In pics | RBI repo rate cut: All you need to know about repo and reverse repo rate

What is the repo and reverse repo rate and how do these work. Here’s all you need to know about it

1/6

The Reserve Bank of India (RBI) cut its repo rate by 40 basis points on May 22. RBI Governor Shaktikanta Das announced the move in view to help the economy revive from the ongoing novel coronavirus crisis. The short-term lending rate now stands at 4 percent. The reverse repo rate was also reduced by 40 bps to 3.35 percent. But what is the repo and reverse repo rate. Here’s all you need to know about it. (Image: Moneycontrol)

2/6

What is the repo rate? (Image: News18 Creative)

3/6

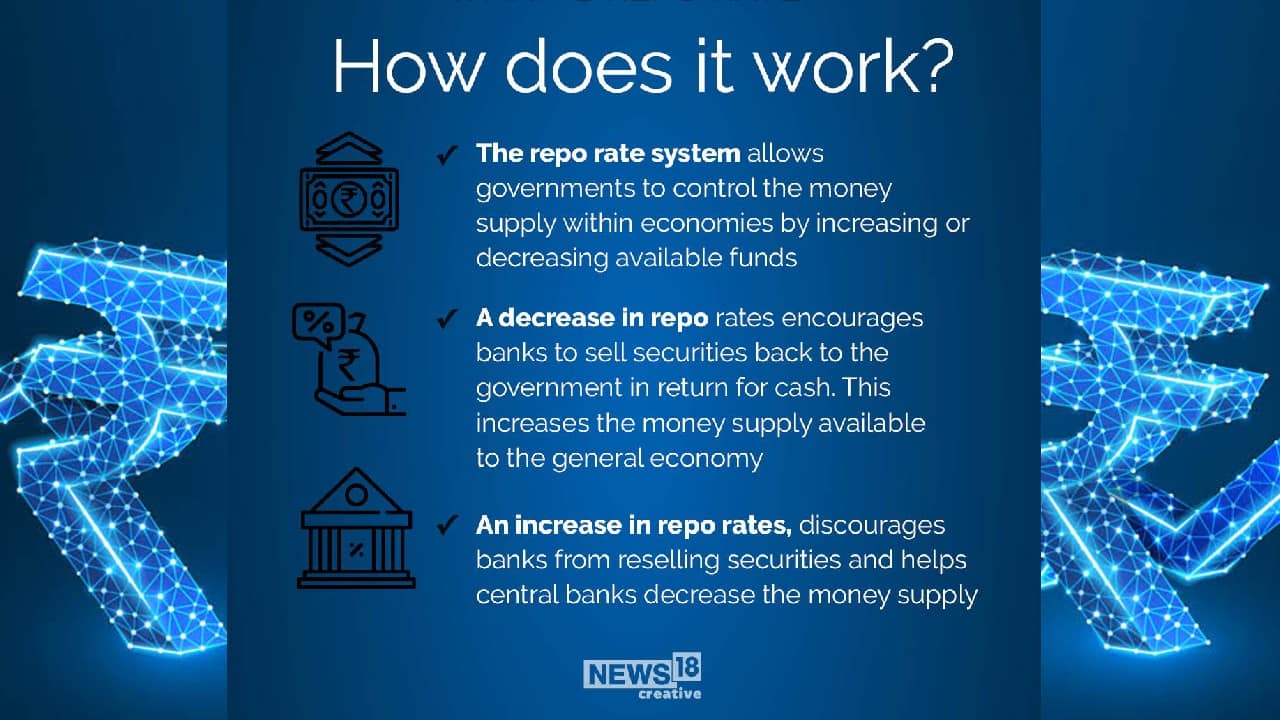

How does the repo rate work? (Image: News18 Creative)

