The market seemed to have given a false upside breakout on July 5 as the Nifty50 surpassed 15,900 in the opening and then 16,000 as well but failed to hold on to both levels due to profit booking in the latter part of the session, registering a bearish candle on the daily charts as the closing was lower than opening levels.

The BSE Sensex fell 100 points to 53,134, and the Nifty50 declined 25 points to 15,811, while the broader space reported a flat closing with negative bias amid mixed market breadth.

"A reasonable negative candle was formed on the daily chart with a long upper shadow. Technically, this pattern signals a false upside breakout of the strong resistance as well as the upper range at 15,950 levels (high low range of 15,700-15,900 levels)," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Hence, he feels the short-term trend of the Nifty seems to have reversed down from the highs and the current chart pattern indicates the possibility of further weakness in the short term. "One may expect Nifty to slide down to 15,600-15,500 levels again in the near term."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,722, followed by 15,634. If the index moves up, the key resistance levels to watch out for are 15,963 and 16,114.

Nifty Bank declined 125 points to 33,816 on Tuesday, forming bearish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 33,595, followed by 33,374. On the upside, key resistance levels are placed at 34,199 and 34,582 levels.

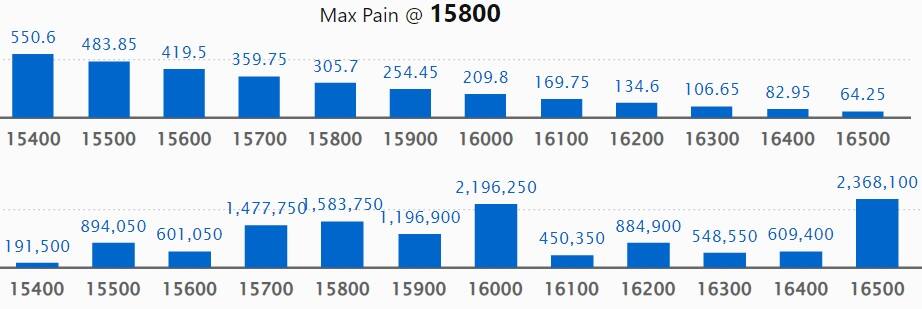

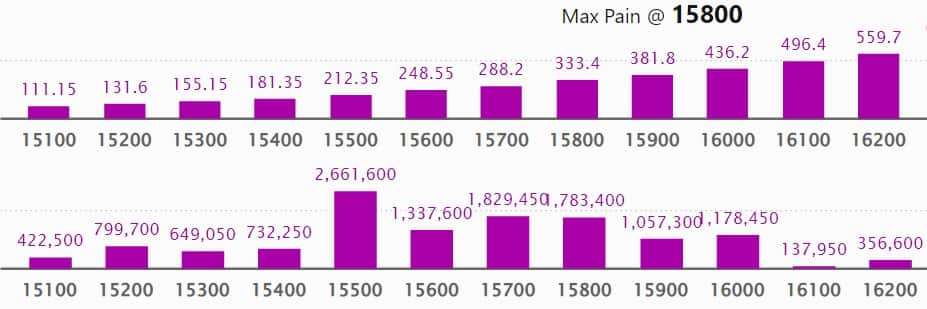

Maximum Call open interest of 23.68 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the July series.

This is followed by 16,000 strike, which holds 21.96 lakh contracts, and 17,000 strike, which has accumulated 21.86 lakh contracts.

Call writing was seen at 15,900 strike, which added 6.31 lakh contracts, followed by 16,000 strike which added 1.23 lakh contracts and 16,400 strike which added 1.21 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 1.86 lakh contracts, followed by 16,500 strike which shed 1.52 lakh contracts and 15,700 strike which shed 72,450 contracts.

Maximum Put open interest of 34.11 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the July series.

This is followed by 15,500 strike, which holds 26.61 lakh contracts, and 14,500 strike, which has accumulated 24.8 lakh contracts.

Put writing was seen at 15,900 strike, which added 7.16 lakh contracts, followed by 15,800 strike, which added 2.18 lakh contracts and 16,000 strike which added 1.65 lakh contracts.

Put unwinding was seen at 14,400 strike, which shed 1.88 lakh contracts, followed by 14,300 strike which shed 1.37 lakh contracts, and 14,500 strike which shed 1.36 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Ipca Laboratories, Oracle Financial, Infosys, Gujarat State Petronet, and Ambuja Cements, among others.

