Explained: How direct plans carved a niche in the Indian mutual fund industry

Introduced in January 2013, direct plans have become the preferred way for large and institutional investors to invest in mutual funds. Over time, SEBI-registered investment advisors have given them a further boost

1/14

Direct plans of mutual fund schemes turned 10 on January 1, 2023. The introduction of direct plans was one of the biggest events in the Indian mutual fund industry. Up until 2013, if you invested in mutual funds directly, you (individual investors) had no option but to pay the same expense ratio (with the distributor commission embedded in it) as someone who went through a distributor. That changed on January 1, 2013, when capital market regulator Securities and Exchange Board of India (SEBI) introduced direct plans. A direct plan’s expense ratio is cheaper than that of a regular plan, because it doesn’t include the distributor’s commission. A lower expense ratio leads to higher returns. Many investors, especially large investors, including corporates and High Networth Individuals (HNIs), started investing in mutual funds via direct plans.

2/14

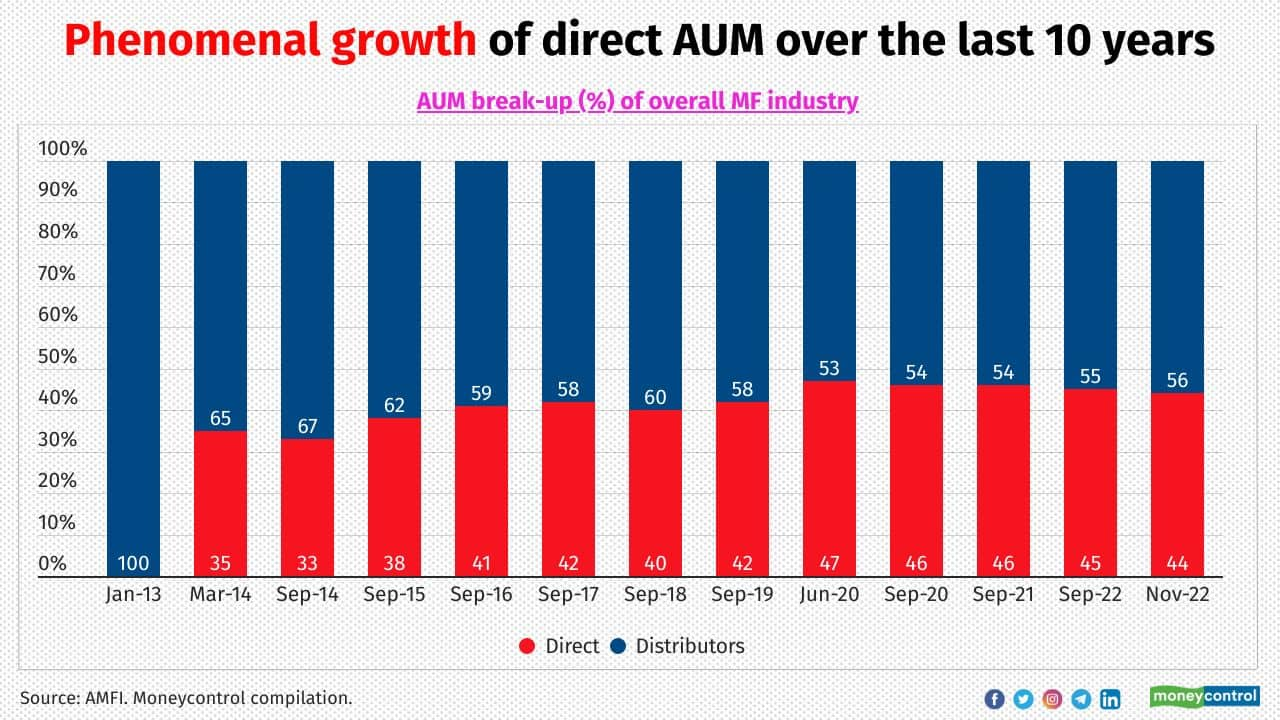

Phenomenal growth of direct AUM over the last 10 years

Within a year, direct plans were introduced, and about a third of industry assets moved to these plans. The preference for direct plans increased in the following years. However, the last two years have seen a fall in the share of the AUM of direct plans. This is mainly due to the increased investment by corporates in debt funds through the distributor route. Additionally, fixed maturity plans that were bought by corporates via the direct route matured during this period that, and in turn, increased the proportion of corporates’ distributor AUM

Within a year, direct plans were introduced, and about a third of industry assets moved to these plans. The preference for direct plans increased in the following years. However, the last two years have seen a fall in the share of the AUM of direct plans. This is mainly due to the increased investment by corporates in debt funds through the distributor route. Additionally, fixed maturity plans that were bought by corporates via the direct route matured during this period that, and in turn, increased the proportion of corporates’ distributor AUM

