Moneycontrol Mutual Fund Summit Highlights: Mutual Fund Distributor Awards ceremony concludes

-330

August 21, 2024· 21:16 IST

The live blog session has concluded. For more news, views and updates, stay tuned with Moneycontrol.com

-330

August 21, 2024· 21:16 IST

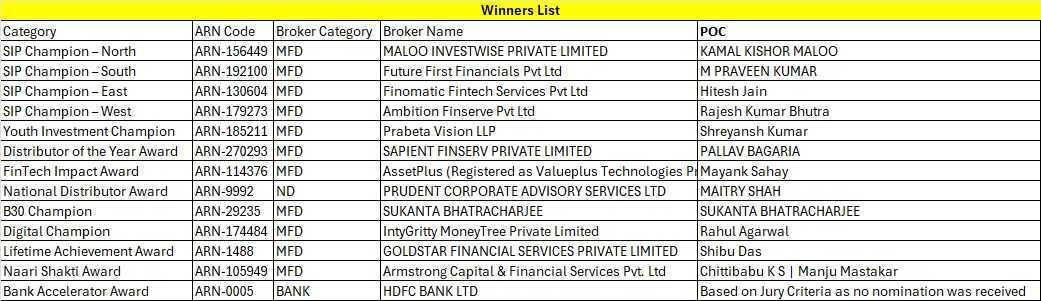

Moneycontrol MF Summit Live Updates: Mutual Fund Distributor Awards ceremony concludes. Check full list of winners

-330

August 21, 2024· 20:13 IST

Moneycontrol MF Summit Live Updates: Roshi Jain on cautious buying

“In every market it is buyer beware. If you don’t like it, you don’t have to buy it, if you feel the valuation is stretched or any other concerns about a promoter selling.”

-330

August 21, 2024· 20:05 IST

Moneycontrol MF Summit Live Updates: Never subscribed to the theory that you must be fully invested always, says Rajeev Thakkar

“We have never subscribed to the theory that you need to be fully invested at all times. If we don’t find something attractive, we do not buy stocks at higher valuations.”

-330

August 21, 2024· 19:59 IST

Moneycontrol MF Summit Live Updates: Roshi Jain on thematic funds

“As the Indian economy has grown, and as the markets have evolved, it has created a significant scale in niches. Thematic products do not have to be mass product, it can be a niche product for select investors.”

-330

August 21, 2024· 19:53 IST

Moneycontrol MF Summit Live Updates: Sanjay Chawla on new themes emerging & whether they are enduring

“What we have seen is a trend where manufacturers do not have the space in terms of new products but there are new themes emerging. The question we should be asking is if these themes are enduring or are they cyclical.”

-330

August 21, 2024· 19:49 IST

Moneycontrol MF Summit Live Updates: Promoters are selling stakes in a company because they aren’t finding the stocks interesting: Rajeev Thakkar

Rajeev Thakkar, Chief Investment Officer, Director, PPFAS Mutual Fund, says, “Various types of supply come into the market. If money comes in for expansion it is a good sign. What worries me is situations where promoters are selling stock because they don’t find them attractive.”

“It is often said in jest that in the beginning, the promoter has the vision, and retail investors have the money, and towards the end, the promoters have the money and investors have the vision,” he adds.

-330

August 21, 2024· 19:44 IST

Moneycontrol MF Summit Live Updates: Valuations are one part of the story where there is overvaluation, says HDFC AM’s Roshi Jain

Roshi Jain, Senior fund manager at HDFC Asset Management, says, “Valuations are one part of the story where there is overvaluation. If we don’t look at it from a one to two-year perspective, corporate earnings will continue to grow. There are segments and sectors that will give us compounding growth opportunities.

“What worries me is the euphoria. We have started to paint all companies with the same brush. This has diluted the discipline and rigour of research,” she adds.

-330

August 21, 2024· 19:41 IST

Moneycontrol MF Summit Live Updates: Large amount of demand in equities is consistent, not sentiment driven, says Gupta

Ashish Gupta, CIO, AXIS Mutual Fund says, “A large amount of demand in equities is consistent demand and not sentiment driven. There is consistent inflow as well as consistent supply. And going ahead the market direction will be determined by FIIs and retail buyers.”

