The share of UPI in digital payments has reached close to 80 percent in 2023, Reserve Bank of India Governor Shaktikanta Das said on March 4.

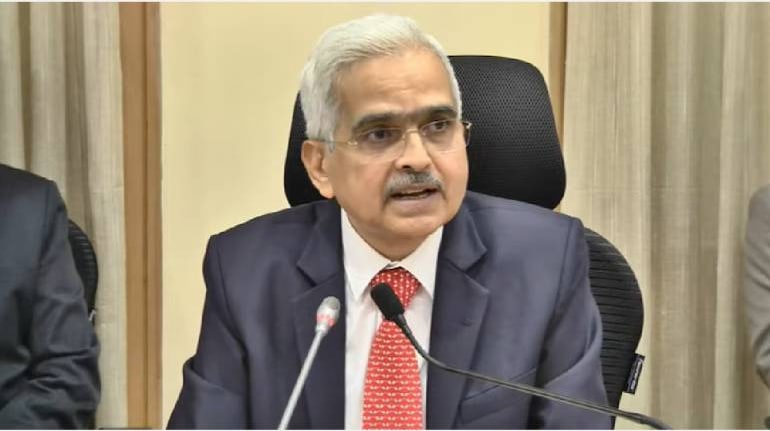

The governor was speaking at the RBI headquarters in Mumbai during the central bank’s Digital Payments Awareness Week programme.

"The flagship of our payment systems, the ‘UPI’, has become the most talked about fast payment system not only in India but across the world. It is the biggest contributor to the growth of digital payments in India. The share of UPI in digital payments has reached close to 80 per cent in 2023," he said.

At a macro level, the volume of UPI transactions increased from 43 crore in CY-2017 to 11,761 crore in CY-2023, he added. About 6.65 crore UPI users were added between March 1, 2023 to January 31, 2024, alone.

"We have seen retail digital payments in India growing from 162

crore transactions in FY2012-13 to over 14,726 crore transactions in

2023-24 (till February 2024) i.e., approximately 90-fold increase over

12 years. Today, India accounts for nearly 46% of the world’s digital

transactions (as per 2022 data)," the governor said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!