3/14

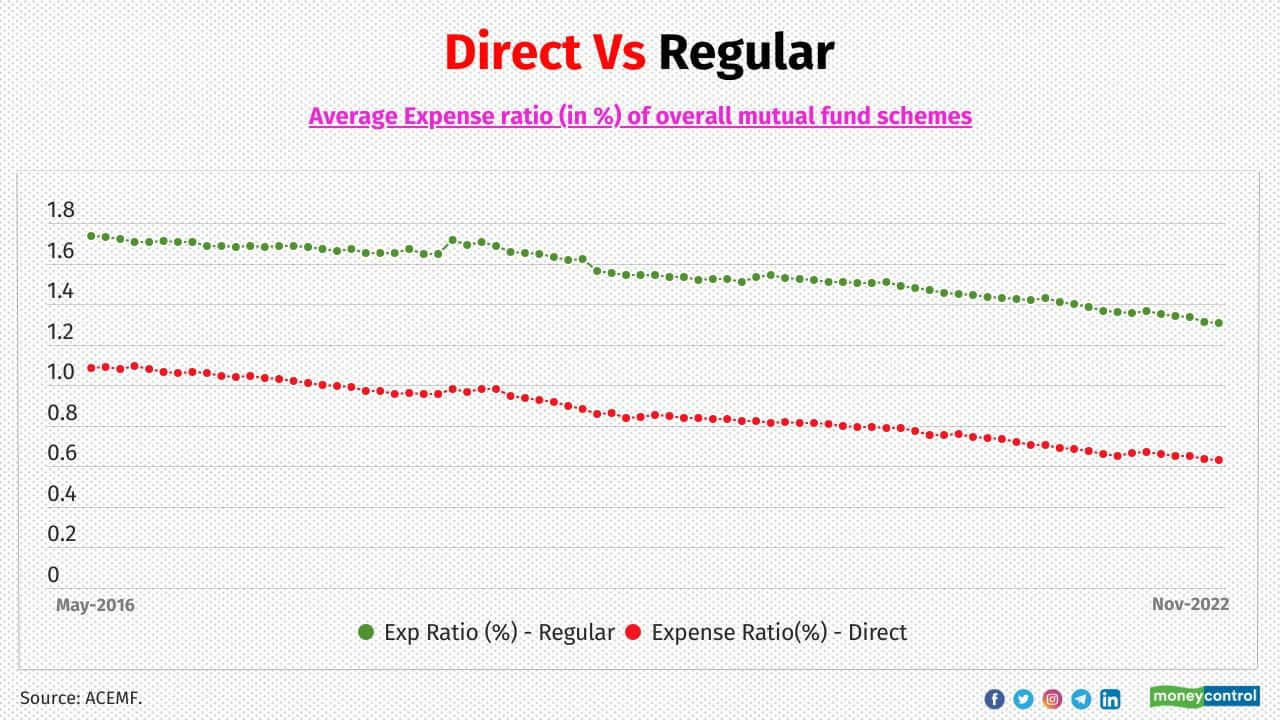

Direct Vs Regular

Under direct plans, the commission paid to intermediaries is excluded from the expenses charged to investors, thus leading to a difference in expense ratios. ACEMF data shows that the difference between the average expense ratio of direct plans and regular plans was in the range of 39 bps to 74 bps. One basis point is equivalent to 0.01% (1/100th of a percent). Eventually, the difference is what the direct investors tend to get extra in return

Under direct plans, the commission paid to intermediaries is excluded from the expenses charged to investors, thus leading to a difference in expense ratios. ACEMF data shows that the difference between the average expense ratio of direct plans and regular plans was in the range of 39 bps to 74 bps. One basis point is equivalent to 0.01% (1/100th of a percent). Eventually, the difference is what the direct investors tend to get extra in return

4/14

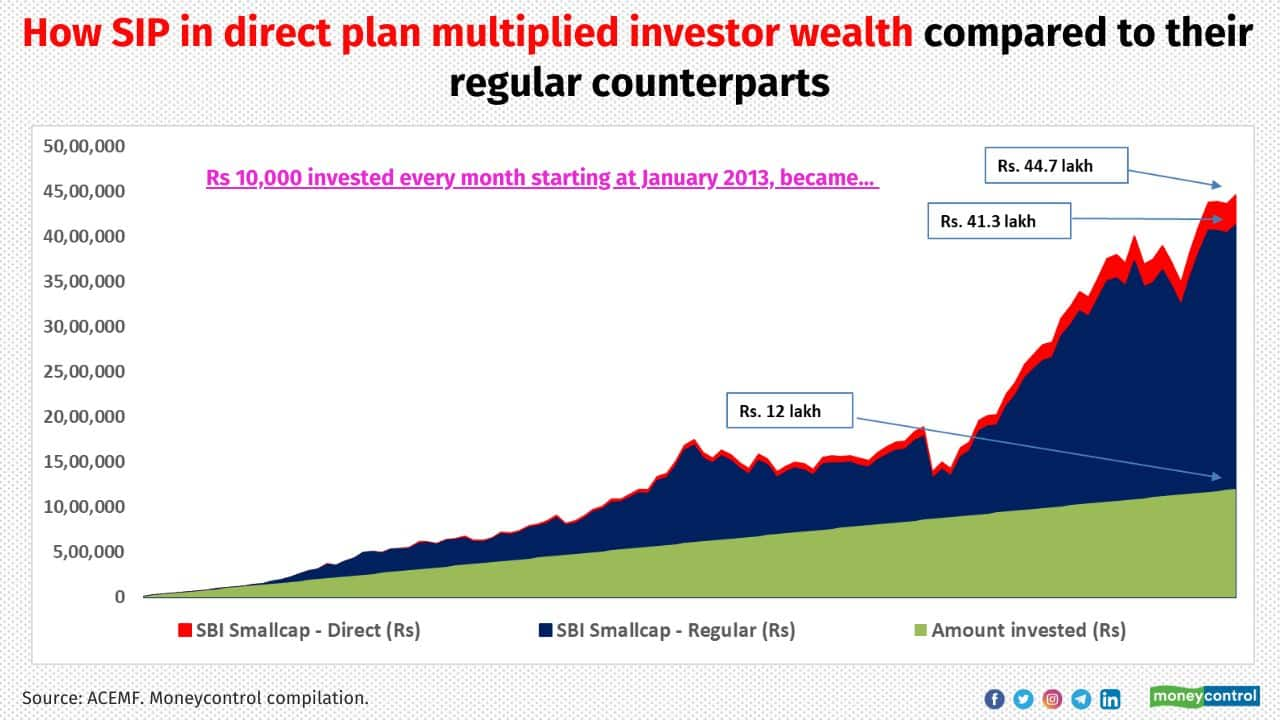

Under direct plans, the commission paid to intermediaries is excluded from the expenses charged to investors, thus leading to a difference in expense ratios. This results in direct plans earning higher returns than regular plans, thanks to the effect of compounding. For instance, if a monthly SIP of Rs 10,000 in SBI Small-cap Fund’s direct plan was started in January 2013, it would have grown to Rs 44.7 lakh today. On the other hand, an identical SIP during the same period in the regular plan of the same fund would have accumulated Rs 41.3 lakh. The direct plan would thus have generated Rs 3.4 lakh more than the regular plan over a 10-year period. The regular and direct expense ratio of SBI smallcap fund as of November 2022 were 1.85% and 0.72% respectively.