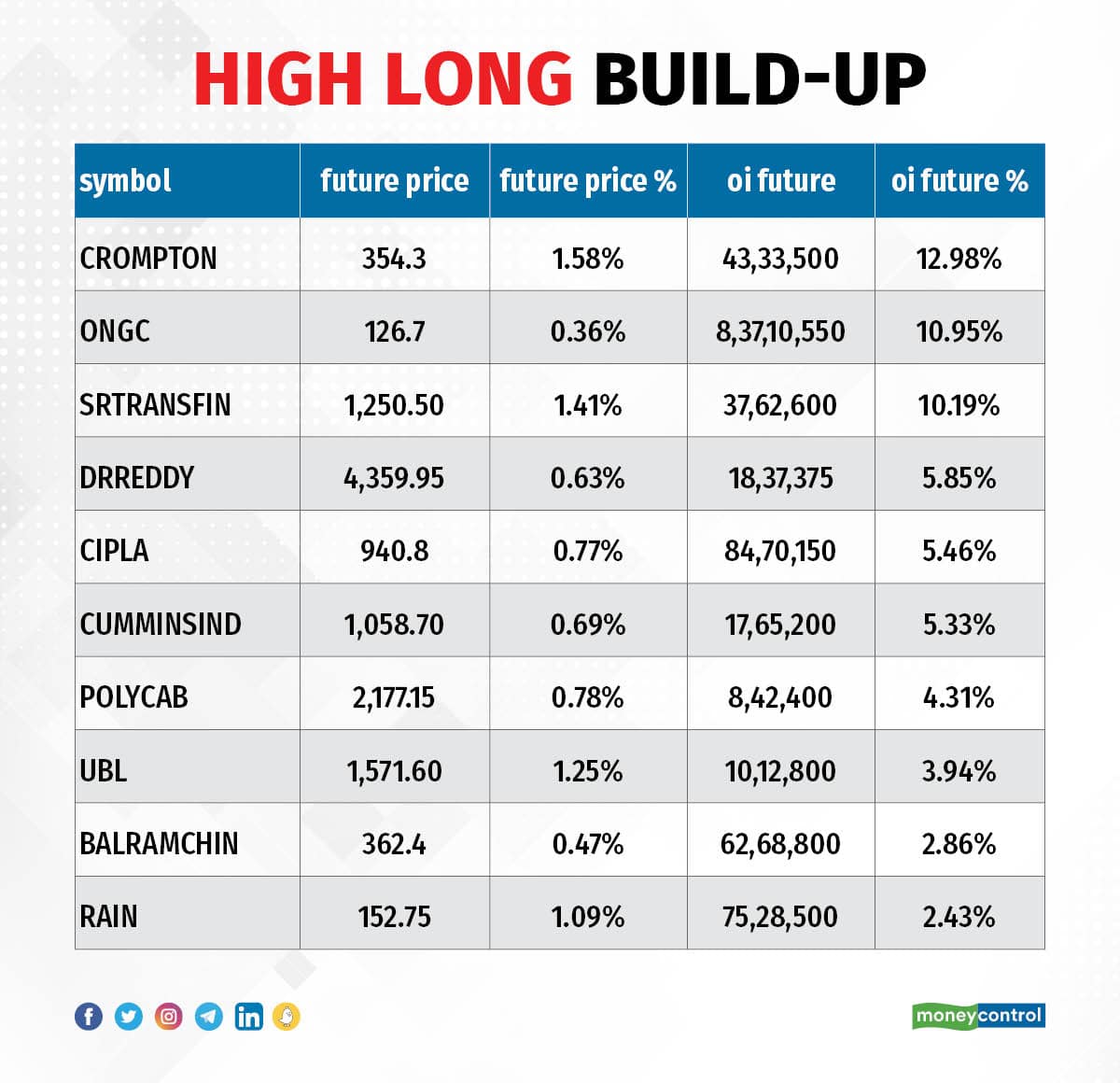

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Crompton Greaves Consumer Electricals, ONGC, Shriram Transport Finance, Dr Reddy's Laboratories, and Cipla, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, Gujarat Gas, REC, Britannia Industries, and Bosch, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks including Nifty Financial, SRF, Syngene International, Aarti Industries, and Voltas, in which a short build-up was seen.

