The bulls ruled Dalal Street for the second consecutive session on February 1 as Finance Minister Nirmala Sitharaman came out with a growth-oriented Budget, increasing capital expenditure to boost the economy. Positive global cues came in handy too.

The Sensex rallied 848.40 points or 1.46 percent to 58,862.57, while the Nifty50 rose 237 points or 1.37 percent to 17,576.80 and formed a small bullish candle that resembled Hanging Man kind pattern on the daily charts, supported by all sectors barring auto and PSU banks.

"The index has ended above the 50-day SMA (17,430) and formed a bullish candle with a long lower shadow which indicates buying at lower levels. The index has bounced sharply from levels and is now close to the 50 percent retracement (17,597) of the fall (18,350-16,840). The index can face resistance in the 17,600-17,640 zone," said Malay Thakkar, Technical Research Associate at GEPL Capital.

Thakkar said traders should initiate long positions only if the Nifty breaks above 17,640 and play for upside targets of 17,770 followed by 17,900.

The broader markets also traded higher. with the Nifty midcap 100 index climbing 1.12 percent and smallcap 100 index rising 0.57 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,340.13, followed by 17,103.47. If the index moves up, the resistance levels to watch out for are 17,717.94 and 17,859.07.

Click Here To Read All Updates On Union Budget 2022

The Nifty Bank climbed 530.20 points or 1.4 percent to 38,505.50 on February 1. The important pivot level, which will act as crucial support for the index, is placed at 37,863.17 followed by 37,220.84. On the upside, key resistance is placed at 38,975.27 and 39,445.03 levels.

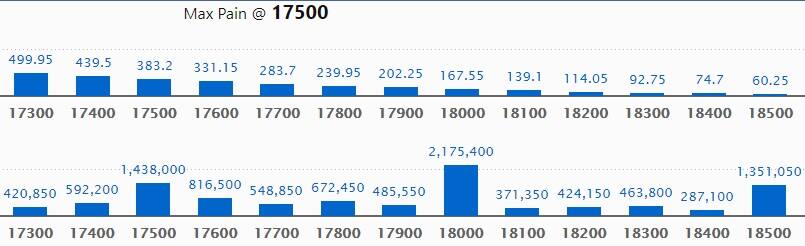

Maximum Call open interest of 21.75 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 17,500 strike, which holds 14.38 lakh contracts, and 18,500 strike, which has accumulated 13.51 lakh contracts.

Call writing was seen at 17,600 strike, which added 3.71 lakh contracts, followed by 17,500 strike which added 1.84 lakh contracts, and 18,000 strike which added 1.7 lakh contracts.

Call unwinding was seen at 17,300 strike, which shed 2.42 lakh contracts, followed by 17,400 strike which shed 1.68 lakh contracts and 17,200 strike which shed 1.11 lakh contracts.

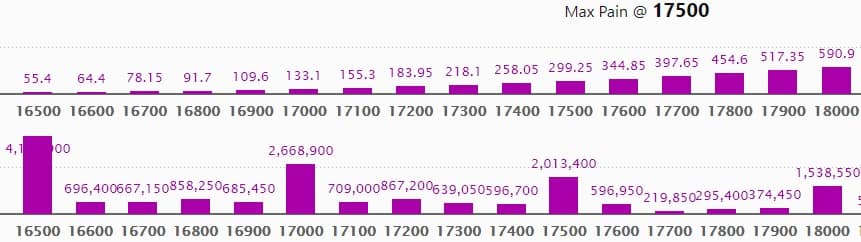

Maximum Put open interest of 41.33 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the February series.

This is followed by 17000 strike, which holds 26.68 lakh contracts, and 17500 strike, which has accumulated 20.13 lakh contracts.

Put writing was seen at 17500 strike, which added 4.16 lakh contracts, followed by 17600 strike, which added 3.68 lakh contracts, and 16500 strike which added 3.41 lakh contracts.

Put unwinding was seen at 17200 strike, which shed 44,550 contracts, followed by 16800 strike which shed 20,350 contracts, and 17300 strike which shed 15,150 contracts.