5/14

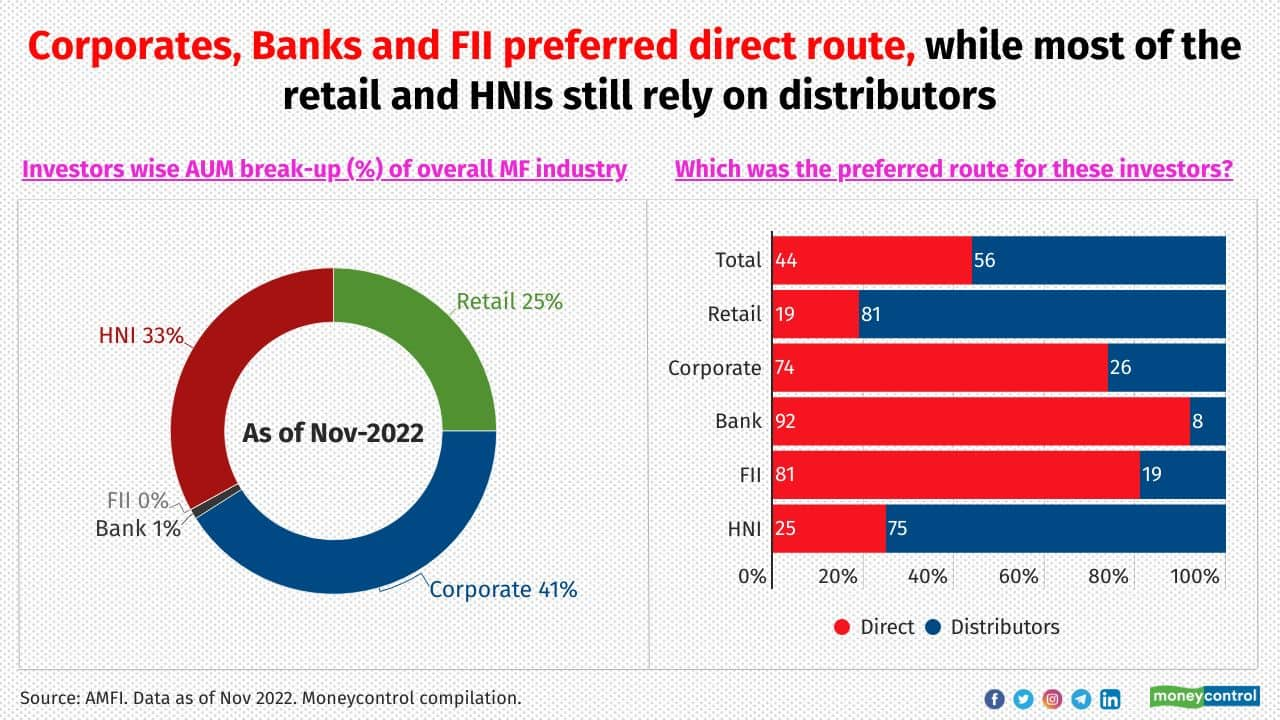

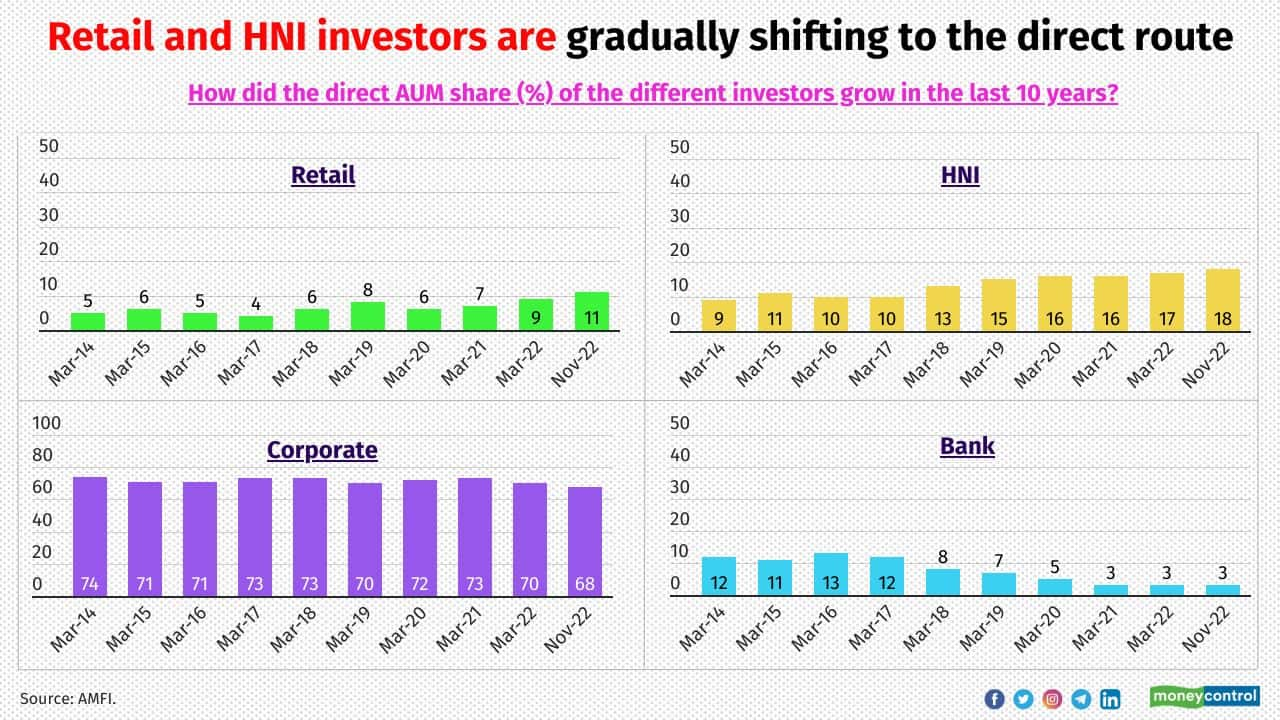

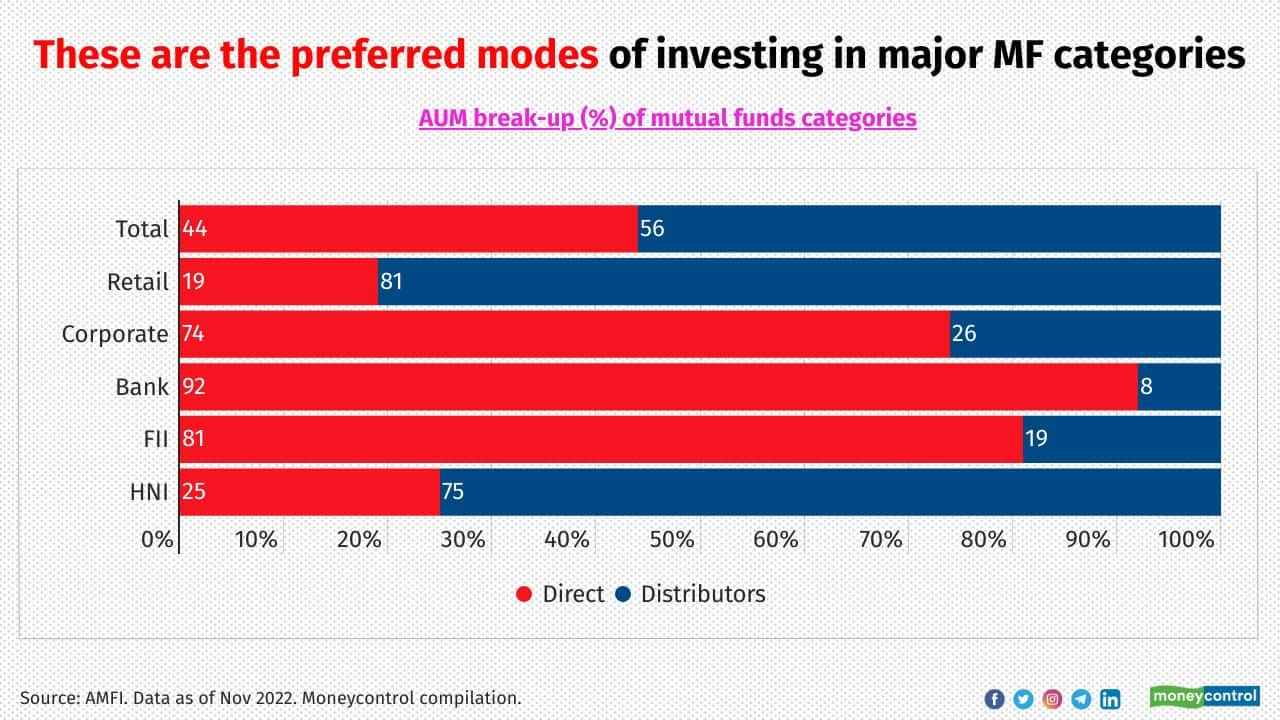

The Indian mutual fund industry has been dominated by large investors such as corporates. These smart investors have reduced their cost of investment by investing in direct plans. Per data as of November 30, 2022 (source: AMFI) corporates, banks and FIIs had 74%, 92% and 81%, respectively, of their assets in the direct plans of mutual funds. Individual investors such as retail and HNIs, too, have opted for direct plans, accounting for 19% and 25%, respectively, of their investments in mutual funds

