Do fintech personal loans make sense for you? Here’s what to know

Fintech lenders offer convenience and speed but risks and costs need to be considered before joining.

1/7

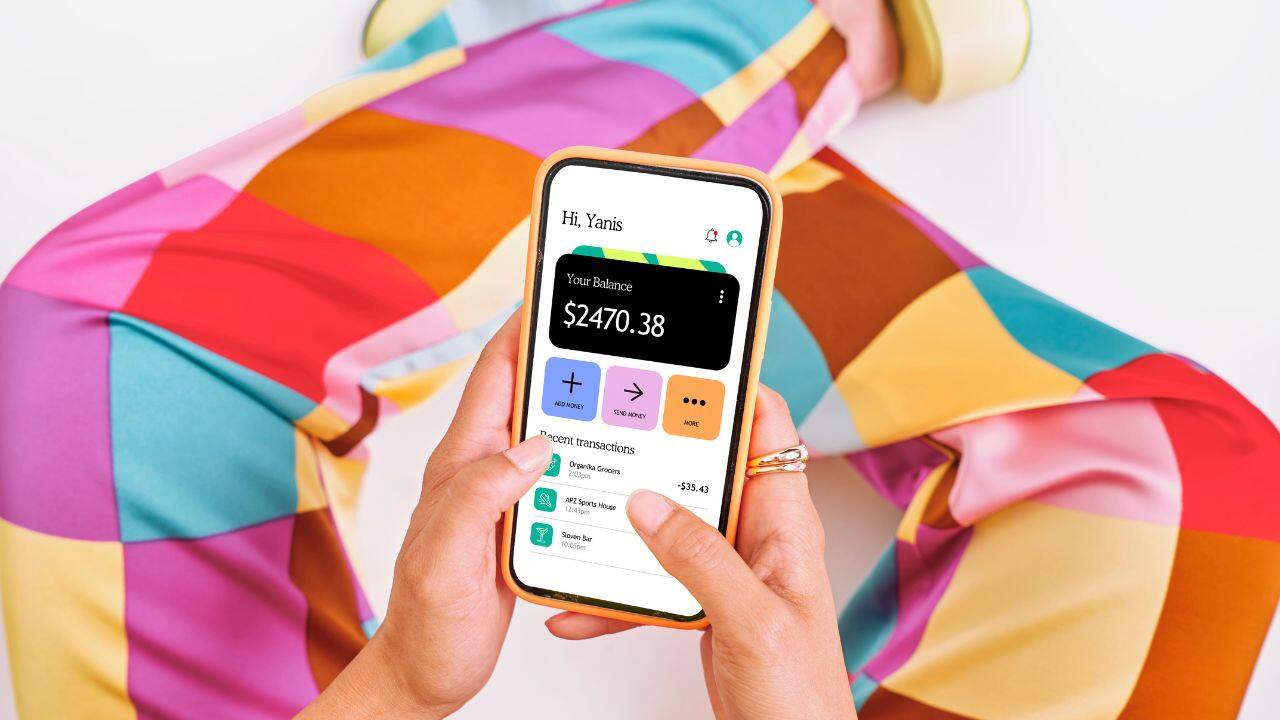

The emergence of fintech lending

In the last few years, financial technology firms — fintechs — transformed the personal loan market. Through mobile phone app downloads, instant approval, and minimal paperwork, fintechs attract borrowers who deem banks too slow or rigid. They typically provide quick cash for surprise bills, discretionary spending, or debt consolidation. Convenience, though, is not always the better choice.

In the last few years, financial technology firms — fintechs — transformed the personal loan market. Through mobile phone app downloads, instant approval, and minimal paperwork, fintechs attract borrowers who deem banks too slow or rigid. They typically provide quick cash for surprise bills, discretionary spending, or debt consolidation. Convenience, though, is not always the better choice.

2/7

Speed and accessibility

One of the strongest reasons to take a fintech loan is quickness. While banks take days or weeks to grant a loan, fintechs can disburse in hours. They are perfect for emergencies such as sudden medical expenses or urgent travel needs. Fintechs also welcome customers with slimmer credit, such as first-time borrowers or junior professionals who may not be easily accepted by traditional banks.

