Nitin Agrawal

Moneycontrol Research

In our quest to identify a quality business with a strong management pedigree, available at a reasonable price, we shortlisted Eicher Motors (EIL) for the long-term. We exude confidence in the company given its dominant position in bikes with an engine displacement of above 250cc and positive shift in customer preference towards premium products.

Recent concerns over volume growth owing to the Kerala floods, delayed festive season and labour problems at its Chennai plant have led to significant correction in the stock, making valuations attractive. We advise investors to start accumulating the stock on every dip for the long term.

Here are six factors that make it a worthy buy for the long term:

Numero uno position; strong brand

Royal Enfield (RE) is the strongest premium motorcycle brand in India. It dominates the above 250cc category, where it commands a 91 percent market share. This is on back of a differentiated motorcycle it provides along with a unique experience.

The company gained substantial market share in the above 125cc category over the years, which has risen to about 27 percent in FY18 from 3.8 percent in FY12. The market expansion was led by strengthening of its position in traditionally strong demand states and inroads in states which have a large motorcycle market but where penetration was lower.

Network expansion an important growth driver

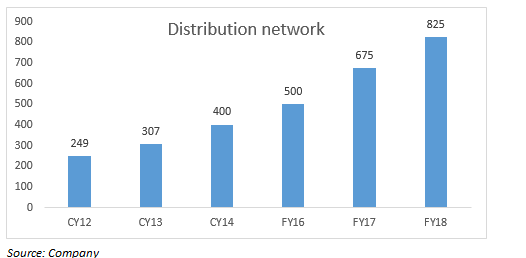

In light of the growth and improved accessibility, RE has been ramping up its distribution network in India and abroad. In the domestic market, the company increased its distribution network quite significantly and added 576 new stores between CY12 and FY18. To cater to growing demand, it added 150 stores in FY18 alone. Going forward, we see huge volume growth coming in from its network.

Strong focus on the international market

RE has also been focusing on the international market to drive growth. Volumes surged 47 percent between FY16 to FY18, though on a small base. In an effort to continue to penetrate international markets, RE continues to ramp-up and increased its exclusive store network to 36 by FY18 from 25 in FY17and has a network of over 500 multi brand outlets.

In FY17, the company opened a subsidiary in Brazil: the biggest two-wheeler market in Latin America. It also made inroads in Vietnam and Argentina by opening its flagship stores and further strengthened its presence in the UK, France, Austria, Mexico, Indonesia, Thailand, New Zealand and Colombia by adding new stores in these countries.

Competitive landscape

Bajaj Auto and Yamaha are RE’s two main competitors but they have not been able to capture much of the market. RE continues to maintain its numero uno position in the above 250cc segment on the back of strong brand royalty that it created over the years.

Growing CV business

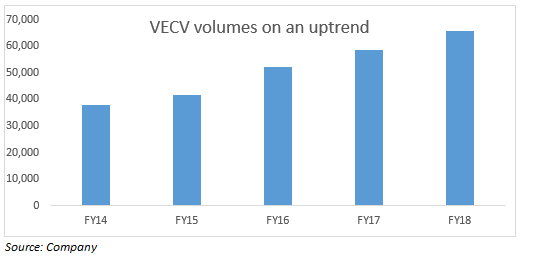

Eicher has a joint venture - VE Commercial Vehicles (VECV) - with Sweden’s AB Volvo to manufacture and supply commercial vehicles. At present, it has a market share of 14 percent in the domestic medium and heavy commercial vehicle (M&HCV) segment and volumes grew at a compounded annual growth rate of 15 percent between FY14 and FY18.

Outlook for the domestic CV segment is positive on the back of increasing demand from construction, government’s focus on infrastructure, increase in mining activity and growth in industrial productivity. We believe VECV should be able to participate in this growth.

Strong financial performance

On a standalone basis, RE has been doing phenomenally well financially. It is a cash-rich company with a debt-free balance sheet.

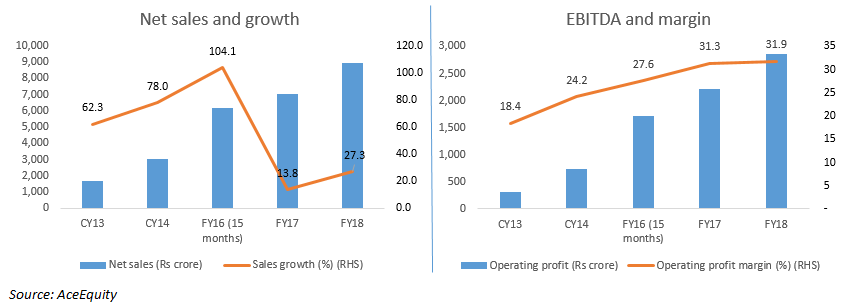

Net sales rose at a compounded annual growth rate of 54 percent between CY12 and FY18 due to strong volume growth. Operating profitability as measured by earnings before interest, depreciation, tax and amortisation (EBITDA) grew 81 percent over the same period. EBITDA margin averaged around 25 percent in the same period, the highest in the industry.

In terms of return ratios, the company has been able to deliver strong returns to its investors. In FY18, Its return on net worth (RoNW) and return on capital employed RoCE stood at 37.28 percent and 56.12 percent, respectively.

Valuations at reasonable levelsFollowing a sum of the parts valuation (SoTP), we conservatively value the RE business at 26 times, (lower than its historical average) and VECV business at 15 times FY20 projected earnings. Our analysis suggests that the business provides a 22 percent upside at current levels. Hence, we advise investors to accumulate the stock on any short term weakness arising out of volume concerns.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!