6/14

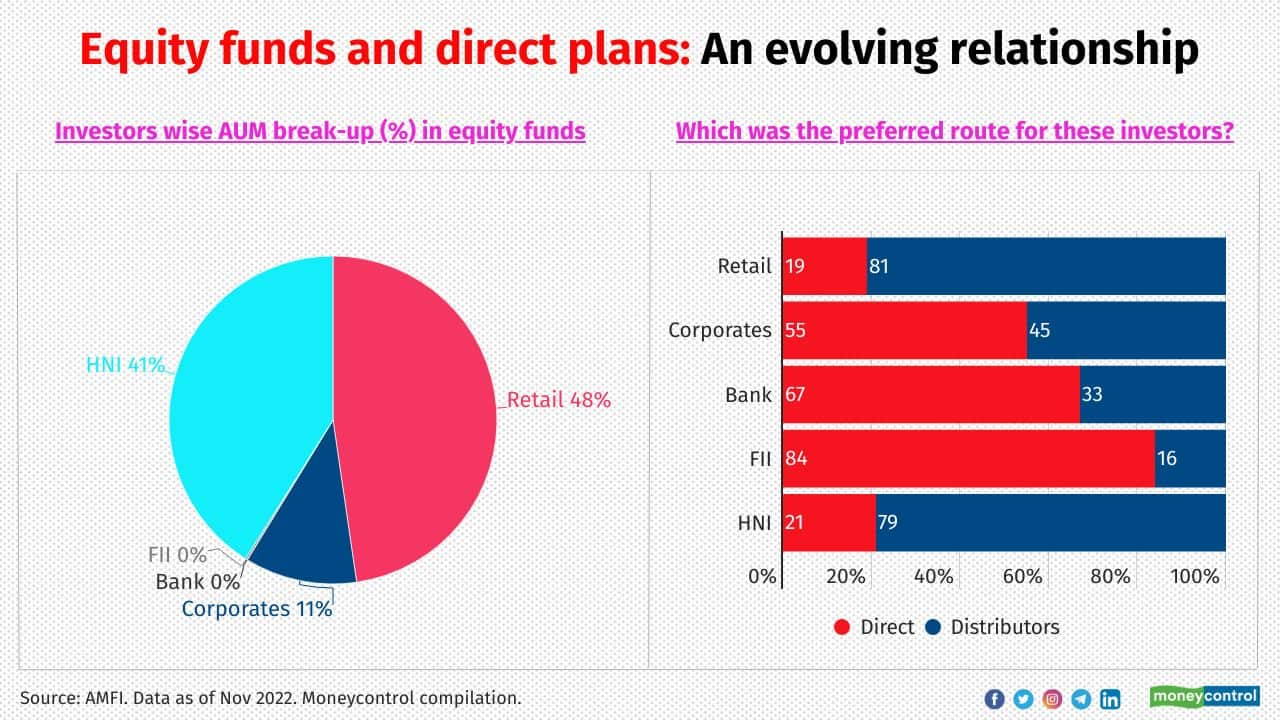

Albeit slowly, retail and HNI investors are taking the direct route while investing in equity schemes. This, in turn, has increased their direct AUM share. As far as corporates are concerned, they have allocated significant amounts to target maturity funds (TMF) in the last 2-3 years thanks to their attractive yields and given the uncertain rate scenario. Most have preferred the FoF of these TMPs and invested in them through regular plans. This has reduced their direct AUM share

7/14

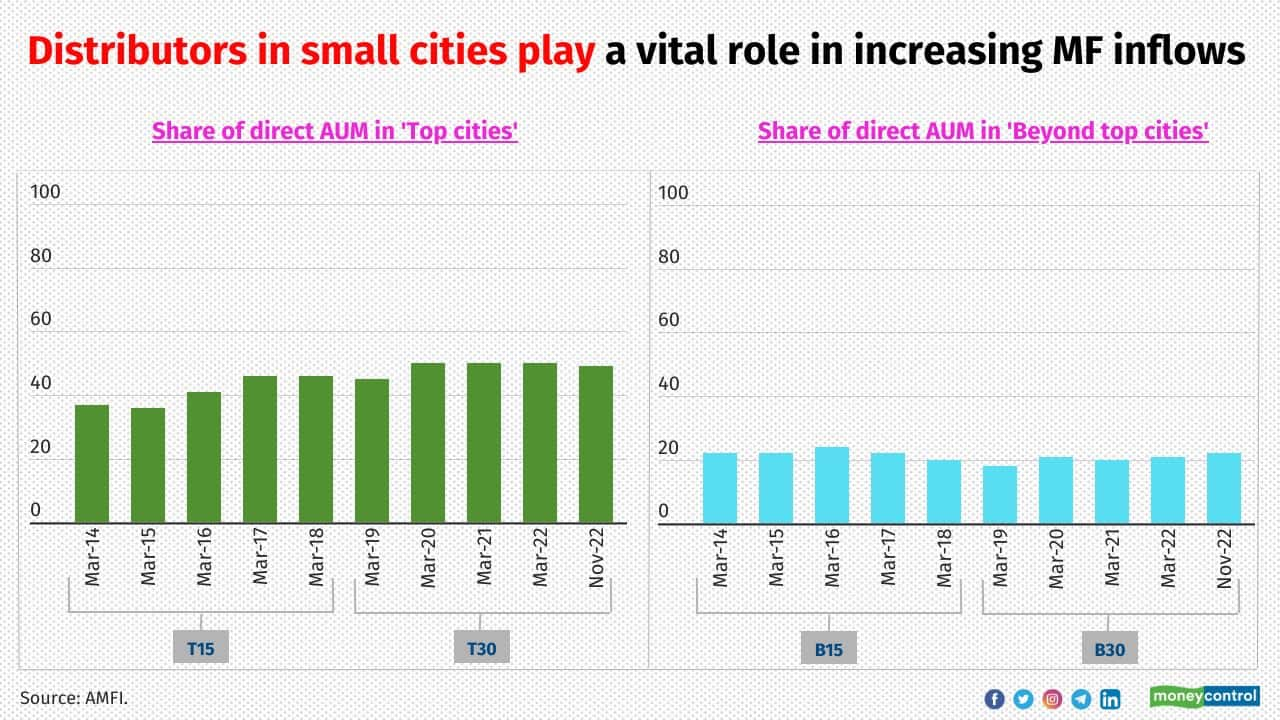

Distributors in small cities play a vital role in increasing MF inflows

While the direct route is gaining attention among investors in top cities, those in small cities prefer going with distributors for MF investments. In 2012, SEBI classified regions as Top 15 cities (T15) and Beyond 15 cities (B15) for operational convenience. In April 2018, the regulator revised this definition to Top 30 cities (T30) and Beyond 30 cities (B30). Distributors such as PSU banking channels and IFAs play an important role in rural areas to garner MF investments

