The market has seen a strong reversal as it recovered all the losses of the previous session and closed around the 200-day simple moving average placed at 17,206 levels on April 26, supported by positive global cues. The buying interest was seen across sectors.

The BSE Sensex surged nearly 800 points to 57,357, while the Nifty50 jumped nearly 250 points to 17,201 and formed a bullish candle on the daily charts.

"The last three days' formation is similar to a Morning Star pattern which is a reversal pattern. The index has formed a double bottom in the 16,850-16,900 zone and this level would act as a major support on the downside," Malay Thakkar, Technical Research Associate at GEPL Capital said.

He further said the resistance for the index lies in the zone of 17,415-17,455 which is the previous week's high and the 20- day SMA (17,465). "We expect the index to move towards 17,400 mark, and a break above which has potential to take the index higher towards 17,650 level."

The broader markets also participated in the rally as the Nifty Midcap 100 and Smallcap 100 indices have gained 1.6 percent and 1.2 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,102, followed by 17,004. If the index moves up, the key resistance levels to watch out for are 17,262 and 17,322.

Bank Nifty closed higher with 322.50 points gains at 36,405, but underperformed the broader markets on April 26. The important pivot level, which will act as crucial support for the index, is placed at 36,246, followed by 36,086. On the upside, key resistance levels are placed at 36,584 and 36,764 levels.

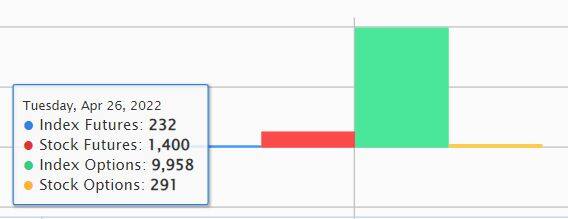

Maximum Call open interest of 84.54 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,200 strike, which holds 62.41 lakh contracts, and 17,800 strike, which has accumulated 61.88 lakh contracts.

Call writing was seen at 17,500 strike, which added 6.49 lakh contracts, followed by 17,600 strike which added 3.66 lakh contracts, and 17,700 strike which added 3.19 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 28.23 lakh contracts, followed by 17,800 strike which shed 20.41 lakh contracts and 18,000 strike which shed 13.5 lakh contracts.

Maximum Put open interest of 75.37 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the April series.

This is followed by 16,400 strike, which holds 65.65 lakh contracts, and 16,500 strike, which has accumulated 52.27 lakh contracts.

Put writing was seen at 16,400 strike, which added 36.01 lakh contracts, followed by 17,200 strike, which added 27.77 lakh contracts and 17,100 strike which added 23.7 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 15.01 lakh contracts, followed by 16,200 strike which shed 2.49 lakh contracts, and 18,000 strike which shed 80,400 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in SBI Card, Crompton Greaves Consumer Electricals, Metropolis Healthcare, Dabur India, and Asian Paints, among others.

