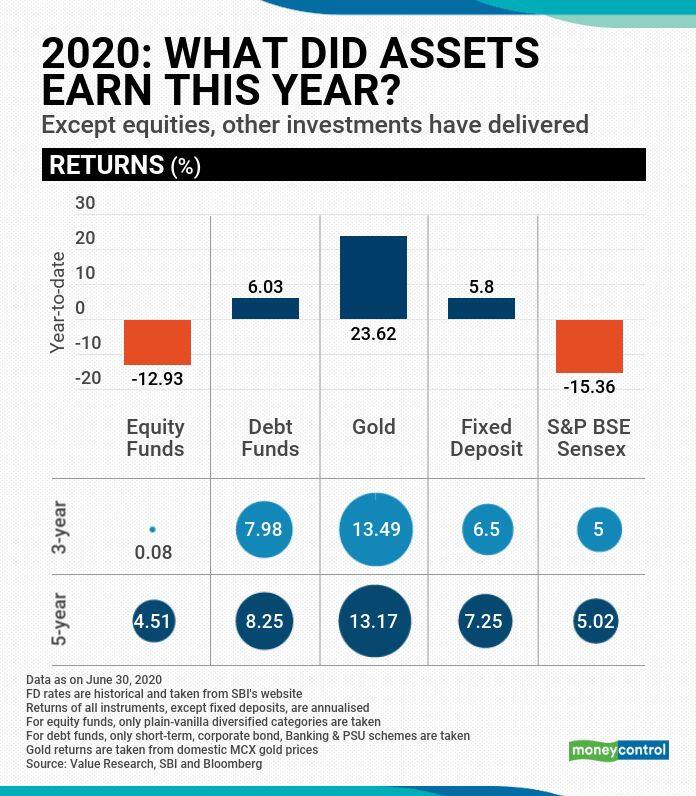

It’s been a fairly mixed bag as far as returns from various asset classes go in 2020. While diversified equity funds have lost close to 13 per cent on an average, debt schemes have given about six per cent returns.

Acting on advice

Had you been following Moneycontrol’s advice on asset allocation, your portfolio would have been better off because gold has given returns of close to 24 percent so far this year.

Equity funds have done better than the benchmark S&P BSE Sensex that lost 15 percent. In fact, in the year 2019, Sensex had delivered 14.38 percent. Only diversified equity funds have been considered in this exercise; thematic and sector funds have been excluded. The purpose of asset allocation is to ensure that you don’t put all your eggs in one basket.

Broadly speaking, every investor must allocate to three asset classes: equity, debt and gold. Your goal horizon, risk appetite and available surplus are critical factors in deciding your asset allocation pattern.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.