While the direct route is gaining attention among investors in top cities, those in small cities prefer going with distributors for MF investments. In 2012, SEBI classified regions as Top 15 cities (T15) and Beyond 15 cities (B15) for operational convenience. In April 2018, the regulator revised this definition to Top 30 cities (T30) and Beyond 30 cities (B30). Distributors such as PSU banking channels and IFAs play an important role in rural areas to garner MF investments

8/14

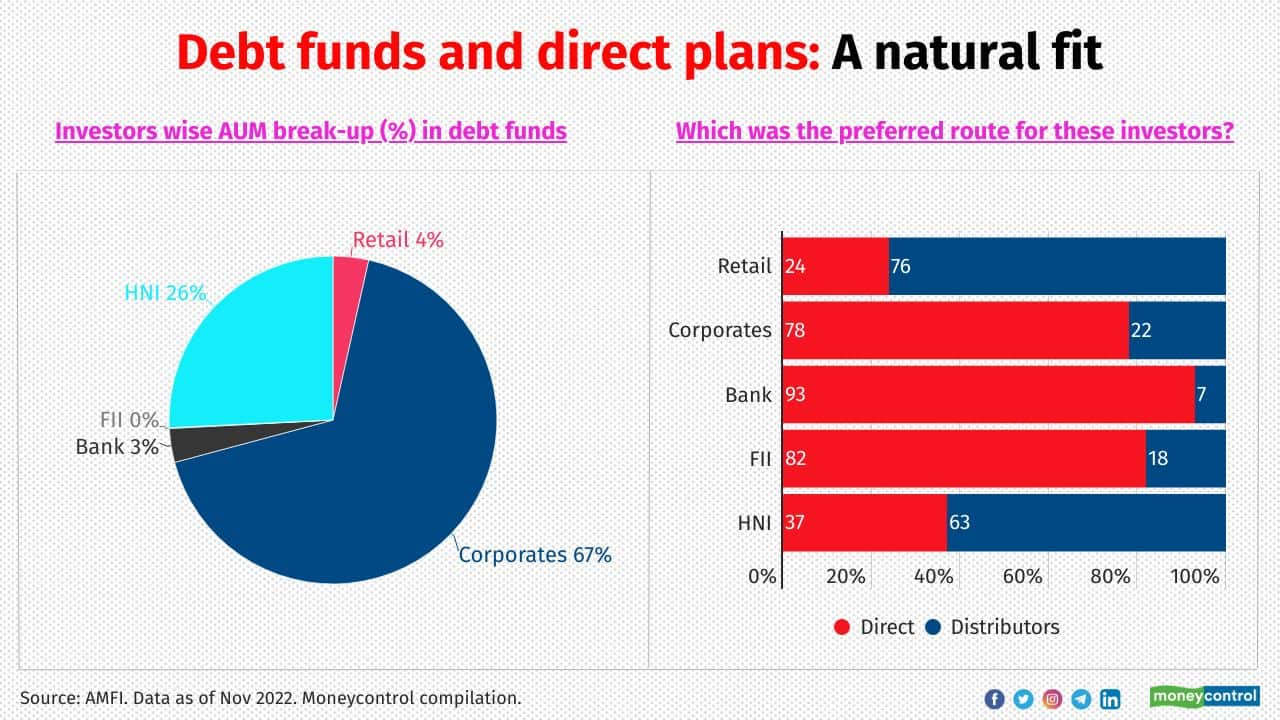

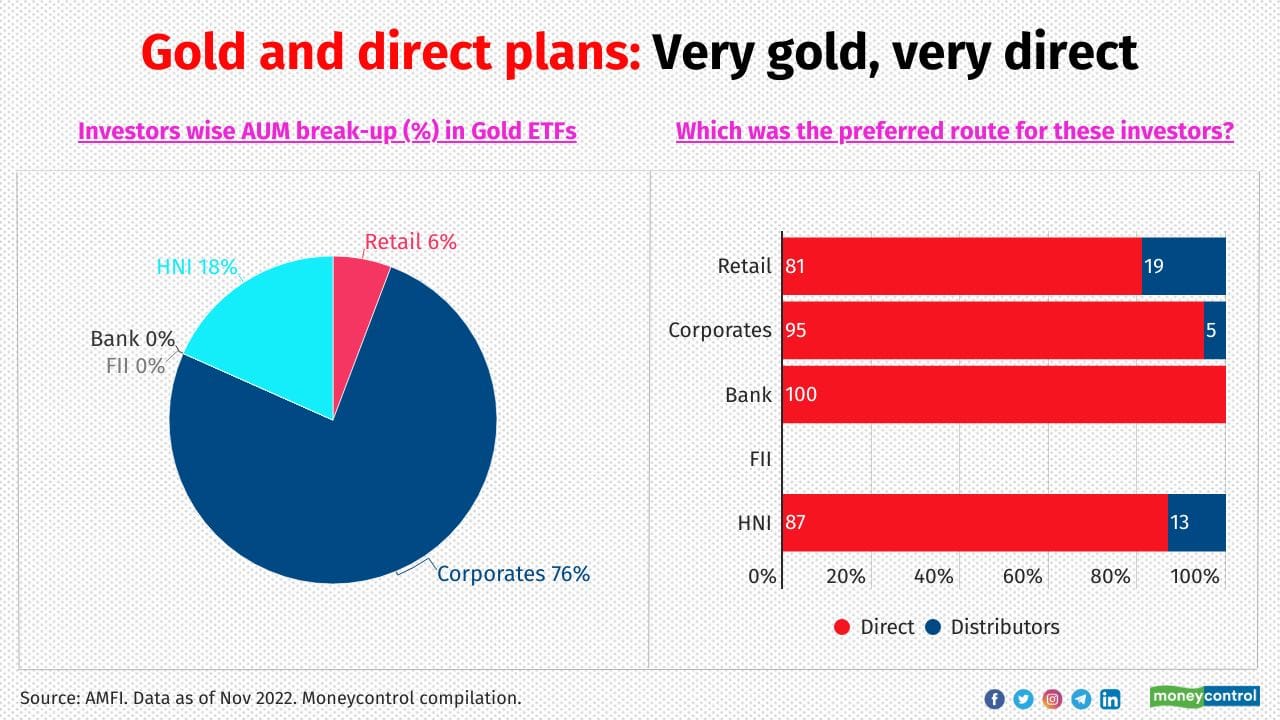

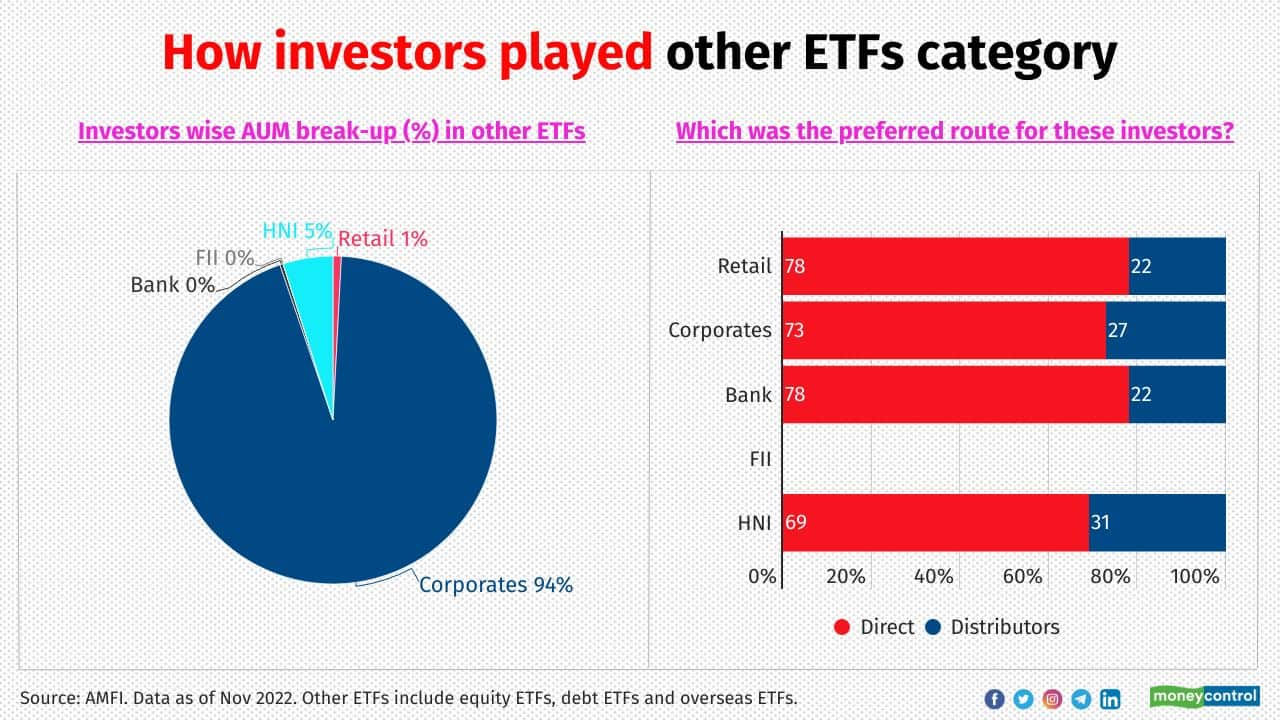

More direct investments came into categories such as Gold ETFs, debt funds and other ETFs. Distributors play an important role while attracting inflows into the equity and balanced categories. Besides, ETFs are sold on stock exchanges, so distributors do not come into the picture much. On the other hand, large institutional investors typically invest in debt funds. They prefer to invest directly with fund houses, bypassing distributors, as their internal treasury departments manage proprietary money

9/14

Retail money comprised about half of the equity AUM (equity and ELSS) as of November 30, 2022. However, direct contributions by the retail segment were as low as 19%. The distributors’ portion had the lion’s share of 81% in retail equity AUM

10/14

Corporates held more than two-third of the debt funds’ AUM, investing mainly in liquid, overnight and TMF funds, mostly through direct investments. Retail investors mainly invested in other debt schemes, including corporate bonds, banking and PSU debt, as well as other duration funds. Retail investment in debt funds was mainly through the distributor channel

