BUSINESS

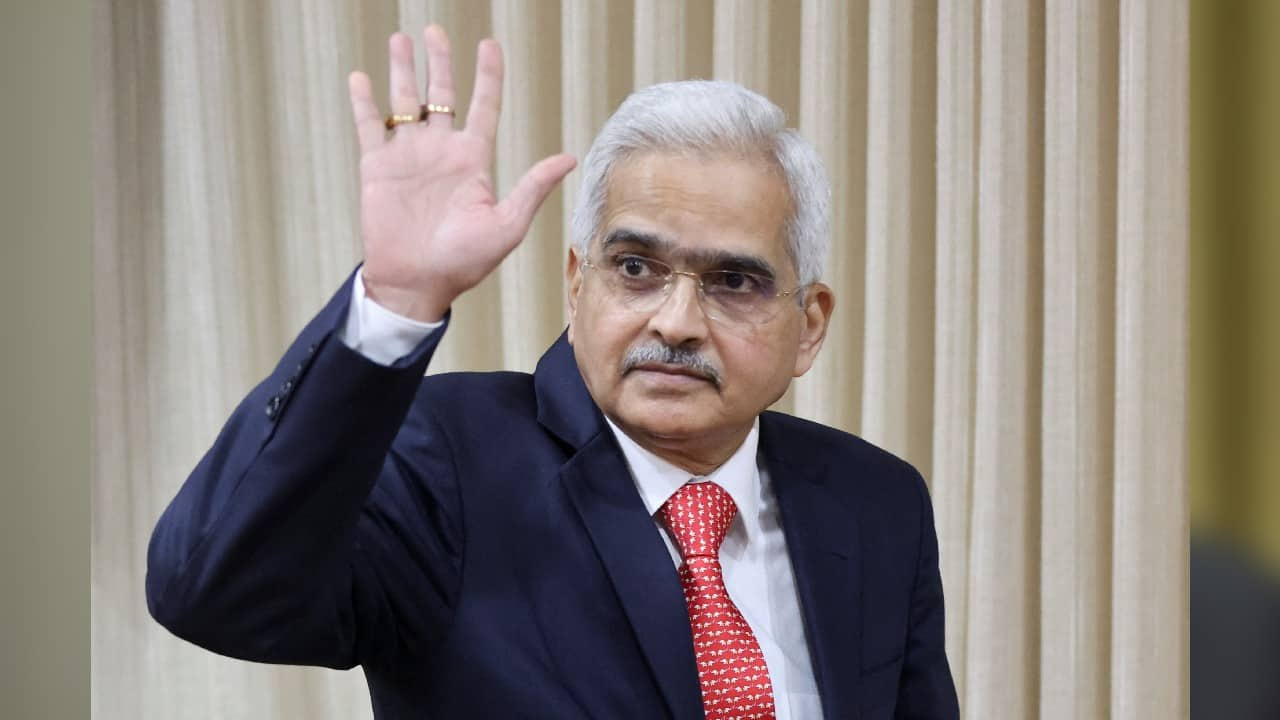

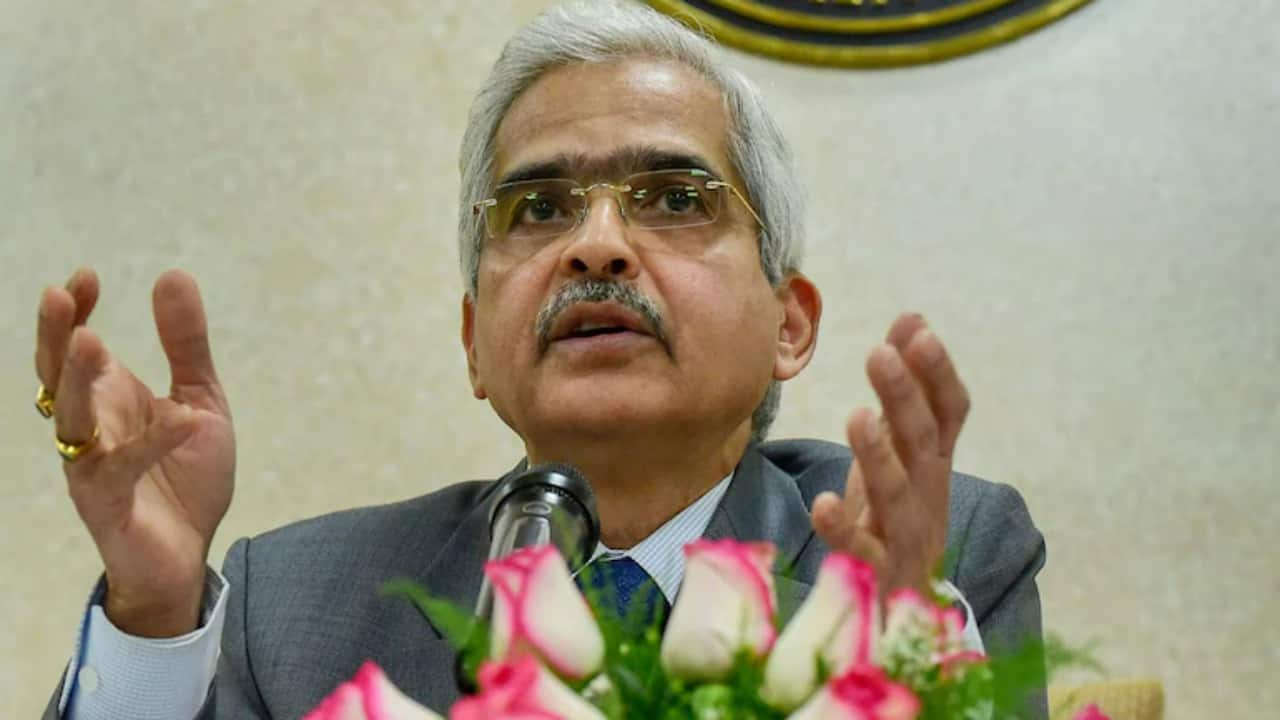

RBI Policy | RBI raises repo rate by 50bps to 4.9% to fight inflation pressure

The central bank forecasts 6.7 percent inflation, while the real GDP growth rate is pegged at 7.2 percent

BUSINESS

Exclusive Interview | Expect back-to-back rate hikes of 25 bps taking the policy rate to 6.25% by March 2023, says Morgan Stanley’s Sumeet Kariwala

