The market extended losses for a third consecutive session with the Nifty50 witnessing a fresh closing low of 2022 on June 14, as traders maintained caution ahead of interest rate decision by the US Federal Reserve.

The BSE Sensex fell 153 points to 52,694, while the Nifty50 declined 42 points to 15,732 and formed a bullish candle which resembles an Inverted Hammer kind of pattern formation on the daily charts.

"Normally, such Inverted Hammers at the lows indicate bottom reversal pattern post confirmation. The Nifty made a new swing low of 15,659 levels on Tuesday, which is near the crucial support of 15,700-15,650 levels (multiple swing lows); but there is no evidence of any sharp upside recovery emerging from near this important support," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The inability of bulls to show any significant upside recovery from the important support (15,700-15,650) indicates chances of one more leg down to 15,600-15,500 levels before showing any significant upside bounce from the lows, the market expert pointed out, adding that"immediate resistance is placed at 15,850 levels".

The selling pressure was also seen in broader space as the Nifty Midcap 100 and Smallcap 100 indices declined 0.23 percent and 0.6 percent respectively amid weak breadth.

The volatility cooled down a bit but is still at higher levels, indicating a favourable trend for bears. India VIX, the fear index, fell by 2.13 percent to 21.89 levels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,642, followed by 15,551. If the index moves up, the key resistance levels to watch out for are 15,840 and 15,948.

Nifty Bank declined 95 points to close at 33,311 on Tuesday, forming an Inverted Hammer kind of pattern on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 33,084, followed by 32,857. On the upside, key resistance levels are placed at 33,578 and 33,845 levels.

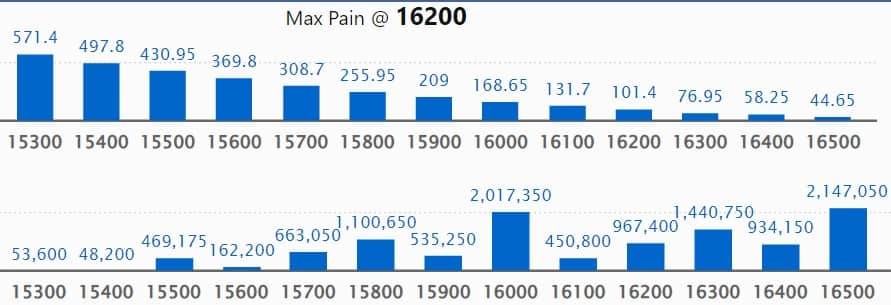

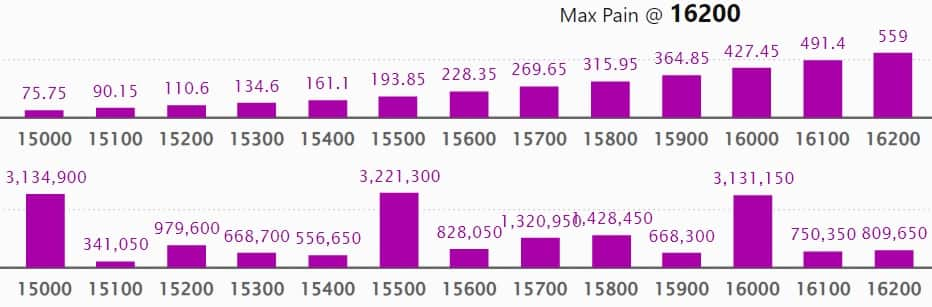

Maximum Call open interest of 25.02 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,500 strike, which holds 21.47 lakh contracts, and 16,000 strike, which has also accumulated 20.17 lakh contracts.

Call writing was seen at 15,700 strike, which added 2.44 lakh contracts, followed by 15,800 strike which added 1.79 lakh contracts and 16,500 strike which added 1.25 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 63,600 contracts, followed by 16,800 strike which shed 37,350 contracts and 17,100 strike which shed 23,450 contracts.

Maximum Put open interest of 32.21 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the June series.

