Despite healthy earnings in FY21, these 5 stocks are at least 20% away from their 52-week high

Aarti Drugs, Tanla Platforms and Granules India are on the list

1/6

Since the benchmark indices are trading near their life high levels, experts say investors should look at stock-specific opportunities. To help you look for quality stocks, Moneycontrol analysed companies that posted at least 10 percent profit margin in each of the four quarters of FY21 and their quarterly sales growth was positive on a year-on-year basis. We considered only stocks that have fallen over 20 percent from their 52-week high and have a market cap of over Rs 1000 crore. From the BSE universe, five stocks have met the above criteria. (Data Source: ACE Equity).

2/6

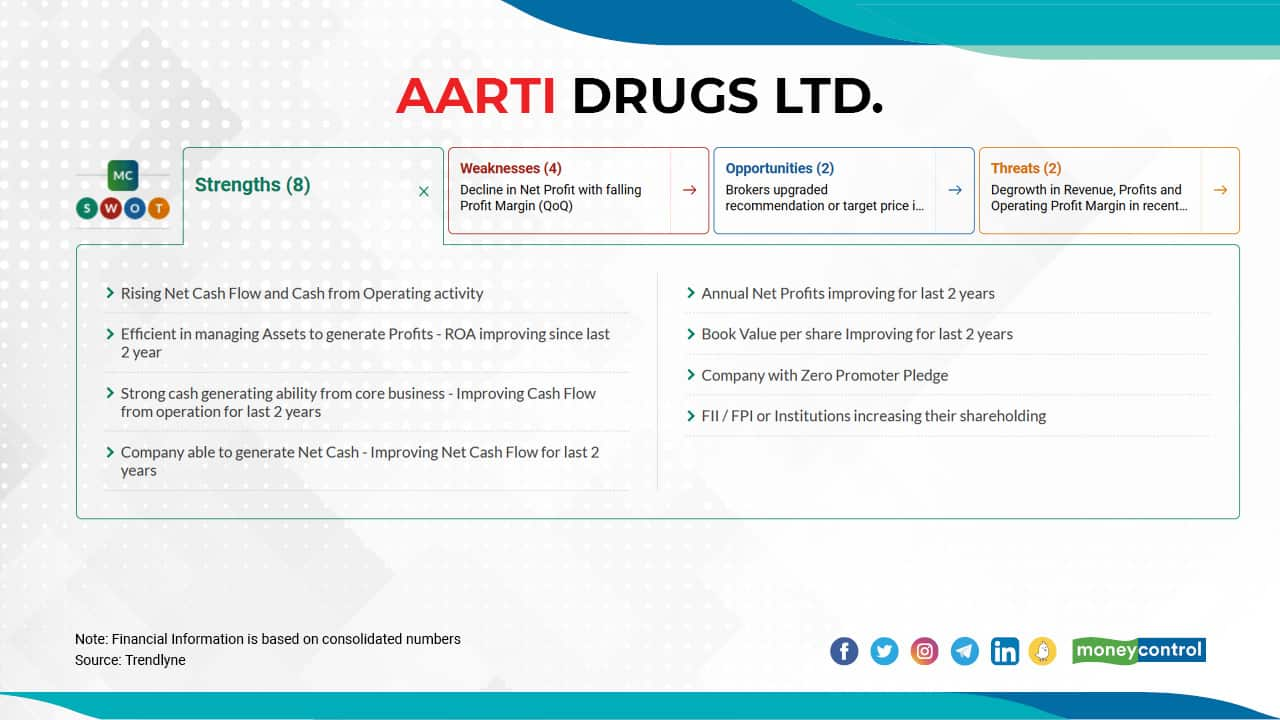

Aarti Drugs Ltd. | The pharmaceuticals & drugs company share price fell 28 percent to Rs 736.75 as on June 16 from its 52-week high of Rs 1025 recorded on October 8, 2020. Its profit margin for the quarter June 2020: 15.69 percent, September 2020: 13.02 percent, December 2020: 12.83 percent, and March 2021: 10.29 percent. Click here for Moneycontrol SWOT analysis.

