After four days of consolidation, the market cracked more than two percent amid rising geo-political tensions between Ukraine and Russia. But there was some buying at lower levels in the last couple of hours of trade, helping the benchmark indices recover losses and close with seven-tenth of a percent on February 22.

The benchmark indices extended correction for the fifth consecutive session. The BSE Sensex fell nearly 400 points to 57,301, while the Nifty50 declined more than 100 points to 17,092 but formed a bullish candle on the daily charts as the closing was higher than opening levels.

"The Nifty50 has been taking support near the 16,800 mark for the past two months and the level would be a critical support going ahead," says Malay Thakkar, Technical Research Associate at GEPL Capital.

He further says the index continued to form lower highs on daily charts and the upside hurdle for the index is now at 17,330 (20-day SMA).

"Broadly index is moving in the 16,800-17,500 range. Only a break below 16,800 will trigger fresh selling and would drag the index towards 16,400," Thakkar added.

The broader markets continued to underperform frontliners. The Nifty Midcap 100 and Smallcap 100 indices fell 1 percent and 2 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support levels for the Nifty are placed at 16,908, followed by 16,723. If the index moves up, the key resistance levels to watch out for are 17,213 and 17,333.

The Nifty Bank lost 314 points to close at 37,372 on February 22. The important pivot level, which will act as crucial support for the index, is placed at 36,907, followed by 36,442. On the upside, key resistance levels are placed at 37,748 and 38,124 levels.

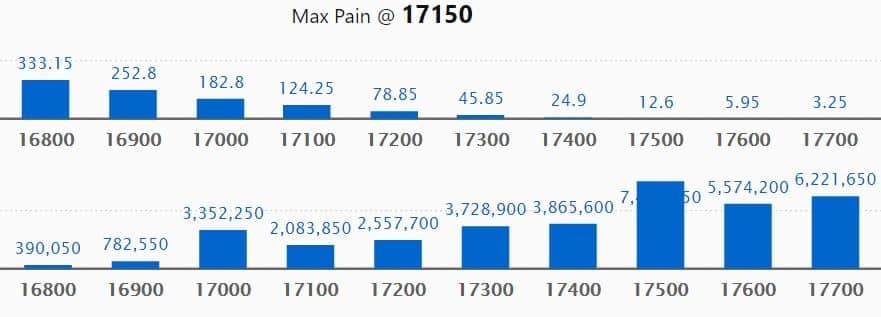

Maximum Call open interest of 83.09 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 17,500 strike, which holds 74.23 lakh contracts, and 17,700 strike, which has accumulated 62.21 lakh contracts.

Call writing was seen at 17,500 strike, which added 25.45 lakh contracts, followed by 17,700 strike which added 23.49 lakh contracts, and 17,000 strike which added 21.03 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 6.73 lakh contracts, followed by 18,100 strike which shed 5.75 lakh contracts, and 17,900 strike which shed 3.64 lakh contracts.

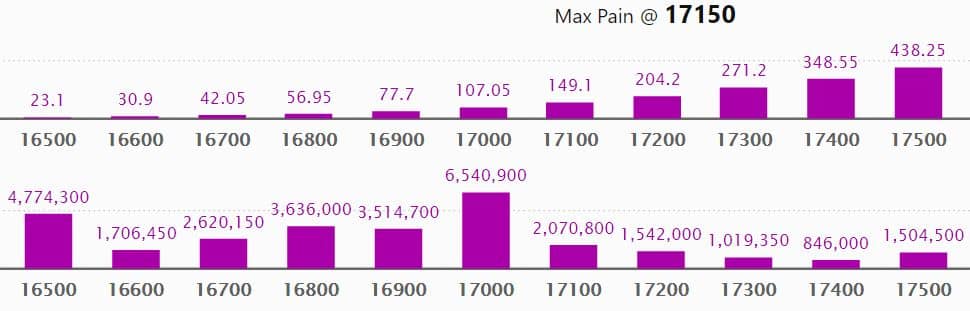

Maximum Put open interest of 65.40 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the February series.

This is followed by 16,000 strike, which holds 62.86 lakh contracts, and 16,500 strike, which has accumulated 47.74 lakh contracts.

Put writing was seen at 16,900 strike, which added 10.46 lakh contracts, followed by 16,700 strike, which added 8.16 lakh contracts, and 16,500 strike which added 6.67 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 16.85 lakh contracts, followed by 17,300 strike which shed 15.37 lakh contracts, and 16,100 strike which shed 9.29 lakh contracts.

