The market corrected more than half a percent on April 5, after witnessing an over 3 percent rally in last three sessions. However, the broader market continued its northward journey with the Nifty Midcap and Smallcap indices rising 1.4 percent and 0.85 percent, respectively.

Banks and financial services stocks led the fall on Tuesday. The BSE Sensex was down 435 points at 60,176, while the Nifty50 fell below crucial 18,000 mark, correcting 96 points to close at 17,957 and formed a bearish candle on the daily charts.

"A reasonable negative candle was formed on the daily chart beside the long bull candle of previous session. This indicates minor profit booking in the market from the highs. Tuesday's weakness so far has not damaged the recent uptrend status of the market," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

The sharp upside momentum in the market seems to have halted and the Nifty shifted into a minor profit booking mode, Shetty added.

"Any sharp weakness from here could be ruled out, but one may expect range movement around 18,200-17,800 levels for the next few sessions. The important resistance of 18,200 levels could eventually be broken on the upside," the market expert said further.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,887, followed by 17,818. If the index moves up, the key resistance levels to watch out for are 18,061 and 18,165.

Private banking stocks pulled the market down as Bank Nifty fell 567 points or 1.5 percent to close at 38,068 on April 5. The important pivot level, which will act as crucial support for the index, is placed at 37,749, followed by 37,431. On the upside, key resistance levels are placed at 38,573 and 39,078 levels.

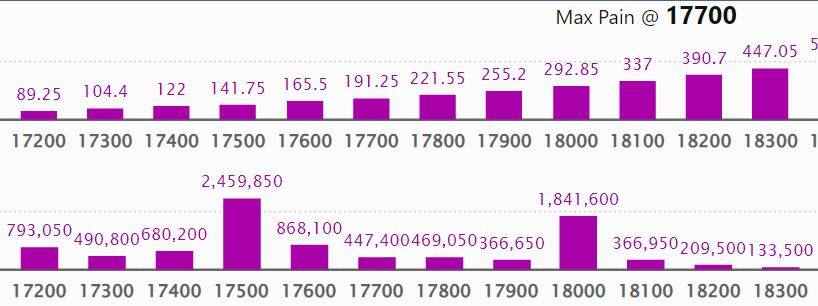

Maximum Call open interest of 20.59 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 19,000 strike, which holds 19.53 lakh contracts, and 18,500 strike, which has accumulated 14.54 lakh contracts.

Call writing was seen at 18,100 strike, which added 1.78 lakh contracts, followed by 18,700 strike which added 1.43 lakh contracts, and 18,000 strike which added 1.14 lakh contracts.

Call unwinding was seen at 18,500 strike, which shed 1.47 lakh contracts, followed by 17,500 strike which shed 1.04 lakh contracts and 17,000 strike which shed 55,650 contracts.

Maximum Put open interest of 24.59 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the April series.

This is followed by 18,000 strike, which holds 18.41 lakh contracts, and 17,000 strike, which has accumulated 18.28 lakh contracts.

Put writing was seen at 17,500 & 17,600 strikes, which added 3.64 lakh contracts each, followed by 18,100 strike, which added 1.46 lakh contracts and 17,400 strike which added 93,400 contracts.

Put unwinding was seen at 17,000 strike, which shed 86,750 contracts, followed by 19,000 strike which shed 30,250 contracts, and 18,300 strike which shed 4,800 contracts.