Morgan Stanley comments come at a time when the three-day monetary policy committee meeting is on.

BUSINESS

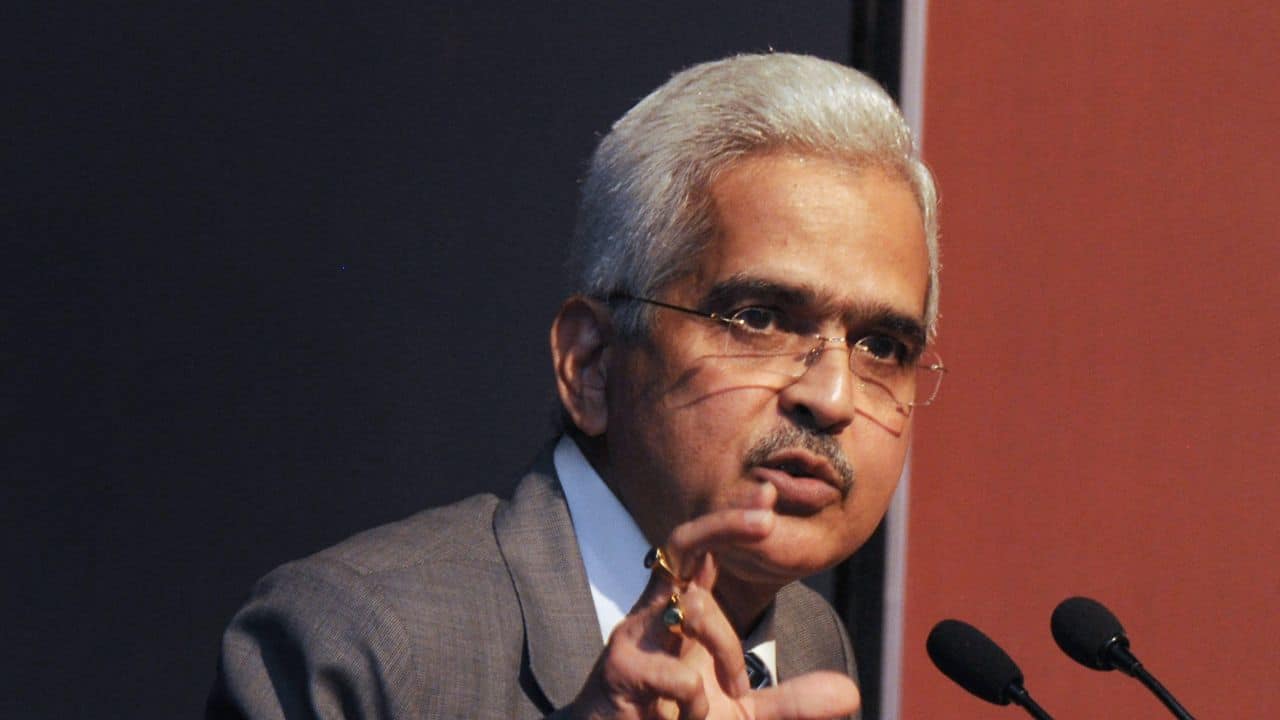

Banking Central | RBI MPC meet begins today. Get ready for even higher interest rates

RBI Monetary Policy Meet: A rate hike is given this time, only the quantum of increase needs to be seen. But what will be the impact on markets, how much can banks pass on?