This is followed by 15,000 strike, which holds 31.34 lakh contracts, and 16,000 strike, which has accumulated 31.31 lakh contracts.

Put writing was seen at 15,000 strike, which added 3.33 lakh contracts, followed by 15,700 strike, which added 1.51 lakh contracts and 14,500 strike which added 1.4 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 2.88 lakh contracts, followed by 16,500 strike which shed 1.73 lakh contracts, and 16,300 strike which shed 50,250 contracts.

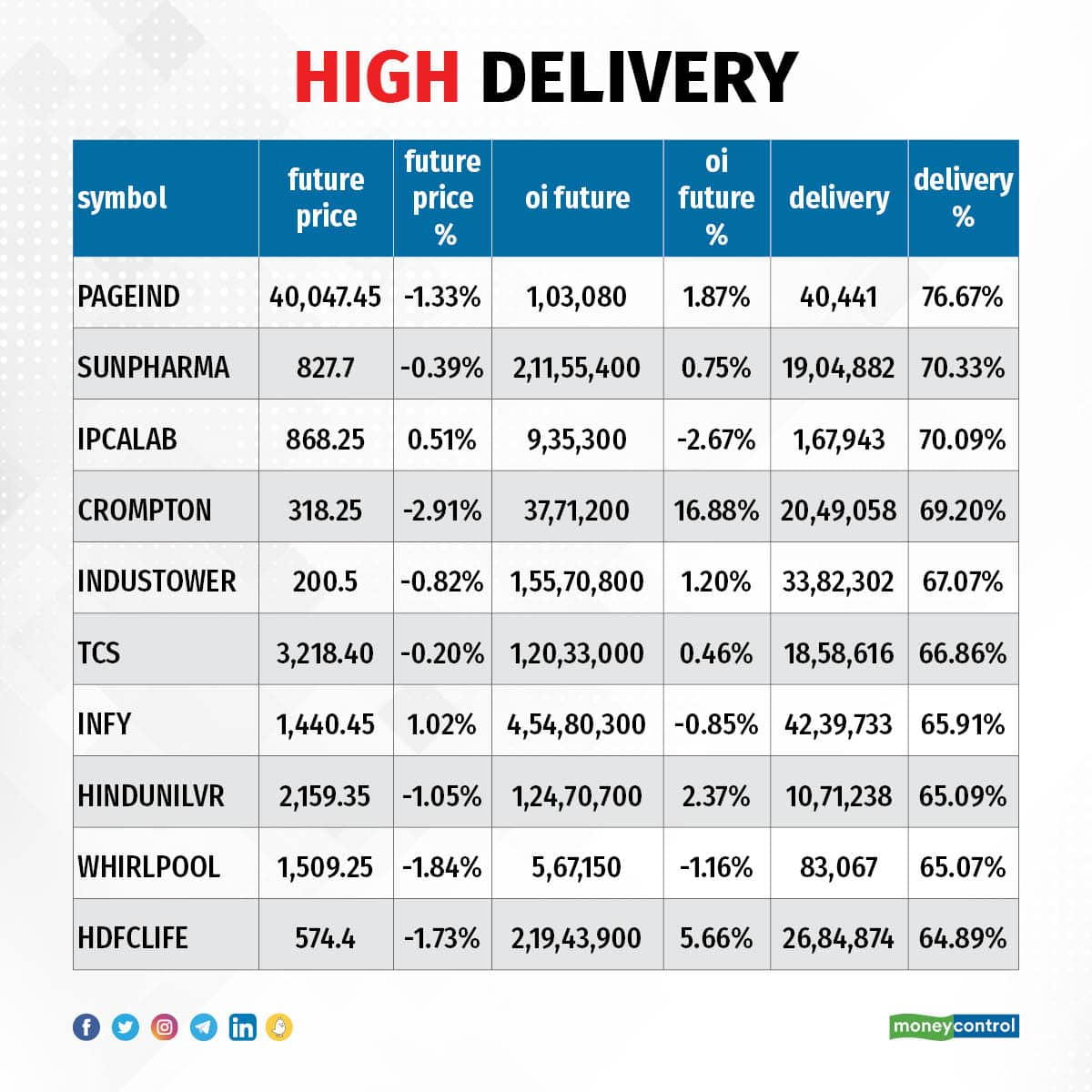

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Page Industries, Sun Pharmaceutical Industries, Ipca Laboratories, Crompton Greaves Consumer Electricals, and Indus Towers, among others.