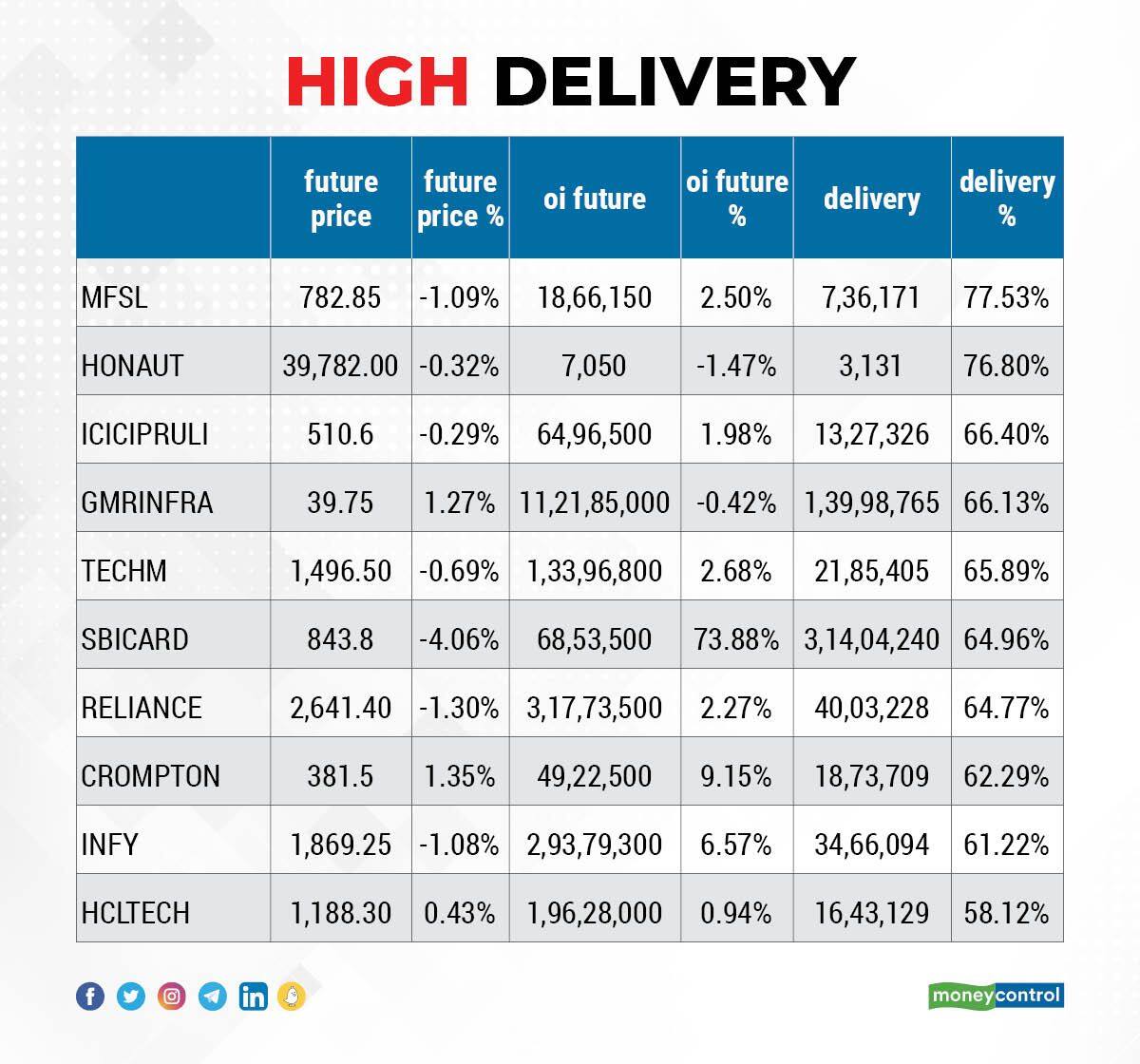

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Max Financial Services, Honeywell Automation, ICICI Prudential Life Insurance, GMR Infrastructure, and Tech Mahindra, among others on Tuesday.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including ABB India, Birlasoft, Astral, GNFC, and Trent, in which a long build-up was seen.