-330

August 21, 2024· 19:35 IST

Moneycontrol MF Summit Live Updates: MF flows have been rising, says Ashish Gupta, CIO, AXIS Mutual Fund

Ashish Gupta, CIO, AXIS Mutual Fund says, “We talk about demand and supply, but 99% of the time demand is equal to supply. What changes is price and that comes because of change in expectations. MF flows have been rising. What has changed in the last three years has been a build up of systematic inflow - through SIPs, through insurance companies. There is around 35 billion in inflows and is giving confidence to the market that there will be consistent demand.

-330

August 21, 2024· 19:20 IST

Moneycontrol MF Summit Live Updates: Some amount of risk necessary when one has to make returns, says Vishwanathan Anand on investments

“My philosophy for investing is just to grow it… I invest in equities and mutual funds… Some amount of risk is necessary when one has to make returns. But advisory helps as I might have some blind spots. Thanks to how India has grown, my style of investing which has a mix of taking risk, has performed well over the years.”

-330

August 21, 2024· 19:10 IST

Moneycontrol MF Summit Live Updates: Chess benefitted tremendously from the pandemic, says Anand

Chess as a sport has benefitted tremendously from the pandemic. People started playing on their phones at home, says Viswanathan Anand, Indian Chess Grandmaster

He adds, Youngsters got their 10,000 hours of practice during COVID-19. It is going to get younger and younger.

-330

August 21, 2024· 19:06 IST

Moneycontrol MF Summit Live Updates: Happy that private corporate sponsorship is going up: Viswanathan Anand

Happy that private corporate sponsorship is going up, We have most of the pieces of a good eco system, says Viswanathan Anand, Indian Chess Grandmaster, in fireside chat with Kayezad E Adajania.

-330

August 21, 2024· 18:54 IST

Moneycontrol MF Summit Live Updates: Suresh Sadagopan says NFOs increase options for investors

Mutual funds are offering a whole basket of products. But we as advisors are playing a financial architect and might not use all the funds and New Fund Offers.

NFOs increase the options for investors. Some fund houses do not have a particular product in its offering basket. But we as advisors need to see whether the NFO is a right fit for the goals or not.

-330

August 21, 2024· 18:53 IST

Moneycontrol MF Summit Live Updates: NFOs get us new investors, says Kailash Kulkarni

Kailash Kulkarni says, “Getting a product in the category, where there is a gap is a big positive for New Fund Offers. NFOs get us new investors.”

He adds, “There are two kinds of NFOs -- the one is the me-too schemes that mimic existing products, but there are lot of newer developments and themes where are there enough opportunities where current products may not fit (and hence new schemes are needed).”

-330

August 21, 2024· 18:47 IST

Moneycontrol MF Summit Live Updates: Misbah Baxamusa on how to avoid recency bias

“For an investor to avoid recency bias is to use an advisor. The advisor in turn has to be careful about mentioning the recent returns, which can be either too promising or lack lustre.”

-330

August 21, 2024· 18:45 IST

Moneycontrol MF Summit Live Updates: Misbah Baxamusa of NJ Invest on publishing returns

“When we are publishing the returns, we don't focus on point-to-point returns. We focus on rolling returns for the longer period of 5-10 years.”

-330

August 21, 2024· 18:40 IST

Moneycontrol MF Summit Live Updates: No one to handhold investors, points out Kulkarni

“Do we have a person to handhold the investors? We struggle during bad times as one needs a shoulder to cry on and technology hardly suffices on that front,” says Kailash Kulkarni

-330

August 21, 2024· 18:37 IST

Moneycontrol MF Summit Live Updates: About 1 lakh investors can move to MFD side, says Suresh Sadagopan

Suresh Sadagopan says, “Considering the SEBI Consultation paper is accepted in the current form, we should consider about 1 lakh advisors to move to the MFD side.”

-330

August 21, 2024· 18:14 IST

Moneycontrol MF Summit Live Updates: Biggest risk for India is not mutual funds, says Ajit Dayal

The biggest risk for India is not mutual funds; mutual funds are phenomenal. The question is what happens to those who are controlling the mutual funds. Are they really looking after the investors interest or are they looking after their own interests as asset gatherers?

-330

August 21, 2024· 18:07 IST

Moneycontrol MF Summit Live Updates: Swaroop Mohanty on sachetization

“If you invest Rs 250 and it becomes Rs 750 what meaningful change is going to happen to a person's life? It will open up avenues but it has to be thought well.”

