Personal loans come to anyone’s rescue during an unforeseen situation of financial crunch. Whether there is an unexpected expense during a wedding preparation or renovation to be done to your house, unfunded medical exigencies, debt restructuring, need to start a small business, etc., a personal loan can help you with immediate funds.

Since a personal loan comes with heavy interest rates, it is always advisable to take a personal loan only when you are in urgent need of some money and you do not want to provide any collateral security against it, for example, shares, investments or any other assets. Personal loans are unsecured in nature, which means a security need not be pledged as a collateral for it.

Here are few things to check before availing a personal loan:

Eligibility

For availing the amount of loan, you need to check your eligibility which you can know through a bank or any of financial institution website and check through the Personal Loan Eligibility Calculator provided by them. Your personal loan eligibility will depend on your income, repaying capacity, credit score etc. The lender generally checks the following things before sanctioning a Personal Loan. Also, depending upon your credit score and other factors as mentioned thereon, the loan amount and the duration of granting a loan from a financial institution vary.

Repayment Capacity

Before availing a loan, it is always advisable to check that whether you will be able to repay the EMI on time. However, repayment capacity profilings are conducted by banks or the lender at the time of granting loan so as to compare a borrower's cash or income sources thereby ensuring that the borrower has sufficient sources to repay the debt as per the requirement.

Pre-payment penalties

You should be aware of the fact that lenders generally charge a fee if you pay off your loan early because as per the deal, early repayment prevents banks or financial institutions from earning the interest as they had expected to take. Hence, it is advisable to pick a loan with the lowest forecloser charges. Currently, no foreclosure charges or prepayment penalties are applied on home loans.

Interest Rates

The interest rate may range between 8 and 16 percent depending on your credit score. Also, one should check and compare the interest rates with other institution before availing a loan because the interest may again vary due to several competitive reasons and in such case, you may get the benefit of getting a loan at a cheaper price.

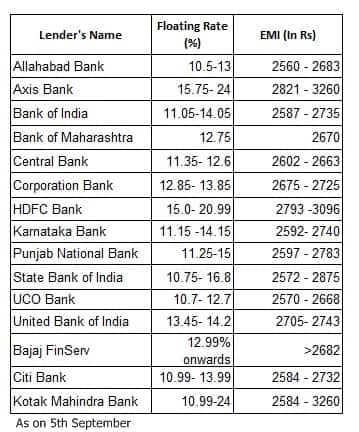

One can have a look at some of the personal loan interest rates offered by different banks and financial institution.

EMI payment

The equated monthly income or the EMI is calculated on basis of the rate of interest, time period and lastly, the present value of the loan. However, the EMI range is indicative and calculated on the basis of the interest rate range as provided in the table. In an actual situation, it may include other fees and charges as per the bank's terms and conditions. The interest rates are based as per salaried individual & pensioners for an unsecured personal loan. The actual applicable interest rate may vary based on the credit profile, loan amount, tenure, company you work for and as per the bank's discretion.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!