Trending Topics:

- Sensex Live

- Meesho IPO GMP

- Vidya Wires IPO

- Aequs IPO GMP

- Gold Rate Today

Income Tax Returns: 6 benefits of ITR filing even if your income is not taxable

Even if a person's income is exempted from tax, filing income tax returns may still have many advantages.

1/7

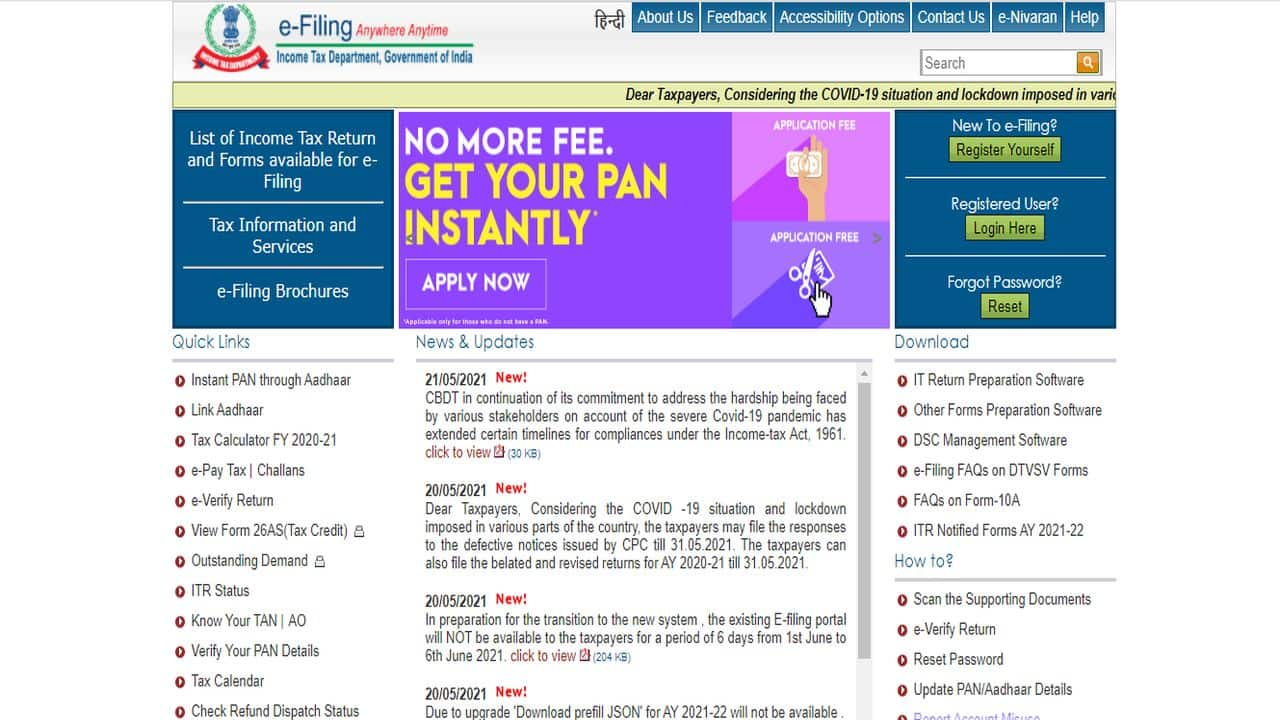

A person has to file Income Tax Returns (ITR) if they have a gross total income exceeding the tax exemption limit. It is not mandatory for a person to file the ITR if the gross total income does not exceed the exemption limit. If a person's income is exempted from tax, filing income tax returns may still have many advantages. Here are five advantages.

2/7

Use as address proof: The Income Tax Assessment Order can be used as an address proof. It can even be used for Aadhaar Card. Check all the valid documents here.

3/7

Get loans from banks: Banks ask for a three-year ITR while processing a loan for its customers. ITR will be a very helpful document for you if you are planning to buy a car pr a house, or looking for a personal loan.

4/7

Get visa approval: For issuing visa to an individual, most countries demand ITR among the documents. It helps if an individual is a tax-compliant citizen of the country. It also gives insight to the visa processing officials about your current financial condition and income levels.

5/7

Use it as proof of income: Employers issue Form 16 to their employees. It is an individual's proof of income. The ITR filing document serves as an authentic income proof for the people who are self-employed. During the financial year, an individual's detailed break-down of income and expenses are given in it.

6/7

Claim tax refund: If an individual files an ITR, they can save taxes on the income from savings instruments like term deposits and also tax can be saved on dividend income. An individual can claim the tax outgo through ITR refunds as these instruments are liable for taxes. An individual can have tax refunds and get the money back that is deducted at the source if the total gross income from different sources is above Rs 250,000. You have made investments in a manner that your net income is below Rs 250,000 in a year.

7/7

Claim losses: To claim specified losses for an individual taxpayer, filing of tax return within the due date is mandatory. This loss can be in the form of capital gains, business or profession.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!