The market bounced back smartly in the afternoon trade on February 28, extending the uptrend for the second consecutive session as Ukraine and Russia headed for the first round of talks. The rally was driven by metals, FMCG, IT shares and Reliance Industries.

The Sensex rallied 389 points to 56,247, while the Nifty50 climbed 135 points to 16,794 and formed a large bullish candle on the daily charts, a positive indication but experts said the index has to clear 16,800-17,000 for the confirmation of the uptrend.

"The Nifty is currently placed at the edge of crucial overhead resistance of around 16,800-17,000 levels (previous swing lows and 200 day EMA). Previously, this area offered crucial support for the market and resulted in a strong upside bounce," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities

Evidence suggests that the bulls will struggle to sustain above 16,800-17,000 in the short term. "But a sustainable upside above the 17,000-mark is likely to change the short-term bearish pattern of the Nifty and could open more upside in the near-term towards 17,500 levels."

The inability of the bulls to stay above 16,800 could trigger another round of correction to 16,300 in the near term, he said.

The broader market also joined the rally, as the Nifty midcap 100 and smallcap 100 gained 1 percent and 0.6 percent.

We have collated 15 data points to help you spot profitable trades:

Key support, resistance levels for the Nifty

As per the pivot charts, the key support levels for the Nifty are placed at 16,495, followed by 16,196. If the index moves up, key resistance levels to watch out for are 16,954 and 17,115.

The Nifty Bank underperformed benchmark indices on February 28, falling 225 points to 36,205. The important pivot level, which will act as crucial support for the index, is placed at 35,788, followed by 35,371. On the upside, key resistance levels are placed at 36,446 and 36,687 levels.

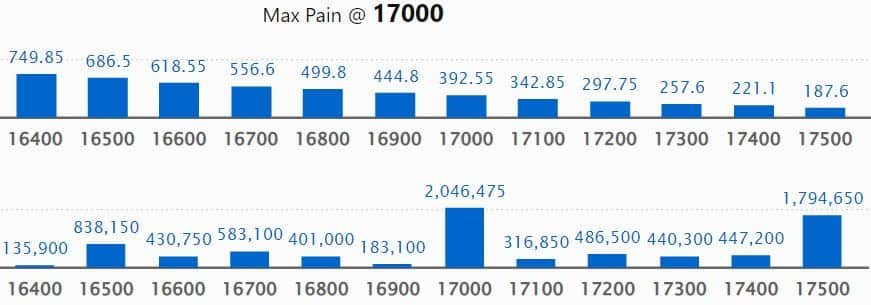

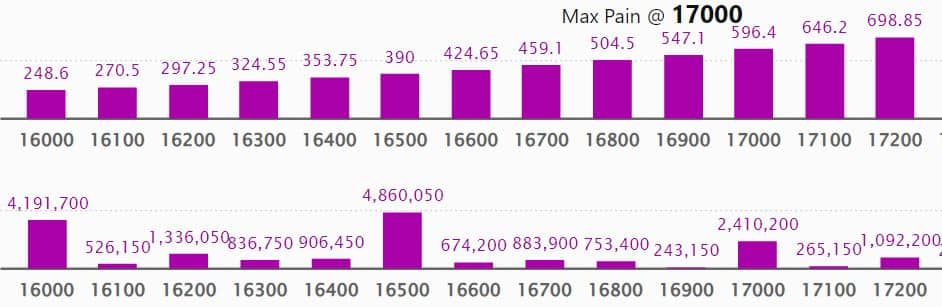

Maximum Call open interest of 20.75 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

It is followed by 17,000 strike, which holds 20.46 lakh contracts, and 17,500 strike that has accumulated 17.94 lakh contracts.

Call writing was seen at 18,000 strike, which added 2.19 lakh contracts, followed by 17,500 strike that added 1.69 lakh contracts, and 17,000 strike, which accumulated 1.71 lakh contracts.

Call unwinding was seen at 16,300 strike, which shed 43,500 contracts, followed by 16,900 strike, which shed 20,650 contracts, and 17,100 strike, which shed 10,350 contracts.

