Ruchi Agrawal

Moneycontrol Research

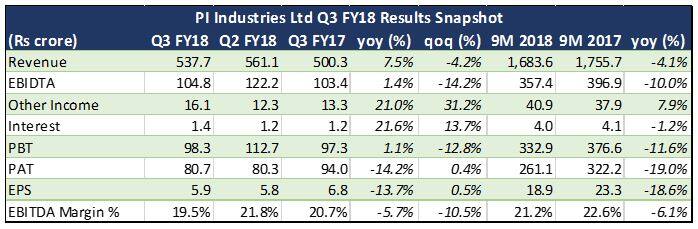

PI Industries (PIND) reported a subdued set of Q3 FY18 results majorly due to soft growth in the domestic business. Although the topline, at Rs 538 crores, grew 7.5 percent YoY, EBIDTA (earnings before interest depreciation and tax) was down sequentially with only a minor improvement of 1.4 percent YoY. Despite reduced taxes, the net profits took a 14 percent hit. Operating margins saw a contraction of 6 percent YoY and 10 percent over the last quarter majorly on account of an unfavorable product mix.

We see the softness in the results as a temporary phase and expect improved performance in FY19 owing to several positive operating factors like substantial growth in the CSM (customs synthesis and manufacturing) segment along with a healthy order book line up and limited exposure to rising global raw material prices.

Margins impacted by weaker product mix -

Rising prices of key raw materials and an unfavorable product mix impacted the EBITDA margins during the quarter. While on one hand the export segment saw a healthy growth of around 3.7 percent, domestic growth remained nearly flattish at around 3 percent YoY.

New product launches –

The company has launched two new molecules during the quarter and has lined up launches of two more in Q4. On the domestic front, the company has four product launches lined up for the upcoming quarter. Moreover, the management has also indicated a robust launch line up for FY19 and expects growth to flow in once the new launches gather momentum.

Backward integration -

The company has reduced its dependence on Chinese imports and plans to further distance from the unstable Chinese supply with plans of backward integration. Moreover, the management is also eyeing the close down of Chines factories as an opportunity to capture markets which are being vacated by China.

Contract manufacturing to drive growth -

The order book in the CSM segment remains strong at $1150 million and the segment is positioned to drive growth in the coming quarters. The company plans to introduce three new products in the coming quarters which is expected to bring further traction.

Outlook -

After hitting all time high in the last year, PI industry stock has seen an overall correction of 8 percent in the past 12 months and almost 9 percent in the last volatile week. Post the correction, the stock is trading at a 2019E PE of 23x and EV/EBITDA of 16.4x.

With continued commercialization of new products, strong orderbook line up, global agrochemical recovery, clearing up of inventory channels and a conducive domestic agri environment, we expect growth to pick up at PI in FY2019. We believe PI is a quality stock in the agrochemical space and at current price levels, it should be considered for accumulation.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!