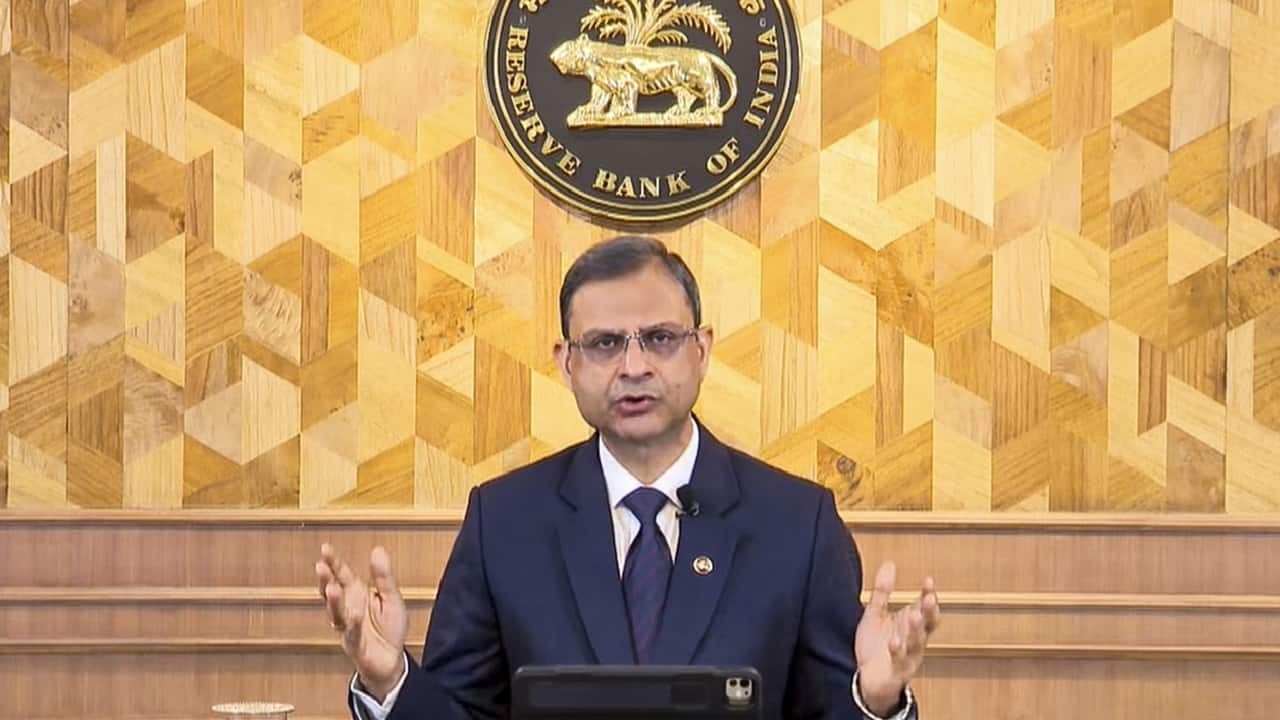

The RBI's Monetary Policy Committee (MPC) on February 7 lowered interest rates by 25 basis points to 6.25 percent from 6.5 percent after almost five years.

BUSINESS

FY25 capex should be close to revised aim of Rs 10.18 lakh crore, says govt source

While, the capital expenditure target for the current financial year was reduced to Rs 10.18 lakh crore from Rs 11.11 lakh crore earlier, the Budget for 2025-26 pegged it at Rs 11.21 lakh crore, almost flat on-year versus the initial aim.

BUSINESS

RBI rate cut, income tax rebate together to boost consumption, says govt source

While the cut in income tax is expected to put more cash in the hands of the people thereby improving demand, the rate cut by RBI should help lower borrowing costs, the official added.

BUSINESS

Economists hopeful of an easing cycle after RBI’s first rate cut in five years

Crisil's Chief Economist has projected that the CPI inflation may decline to 4.4 percent in FY26, supported by a healthy kharif and rabi crop. He anticipates another 75–100 basis points in rate cuts by RBI next fiscal.

BUSINESS

New Income Tax bill meant to be understood by citizens, not just lawyers: Finance Secretary

"It will be simple, with no provisos or complicated language,” Tuhin Kanta Pandey said, highlighting the significant departure from the current structure of tax laws.

