BUSINESS

We don't need to overpay for deposits anymore: Unity SFB's Jaspal Bindra

We have no immediate need to raise funds. We have few years before the IPO mandate kicks in; there is ample time to plan, Bindra said

BUSINESS

SMBC to seek promoter tag in Yes Bank after primary capital infusion

According to sources, Yes Bank is expected to roll out a plan to raise equity by December this year. SMBC may infuse around Rs 4,000 crore in the bank to increase its stake from 20 percent to 24.99 percent.

BUSINESS

Prioritise compliance, fix process loopholes: IndusInd Bank new CEO’s message to business heads

In an internal meeting with select business head of the bank, Rajiv Anand is said to have asked business heads to draw up a plan within the next 45 days to tighten compliance, fill the gaps in processes and strengthening the business.

BUSINESS

India is Asia’s 3rd largest, fastest growing market for sustainability finance, says DBS Bank’s Chief sustainability officer Helge Muenkel

Businesses waiting to shift from being fossil fuels guzzlers to green units would be the focus and the sweet spot for DBS Bank's 'transition finance', says Helge Muenkel

BUSINESS

Emirates NBD, Fairfax, Kotak Bank, Oaktree likely to bid for IDBI Bank

According to sources, financial bids for IDBI Bank is likely to be sought in October. Kotak Mahindra Bank said to have renewed its interest in the bidding process, extensive diligence underway.

BUSINESS

GST 2.0: Insurers approach govt to seek clarity on ITC treatment

Insurers, who had initially lobbied for GST to be charged at a 0% rate instead of an exemption, have sought clarification on whether insurance companies can claim input tax credit at an entity level

BUSINESS

PhonePe to file for IPO via confidential route by September-end

IPO likely to be sized at Rs 10,000–13,000 crore ($1.2–1.5 billion) and will be a mix of fresh issue and offer for sale. Walmart, Tiger Global and General Atlantic likely to be among the key investors who might seek part-monetisation via the IPO

BUSINESS

RBI may allow Tata Sons to remain unlisted

Regulator said to have asked the shareholders to resolve differences before it takes final decision.

BUSINESS

Deutsche Bank puts its India retail franchise on block

With loan assets of around Rs 25,000 – 30,000 crore, Deutsche Bank’s retail business is up for sale post a global review of its operations. According to sources, at least three out of four private banks reached out to for the sale haven’t evinced strong interest yet.

BUSINESS

IPOs targeting aggressive valuation will face resistance in volatile times: Ganeshan Murugaiyan of BNP Paribas India

Outbound M&A activity continues to be active in pharma, IT and industrial space. Acquisitions over the past few years have been strategic in nature; it is no longer about acquiring only to expand the presence outside of India. Indian companies are looking to add capabilities and geographies which are strategic for their expansion plans.

BUSINESS

IPO-bound Tata Capital bets big on retail and SMEs; aims to extend formal credit to wider markets

The company’s loan book rose from Rs 1.2 lakh crore in 2023 to Rs 2.26 lakh crore in 2025, reflecting an 88%

BUSINESS

Delinquencies marginally higher in informal, self-employed segment and loans with over 75% LTV: IMGC MD & CEO

We’ve already guaranteed close to Rs 35,000 crore in home loans—backing over 1.5 lakh homeowners across more than 400 locations nationwide, with the trust of over 25 lending institutions, including banks and housing finance companies, says IMGC's Mahesh Misra

BANKING

Can Rajiv Anand put IndusInd Bank stock back in the Nifty50 universe?

Nearly 12 years after the stock was included in the Nifty50 index, IndusInd Bank is no longer a part of the bellwether benchmark. But, IndusInd Bank isn’t alone. Yes Bank and Bandhan too saw their exclusion from the index and despite the respective crises apparently behind them, sentiments are yet to turn positive.

BUSINESS

Online gaming ban: Banks evaluate next steps on RMG entities; tighten real-time payments monitoring

Senior bank officials say they would be extra careful in overseeing digital payments and blocking those that may be suspected towards online gaming

BUSINESS

PNB Housing’s Girish Kousgi set to join IIFL Home Finance as CEO

On August 3, PNB Housing informed stock exchanges about Kousgi’s decision to step down as CEO citing personal reasons. Monu Ratra’s tenure as chief of IIFL Home Finance will end on October 6, as per IIFL Finance’s disclosures

BUSINESS

Focused on curbing opex and credit cost, says Fusion Finance CEO Sanjay Garyali

The microfinance lender plans to step up its MSME business. MFI and MSME will be built as two separate business units, with two separate COO, says Garyali

BUSINESS

See a big opportunity in medium-yielding segments: KVS Manian, MD & CEO, Federal Bank

We need a holistic portfolio wallet share of a client to make money in the corporate banking business, Manian said.