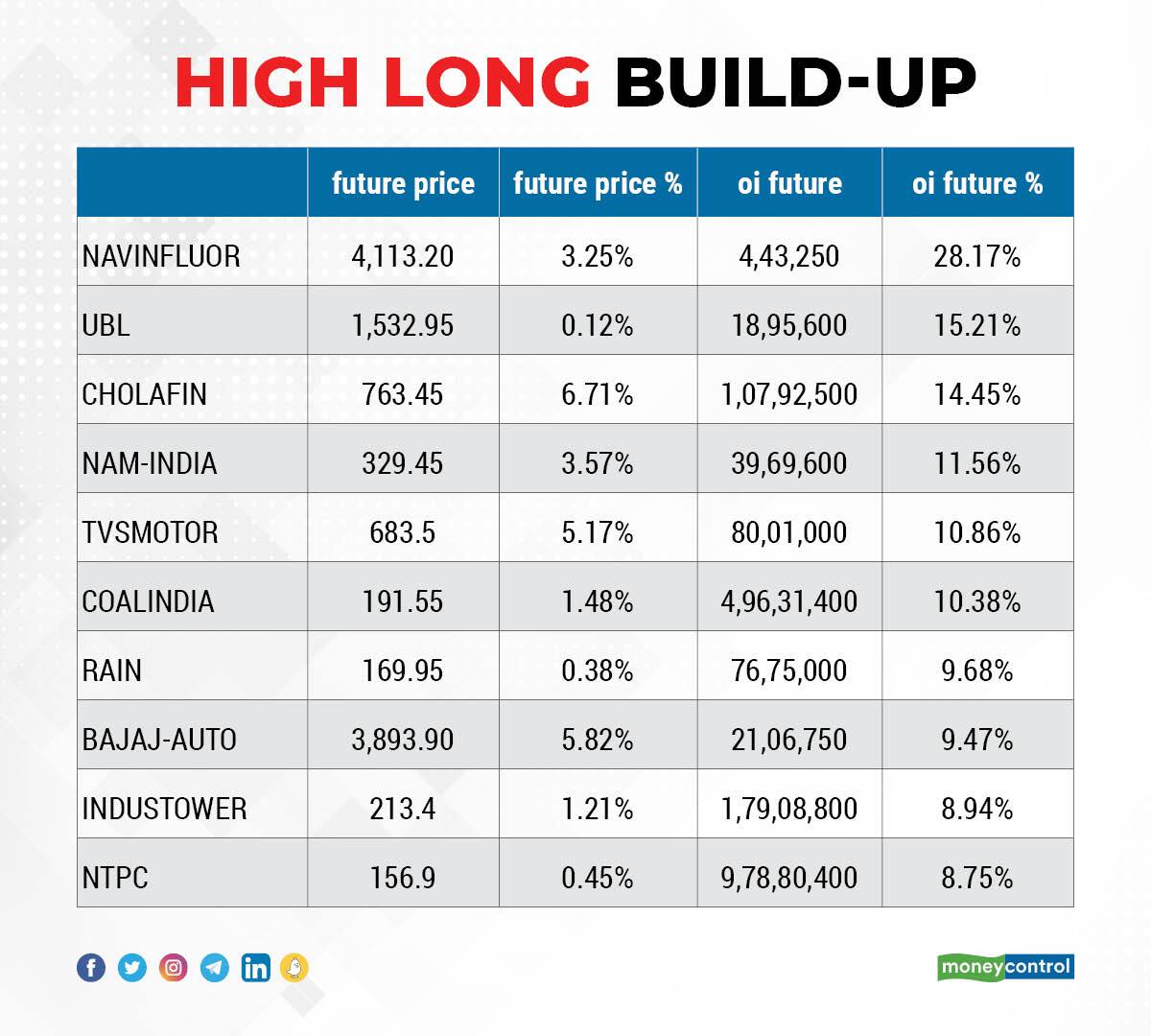

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Navin Fluorine International, United Breweries, Cholamandalam Investment, Nippon Life India Asset Management, and TVS Motor Company, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Pfizer, Astral, Syngene International, Abbott India, and Whirlpool of India, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Atul, GAIL India, Indian Hotels, Tata Communications, and Alkem Laboratories, in which a short build-up was seen.

98 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Honeywell Automation, IDFC, Max Financial Services, and JK Cement, in which short-covering was seen.