4/6

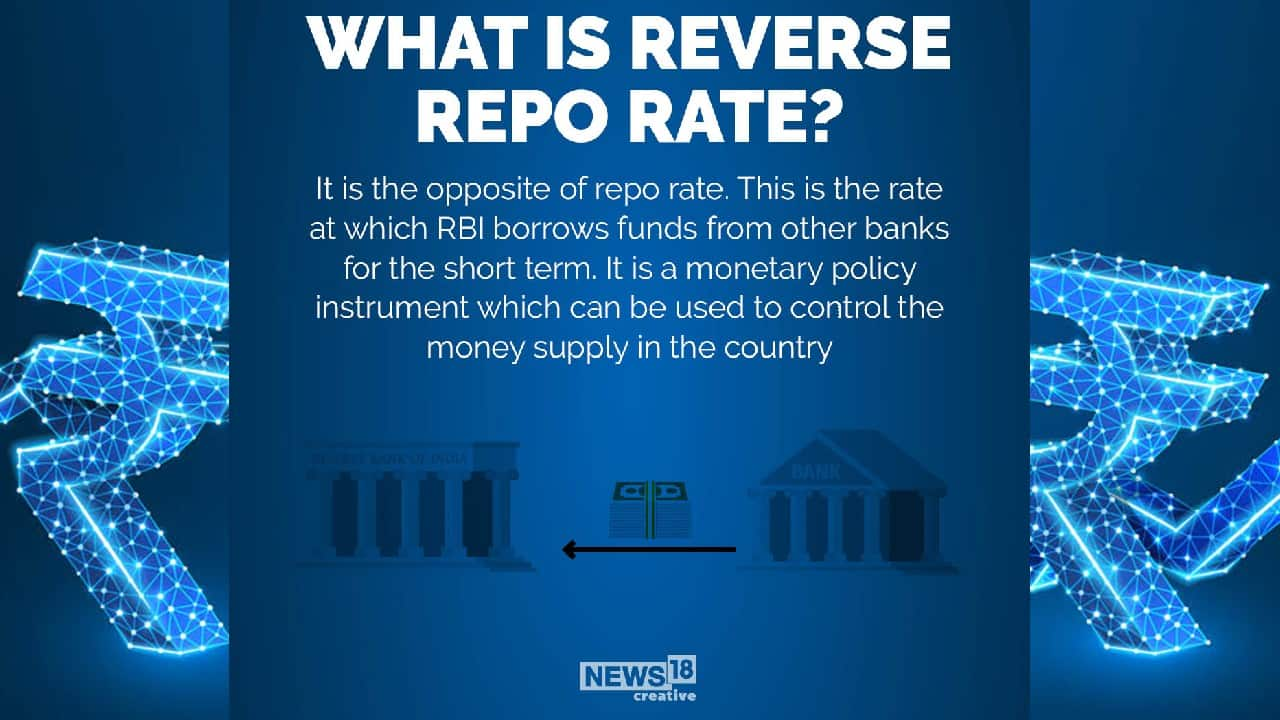

What is the reverse repo rate? (Image: News18 Creative)

5/6

How does the reverse repo rate work? (Image: News18 Creative)

6/6

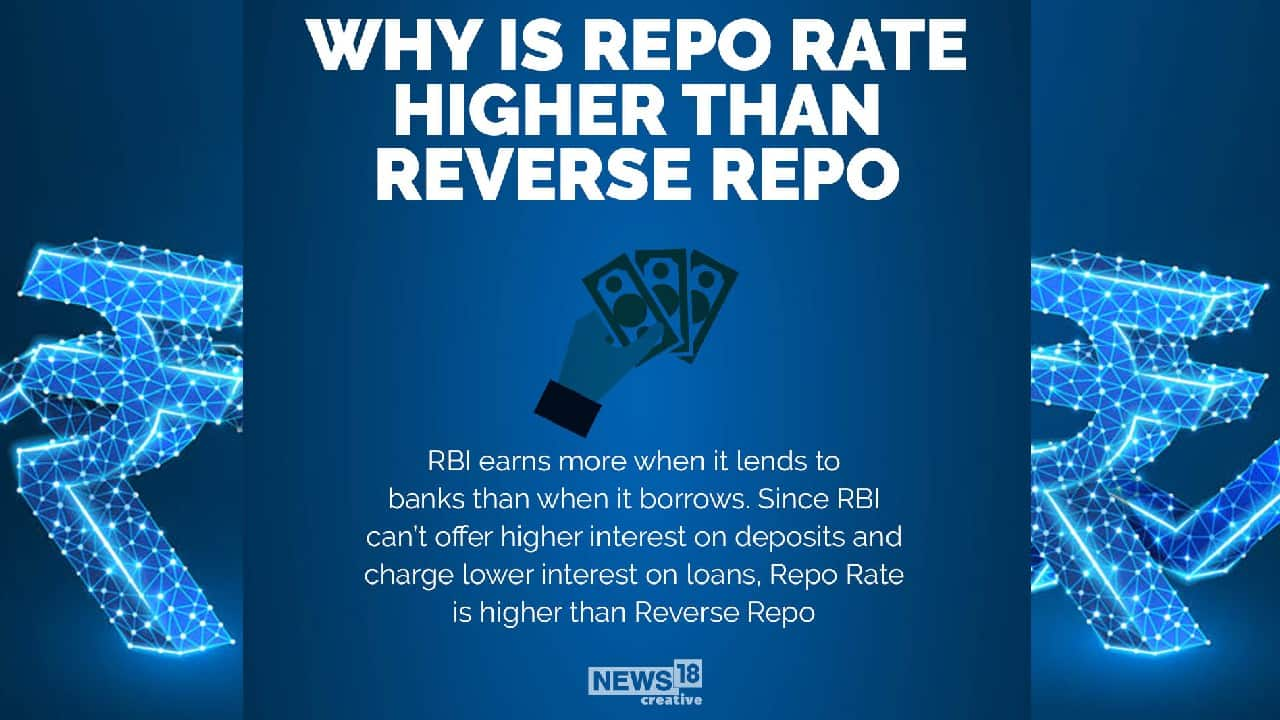

Why is repo rate higher than reverse repo rate? (Image: News18 Creative)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!