Maximum Put open interest of 48.60 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the March series.

This is followed by 16,000 strike, which holds 41.91 lakh contracts, and 17,000 strike, which has accumulated 24.10 lakh contracts.

Put writing was seen at 16,700 strike, which added 2.84 lakh contracts, followed by 16,800 strike, which added 1.26 lakh contracts, and 16,400 strike, which added 59,000 contracts.

Put unwinding was seen at 16,300 strike, which shed 2.93 lakh contracts, followed by 16,500 strike which shed 1.62 lakh contracts, and 16,000 strike ,which shed 10,700 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. High delivery was seen in Dabur India, HDFC Bank, HDFC, Nestle India, Torrent Pharma, and Escorts on February 28.

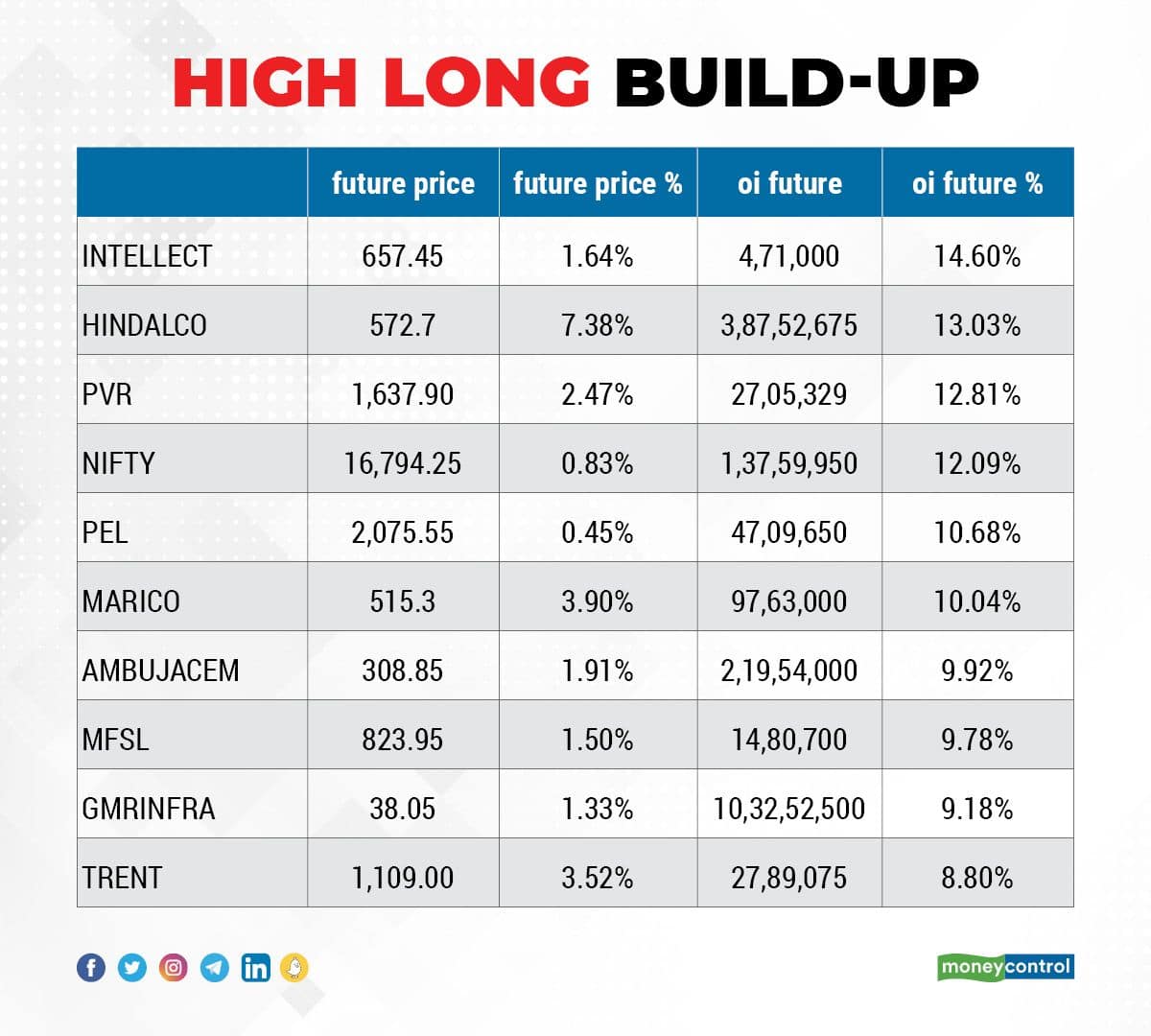

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

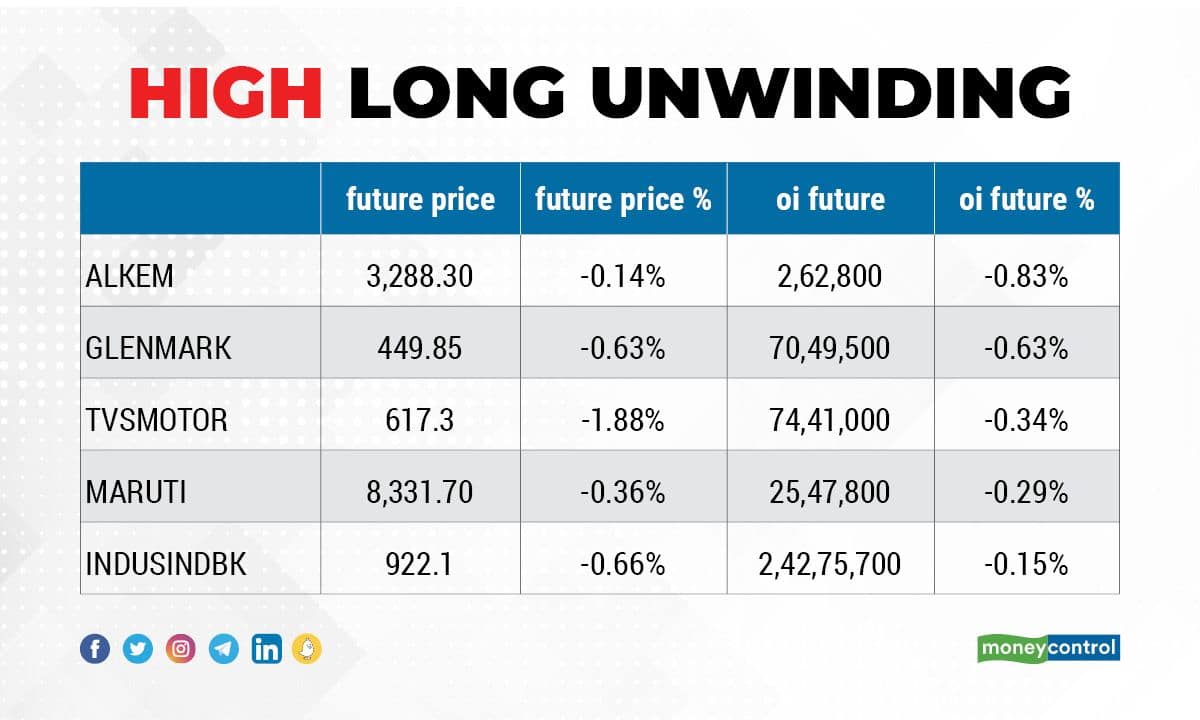

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 5 stocks - Alkem Laboratories, Glenmark Pharma, TVS Motor, Maruti Suzuki, and IndusInd Bank - in which long unwinding was seen.