-330

August 21, 2024· 18:03 IST

Moneycontrol MF Summit Live Updates: Thematic funds are a “no no” for Ajit Dayal

“Thematic funds are a no no for me. Unless you're very smart and you time the cycle of a particular sector, you cannot say,” says Ajit Dayal of Quantum Mutual Funds.

-330

August 21, 2024· 17:58 IST

Moneycontrol MF Summit Live Updates: Investors have FOMO, now everyone’s just gathering AUM, says Quantum MF’s Dayal

“If we look at investors, they have FOMO. Everyone is talking about returns of the industry, but no one is talking about risks. Now everyone is just gathering AUM,” says Ajit Dayal of Quantum Mutual Funds

-330

August 21, 2024· 17:46 IST

Moneycontrol MF Summit Live Updates: Average age of investors declining day by day, says Swaroop Mohanty

“The average age of investors coming in is declining day by day. There are more people in bitcoin and derivatives, says Swaroop Mohanty of Mirae Asset Mutual Fund (India).

-330

August 21, 2024· 17:40 IST

Moneycontrol MF Summit Live Updates: I’m a strong proponent of daal chawal investing, says Radhika Gupta

Radhika Gupta, MD and CEO, Edelweiss Asset Management, said, “In the last couple of years, there has been a lot of talk about liquidity coming into the market. This was an outcome that we wanted - this is good liquidity.

She further said, “I am a strong proponent of daal chawal investing,” and added, “There are two challenges facing the industry – one is the kind of money that is channelised. I am worried that a large amount of money is going into thematic funds. Second is that I think we need more to bring the mutual fund story to the whole country.”

-330

August 21, 2024· 17:35 IST

Moneycontrol MF Summit Live Updates: SEBI Whole-Time Member Amarjeet Singh on PMS-lite model and low-ticket SIPs

-- The PMS-lite model is aimed at bringing the gap between PMSes and mutual funds.

-- Low-ticket SIPs are an interesting idea to further the mutual fund penetration.

-- We recently concluded consultations on MF lite regulations for passive funds and the proposed low-ticket SIPs as another promising prospect for deepening financial inclusion.

-330

August 21, 2024· 17:32 IST

Moneycontrol MF Summit Live Updates: Must ensure infrastructure robust enough to handle greater volume of transactions, says Amarjeet Singh

As the industry is growing, we need to ensure that the infrastructure and the ecosystem are robust enough to handle greater volume of transactions. It is critical to maintain sufficient capacity and scale it up… We need more listings, more asset classes, more fund raising, so that the fresh money can be appropriately allocated.

We recently had a situation where there was substantial surge in MF transactions. There was a fall in the market on a particular day and people wanted to take advantage of lower NAV, but some AMCs were unable to allot the same day NAV to investors.

So, it is very important to have appropriate capacity which is proactively monitored.

-330

August 21, 2024· 17:25 IST

Moneycontrol MF Summit Live Updates: Amarjeet Singh on SEBI deploying technology to automate compliance checks

“In recent years, we have been increasingly deploying technology in our supervisory process, through compliance checks.

The broader intent is to enhance a culture of continuous compliance. Technology has enabled us to monitor 1000s of data points which are impossible to monitor manually.

We developed an algorithm based alert monitoring system that is used to take regulatory compliance. Additionally, we also have alerts to detect potential many practices, such as list serving, churning, continuous rollover of short-term deposits, etc.

At Sebi we are using algorithms/technology to maintain regulations and to identify malpractices. This technology driven supervision is helping expand our supervisory bandwidth and identify blind spots and risks building up in the system.

We are also using technology to back test our data points.”

-330

August 21, 2024· 17:21 IST

Moneycontrol MF Summit Live Updates: Some important observations flagged by SEBI

- Ensuring segregation of MFs with those of portfolio management

- Implementation of dealing room controls

- A stress test mechanism

- Ensuring compliance by employees

- Proper maintenance of record to show due diligence

-330

August 21, 2024· 17:19 IST

Moneycontrol MF Summit Live Updates: Amarjeet Singh on self-regulation within AMCs

"We have recently mandated AMCs to maintain structured institutional mechanisms, which can proactively identify and deter instances of potential market abuse including front-running.

Self-regulation is an important part of good governance. AMCs are better positioned to identify malpractices better than us. Considering the recent front running in the past, we have told AMCs to identify and deter instances of potential front running. It will include whistle blower policies, etc.

This mechanism will help in having uniform practices across AMCs."