BUSINESS

Dhanlaxmi Bank shareholders raise alarm on financials; number of Board members falls to 5

Sebi rules require listed entities to have a minimum of six directors. Of the five directors left on the board of Dhanlaxmi Bank, only one is an independent director; two are RBI-appointed nominee directors.

BUSINESS

Explained: ED arrests Delhi minister Satyendar Jain in hawala case: 5 key points on PMLA Act

The ED action comes over a month after assets linked to Jain, worth around Rs 4.81 crore, were attached by the agency.

BUSINESS

Banking Central | Counterfeit notes are back in full swing and that’s worrying

Curbing the circulation of fake notes or counterfeit notes, as we call them, was a stated aim of 2016 demonetisation. But, as the evidence suggests, the problem is far from over and demonetisation has failed to curb fake money

BUSINESS

Banking Central | Government, RBI's inflation battle is a double-edged sword

After the RBI, the government has taken a series of measures to cool inflation There will be more such steps ahead but at what cost?

BUSINESS

Exclusive | Mine has been a lone voice in MPC, but I have never felt lonely: Jayanth Varma

In his comments in the MPC minutes, Varma had said the logic of a 40 bps rate cut was not clear to him. He says he believes a decisive rate action can subdue the unpleasant inflationary episode we are witnessing currently, and bring inflation down to target.

BUSINESS

Banking Central | Is there a shadow ban on crypto payments in India?

The allegations by the Coinbase CEO and reports contradicting his claim made news last week. What really happened?

BUSINESS

RBI hasn't imposed any shadow ban on Coinbase, CEO's claim incorrect, say sources

Recently, US-based crypto exchange Coinbase's chief executive officer Brian Armstrong had alleged that it suspended its UPI payment method due to 'informal pressure from RBI.'

BUSINESS

Analysis | Why SC ruling on NBFC regulation is a big relief for industry

The issue of dual regulation of NBFCs by the RBI and state governments had created huge uncertainty for the industry. The Andhra Pradesh microfinance crisis is an example.

BUSINESS

Corporate Rejig: In six months, Ujjivan SFB gets six top execs on board; collections, asset quality improve

Former CEO Nitin Chugh had quit last August and multiple executives resigned thereafter at various levels. But, the bank has revamped the team since then and focused on collections.

BUSINESS

Axis MF frontrunning case: Axis Bank awaits probe report; will not take action against mutual fund officials for now

The bank is standing by Axis Mutual Fund CEO and MD Chandresh Nigam after suspending two other fund house officials in connection with frontrunning allegations, say sources. But Nigam’s continuance might run afoul of the regulator.

BUSINESS

Exclusive | HDFC Bank top brass batted for merger with HDFC as early as November

Bank cited the potential benefits of the merger to the parent, primarily access to a booming mortgage lending market. It was assessed that the conditions for the merger are more conducive now compared to before.

BUSINESS

Exclusive| HDFC Bank may get RBI glide path to pare holding in HDFC Credila, HDB Financial after merger

Though HDFC Bank has expressed interest to retain all subsidiaries in the current form, the RBI may raise questions with respect to two subsidiaries that are into lending business which can be done within bank

BUSINESS

Banking Central | What does the RBI rate hike mean for the common man

Rising interest rates are both bad news and good news for customers. For borrowers, EMIs will become costlier as banks adjust rates while for depositors returns on their fixed deposits will be more.

BUSINESS

What does RBI know that we don’t know yet?

Inflation has stayed above the MPC’s comfort zone for several months now. There is a view that MPC has acted too late in its inflation fight and any further delay could lead to breach of its mandate.

BUSINESS

RBI hikes repo rate by 40bps to 4.40%, CRR by 50bps, cites inflation worries

This is the first such unscheduled statement from the RBI governor since the start of the pandemic in 2020

BUSINESS

Interview | Will make a serious attempt to look at inorganic growth options now, says Ageas Federal Life Insurance CEO Vighnesh Shahane

Although the company has been open for inorganic options for a few years, it will make a serious attempt now, said Shahane.

BUSINESS

Banking Central | What’s the message from HDFC twins' merger to NBFCs?

NBFCs need to rethink their industry positioning going ahead. The primary reason why many NBFCs chose to be so—the benefit of lighter regulations vis-à-vis banks—no longer exists.

BUSINESS

Exclusive | Spandana Sphoorty founder Padmaja Reddy buys Rajshree Tracom, signals return to small loan business

The new NBFC, which will be renamed Keertana Finserve, will focus on gold loans, MSME loans and loans against property. Reddy is slated to be the MD & CEO of the new company

BUSINESS

Banking Central | Where have all the woman CEOs in Indian financial services gone?

Over years, more women have risen to the top in financial services. Yet, there are very few of them compared with their male counterparts.

BUSINESS

Analysis | What does high WPI inflation mean for interest rates?

The spike in WPI will put more pressure on the rate-setting body to initiate a tight policy stance

BUSINESS

Banking Central: RBI's oldest and mightiest enemy is back

Persistently high inflation is worrying in an economy as it hurts low-income groups the most.