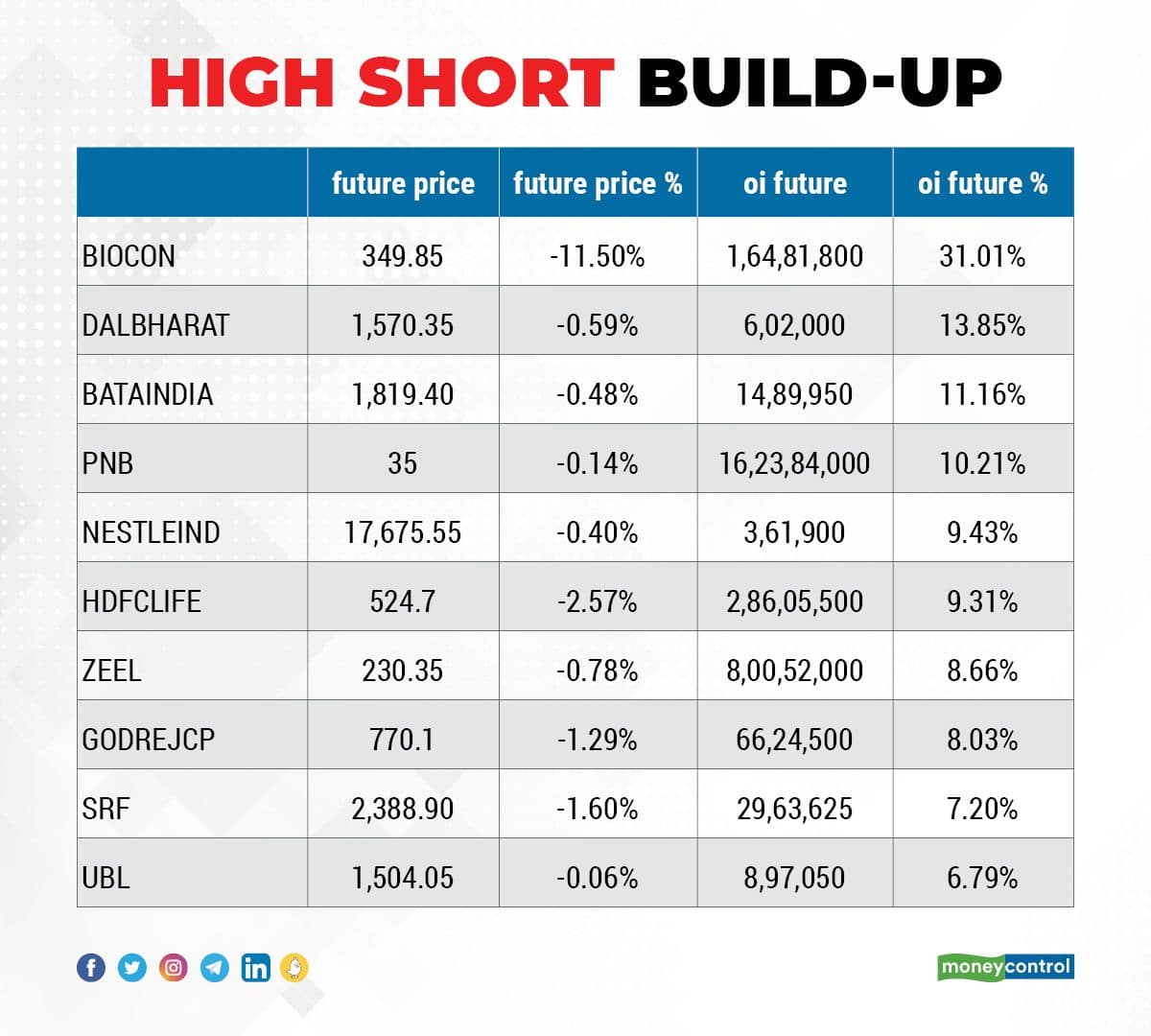

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

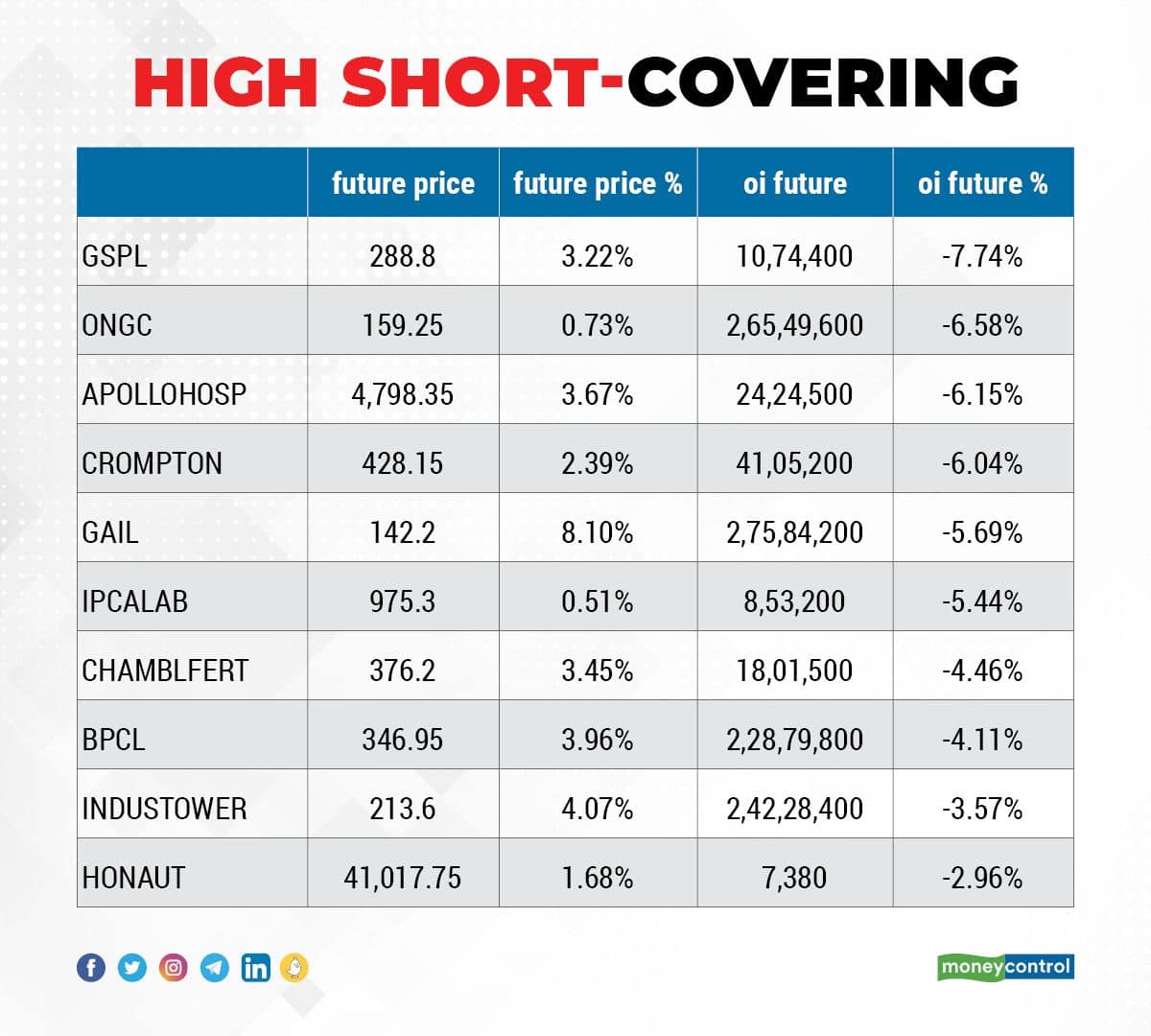

55 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

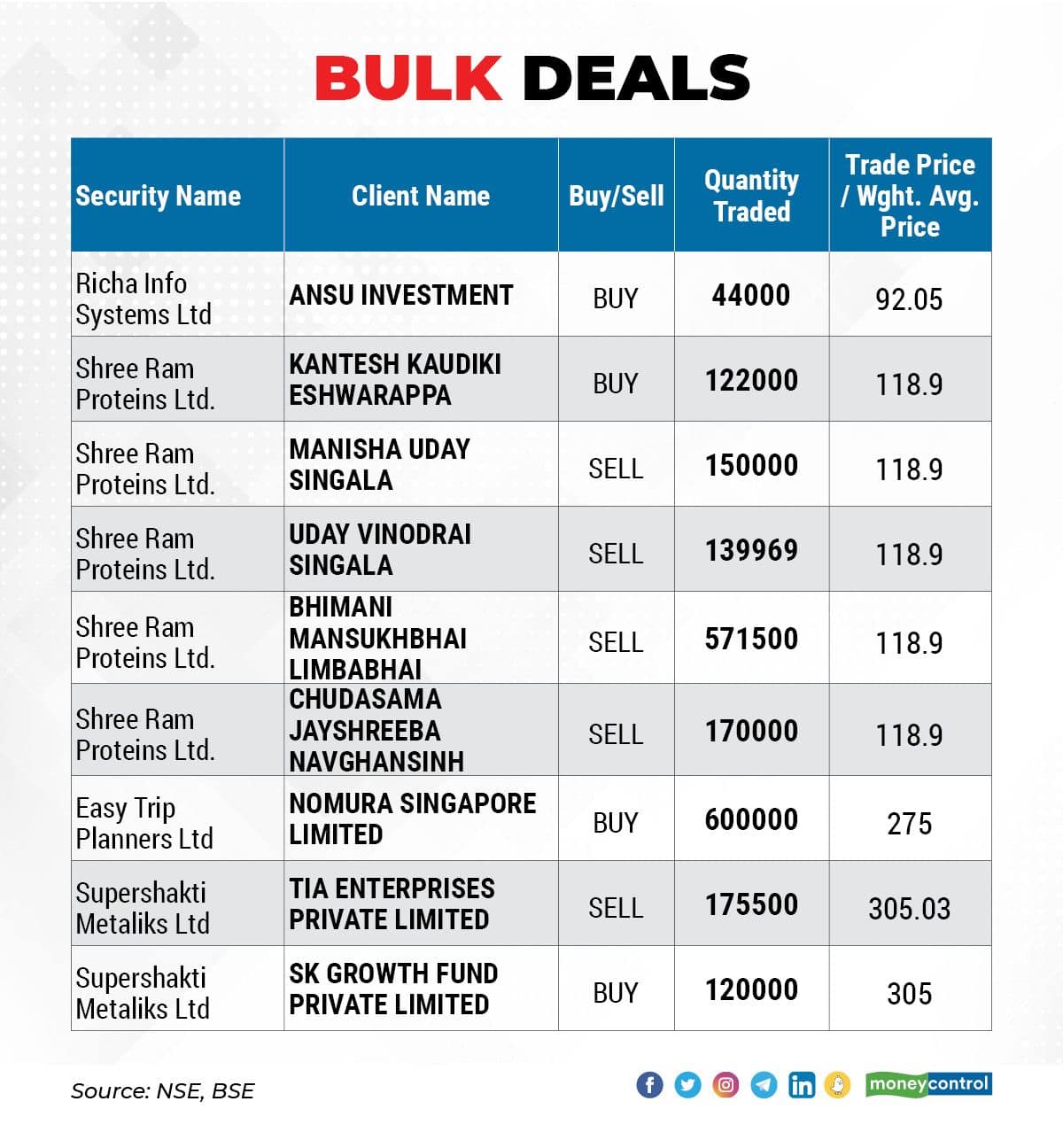

Easy Trip Planners: Nomura Singapore acquired 6 lakh equity shares in the company via open market transactions on the BSE. These shares were bought at an average price of Rs 275 per share.

(For more bulk deals, click here)

Analysts, investors meetings

Bosch: The company's officials will meet Aberdeen Standard Investments and First Sentier Investors (FSSA) on March 2.

Blue Star: The company's officials will meet Ventura Securities & FSSA Investment on March 2.

Tata Consumer Products: The company's officials will meet UBS Global Asset Management, Singapore on March 2 and Phillip Capital (India) on March 4.