-330

August 21, 2024· 17:17 IST

Moneycontrol MF Summit Live Updates: Believe MFs can play significant role in promoting good governance, says Singh

“We believe that MFs through their voice can help promote good governance practices…. In order to sustain, it is essential for MFs to follow strong governance practices. This is of significance. Many of the new investors are first time investors it is important to maintain their trust in the markets. Once trust is lost it is difficult to get back,” says Amarjeet Singh, Whole Time Member, SEBI.

-330

August 21, 2024· 17:15 IST

Moneycontrol MF Summit Live Updates: Retail investors comprise 52% of equity AUM: Singh

Retail investors comprise 52% of equity AUM of the mutual fund industry... Many retail investors are first time investors. So, it is very imp to maintain their trust in the markets, says Amarjeet Singh, adding, “Once the trust of retail investors is lost it is tough to get the same set of investors back into the market.”

-330

August 21, 2024· 17:13 IST

Moneycontrol MF Summit Live Updates: Over 60% of AUM comes from metro cities, but industry expanding reach, says Singh

Amarjeet Singh says, “While the industry is expanding its reach beyond top cities, over 60% of ind AUM comes from metro cities including Mumbai, Delhi, Bengaluru and Kolkata. The number of unique investors is still a fraction of 55 crore PAN holders. These are numbers are reflective of the opportunity to tap into savings across regions.”

-330

August 21, 2024· 17:12 IST

Moneycontrol MF Summit Live Updates: DIIs now playing strong counterbalancing role against FPIs, says Singh

DIIs are now playing a strong counterbalancing role as against FPIs, says Amarjeet Singh while delivering the keynote address at the third Moneycontrol MF Summit.

-330

August 21, 2024· 17:10 IST

Moneycontrol MF Summit Live Updates: AUM of MF industry risen to Rs 65 trillion as of July end, says Amarjeet Singh

AUM of the MF industry has risen to Rs 65 trillion as of July end. The share of B-30 cities has increased to 18% of the industry AUM, says Amarjeet Singh, Whole Time Member, SEBI.

SIP has become part of our vocabulary. It has been such a huge transition… SIPs and retail participation signal the beginning of a shift in India’s investment culture from FDs to more effective wealth creating tools, he adds.

There is still a good runway and ample scope for penetration in the mutual fund industry, Singh further says

-330

August 21, 2024· 17:08 IST

Moneycontrol MF Summit Live Updates: Amarjeet Singh begins delivering keynote address. Here’s what he said

- It is very gratifying to see that the objective of using MFs as vehicle for spreading equity cult fructifying.

- Both the industry and regulator have worked together for decades for this moment.

- MFs are now an integral part of investment landscape.

- While we are celebrating the success of mutual funds, we should be mindful of the challenges we face

-330

August 21, 2024· 16:16 IST

Moneycontrol MF Summit Live Updates: What are SIPs

Systematic Investment Plans (SIPs) are one of the most popular ways to invest in MFs. SIPs help inculcate financial discipline and build wealth over the long run. It helps to take advantage of market volatility through rupee-cost averaging.

Franklin Templeton Mutual Fund (formerly known as Kothari Pioneer) introduced the first SIP in India in 1993.

-330

August 21, 2024· 16:00 IST

Moneycontrol MF Summit Live Updates: Summit to host MF awards ceremony

The 2024 edition of the summit will host the Mutual Funds Distributors Awards ceremony, which recognizes top performers who have contributed to expanding the reach and impact of the sector in India.

-330

August 21, 2024· 15:36 IST

Moneycontrol MF Summit Live Updates: Whole-time SEBI member Amarjeet Singh to deliver keynote address

Other prominent speakers at the Moneycontrol MF Summit 2024 include chess grandmaster Viswanathan Anand; Radhika Gupta, MD and CEO, Edelweiss Asset Management; Kalpen Parekh, CEO, DSP MF; Swarup Mohanty, VC and CEO, Mirae Asset Investment Managers, India; Ajit Dayal, founder and advisor, Quantum Advisors; Kailash Kulkarni, CEO, HSBC India Asset Management.

-330

August 21, 2024· 15:34 IST

Moneycontrol MF Summit Live Updates: ‘How SIPs Are Empowering Bharat’ is the theme of the 2024 edition of the MF summit

The 2024 edition of the ‘Moneycontrol Mutual Fund Summit’ is being held today in Mumbai. This year’s theme is ‘How SIPs Are Empowering Bharat’, which will highlight the growing impact of SIPs in driving financial inclusion in India.