BUSINESS

Vodafone Idea in talks with private credit funds as bank funding remains elusive

The struggling telco is in talks with Davidson Kempner, Oaktree and Värde Partners to raise a small tranche of debt

BUSINESS

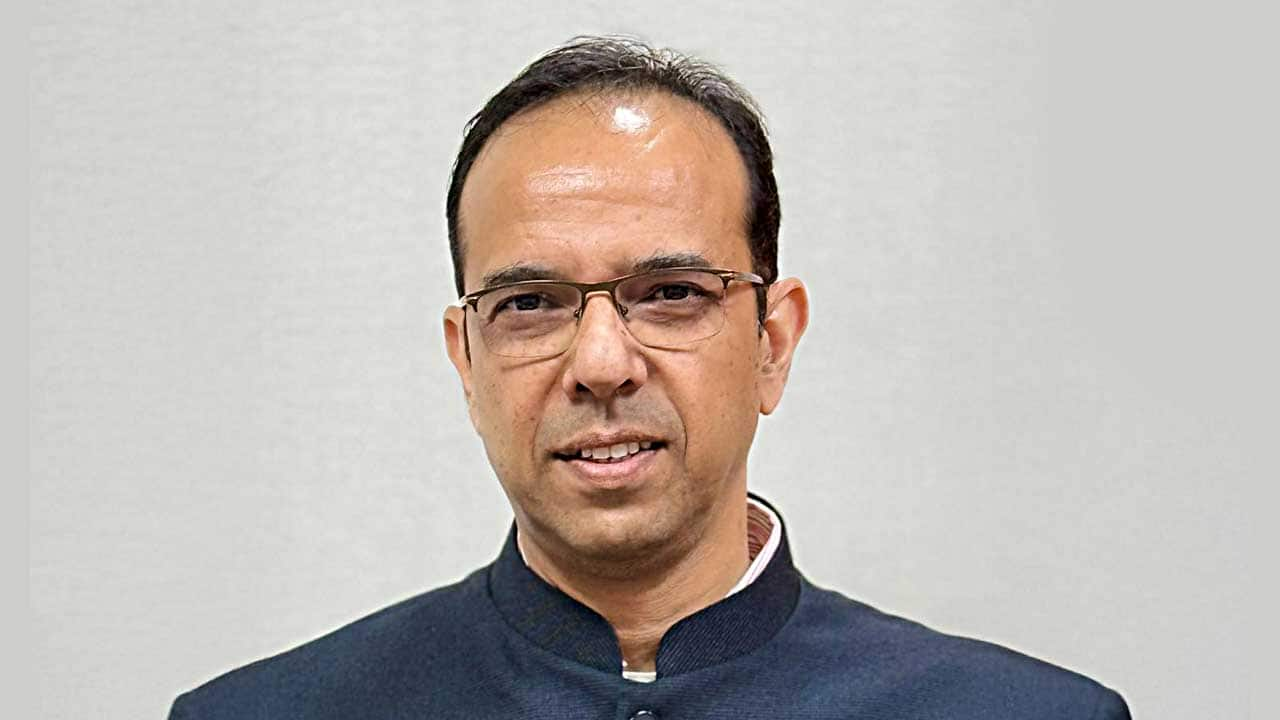

Veteran banker Ravi Narayanan appointed as CEO of SMFG India Credit

Set to take charge by end of August, sources say Narayanan’s immediate task would be to clean up and overhaul the operations of the lender

BUSINESS

We've strengthened the team and have a more diversified portfolio, says Axis AMC's B Gopkumar

The Axis AMC managing director and CEO says the firm's goal is to bridge the gap between traditional fund management and the transparency offered by modern fintech platforms, empowering customers with comprehensive but easy-to-understand portfolio analysis

BUSINESS

New normal credit cost for MFI likely 3 – 4% says PN Vasudevan, MD & CEO, Equitas Small Finance Bank

Speaking exclusively to Moneycontrol, PN Vasudevan, MD & CEO of the bank explained the rationale for higher provisioning. Interestingly, he said going ahead, banks ought to look at microfinance as just another business to have, not bet on it entirely shore up return ratios.

BUSINESS

May engage with regulator to understand NOFHC requirement: Sanjay Agarwal, MD & CEO, AU Small Finance Bank

Speaking exclusively to Moneycontrol, Agarwal said he will approach the regulator soon to understand why the requirement to convert his stake into a non-operative finance holding company was imposed as a licensing condition.

BUSINESS

RBI holds repo rate steady: Are we in for a long pause?

Another rate cut may be at a bay until the last mile transmission of the 100 bps reduction from February is fully reflected in economy. Equally, the possible impact of macro uncertainties on economic growth may play a larger role in deciding the rate trajectory from hereon.

BUSINESS

Merchant bankers tasked to bring foreign capital into PSU banks during upcoming QIPs

The government budgets to earn approximately Rs 20,000 crore through QIP of five banks, namely Bank of Maharashtra, Indian Overseas Bank, UCO Bank, Central Bank of India, and Punjab and Sind Bank.