R Systems International: The company's officials will meet analysts on March 2 to discuss financial results.

TCS: The company's officials will attend Daiwa Investment Conference on March 7.

Indian Energy Exchange: The company's officials will meet Elephant Asset Management on March 7

IZMO: The company's officials will meet Green Portfolio on March 8.

Crompton Greaves Consumer Electricals: The company's officials will meet Karma Capital on March 2; JP Morgan on March 3; UBS Global Asset Management & ICICI Securities on March 4; SBI Life Insurance Company on March 8; and Enam AMC on March 9.

Stocks in News

Route Mobile: Its subsidiary Routesms Solutions FZE (RSL FZE) has successfully completed the acquisition of MR Messaging FZE, based in teh United Arab Emirates. With this, MR Messaging has become a wholly-owned subsidiary of RSL FZE and a stepdown subsidiary of Route Mobile.

Panacea Biotec: The company will sell the pharmaceutical formulations brands of its subsidiary to Mankind Pharma. The total value of the transaction is Rs 1,872 crore. The company and its material subsidiary Panacea Biotec Pharma (PBPL) have entered into definitive agreements for the transaction. This stake sale is in line with the company's strategic plan to become debt-free and focus on exports of pharmaceutical formulations in the US and other international markets besides the vaccine business in global markets.

DB Realty: The Supreme Court has allowed the real estate company to develop land in Mumbai. The decision makes freehold 22,000 square meters in commercial zone in Mumbai available to its subsidiary Esteem Properties for development. The company intends to develop the land into a 2 million square feet (leasable area) Grade A office space over the next three years.

Vedant Fashions: Ethnic wear brand Manyavar operator clocked healthy 24.1 percent year-on-year growth in consolidated profit at Rs 127.8 crore on strong sales and operating income in the quarter ended December 2021. Revenue grew by 28 percent year-on-year to Rs 384.8 crore. The company registered a 24.5 percent YoY growth in EBITDA at Rs 191.5 crore for the quarter.

Huhtamaki India: The packaging solutions firm posted a loss of Rs 13.52 crore for the December 2021 quarter against a profit of Rs 5.08 crore in the corresponding period of the last fiscal. But the topline grew nearly 19 percent year-on-year to Rs 661.6 crore in Q4CY21.

Vipul Organics: The specialty chemicals company has recommended bonus equity shares for its shareholders and employee stock options scheme for its employees in the 50th year of its operations. The company will issue one bonus share for every four shares held by shareholders and also issue 2 lakh options to eligible employees.

Lemon Tree Hotels: The company has signed a license agreement for 41 room hotel at Mukteshwar, Uttarakhand. The hotel is expected to be operational in July 2022. The hotel is owned by The Alpine Chalet Resort. Its subsidiary Carnation Hotels and the hotel management arm will be operating and marketing this hotel.

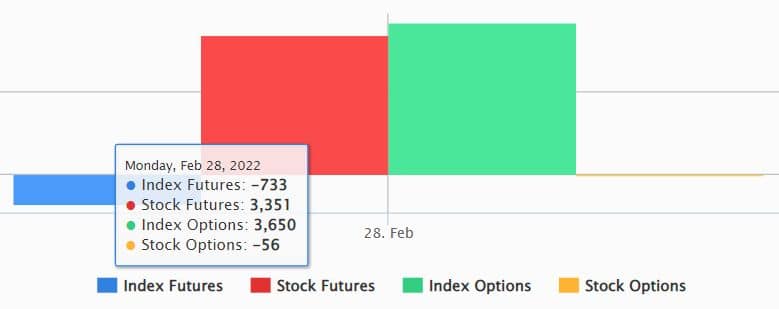

Fund Flow

Foreign institutional investors (FIIs) continued selling of shares in Indian equities, as they have net offloaded Rs 3,948.47 crore worth of shares. However, domestic institutional investors (DIIs) compensated the FII outflow by buying shares worth Rs 4,142.82 crore, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the March series, we don't have any stock that is under the F&O ban for March 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!