11/14

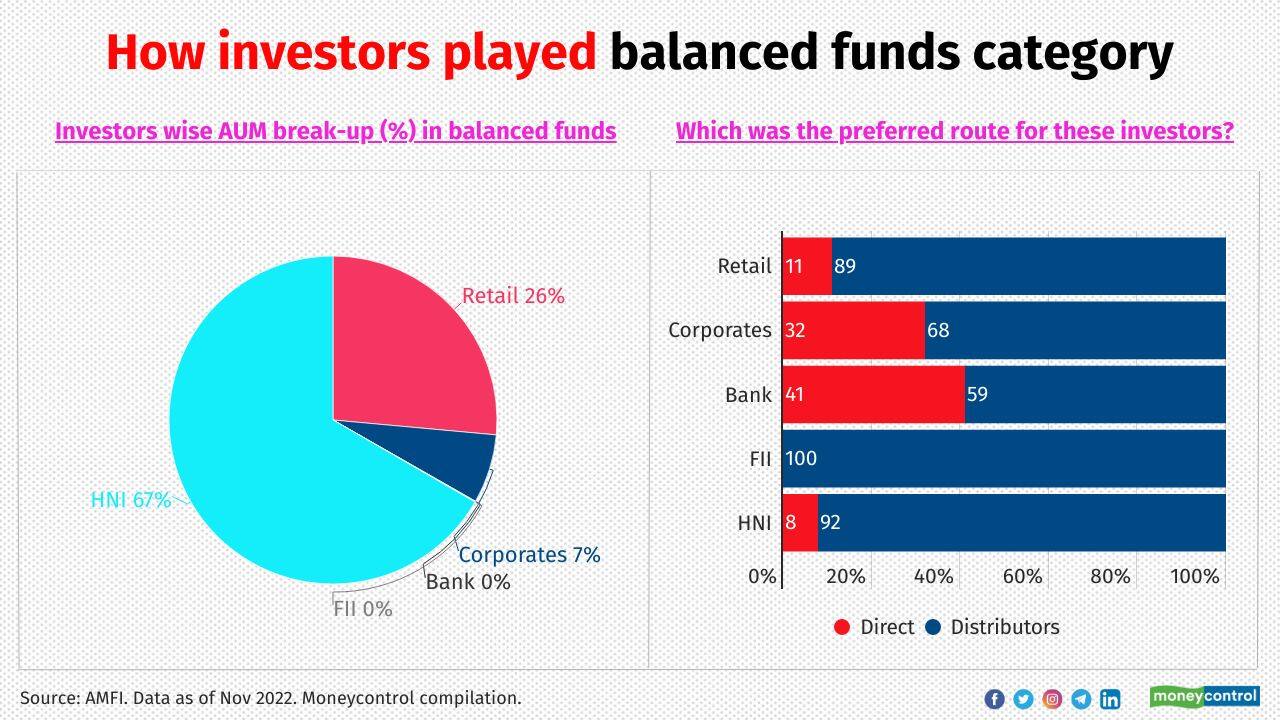

HNI and retail investors have been the major investors in the balanced funds category, mostly through intermediaries

12/14

Distributors had no major role to play in gold ETFs as these are exchange traded instruments. Corporates and HNIs mostly buy and sell these instruments on the exchanges. On the other hand, Gold FoFs (which, in turn, invest in gold ETFs) have been a preferred investment option for retail and HNI investors participating in the gold asset class

13/14

Corporates were the major investors in Equity and Debt ETFs. About three-fourths of their investments here were through direct plans

14/14

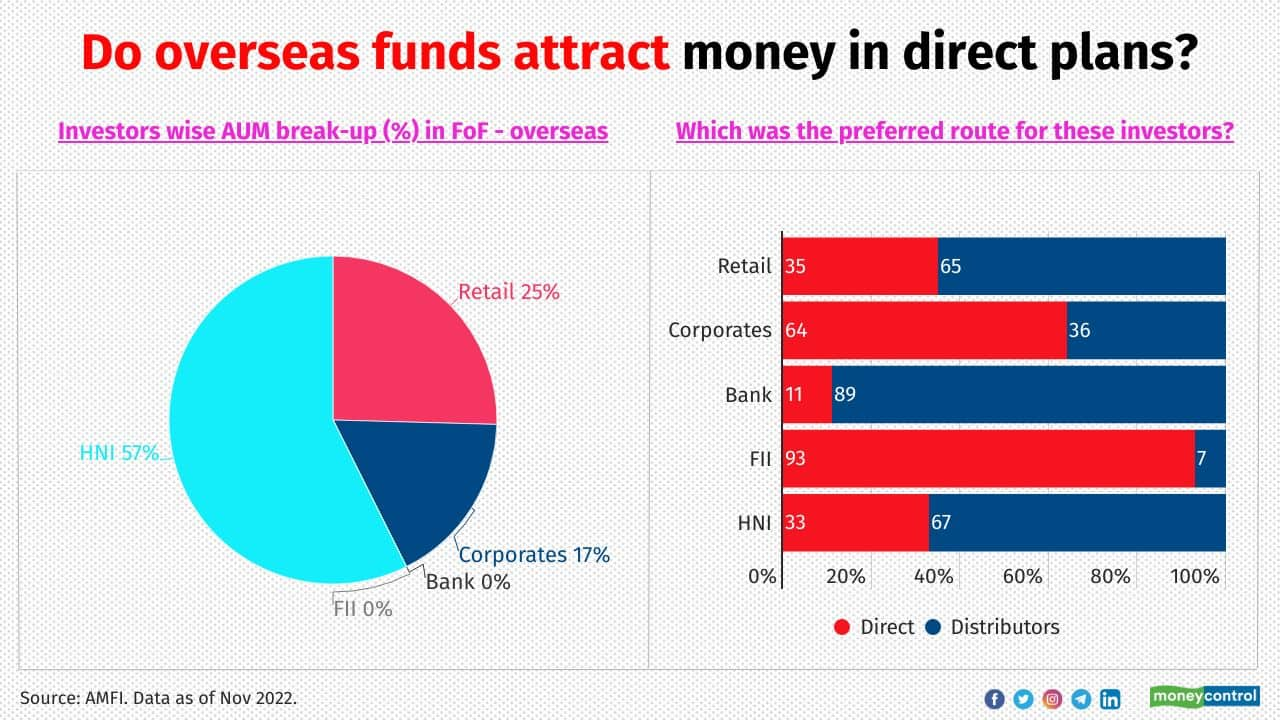

HNIs and retail investors were the two major investors in the FoF Overseas category. However, their direct participation was just one third of the AUM in this category.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!