21 January, 2025 | 18:25 IST

One of the key aspects to consider while looking for a personal loan is the applicable interest rate. It directly impacts the overall cost of your loan and determines how much you will eventually repay. Factors like the loan amount, repayment tenure, credit score and employment status can impact the actual interest rate you may be charged.

So, it’s essential to understand what constitutes a good personal loan interest rate while comparing different lenders.

Let’s delve deep to understand the key factors to secure a personal at cheap interest rates:

Table of Contents

Personal loan interest rate is a percentage of the total loan amount charged by lenders as the cost of borrowing. The interest rate on personal loans can differ greatly depending on variables such as your income, credit score, loan amount and loan tenure. A lower interest rate, for instance, results in lower overall interest payments during the loan's term, whereas a higher interest rate raises the total amount of interest paid. Currently, personal loan interest rates can start at around 10% per annum and can go as high as 24% per annum.

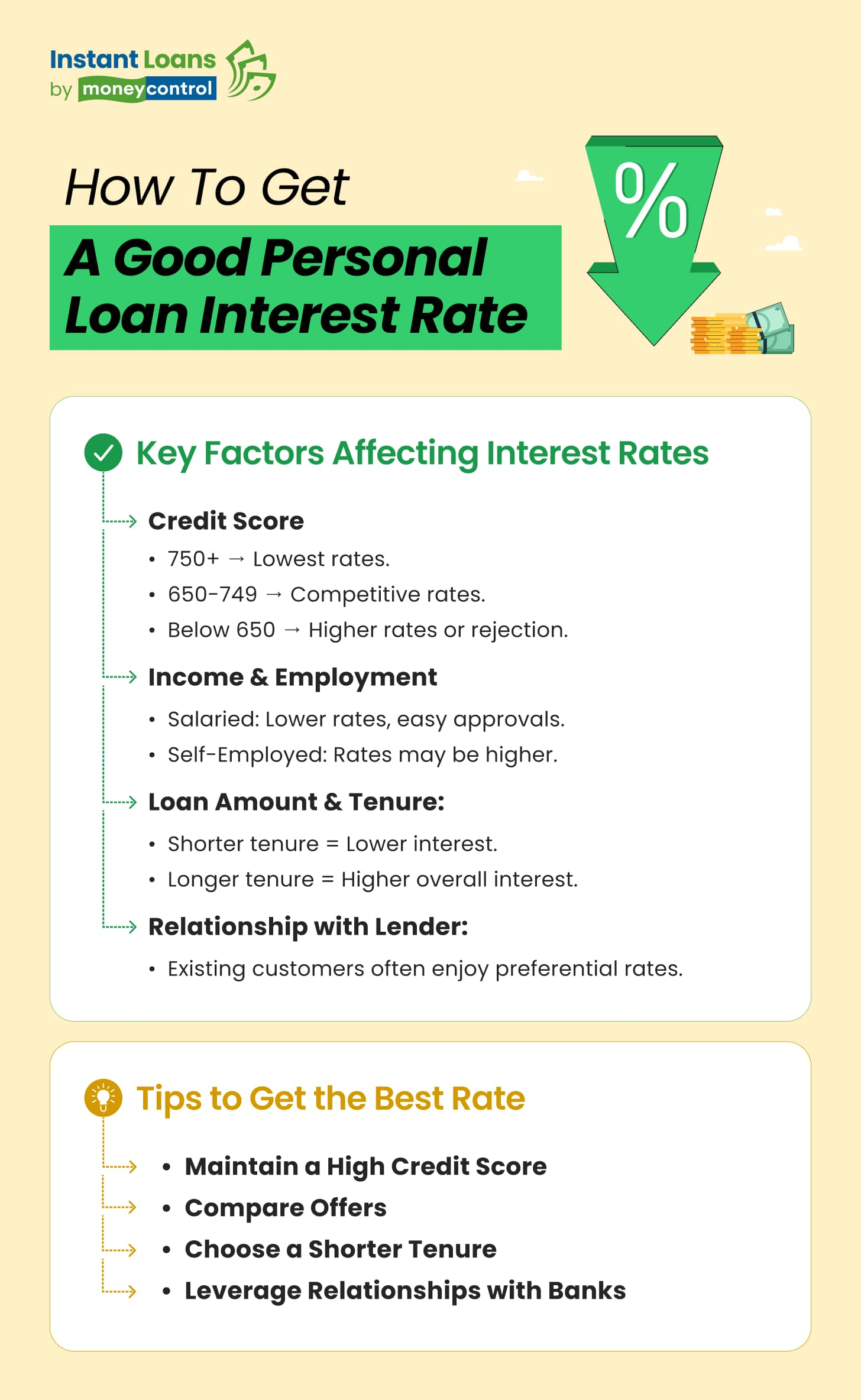

1) Credit Score: Lenders use your credit score to assess your creditworthiness, which reflects how likely you are to repay the loan. A higher credit score usually results in a lower interest rate, as it indicates that you are a low-risk borrower.

High credit score (750 and above): You may qualify for the lowest interest rates available.

Moderate credit score (650-749): You will get competitive rates but not the lowest.

Low credit score (Below 650): You may face higher interest rates or may not qualify for a loan at all.

2) Income and employment status: While trying to figure out your personal loan best interest rate, lenders also take these factors into account. A consistent income and work history imply that you won't struggle to repay the loan, which translates into a lower interest rate.

Salaried employees: Those who are paid a fixed salary usually get better interest rates and can apply without much documentation.

Self-employed: Lenders may see self-employed individuals’ income as less steady, which could result in higher interest rates.

3) Loan amount and tenure: Your personal loan interest rate is also influenced by the amount you borrow and the tenure of the loan. Longer loan terms may result in higher overall interest payments over time even though they cut your monthly repayment obligations. Shorter loan terms often have lower interest rates.

