Nitin Agrawal Moneycontrol Research

Ashok Leyland (AL) posted a decent set of Q2 FY19 earnings driven by volume growth and cost control measures. Positive industry outlook, strong financial performance, focus of defence and electric vehicles (EVs) and reasonable valuation make it a long term buy.

Quarter at a glance

Volumes grew 26.8 percent year-on-year (YoY) in Q2. Segment-wise, medium and heavy commercial vehicles (M&HCV) and light commercial vehicle (LCV) witnessed 22 percent and 42 percent volume growth, respectively. Volume growth was led by strong demand from the construction segment on increased infrastructure activities.

Realisation, however, continues to be under pressure and declined 0.7 percent YoY due to intensified competitive intensity and rampant discounts.

Despite significant rise in raw material (RM) prices and discounting, AL continues to maintain profitability. Operating profit margin expanded 47.6 basis points (100 bps = 1 percentage point) on the back of operating leverage and cost control measures undertaken by the management.

Why do we continue to like the company?

Strong market presence On the back of superior technology and products, AL continues to have a strong industry presence, which led to market share gains. The latter expanded 150 bps YoY for the M&HCV segment in Q2 despite undertaking price hikes to combat rising raw material prices. We believe it would continue to maintain and/or gain market share going forward as well.

Industry opportunities to continue The CV segment has been a strong performer over the last couple of years, led by demand emerging from the construction segment, increase in mining activity and rising rural income lifting sentiment there. With the Centre’s continued focus on the rural economy and infrastructure in select pockets, the CV segment should witness strong demand going forward. Despite admitting to demand weakness ahead of general and state elections, the management remains confident about its positioning and products.

Pre-buying ahead of BS VI implementation

Bharat Stage VI emission norms are to be implemented from April 2020 and the management expects 30 percent growth in FY20 as the new BS VI compliant vehicles would be more expensive than current ones.

Focus of the international market Though AL is facing challenges in export markets, especially in Sri Lanka and Middle East, it expects exports to drive the next leg of growth. Initially, the company used to export only buses, but it now exports the entire range of products, which would help it gain market share.

Scrappage policy The government’s scrappage policy is to be implemented from April 2020 and would potentially lead to replacement of 2-3 lakh trucks that are over 20 years old. This would generate additional demand for the company’s products.

Focus on EVs AL has a focused strategy for developing EVs. The management expects EVs to constitute a large part of its business in future and is making significant investments in various technologies.

Strong position in defence The company had identified defence as one of the key growth drivers for the future and continues to focus in that direction. The management believes the government’s increasing focus on defence should support the sector’s long term prospects.

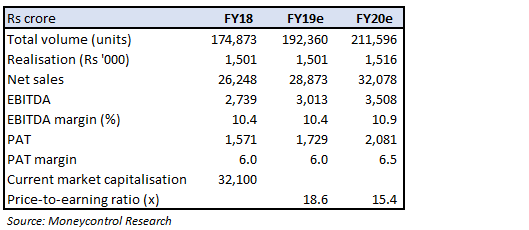

Valuation Amid market volatility and departure of its Managing Director and CEO, Vinod Dasari, the stock has corrected over nine percent, thereby making valuations attractive and giving investors an accumulation opportunity. At the current price, the stock trades at a reasonable valuation of 18.6 times FY19 and 15.4 times FY20 estimated earnings.

We continue to maintain our positive outlook on the company. However, investors need to watch out for its succession plan.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!