3/6

Indiamart Intermesh Ltd. | The e-commerce company share price fell 27 percent to Rs 7290.80 as on June 16 from its 52-week high of Rs 9951.95 recorded on February 5, 2021. Its profit margin for the quarter June 2020: 48.66 percent, September 2020: 42.89 percent, December 2020: 46.49 percent, and March 2021: 31.89 percent. Click here for Moneycontrol SWOT analysis.

4/6

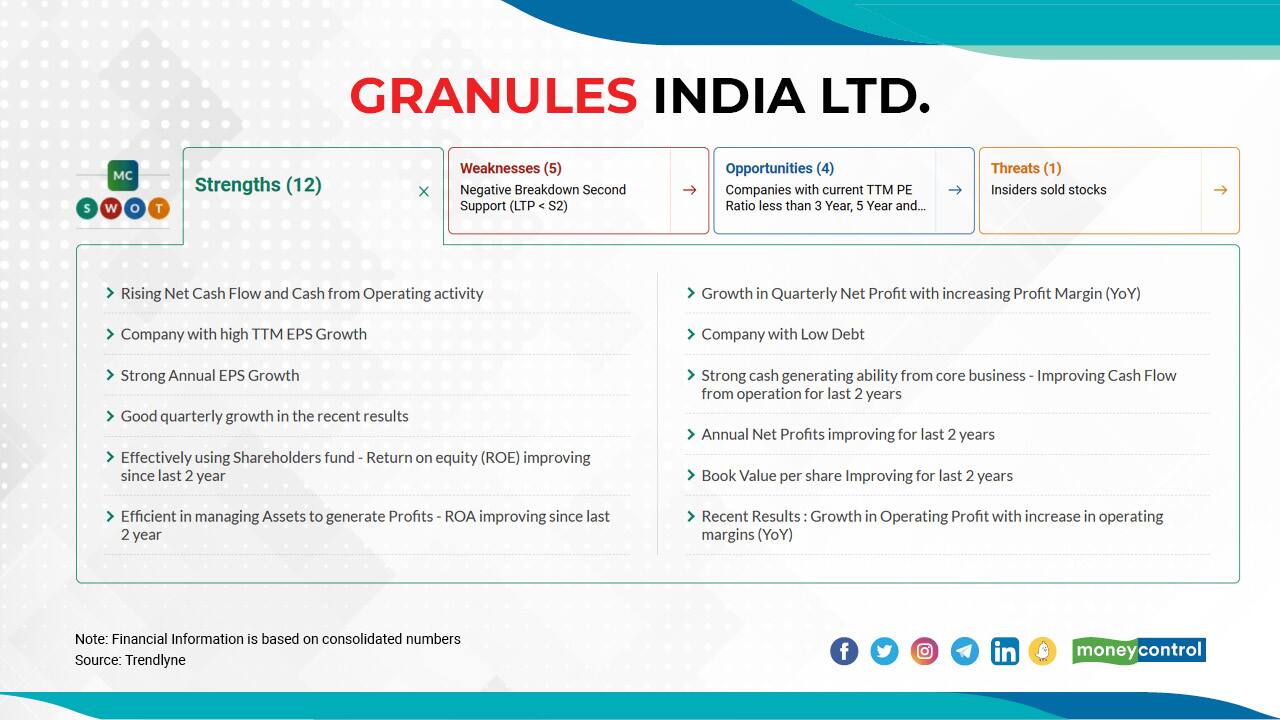

Granules India Ltd. | The pharmaceuticals company share price fell 26 percent to Rs 323.70 as on June 16 from its 52-week high of Rs 438.00 recorded on December 1, 2020. Its profit margin for the quarter June 2020: 15.15 percent, September 2020: 19.07 percent, December 2020: 17.38 percent, and March 2021: 15.96 percent. Click here for Moneycontrol SWOT analysis.