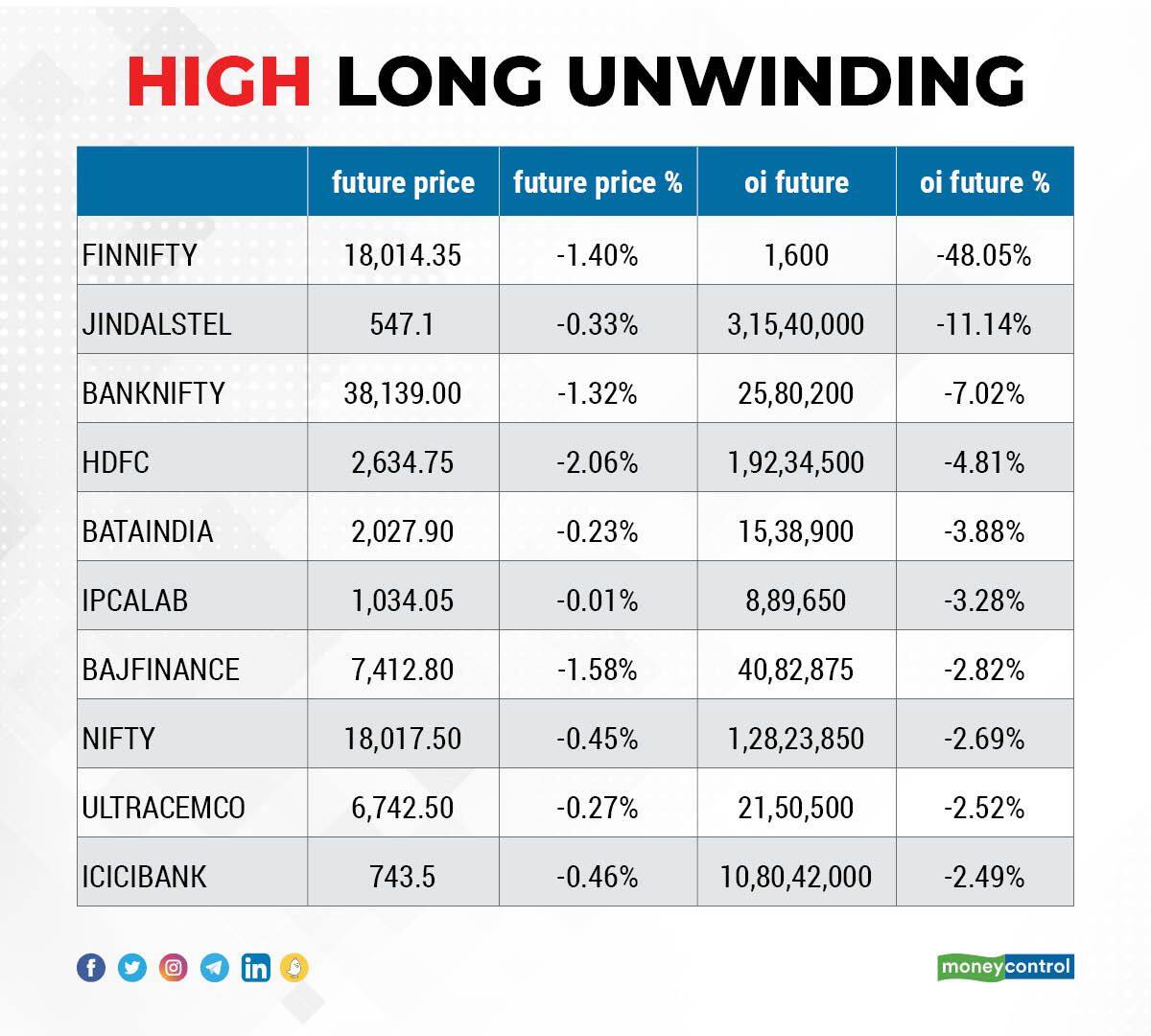

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Jindal Steel & Power, Bank Nifty, HDFC, and Bata India, in which long unwinding was seen.