One of the strongest reasons to take a fintech loan is quickness. While banks take days or weeks to grant a loan, fintechs can disburse in hours. They are perfect for emergencies such as sudden medical expenses or urgent travel needs. Fintechs also welcome customers with slimmer credit, such as first-time borrowers or junior professionals who may not be easily accepted by traditional banks.

3/7

Competitive rates in some cases

While fintech loans have been accused of being expensive in some cases, they are not always. Some fintechs offer competitive interest rates even to good borrowers, even better than credit card borrowing in some cases. That is understandable when the borrower takes a look at the fintech's APR and compares it to alternatives and decides it is cheaper than maintaining balances on cards that have high interest rates. In this case, fintech loans can be employed as a debt-consolidation option at reduced cost.

While fintech loans have been accused of being expensive in some cases, they are not always. Some fintechs offer competitive interest rates even to good borrowers, even better than credit card borrowing in some cases. That is understandable when the borrower takes a look at the fintech's APR and compares it to alternatives and decides it is cheaper than maintaining balances on cards that have high interest rates. In this case, fintech loans can be employed as a debt-consolidation option at reduced cost.

4/7

Flexibility in loan products

Fintechs typically provide low-ticket loans — at times of merely a few thousand rupees — which large banks avoid. This flexibility is attractive for short-term needs such as gadget upgrades, learning courses, or repairs at home. Flexibility in selecting repayment cycles through mobile apps also becomes attractive among young users requiring more financial control.

Fintechs typically provide low-ticket loans — at times of merely a few thousand rupees — which large banks avoid. This flexibility is attractive for short-term needs such as gadget upgrades, learning courses, or repairs at home. Flexibility in selecting repayment cycles through mobile apps also becomes attractive among young users requiring more financial control.

5/7

When fintech loans can backfire

Though the advantages are many, fintech loans turn into a nuisance very soon if misused. Interest is highly charged compared to bank loans for individuals with worse credit ratings, and late payment charges are generally high. Borrowers also fail to observe such as hidden costs like processing cost or prepayment charges. With lack of foresight, availability can result in over-borrowing and debt trap.

Though the advantages are many, fintech loans turn into a nuisance very soon if misused. Interest is highly charged compared to bank loans for individuals with worse credit ratings, and late payment charges are generally high. Borrowers also fail to observe such as hidden costs like processing cost or prepayment charges. With lack of foresight, availability can result in over-borrowing and debt trap.

6/7

When fintech loans are justified

Taking a personal loan from fintechs is a financially sound option when the borrower needs quick cash and does not want to wait for a bank's approval process, when the loan has characteristics of interest and fees that are more cost-effective compared to alternatives like credit cards, when there is a brief funding need with characteristics of easy payment flexibility, and when debt consolidating in a fintech loan pays less on the overall cost of interest.

Taking a personal loan from fintechs is a financially sound option when the borrower needs quick cash and does not want to wait for a bank's approval process, when the loan has characteristics of interest and fees that are more cost-effective compared to alternatives like credit cards, when there is a brief funding need with characteristics of easy payment flexibility, and when debt consolidating in a fintech loan pays less on the overall cost of interest.

7/7

The bottom line

Fintech personal loans are not good or evil — they are tools to use well or ill. For borrowers on their own terms, using price comparison with care, reading the small print, and borrowing no more than they can realistically repay, fintechs offer a fast, flexible alternative to banks. For those using them as a pay-day loan alternative, however, they can become an instant snare. The financial wisdom does not reside in the lender, but in the wise manner in which the borrower utilizes the loan.

Fintech personal loans are not good or evil — they are tools to use well or ill. For borrowers on their own terms, using price comparison with care, reading the small print, and borrowing no more than they can realistically repay, fintechs offer a fast, flexible alternative to banks. For those using them as a pay-day loan alternative, however, they can become an instant snare. The financial wisdom does not reside in the lender, but in the wise manner in which the borrower utilizes the loan.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!