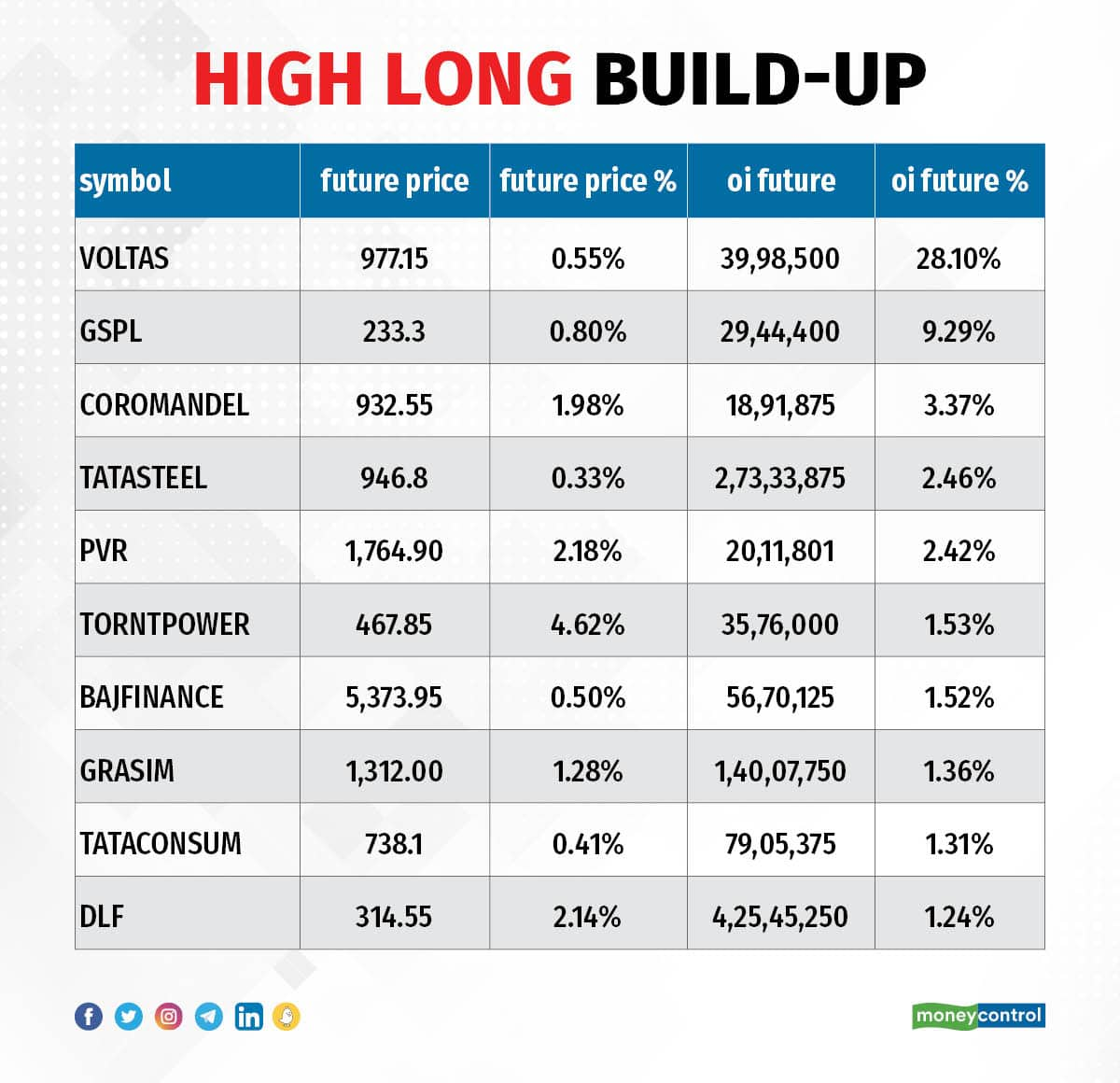

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Voltas, Gujarat State Petronet, Coromandel International, Tata Steel, and PVR, in which a long build-up was seen.