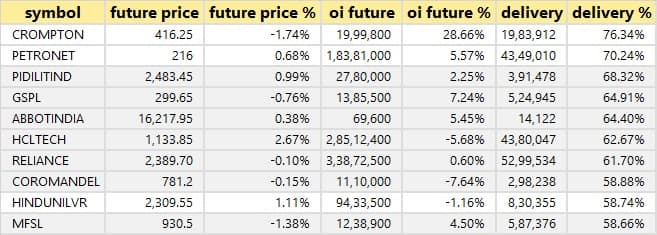

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

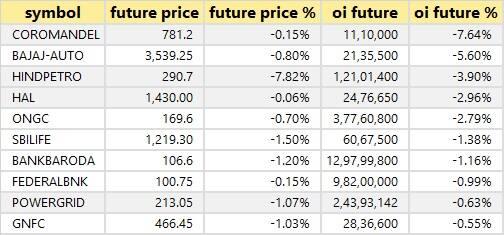

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

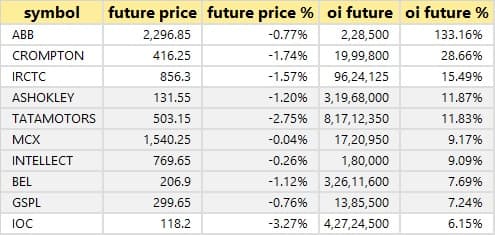

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

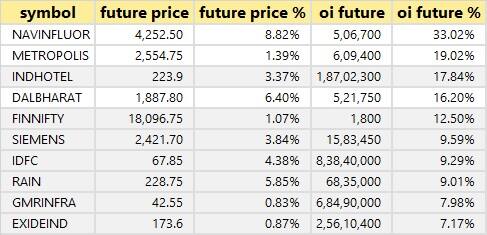

61 stocks witnessed short-covering

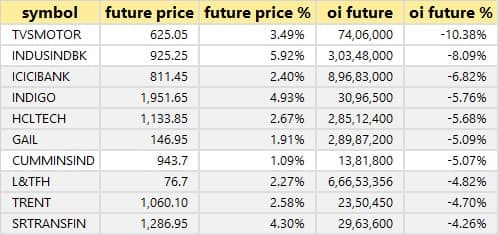

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

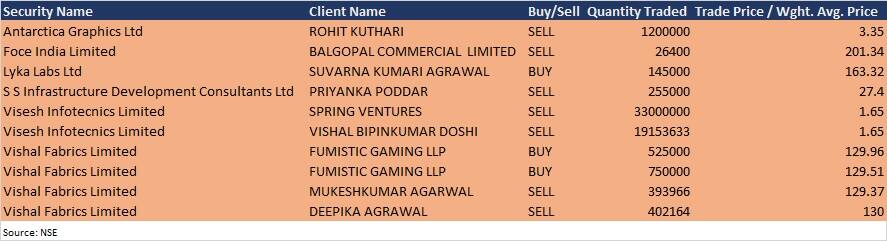

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on February 2

Results on February 2: HDFC, Adani Green Energy, Dabur India, Aarti Surfactants, Apollo Tyres, Adani Total Gas, Bajaj Consumer Care, Balaji Amines, Balrampur Chini Mills, Blue Star, eClerx Services, Gillette India, Indian Overseas Bank, JK Lakshmi Cement, Jubilant FoodWorks, Mahindra & Mahindra Financial Services, Meghmani Organics, Sandhar Technologies, Shankara Building Products, Suryoday Small Finance Bank, Tata Consumer Products, Timken India, VRL Logistics, Windlas Biotech, Zee Entertainment Enterprises, and Zydus Wellness will release quarterly earnings on February 2.

Olectra Greentech: The company's officials will meet analysts and investors on February 2.

Craftsman Automation: The company's officials will meet Svan Investment on February 2 and DAM Capital-Investor Conference on February 3.

Indian Energy Exchange: The company's officials will meet Millingtonia Capital on February 2, and Somerset capital on February 7.

Supriya Lifescience: The company's officials will interact analysts and investors on February 2.

Welspun Enterprises: The company's officials will meet investors and analysts on February 3, to discuss financial results.

Emami: The company's officials will meet investors and analysts on February 3 to discuss financial results.

PI Industries: The company's officials will meet analysts and investors on February 4, to discuss financial results.

Trident: The company's officials will meet Shukr Investments, UAE, on February 4.

Coromandel International: The company's officials will meet investors and analysts on February 4.

CL Educate: The company's officials will meet analysts and investors on February 4, to discuss financial results.

Symphony: The company's officials will meet O3 Capital on February 7.

TVS Motor Company: The company's officials will meet analysts and fund houses on February 7 to discuss financial performance.

Glenmark Life Sciences: The company's officials will meet analysts and investors on February 9, to discuss financial results.

Stocks in News

Tech Mahindra: The company reported a higher consolidated profit at Rs 1,378.2 crore in Q3FY22 against Rs 1,340.9 crore in Q2FY22, revenue rose to Rs 11,450.8 crore from Rs 10,881.3 crore QoQ.

Laxmi Organic Industries: The company reported a higher consolidated profit at Rs 82.09 crore in Q3FY22 against Rs 45.21 crore in Q3FY21, revenue jumped to Rs 859.87 crore from Rs 435.5 crore YoY.

Amber Enterprises India: The company has entered into definitive agreements with Pravartaka Tooling Services and acquired a 60% stake in Pravartaka, which is in the business of injection mould tool manufacturing and injection moulding components manufacturing for various industries.

Windlas Biotech: The company concluded SAHPRA (South African Health Products Regulatory Authority) inspection audit report for the Plant-IV situated at Dehradun with zero critical observations/ deficiencies, zero major deficiencies and some minor deficiencies.

Anupam Rasayan: The company will acquire a 24.96% stake in Tanfac Industries from Birla Group Holdings and Others.

VIP Industries: The company reported consolidated profit at Rs 33.47 crore in Q3FY22 against loss of Rs 7 crore in Q3FY21, revenue rose to Rs 397.34 crore from Rs 232.53 crore YoY.

MMTC: The government approved Tata Steel Long Products as a strategic buyer for privatisation of Neelachal Ispat Nigam, a joint venture of four CPSEs (MMTC, NMDC, BHEL, MECON) and two Odisha government PSUs (OMC and IPICOL).

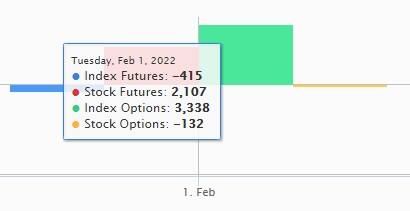

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 21.79 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,597.70 crore in on February 1, as per the provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of February series, not a single stock is under the F&O ban for February 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!