32 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including SBI Card, Coforge, Chambal Fertilizers, Gujarat State Petronet, and City Union Bank, in which short-covering was seen.

(For more bulk deals, click here)

Investors Meetings on July 6

Tata Motors: Officials of the company will interact with ICICI Prudential Asset Management.

Jubilant Ingrevia: Officials of the company will interact with Value Quest, IDFC Mutual Fund, Aditya Birla Sun Life Insurance Company, Mirae Asset Management, and Unique Investment Consultancy.

Krishna Institute of Medical Sciences: Officials of the company will interact with various investors in Singapore.

Easy Trip Planners: Officials of the company will interact with institutional investors.

Inox Leisure: Officials of the company will meet Bajaj Allianz Life Insurance.

Stocks in News

Biocon: Subsidiary Biocon Biologics has received EU GMP certificate from the Health Products Regulatory Authority (HPRA), Ireland, for its new monoclonal antibodies (mAbs) drug substance manufacturing facility (B3) at Biocon Park, Bengaluru. This is after the good manufacturing practice (GMP) inspection conducted in April 2022 by the said authority.

Tejas Networks: The company has acquired 60,81,946 equity shares or 62.65% stake in Saankhya at a price of Rs 454.19 per equity share. The transaction cost is Rs 276.24 crore. After the said acquisition, Saankhya has become a subsidiary of the company.

KPI Green Energy: The company has received the biggest order for executing solar power project of 23.60 MWdc capacity from Nouveau Jewellery LLP and 3 MWdc capacity from Nouveau Diamonds Manufacturing India LLP. The order is under 'captive power producer (CPP)' segment of the company.

Satia Industries: The company has received an order worth over Rs 105 crore from National Council of Educational Research and Training (NCERT). The company will supply 11,000 tons of Maplitho paper of 80 GSM in sheets and reels for printing of text books.

Transcorp International: Tide, the UK's leading SME-focused business financial platform that began setting up operations in India in 2020, has partnered with Transcorp International, an Authorised Dealer Category II and perpetual Prepaid Payment Instrument (PPI) license holder. They will launch co-branded prepaid cards (Tide Expense Card) as an entry product. Tide will offer payment services to small businesses across India, starting with a Tide business account, accompanied by a Tide Expense Card.

Equitas Holdings: The company has completed the sale of its entire shareholding in its subsidiary, Equitas Technologies (ETPL). With this, the company complied with the condition stated by RBI as part of its no objection letter for amalgamation of Equitas Holdings with Equitas Small Finance Bank.. Consequently, ETPL has ceased to be the subsidiary of the company.

J Kumar Infraprojects: The company has received Letter of Acceptance from Brihanmumbai Municipal Corporation, for design, build and commissioning of priority sewer tunnel-Phase I from Don Bosco to New Malad IPS with segment lining method in Mumbai. The project cost is Rs 571.01 crore. J Kumar lnfraprojects in joint venture with Michigan Engineers bagged this project with 60:40 proportion.

Marico: India business volumes in Q1FY23 declined in mid-single digits, particularly dragged by a sharp drop in Saffola Oils, while Parachute coconut oil recorded a minor volume decline. Value added hair oils grew in low single digits in value terms despite weak consumption sentiment, especially in rural. The International business maintained its strong momentum, delivering high-teen constant currency growth. Consolidated revenue in the quarter ended June 2022 was marginally higher on a year-on-year basis.

Fund Flow

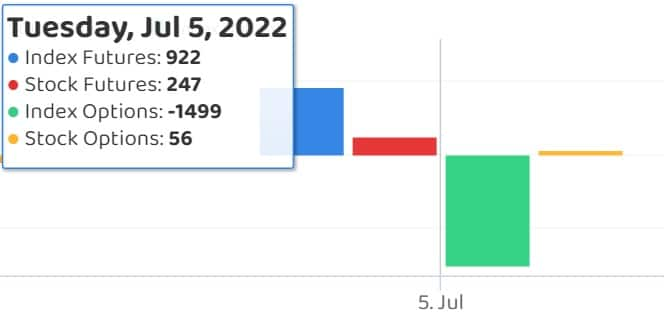

Foreign institutional investors (FIIs) turned net buyers for the first time since May 30, buying shares worth Rs 1,295.84 crore, whereas domestic institutional investors (DIIs) turned net sellers for the first time since April 11, selling shares worth Rs 257.59 crore on July 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock under its F&O ban list for July 6 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!