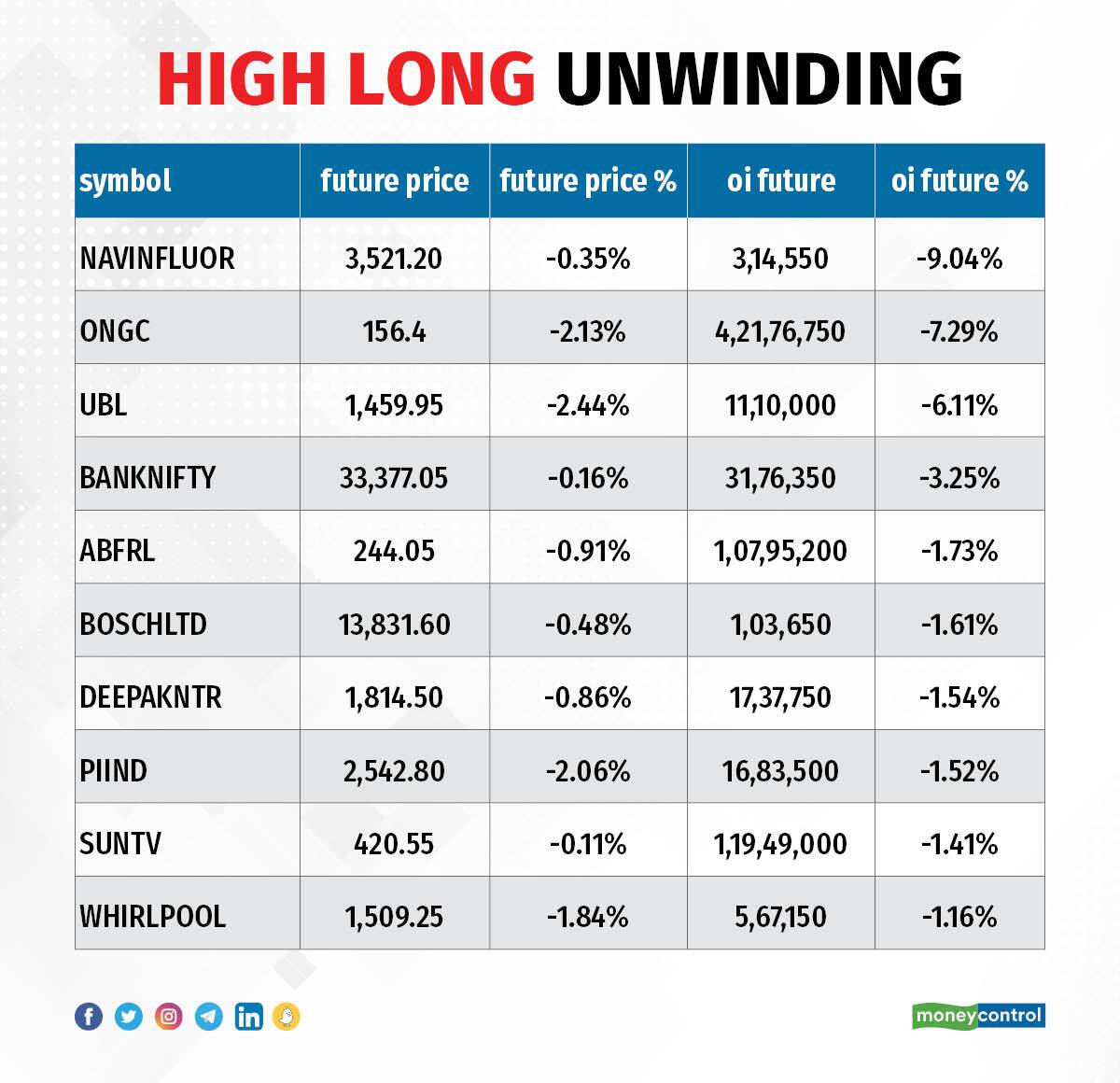

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Navin Fluorine International, ONGC, United Breweries, Bank Nifty, and Aditya Birla Fashion and Retail, in which a long unwinding was seen.

