The market erased all its gains in the last hour of trade and continued its downtrend for a third consecutive session on May 10, weighed down by metals, technology stocks and index heavyweight Reliance Industries. Weak Asian counterparts and rupee depreciation also dented sentiment.

The BSE Sensex fell 106 points to 54,365, while the Nifty50 declined 62 points to 16,240 and formed a small-bodied bearish candle which resembles the Inverted Hammer kind of pattern formation on the daily charts.

"A small body negative candle was formed on the daily chart with a long upper shadow. Technically, this pattern indicates a lack of strength in the market to sustain the upside bounce. This is a negative indication and signals the possibility of further weakness in the market ahead," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Hence, a slide below 16,140 levels is likely to bring bears into action again, he added. "The near-term downside target remains at 15,700 levels. On the upper side, 16,400-16,500 levels could be strong overhead resistance for the short term."

The overall market breadth was weak and broad market indices like Nifty Midcap 100 and Smallcap 100 indices have continued with a downtrend on Tuesday as well, falling around 2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,157, followed by 16,073. If the index moves up, the key resistance levels to watch out for are 16,364 and 16,488.

Nifty Bank gained 207 points to close at 34,483 on Tuesday, outperforming the broader space. The important pivot level, which will act as crucial support for the index, is placed at 34,179, followed by 33,875. On the upside, key resistance levels are placed at 34,784 and 35,085 levels.

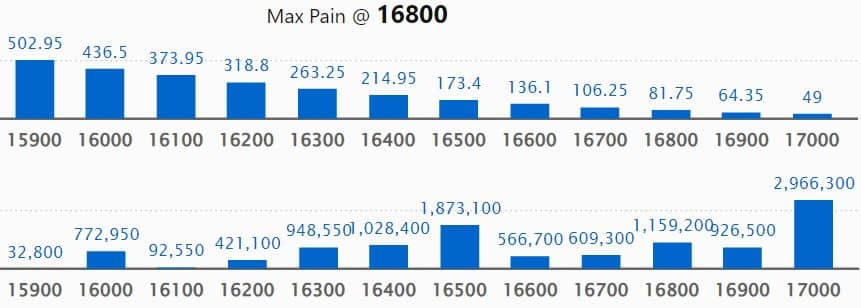

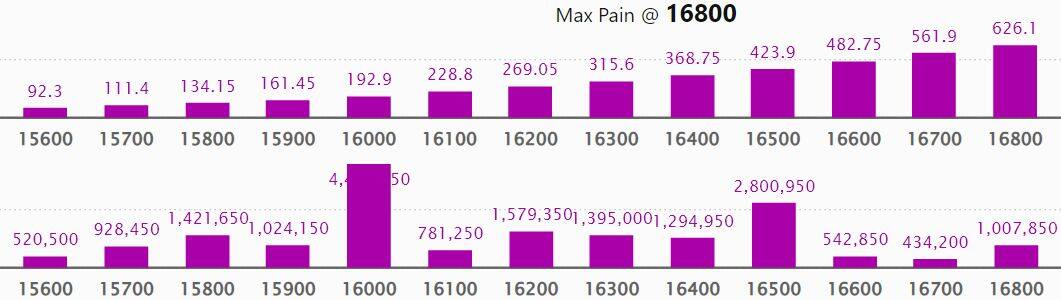

Maximum Call open interest of 29.66 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 17,500 strike, which holds 23.92 lakh contracts, and 16,500 strike, which has accumulated 18.73 lakh contracts.

Call writing was seen at 16,500 strike, which added 2.78 lakh contracts, followed by 16,300 strike which added 2.74 lakh contracts and 16,900 strike which added 2.29 lakh contracts.

Call unwinding was seen at 16,700 strike, which shed 35,750 contracts, followed by 15,600 strike which shed 1,800 contracts.

Maximum Put open interest of 44.39 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

This is followed by 16,500 strike, which holds 28 lakh contracts, and 15,500 strike, which has accumulated 24.75 lakh contracts.

Put writing was seen at 16,300 strike, which added 3.79 lakh contracts, followed by 16,000 strike, which added 3.57 lakh contracts and 15,800 strike which added 2.11 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 2.68 lakh contracts, followed by 16,800 strike which shed 57,450 contracts, and 16,700 strike which shed 28,150 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Whirlpool of India, Infosys, TCS, Wipro, and Tech Mahindra, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Indus Towers, PVR, Bandhan Bank, Colgate Palmolive, and Bank Nifty, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including ABB India, ONGC, Gujarat Gas, Nifty, and Vedanta, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Alkem Laboratories, Voltas, SRF, Dixon Technologies, and Tata Steel, in which a short build-up was seen.

25 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Oracle Financial Services Software, HPCL, Apollo Tyres, SBI Life Insurance Company, and Maruti Suzuki, in which short-covering was seen.