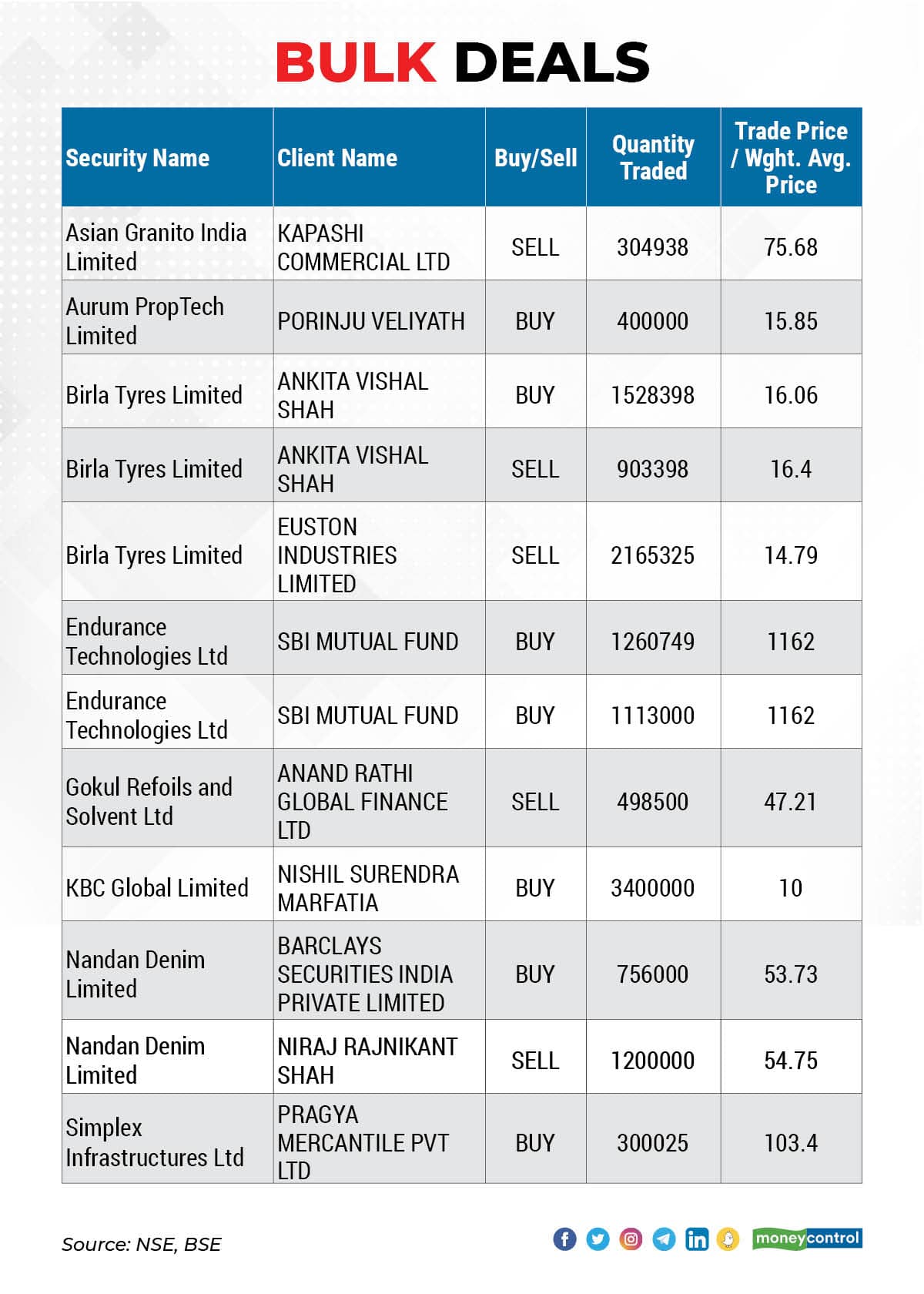

Aurum PropTech: Ace investor Porinju Veliyath acquired four lakh equity shares in the company via open market transactions at an average price of Rs 15.85 per share.

Endurance Technologies: SBI Mutual Fund bought 23.73 lakh equity shares in the auto ancillary company via open market transactions, at an average price of Rs 1,162 per share.

(For more bulk deals, click here)

Hindustan Unilever, Bajaj Auto, HDFC Asset Management Company, Hatsun Agro Product, Indian Energy Exchange, 5paisa Capital, Indian Hotels Company, Persistent Systems, Syngene International, Trent, Mahindra Lifespace Developers, Chennai Petroleum Corporation, KPR Mill, MPL Plastics, Shree Digvijay Cement, Supreme Petrochem, and Swaraj Engines will release quarterly earnings on April 27.

Stocks in News

Schaeffler India: The company recorded a massive 48.4 percent year-on-year growth in profit at Rs 207 crore for the quarter ended March 2022, driven by topline as well as operating performance. Revenue from operations rose 19 percent YoY to Rs 1,567.5 crore during the quarter and EBITDA grew by 45 percent in the same period.

Bajaj Finance: The non-banking finance company clocked an 80 percent year-on-year growth in profit at Rs 2,420 crore in Q4FY22 led by strong NII and decline in provisions. Net interest income during the quarter grew by 30 percent to Rs 6,068 crore with assets under management (AUM) rising 29 percent to Rs 1,97,452 crore as of March 2022. Loan losses and provisions for Q4 FY22 at Rs 702 crore declined sharply compared to Rs 1,231 crore in the year-ago period.

Lasa Supergenerics: API manufacturer Lasa Supergenerics has bagged a new order of Rs 50 crore from five customers. The order will help the company boost its production and contribute to the topline.

Wipro: The IT services company has decided to acquire US-based Rizing Intermediate Holdings Inc, a global SAP consulting firm, for $540 million. The acquisition will help Wipro expand its leadership in oil and gas, utilities, manufacturing, and consumer industries. The process of buyout is expected to close before the end of the quarter ending June 2022.

AU Small Finance Bank: The bank in a BSE filing said profit in Q4FY22 rose by 105 percent year-on-year to Rs 346 crore on fall in provisions and higher NII. Net interest income grew by 43 percent YoY to Rs 936.6 crore in the quarter ended March 2022 with net interest margin expanding 60 bps YoY to 6.3 percent. The bank declared a bonus issue of one equity share for every one equity share held by shareholders.

Reliance Industries: Reliance Industries, and Abu Dhabi Chemicals Derivatives Company RSC (TA'ZIZ) have signed the formal Shareholder Agreement for TA'ZIZ EDC and PVC project. The joint venture will construct and operate a chlor-alkali, ethylene dichloride (EDC) and polyvinyl chloride (PVC) production facility, with a total investment of over $2 billion.

Omaxe: The real estate firm has raised Rs 440 crore from Värde Partners, a leading global alternative investment firm. The funds will be deployed for expediting construction and delivery of its projects as well as for expansion.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,174.05 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 1,643.84 crore on April 26, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not put any stock under the F&O ban for April 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!