4) Relationship with the lender: Existing customers of a bank or financial institution may be eligible for personal loan best interest rates. Lenders often offer preferential rates to their customers as a way of retaining their business.

Through digital financial services platforms like Moneycontrol, you can access instant loans of up to Rs 15 lakh from top lenders. You can access personal loans through a completely digital process with interest rates starting at around 12%.

The best personal loan interest rate is something that aligns with your financial profile while offering you the most affordable terms. In India, personal loan interest rates usually start from around 10% per annum. However, rates can vary based on the factors mentioned above.

A personal loan interest calculator can help you determine the interest you will end up paying when you enter the loan amount, interest rate and tenure of the loan. On Moneycontrol you can explore personal loan offers from top lenders based on your application. The entire application process is 100% digital and you can get instant disbursal of funds in your account.

ALSO READ: How a Personal Loan Works: Eligibility, Interest Rate, Loan Amount and More

Securing the best personal loan interest rate requires a bit of preparation and knowledge of your financial circumstances.

A personal loan interest rate calculator is a valuable tool that helps you understand how different interest rates, loan amounts and tenures affect your monthly payments and the total cost of borrowing. By entering your desired loan amount, tenure and the expected interest rate, you can see how much you’ll pay each month and over the entire loan period. Moneycontrol provides a user-friendly personal loan interest rate calculator that allows you to experiment with different scenarios, helping you determine the best personal loan interest rate for your financial situation.

To sum up, choosing the personal loan best interest rate can save you a significant amount of money over the loan’s tenure. By understanding the factors that influence the personal loan interest rate and using tools like a personal loan interest rate calculator, you can navigate the process of applying for personal loans with ease.

Share it in your circle

Table of Contents

Explore Top Lenders for Instant Loan upto

Get Instant Loan up to ₹50 Lakhs with Zero Paperwork from Top Lenders

100% Digital

100% Digital Quick Disbursal

Quick Disbursal Low Interest Rates

Low Interest Rates