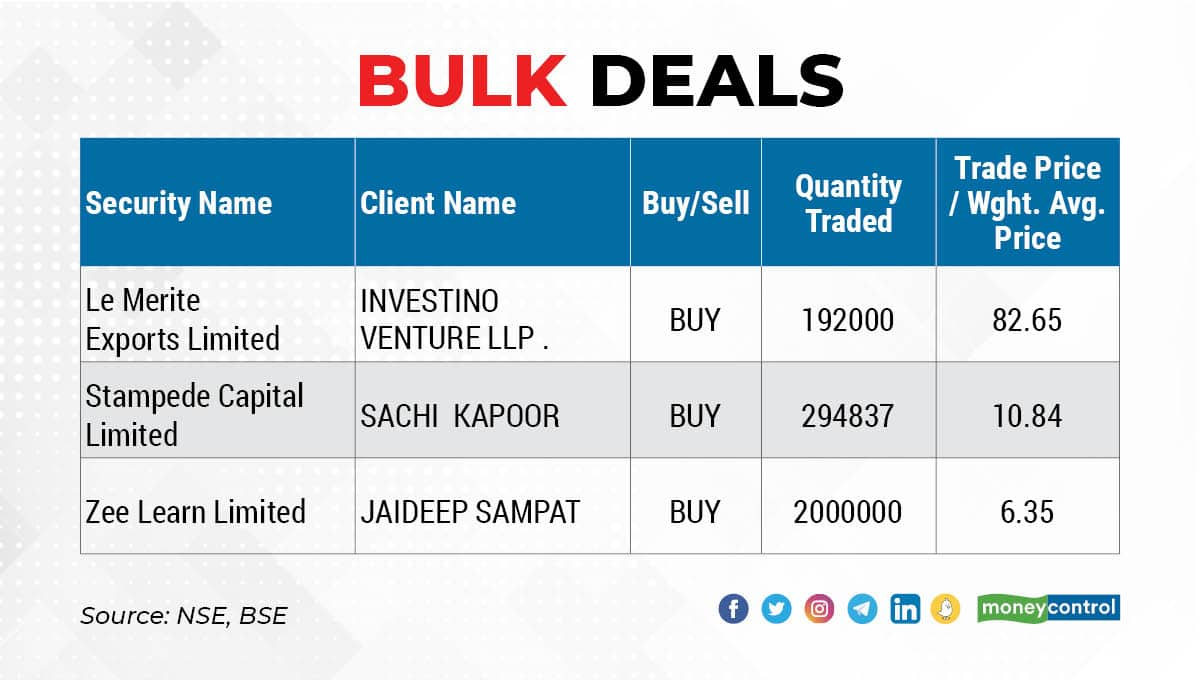

(For more bulk deals, click here)

Adani Ports, Punjab National Bank, Indian Bank, Petronet LNG, Balaji Amines, Birla Corporation, HSIL, JSW Ispat Special Products, Kalyan Jewellers India, Kennametal India, KSB, Lakshmi Machine Works, Lloyds Steels Industries, NCC, Skipper, Prism Johnson, Relaxo Footwears, Sagar Cements, SKF India, Butterfly Gandhimathi Appliances, Century Enka, Cholamandalam Financial Holdings, and DIC India will release quarterly earnings on May 11.

Stocks in News

Cipla: The pharmaceutical company reported a 10 percent year-on-year fall in consolidated profit at Rs 370.7 crore in the quarter ended March 2022, impacted by lower operating income and impairment loss with respect to investment in associate company Avenue Therapeutics Inc. Revenue during the quarter grew by 14.2 percent to Rs 5,260.33 crore compared to the year-ago period, while EBITDA fell 6 percent to Rs 750 crore in the same period.

Vodafone Idea: The telecom operator posted a consolidated loss of Rs 6,563.1 crore in the quarter ended March 2022, which narrowed compared to a loss of Rs 7,230.9 crore in the previous quarter, supported by higher operating income and ARPU. Revenue during the quarter at Rs 10,239.50 crore increased by 5.4 percent QoQ aided by tariff hikes taken in November 2021, with 24.38 crore subscribers as of March 2022. EBITDA grew by 22 percent QoQ to Rs 4,649 crore and margin improved by 610 bps QoQ to 45.4 percent in Q4FY22 with average revenue per user rising by Rs 9 sequentially to Rs 124 during the quarter.

Torrent Power: The company posted a consolidated loss of Rs 487.4 crore in Q4FY22 against a profit of Rs 398 crore in the same period last year impacted by an additional impairment charge of Rs 1,300 crore with respect to DGEN Mega Power Project. Revenue from operations grew by 21 percent YoY to Rs 3,744 crore in Q4FY22 and EBITDA increased by 15 percent YoY to Rs 1,088 crore during the same quarter.

Gulshan Polyols: The company has signed and executed a contract with Meghna Pulp & Paper Mills received on May 9. It will supply GCC, GCC coating plant, vibrator separating machine with standard accessories including motor, conveyor, panel etc. and spare parts for GCC and GCC-coated machine to Meghna Pulp.

Gujarat Gas: The company clocked a 27.6 percent year-on-year growth in consolidated profit at Rs 444.4 crore in the quarter ended March 2022 despite higher input cost, led by strong topline and operating income. Revenue surged 36.5 percent to Rs 4,773.4 crore during the same period.

EPL: The company reported a 14.2 percent year-on-year decline in consolidated profit at Rs 50.1 crore in the quarter ended March 2022 impacted by higher input costs. Revenue grew by 8.6 percent to Rs 880.2 crore during the same period.

Wipro: The IT services company has extended its strategic agreement with Crédit Agricole CIB, the corporate and investment bank division of Crédit Agricole Group, to support its IT infrastructure transformation.

Welspun India: The company reported a 62 percent year-on-year fall in consolidated profit at Rs 51.25 crore in the quarter ended March 2022, impacted by lower operating income, lower other income, and tepid topline growth. Revenue grew by 4.3 percent to Rs 2,227 crore and EBITDA increased by 29.3 percent to Rs 226.5 crore during the same period.

Fund Flow

Foreign institutional investors (FIIs) have net offloaded shares worth Rs 3,960.59 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,958.40 crore worth of shares on May 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The NSE has not put any stock under the F&O ban for May 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!