INDIA

Only 30% urban infra in place for Viksit Bharat target, financing for local bodies critical: DFS secretary

M Nagaraju said that provision of high-quality public services in urban areas will play a significant role in enhancing India’s growth potential

BUSINESS

Life insurers oppose GST exemption on term insurance, flag input tax credit concerns

Insurers argue that a complete exemption will lead to denial of input tax credit and the increased costs will have to be passed on to the consumers, negating the intended benefit of exemption

BUSINESS

GST receipts growth to stay above nominal growth over the next few years: CBIC chairman

GST collections growth for FY26 is estimated at 10.9 percent in the budget, similar to the previous fiscal.

BUSINESS

India has corrected bad optics on high tariffs, travelled towards ASEAN average: CBIC Chairman

This entire exercise has resulted in a loss of Rs 1,900 crore, says Sanjay Kumar Agarwal, Chairman, Central Board of Indirect Taxes and Customs

BUSINESS

CBIC to digitise customs refund process within a month: Chairman Sanjay Agarwal

While most customs processes have already transitioned to digital platforms, the refund process remains manual.

BUSINESS

Customs duty cuts to cost Rs 1,900 crore: CBIC Chairman

The government is expected to collect Rs 2,35,000 crore from customs in FY25, which is expected to rise to Rs 2,40,000 crore in FY26

BUSINESS

GST rate rationalisation challenging due to socio-economic, revenue considerations: CBIC Chairman

'The GoM is examining all issues comprehensively and will submit a report. They will have to arrive at some consensus,' Sanjay Agarwal said.

BUDGET

‘The new direct tax code bill will not have any new taxes, will be applicable from April’: Tuhin Kanta Pandey, Finance secy

Finance Minister Nirmala Sitharaman announced that the new income tax bill will be tabled in the Budget session of the Parliament- the bill will simplify the existing act and will not introduce any new taxes

BUDGET

PM Modi wanted a ‘pro-growth, pro-people and pro-taxpayer budget’: Finance secy

The Budget had to balance several imperatives but the Prime Minister was very clear that it has to be a taxpayer-friendly budget, Tuhin Kanta Pandey told Moneycontrol

BUSINESS

Full transcript: Finance Secretary Tuhin Kanta Pandey's exclusive interview with Moneycontrol

“ Make it a pro-growth, pro-people and pro-taxpayer budget. These were the overall guidance, says the Finance and Revenue Secretary.

BUSINESS

Being protectionist doesn’t benefit anyone: Finance Secretary

Tuhin Kanta Pandey’s remarks come at a time when the United States is intensifying its protectionist trade policies under former President Donald Trump.

BUSINESS

Tax cuts won’t be inflationary, fiscal consolidation path intact, says finance secretary

Rejecting the notion that the Budget is skewed towards either consumption or capital expenditure, Tuhin Kanta Pandey tells Moneycontrol that the government has ensured a balanced approach

BUSINESS

With fiscal support in Budget, hope RBI will act in tandem to boost growth: Finance secretary

Monetary and fiscal policies should not work at cross purposes but rather complement each other to ensure balanced economic growth, Tuhin Kanta Pandey told Moneycontrol in an interview.

BUSINESS

Govt may ease rules on dividend repatriation, managerial appointments for foreign investors in insurance

"All those restrictions will be reviewed as part of the bill, which means we will bring it together as an amendment to the Insurance Act."

BUSINESS

NARCL holds Rs 1.05 lakh crore banks’ bad assets, eyes resolution of 28 accounts

The government expects 18 percent recovery rate. The approval for Rs 30,000 crore in Security Receipts (SRs) is already taken from the Expenditure department of the Finance Ministry

BUSINESS

Govt hopeful of ratings upgrade as Budget draws debt-reduction roadmap

S&P Ratings was the only agency to have recently revised India’s outlook to positive from stable earlier this year

BUSINESS

Tax relief to give bank deposits a Rs 45,000-crore boost, strengthen credit growth, says DFS secretary

The tax measures announced in the Budget will provide liquidity to the banks, making them more comfortable in lending, financial services secretary M Nagaraju has said

BUSINESS

Govt plans Bill to grant more autonomy to LIC, allow composite licensing in insurance sector

New legislation to amend LIC Act, Insurance Act, IRDAI Act likely in Budget Session

BUSINESS

GST rate rationalisation process underway, say sources

The government had set up a ministerial panel, the Group of Ministers (GoM), to examine GST rate rationalisation.