5/6

Share India Securities Ltd. | The stock broking company share price fell 25 percent to Rs 450.15 as on June 16 from its 52-week high of Rs 600.00 recorded on May 31, 2021. Its profit margin for the quarter June 2020: 14.63 percent, September 2020: 13.74 percent, December 2020: 15.87 percent, and March 2021: 18.71 percent. Click here for Moneycontrol SWOT analysis.

6/6

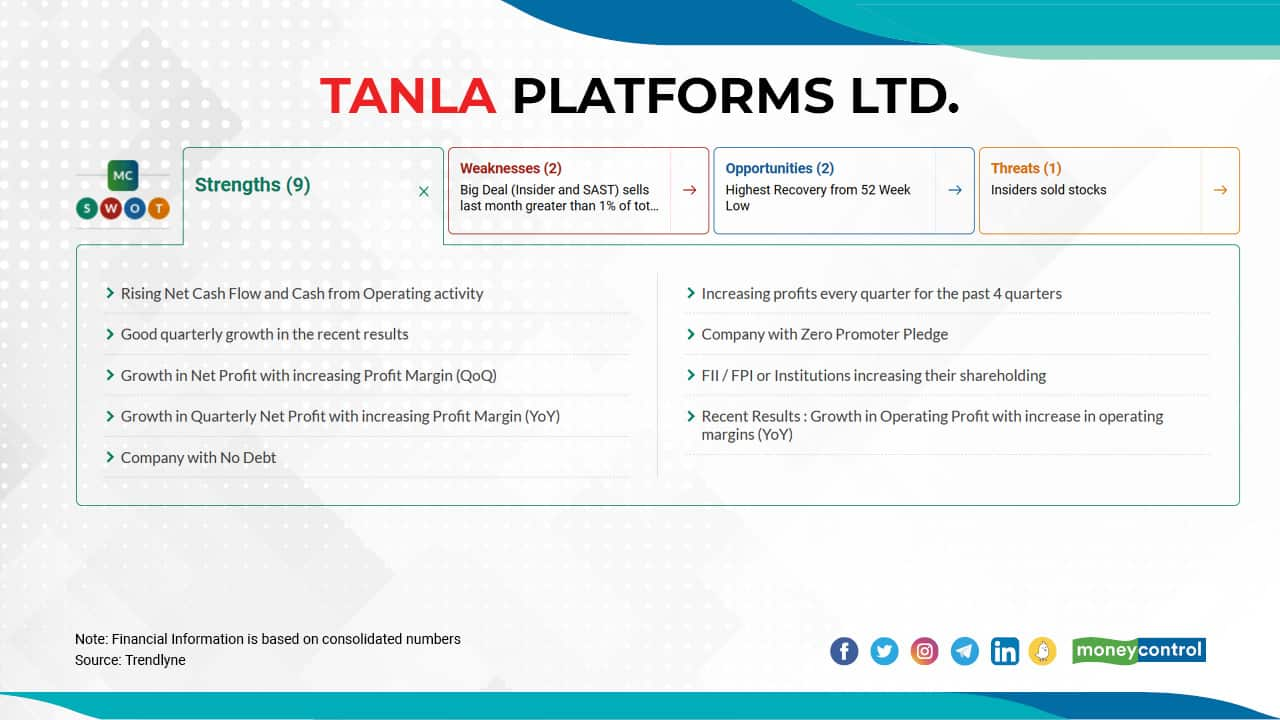

Tanla Platforms Ltd. | The IT - Software company share price fell 22 percent to Rs 803.25 as on June 16 from its 52-week high of Rs 1030.00 recorded on March 3, 2021. Its profit margin for the quarter June 2020: 17.26 percent, September 2020: 13.97 percent, December 2020: 14.30 percent, and March 2021: 15.81 percent. Click here for Moneycontrol SWOT analysis.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!