Anubhav Sahu

Moneycontrol Research

Highlights:

- Significant global market share in the Vitamin D3 API market

- Strong performance aided by both human and animal feed applications

- New capacity to add 15-20 percent to API capability

- Long-term positioning as a nutraceuticals company

-------------------------------------------------

DIL (market capitalisation: Rs 679 crore), the key global manufacturer of Vitamin D3 active pharmaceutical ingredient (API), continues to witness strong performance, aided by favourable supply-demand dynamics for the Vitamin D3 API market.

Read: This little-known Indian firm is a major Vitamin D ingredient producer

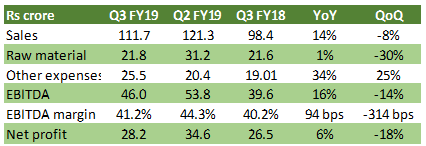

Result snapshot

Source: Company

Key positives

In the quarter gone by, DIL posted a year-on-year sales growth of 14 percent, with the bulk of revenue growth (87 percent share) attributed to performance of its Vitamin D3 active pharmaceutical ingredients (APIs) manufacturing subsidiary: Fermenta Biotech (91.2 percent share).

For 9M FY19, consolidated sales grew 54 percent, with Vitamin D3 API applications meant for human consumption growing 70 percent and APIs for the animal feed segment rising 46 percent. Its enzyme manufacturing businesses has also starting contributing to topline, with about three percent share.

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin in Q3 have improved 94 basis points (100 bps=1 percentage point) on account of better gross margin, partially offset by higher other expenses. For 9M FY19, EBITDA margin stood at 41.2 percent, which is significantly higher than that prevailing last year (28.9 percent).

Key negatives

Sequentially, there was a deceleration in topline numbers due to moderation in prices of Vitamin D3 API, particularly for the animal feed end-market. It is noteworthy that prices in this category rose three-to-four times in the last one year. Nevertheless, the quarterly run-rate is still significantly higher than that of earlier quarters, barring Q2 FY19.

Vitamin D3 export volumes (tonne) in form of tablets, capsules, syrup

Source: Ministry of Commerce and Industry, Moneycontrol research

Key observation

An investment of Rs 55 crore in Fermenta Biotech will lead to Vitamin D3 API capacity enhancement of 15-20 percent by FY20-end. The project will have multi-synthesis capabilities, which in turn would facilitate product extensions and new product rollouts.

While the project is majorly funded through debt (Rs 40 crore), peak debt-to-equity ratio is not expected to rise beyond one time during the upcoming capex cycle.

The company has taken the external commercial borrowing route to fund this project at an interest rate of 3-3.5 percent. Interest liabilities are not hedged for currency movement as it can be paid through export earnings.

OutlookSo, what keep us constructive on the company is the demand outlook. Human applications for Vitamin D3 is expected to grow by double-digits in volume terms aided by structural demand and applications in personal care and nutrition.

Pricing in the animal segment can remain strong and may not revert to the pre-2017 phase because the factor cost for producing Vitamin D3 in China has increased significantly over the years.

High barriers to entry in terms of technology requirements (photosynthesis replication) and regulatory permissions makes a supportive case for the stock.

We take note of the fact that at the strategic level, the company’s plan for a multi-synthesis platform is expected to help it position itself as a nutraceuticals company. Towards this, it is looking at both organic and inorganic opportunities.

After the recent correction, the stock is now trading around eight times FY20 estimated earnings, which is towards the lower range for the API segment. Investors with a high-risk appetite can keep this stock on their investment radar.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!