The turn of events in Saudi Arabia could push crude prices higher, but a bigger driver of prices will be OPEC's impending decision on extending the production cut.

But equity investors in India need not panic. The possibility of a big jump in crude prices hereon appears slim as at this price many shale gas producers could up their output. Further, correlation studies don’t show high crude prices hurting stock market returns. On the positive side, sovereign fund flows from the Middle-East could revive if oil prices stay firm.

Oil market developmentsSaudi Arabia’s recent crackdown on corruption apparently helps Crown Prince Mohammad bin Salman in consolidating power while removing any challenger within the family. This will no doubt fuel geopolitical tension in the near term, and given Saudi Arabia’s hostile view of Iran, oil prices look set to rise.

Having said that, a stronger Mohammad bin Salman could persuade OPEC members to extend production cuts beyond March 2018. In this context, the OPEC meet in Vienna at the end of this month is crucial. Given this context, oil prices can remain elevated.

Higher oil prices to weigh on corporate earningsHigher oil prices adversely impact margins for consumer staples (packaging), consumer durables (raw material cost), downstream chemical companies (input cost for paints, dyes, plastics, pipes, luggage), oil marketing companies, airline companies, among others. Oil exploration companies, obviously would be a net gainer. In few of the cases like consumer staples, companies may have to absorb higher input costs due to competition and fragile domestic recovery. However, downstream chemical companies linked to better end markets like steel, aluminum may be able to pass on a moderate increase in oil prices.

Also, crude above USD 60/barrel could strain the government’s finance and upset its fiscal math.

Positive correlation between oil prices and NiftyTo understand the impact of high oil prices on the stock market, we analysed the the Nifty and weekly oil price data for the last twenty years. Interestingly, there are very few episodes in the last twenty years, when the co-relation was negative. In other words, most of the time, equity market and oil prices have moved in tandem. One reasonable explanation is that rise in oil prices have typically been in sync with the upswing in economic cycle.

Chart: Oil price and Nifty- One year rolling correlation

Yet, investors should watch out for any sharp moves in oil prices. A spike in oil prices as witnessed in FY08 and FY11 could depress stock market mood. Similarly, a sharp oil price decrease in 2008 and FY15 could signal a recession, deflation-like scenario, impacting equities adversely.

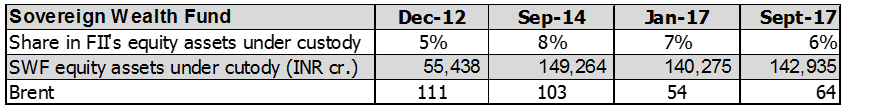

Fund flows from the Middle-EastAnother angle to look at is fund flows. Here, the hypothesis is that fund flows from the Middle-East improves when oil prices are strong. One proxy for tracking the fund flows from oil-rich nations fund flow is SWF (Sovereign Wealth Fund). SWF share in FII’s equity assets under custody increased in the period 2012-2014 till the oil price remained above USD 100. However, since then after the near collapse of oil market, this share has been reducing and absolute assets in custody is below the level seen in September 2014.

Source: NSDL

Source: NSDL

So the silver lining to the looming clouds of high crude price could be stabilisation in fund flows from the Middle-East, at the very least. Since our base case is for a moderate increase in oil prices from here, at best, we think that market attention would be focused on the recovery in domestic demand which will be crucial to companies’ ability to deal with higher input costs.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research PageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!