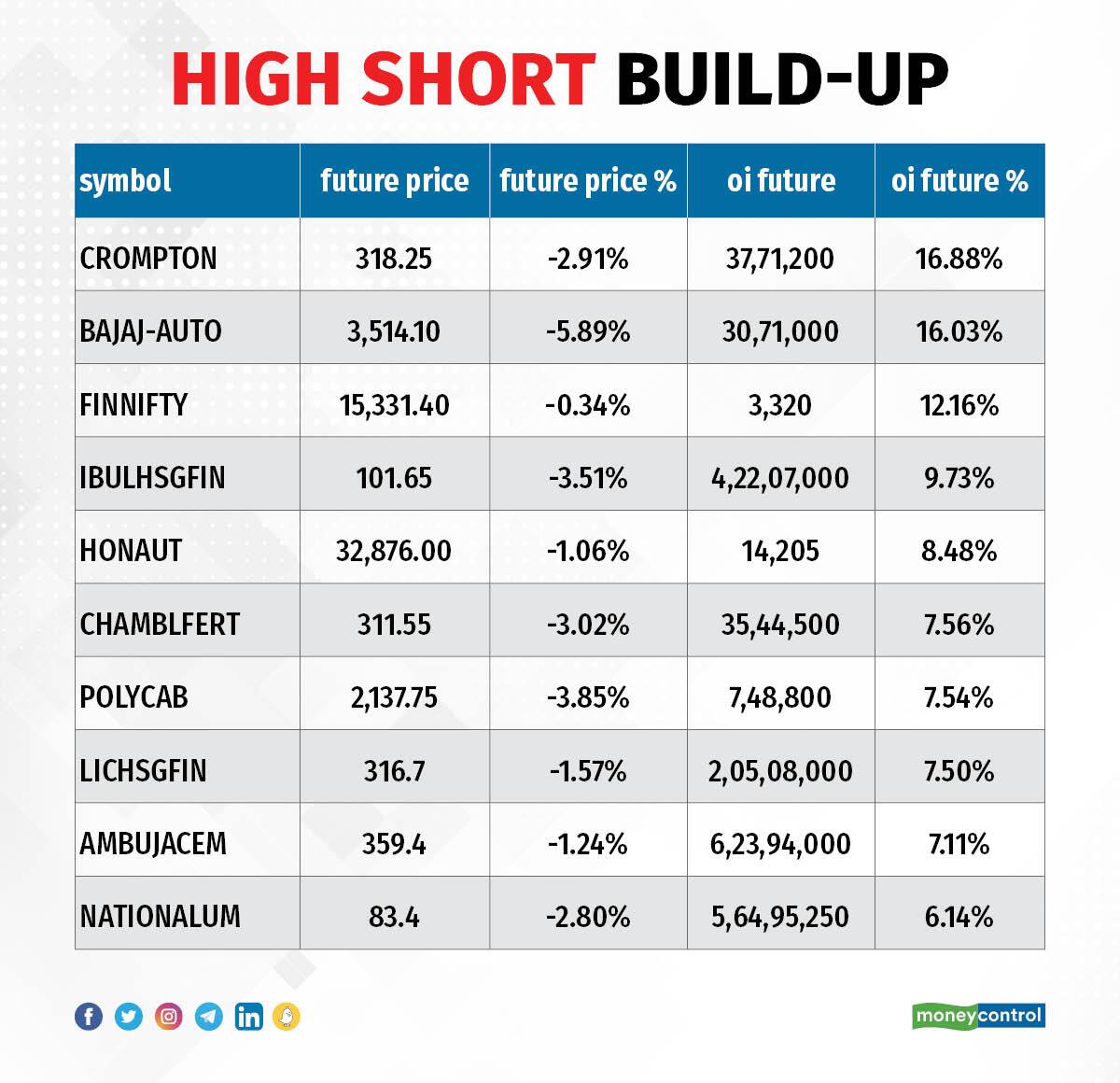

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Crompton Greaves Consumer Electricals, Bajaj Auto, Nifty Financial, Indiabulls Housing Finance, and Honeywell Automation, in which a short build-up was seen.