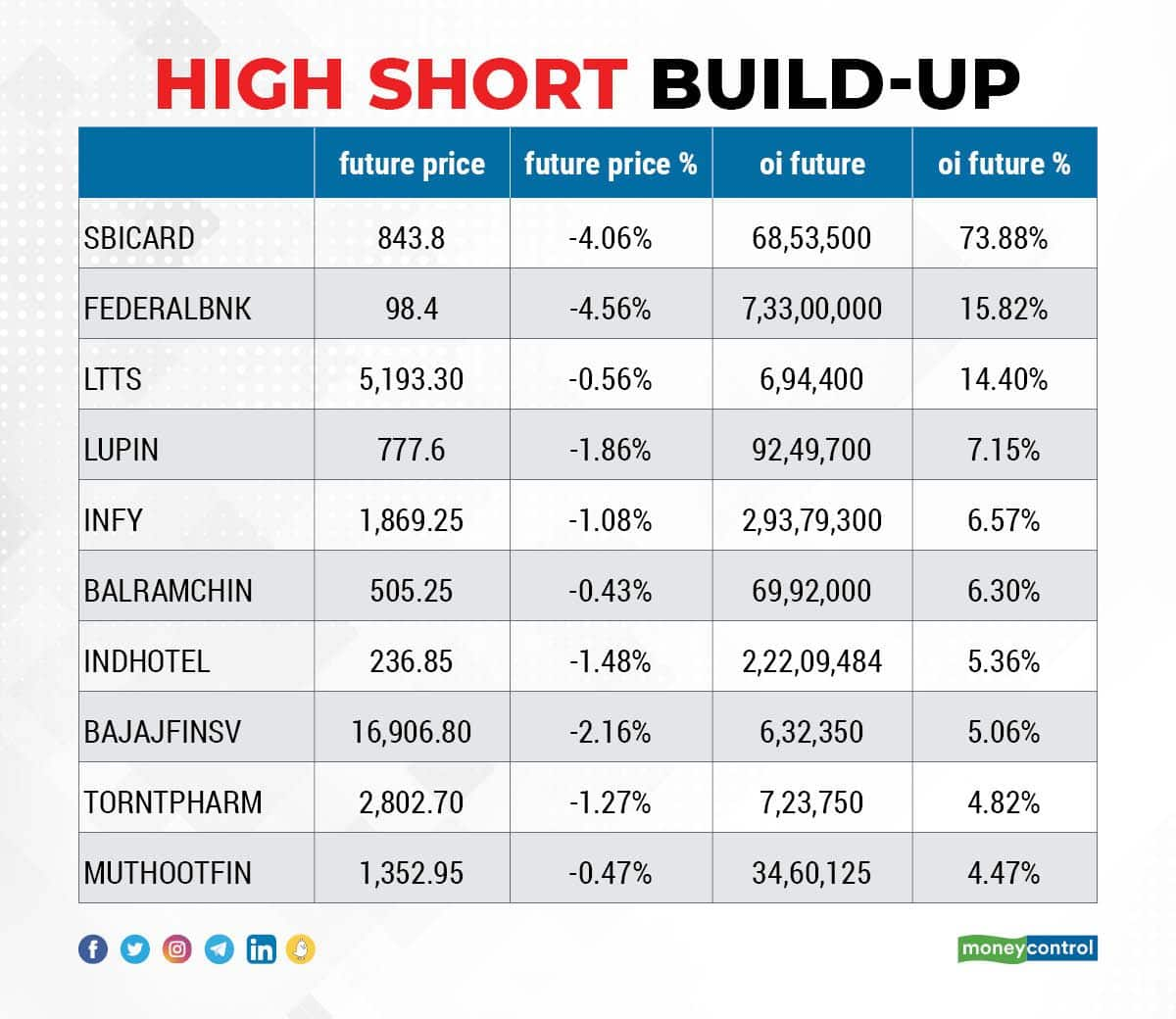

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including SBI Card, Federal Bank, L&T Technology Services, Lupin, and Infosys, in which a short build-up was seen.

70 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including JK Cement, Syngene International, AU Small Finance Bank, Jubilant Foodworks, and Axis Bank, in which short-covering was seen.

SBI Cards & Payment Services: CA Rover Holdings, a Carlyle entity, sold 2,61,73,488 equity shares (2.77 percent of paid up equity) in the company via open market transactions. These shares were sold at an average price of Rs 851.73 per share. As of December 2021, CA Rover's shareholding was 3.09 percent in the company.

(For more bulk deals, click here)

Analysts/Investors Meetings on April 6

Quess Corp: The company's officials will meet ULJK Financial Services.