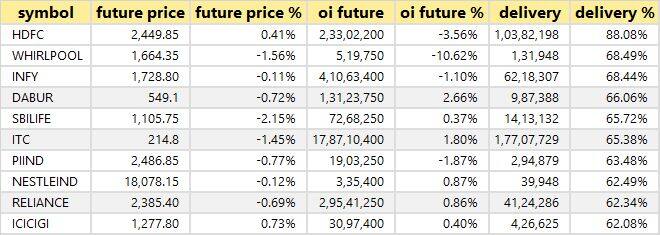

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

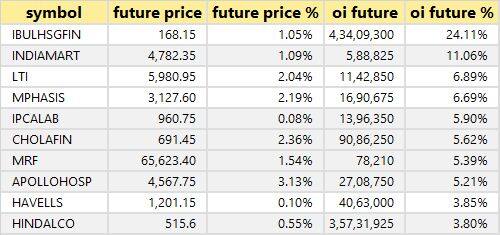

35 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

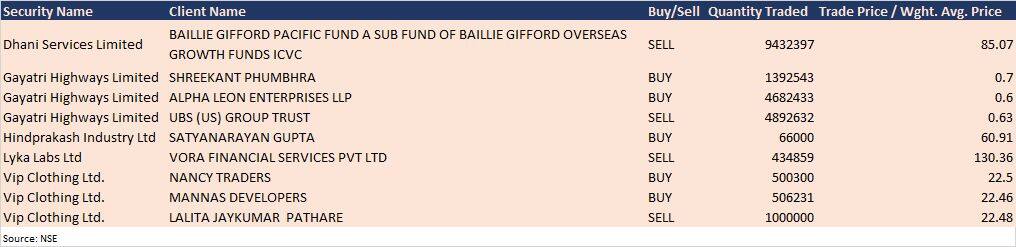

Dhani Services: Baillie Gifford Pacific Fund A Sub Fund of Baillie Gifford Overseas Growth Funds ICVC sold 94,32,397 equity shares in the company via open market transactions at an average price of Rs 85.07 per share on the NSE, as per the bulk deals data.

(For more bulk deals, click here)

Analysts/Investors Meetings

Vijaya Diagnostic Centre: The company's officials will attend Kotak Chasing Growth conference, and will meet Wasatch Advisors on February 23.

Man Industries (India): The company's officials will meet investors and analysts on February 23.

Antony Waste Handling Cell: The company's officials will meet investors and analysts on February 23.

Polycab India: The company's officials will meet Newport Asia LLC, USA on February 23; and Aditya Birla Capital AMC on February 25.

Aditya Birla Sun Life AMC: The company's officials will attend Nirmal Bang Virtual Investor Conference on February 23.

Kamdhenu: The company's officials will attend Incred Equities' investors' conference on February 23.

Kotak Mahindra Bank: The company's officials will attend JP Morgan India Bank CEO Access Day on February 23.

Home First Finance Company India: The company's officials will attend GS India Thematic Financials Tour, and Kotak's Chasing Growth Investor Conference on February 23.

SRF: The company's officials will attend Kotak Conference - Chasing Growth 2022 on February 24.

TCI Express: The company's officials will meet institutional investors, mutual funds, and analysts on February 24.

Tube Investments of India: The company's officials will meet Wasatch Advisors, and Neuberger Berman on February 25.

Stocks in News

Mahindra CIE Automotive: Profit for the December 2021 quarter fell 28 percent year-on-year to Rs 80 crore, compared to Rs 112 crore profit reported in the corresponding period last fiscal. However, revenue during the same period increased 5.4 percent to Rs 2,064 crore, against Rs 1,958 crore YoY. The firm said the board of directors has approved a dividend of Rs 2.50 per share for the financial year ended December 31, 2021.

FSN E-Commerce Ventures (Nykaa): The company informed that its litigation with L'Oreal S.A. has been settled. It had disclosed the details of pending litigation with L'Oreal S.A. in its IPO prospectus.

Dilip Buildcon: The firm has won a road project in Chhattisgarh. It has been declared as L-1 bidder for a new HAM project under Raipur-Visakhapatnam in the state and the order is worth Rs 1,141 crore.

SIS: The company has bagged a contract worth Rs 225 crore, from Mahanadi Coalfields. With this, it will deliver security solutions to Mahanadi Coalfields at 18 sites across India for the next two years.

Elantas Beck India: Profit for the December 2021 quarter fell by 26 percent to Rs 16.60 crore, compared to Rs 22.55 crore profit reported in the year-ago period. Revenue, however, jumped 23 percent to Rs 145 crore against Rs 118 crore in the same period. The firm said its board of directors has recommended payment of a dividend of Rs 5 per equity share for the year 2021.

Capri Global Capital: Life Insurance Corporation of India has bought 1.5 lakh equity shares in the company via open market transactions on February 21. With this, LIC's shareholding stands at 5.04 percent now, up from 4.95 percent earlier.

Carborundum Universal: HDFC Asset Management Company sold 1.1 lakh equity shares in the company via open market transactions on February 18. After stake sale, HDFC AMC holds 5.59 percent shareholding now, down from 5.65 percent earlier.

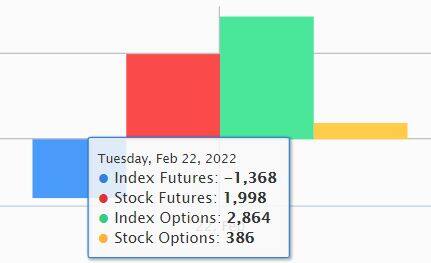

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 3,245.52 crore worth of shares, whereas domestic institutional investors (DIIs) have net bought Rs 4,108.58 crore worth of shares in the Indian equity market on February 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Indiabulls Housing Finance, and Punjab National Bank - are under the F&O ban for February 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!