65 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including RBL Bank, Nippon Life India, Havells India, ICICI Lombard General Insurance Company, and Aurobindo Pharma, in which a short-covering was seen.

(For more bulk deals, click here)

Investors Meetings on June 15

Escorts: Officials of the company will meet various investors at PhillipCapital Ground View Conference 2022.

Voltas: Officials of the company will meet GIC, Principal Asset Management, Nikko Asset Management, Polymer (PAG), and Comgest S.A.

Mahindra Holidays and Resorts India: Officials of the company will meet Tata Investment Corporation.

Timken India: Officials of the company will meet Sundaram Mutual Fund.

Asian Paints: Officials of the company will meet Marcellus Investment Managers.

M&M Financial Services: Officials of the company will participate in CLSA: Investor Conference.

CRISIL: Officials of the company will meet Sundaram Mutual Fund.

Vijaya Diagnostic Centre: Officials of the company will attend Credit Suisse's Asia Healthcare Corporate Day.

Sapphire Foods India: Officials of the company will meet T Rowe Price.

TTK Prestige: Officials of the company will meet Phillip Capital (India).

Nuvoco Vistas Corporation: Officials of the company will meet Marval Capital, Dalton Investments, and Haitong Securities.

Supriya Lifescience: Officials of the company will meet various investors at PhillipCapital Ground View Conference 2022.

Devyani International: Officials of the company will meet various investors at PhillipCapital Ground View Conference 2022.

UltraTech Cement: Officials of the company will meet Abu Dhabi Investment Authority (ADIA).

KRBL: Officials of the company will meet Banyan Capital.

Barbeque-Nation Hospitality: Officials of the company will meet IDBI Capital Markets & Securities.

PVR: Officials of the company will attend UK & EU Virtual Access Day, organised by CLSA.

Stocks in News

Asian Paints: The paint company acquired a 51 percent stake in Weatherseal Fenestration for Rs 18.84 crore. Weatherseal Fenestration is now a subsidiary of the company.

Engineers India: Nayveli Lignite Corporation has appointed Engineers India as a project management consultant for its 1,200 TPD lignite to methanol project. This landmark project is expected to be commissioned in 2027.

GR Infraprojects: Subsidiary GR Bandikui Jaipur Expressway Private Limited has executed the concession agreement with the National Highways Authority of India. The project worth Rs 1,368 crore includes the construction of a 4-lane greenfield expressway spur from Delhi-Vadodara Greenfield expressway near Bandikui to Jaipur in Bharatmala Pariyojana Phase-1 in Rajasthan on hybrid annuity mode.

Pricol: Priyadarsi Bastia is appointed as Chief Financial Officer and key managerial personnel of the company, with effect from July 1, 2022. It was after P Krishnamoorthy resigned as Chief Financial Officer of the company.

Cipla: Cipla, and not-for-profit research and development organisation DNDi launched child-friendly 4-in-1 anti-retroviral treatment for young children living with HIV in South Africa. This combination treatment has been developed by Cipla and the Drugs for Neglected Diseases initiative (DNDi).

Dev Information Technology: The company has bagged orders worth Rs 2.52 crore for an online integrated portal for farmers (RajKisan Saathi) comprising services related to agriculture, horticulture, seed certification, seed corporation, and agriculture marketing.

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 4,502.25 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 3,807.60 crore worth of shares on June 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Indiabulls Housing Finance, RBL Bank, and Delta Corp - are under the NSE F&O ban for June 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!