Parag Milk Foods: The company's officials will attend Sixth Sense Ventures Investor Meet 2022.

Som Distilleries & Breweries: The company's officials will meet Edelweiss, and Way2Wealth Securities.

Ujjivan Small Finance Bank: The company's officials will meet Avendus.

Poonawalla Fincorp: The company's officials will meet Jainmay Venture Advisors LLP.

Tata Motors: The company's officials will meet Blackrock.

Windlas Biotech: The company's officials will meet analysts and investors.

Mrs. Bectors Food Specialities: The company's officials will meet institutional investors.

Orient Bell: The company's officials will meet analysts and investors.

Stocks in News

Tata Steel: Tata Steel India achieved highest-ever annual crude steel production of 19.06 million tons, with a growth of 13 percent YoY despite the COVID 2nd wave related disruption early in the financial year. Tata Steel India deliveries increased by 6 percent YoY in FY22, surpassing the previous best recorded in FY21. Tata Steel Europe steel production in FY22 grew by 6 percent YoY and total deliveries increased by 2 percent YoY, driven by broad-based improvement in most steel consuming sectors.

Tata Steel Long Products: Its crude steel production grew by 6 percent YoY in FY22, despite the disruption caused by COVID 2nd wave and shutdown of one of the blast furnaces for few weeks during Q4FY22. Steel sales volumes have increased by 2 percent YoY in FY22, with a higher share of rolled product sales enabled by customer approval and continued mix enrichment.

Rain Industries: Due to a lower allocation of raw petroleum coke (RPC) by Directorate General of Foreign Trade (DGFT) for FY23 than in the previous years, the lack of sufficient raw materials has now reached a level necessitating that subsidiary RAIN shuts down one Kiln, until further notice. Subsidiary Rain CM Carbon (Vizag) (RAIN) is facing RPC shortfall to the tune of 40 percent. Apart from calcined petroleum coke (CPC), the shutdown of RAIN's Kiln will also result into net loss of 20 MW of waste-heat power generation to the grid. RAIN has two Kilns for manufacture of CPC at Visakhapatnam, Andhra Pradesh.

Tata Power Company: Resurgent Power Ventures, co-sponsored by Tata Power and ICICI Bank and has other global reputed investors, has completed acquisition of NRSS XXXVI Transmission, a special purpose vehicle to establish and operate transmission system in Northern Region along with LILO of SikarNeemrana 400kV D/C line at Babaion on build-own-operate-maintain (BOOM) basis. Resurgent Power Ventures was set up to acquire stressed assets in the Indian Power Sector.

TVS Motor Company: The company and Jio-bp have agreed to explore the creation of a robust public electric vehicle (EV) charging infrastructure for electric two-wheelers and three-wheelers in the country, building on Jio-bp's growing network in this space. Under this proposed partnership, the customers of TVS electric vehicles are expected to get access to the widespread charging network of Jio-bp, which is also open to other vehicles.

Marico: The FMCG company in its BSE filing said revenue growth in Q4FY22 was in low single digits, while volumes were marginally positive on an exceptionally high base (25 percent), leading to a double-digit volume growth on a 2-year CAGR basis. Parachute Coconut Oil volumes were marginally lower year-on-year, mainly due to a daunting base (29 percent). Value Added Hair Oils grew in low single digits in value terms. The International business delivered double-digit constant currency growth on a strong base, with all markets faring well. Consolidated revenue growth in the quarter touched high-single digits.

Tata Consultancy Services: Kansas Department of Labour (KDOL) has selected TCS to build a modern, secure, web-based system for the state's unemployment insurance program. This will help transforming a legacy mainframe platform from the 1970s into a cloud-based system that dramatically improves the delivery of services to Kansas residents.

Fund Flow

Foreign institutional investors (FIIs) have continued its buying into India as they have net bought shares worth Rs 374.89 crore, while domestic institutional investors (DIIs) have also net purchased shares worth Rs 105.42 crore on April 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As it's the beginning of April series, there isn't any stock under the F&O ban for April 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!