The power transmission and distribution segment (T&D) has been one of the outliers in the engineering space, having done quite well in the last one year.

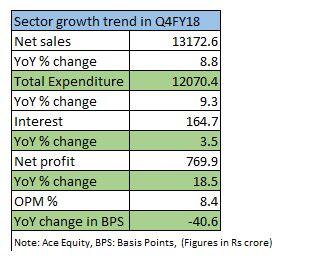

On an aggregate basis, 9 companies in our coverage universe have delivered 9 percent year-on-year growth in Q4 FY18. During the same period, pure transmission companies such as Kalpataru Power and KEC International have delivered robust 27 percent growth. Cost control and reduction in overall interest expenses helped these players deliver a strong 18.5 percent growth in net profits.

Contrast this to the broader trend in the engineering space that continues to be impacted by lower private sector capex. Companies in the T&D space were the major beneficiaries of higher government spending.

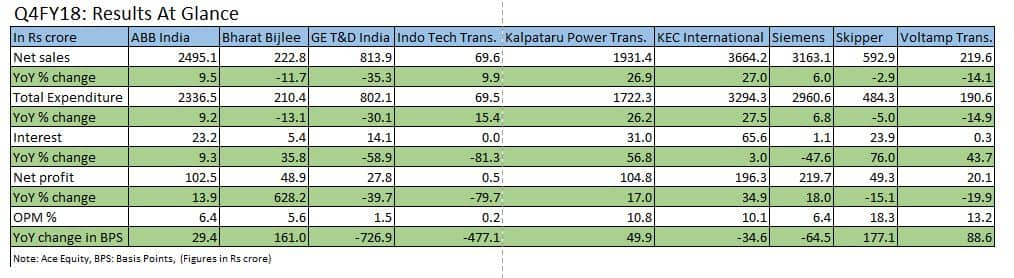

KEC International was the biggest outperformer. Led by strong growth in railways and civil construction segments and recovery in its core T&D business, the company reported a strong 35 percent YoY growth in profits. The management has guided to over 20 percent sales growth in the current fiscal backed by a strong order book of close to Rs 17,298 crore, or about 1.7 times its FY18 revenue. The stock is trading at 16 times FY20 estimated earnings and remains our top pick in the sector.

Kalpataru Power, which is sitting on an order book of close to Rs 12,400 crore, or over 2 times its FY18 revenue, has guided to similar 15-20 percent revenue growth and could be another stock in this space to watch out for.

ABB too benefitted from the government’s spending on upgradation of existing power infrastructure. It is far more diversified given its exposure to various segments. A broader recovery in the capex cycle would help it report consistent growth. However, at 40 times FY19 estimated earnings, the stock offers limited scope for appreciation.

Except KEC and Kalpataru, the performance of other companies were largely subdued. GE T&D, which is busy commissioning existing orders and recover dues, saw a 35.3 percent YoY decline in sales. Its focus on cash generation and recovery of dues resulted in generation of about Rs 880 crore in free cash flows, making the company debt-free in FY18. However, sales and profitability suffered, which may remain a concern in the medium term. Its expensive valuations, (trading at 32 times FY20 estimated earnings) make us cautious.

The transformer segment disappointed. Be it Bharat Bijlee, Indo Tech Transformers or Voltamp Transformers, most companies reported a decline or marginal revenue growth. This segment suffered because of lower demand and high capacity. Most of the demand is shifting to lower capacity transformers, which largely cater to segments like renewables, rural electrifications and railways.

We like Voltamp Transformers in this segment. The company has seen robust traction in order inflows, up 48 percent YoY. It has a large underutilised capacity and is currently trading at 8 times its FY20 estimated earnings.

OutlookIt would be prudent at this point in time to stick to pure T&D players that have a robust order book and strong grip on working capital management. Across the board capex recovery could still be far given the slow recovery in the private capex. It is important to note that most T&D stocks are reasonably valued given the growth in earnings.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!