Trending Topics:

- Sensex Live

- Meesho IPO GMP

- Vidya Wires IPO

- Aequs IPO GMP

- Gold Rate Today

These 8 fertilizer stocks doubled in a year, but saw up to 40% dip recently; worth a look?

"Fertilizer stocks have witnessed a good amount of correction in the last few weeks initially due to profit booking as some of the stocks from this sector rallied to lifetime highs on expectations of good monsoon," said Gaurav Garg of CapitalVia Global Research Limited.

1/9

Fertilizer stocks have been on a good run since the last 12 months. Many of the top stocks hit their 52-week high a couple of months back on expectations of a good monsoon, however, these names have seen a decent correction since. Moneycontrol found eight fertilizer stocks that have doubled the investors' wealth in the last one year but have recently corrected 10-40 percent from their 52-week high. As an additional filter, we have considered only companies with a market cap of over Rs 500 crore. (Data Source: ACE Equity)

2/9

Reason behind the fall: "Fertilizer stocks have witnessed a good amount of correction in the last few weeks initially due to profit booking as some of the stocks from this sector rallied to lifetime highs on expectations of good monsoon. Also, some of China’s key fertilizer companies said they would temporarily suspend exports to assure supply in the domestic market. However, soaring international prices, resulting in lower imports led to a healthy correction in most of these stocks, " said Gaurav Garg of CapitalVia Global Research Limited.

3/9

Rama Phosphates Ltd. | In the last 12 months, the stock rose 435 percent to Rs 303 ( as of September 17, 2021) from Rs 57 (as of September 17, 2020). However, it has fallen 40 percent from its 52-week high of Rs 505.

4/9

Southern Petrochemical Industries Corporation Ltd. | In the last 12 months, the stock rose 169 percent to Rs 53 (as of September 17, 2021) from Rs 20 (as of September 17, 2020). However, it has fallen 23 percent from its 52-week high of Rs 68.45.

5/9

The Fertilisers And Chemicals Travancore Ltd. | In the last 12 months, the stock rose 164 percent to Rs 123 (as of September 17, 2021) from Rs 46 (as of September 17, 2020). However, it has fallen 20 percent from its 52-week high of Rs 153.

6/9

Deepak Fertilisers And Petrochemicals Corporation Ltd. | In the last 12 months, the stock rose 159 percent to Rs 427 (as of September 17, 2021( from Rs 165 (as of September 17, 2020). However, it has fallen 13 percent from its 52-week high of Rs 492.6.

7/9

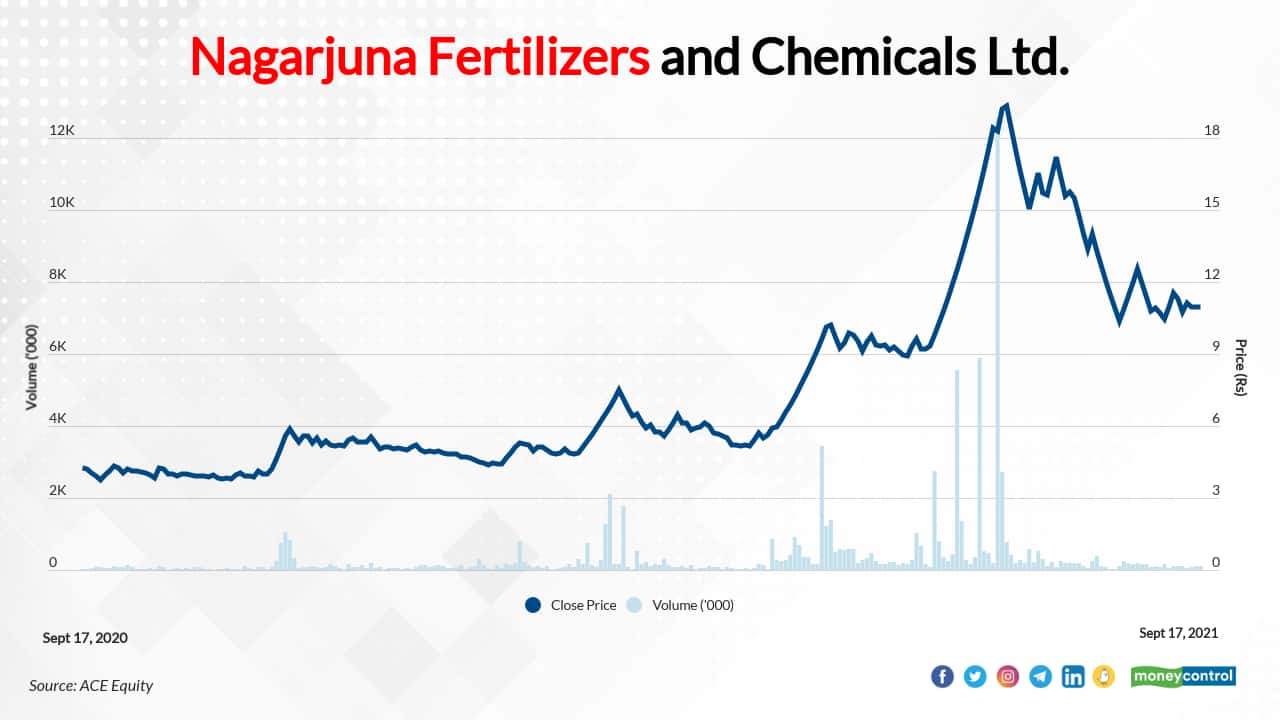

Nagarjuna Fertilizers and Chemicals Ltd. | In the last 12 months, the stock rose 158 percent to Rs 11 (as of September 17, 2021) from Rs 4 (as of September 17, 2020). However, it has fallen 46 percent from its 52-week high of Rs 20.67.

8/9

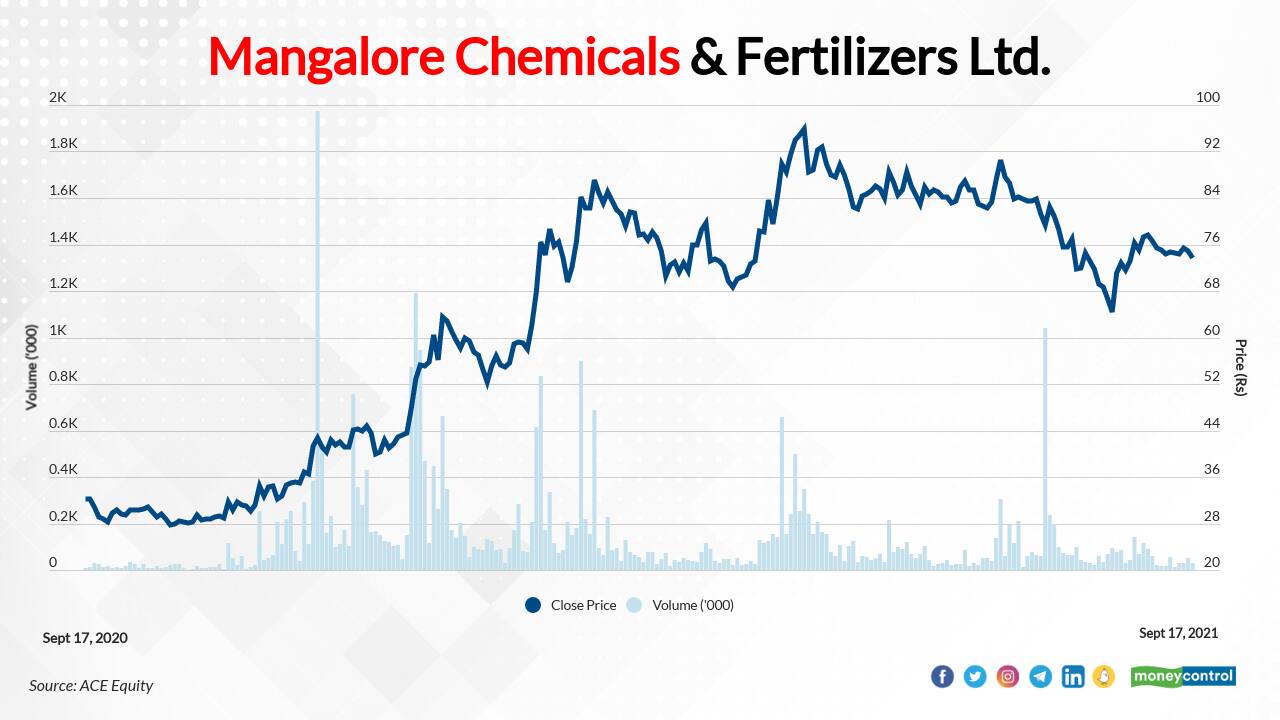

Mangalore Chemicals & Fertilizers Ltd. | In the last 12 months, the stock rose 128 percent to Rs 74 (as of September 17, 2021) from Rs 32 (as of September 17, 2020). However, it has fallen 27 percent from its 52-week high of Rs 101.

9/9

Chambal Fertilisers and Chemicals Ltd. | In the last12 months, the stock rose 105 percent to Rs 313 (as of September 17, 2021) from Rs 153 (as of September 17, 2020). However, it has fallen 10 percent from its 52-week high of Rs 348.4.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!