The market corrected sharply in the last hour of trade and finally settled with a one percent loss on January 18, following weak global trends. The selling pressure was seen across sectors.

The BSE Sensex plunged 554.05 points to 60,754.86, while the Nifty50 dropped 195.10 points to 18,113 and formed a bearish engulfing pattern on the daily charts.

"The Nifty50 registered a bearish engulfing kind of formation as it reversed the course from intraday high of 18,351 levels thereby erasing all the gains of the preceding trading session. In this process it almost bridged the bullish gap, present in the zone of 18,128 and 18,081, with an intraday low of 18,085 levels," says Mazhar Mohammad, Chief Strategist, Technical Research & Trading Advisory at Chartviewindia.in

Hence, he feels that in the next trading session, selling may get accentuated if it consistently trades below 18,080 levels. "In such a situation, it can head to lower levels with initial targets present around 50-day exponential moving average whose value is placed around 17,600 levels."

Contrary to this, he says that if bulls manage to defend 18,080 levels on a closing basis then sideways consolidation can be expected. "Strength shall not prevail unless Nifty closes above 18,350 levels. Therefore for time being it looks prudent to avoid long side bets and to look for shorting below 18,080 levels."

The broader markets also witnessed selling pressure. The Nifty Midcap 100 and Smallcap 100 indices fell more than 2 percent each.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 18,015.7, followed by 17,918.3. If the index moves up, the key resistance levels to watch out for are 18,280.7 and 18,448.3.

The Nifty Bank declined 5.85 points to 38,210.30 on January 18. The important pivot level, which will act as crucial support for the index, is placed at 37,918.59, followed by 37,626.89. On the upside, key resistance levels are placed at 38,678.8 and 39,147.3 levels.

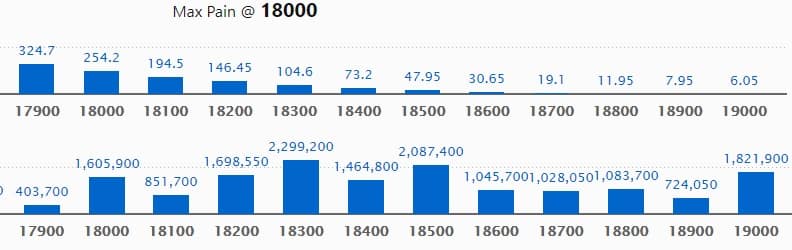

Maximum Call open interest of 22.99 lakh contracts was seen at 18300 strike, which will act as a crucial resistance level in the January series.

This is followed by 18500 strike, which holds 20.87 lakh contracts, and 19000 strike, which has accumulated 18.21 lakh contracts.

Call writing was seen at 18300 strike, which added 6.11 lakh contracts, followed by 18200 strike which added 5.15 lakh contracts, and 18400 strike which added 4.31 lakh contracts.

Call unwinding was seen at 17700 strike, which shed 40,950 contracts, followed by 17800 strike which shed 37,000 contracts and 18100 strike which shed 31,900 contracts.

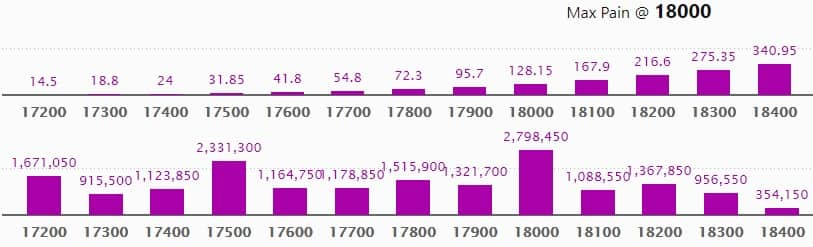

Maximum Put open interest of 27.98 lakh contracts was seen at 18000 strike, which will act as a crucial support level in the January series.

This is followed by 17500 strike, which holds 23.31 lakh contracts, and 17200 strike, which has accumulated 16.71 lakh contracts.

Put writing was seen at 17900 strike, which added 2.21 lakh contracts, followed by 18200 strike, which added 1.85 lakh contracts, and 17700 strike which added 1.58 lakh contracts.

Put unwinding was seen at 17300 strike, which shed 1.71 lakh contracts, followed by 18300 strike which shed 1.36 lakh contracts, and 18000 strike which shed 54,500 contracts.

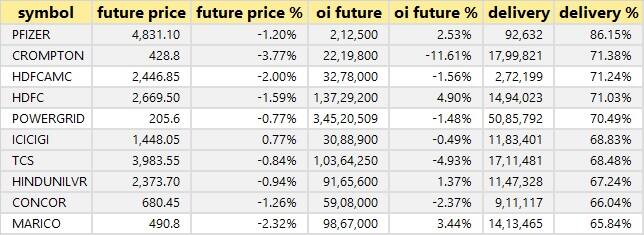

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

3 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 3 stocks in which a long build-up was seen.

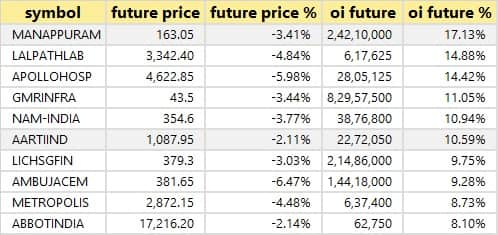

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

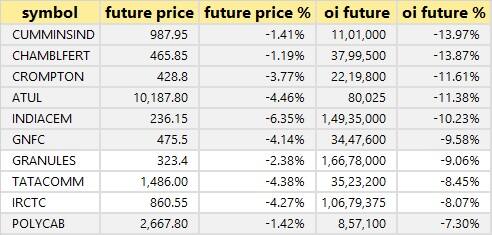

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

Seven stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the seven stocks in which short-covering was seen.

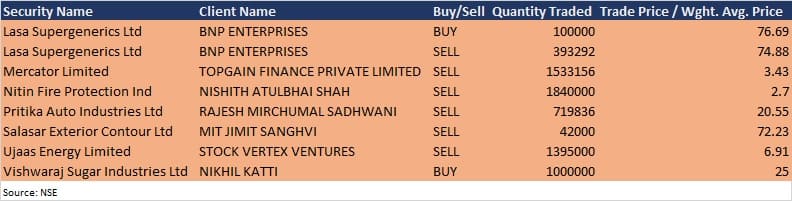

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 19

Results on January 19: Bajaj Auto, ICICI Lombard General Insurance Company, Larsen & Toubro Infotech, JSW Energy, Aptech, CCL Products (India), Ceat, Chembond Chemicals, Continental Securities, DRC Systems India, Orient Green Power Company, JSW Ispat Special Products, Mastek, Nelco, Oracle Financial Services Software, Rallis India, Saregama India, Sterlite Technologies, Syngene International, Tata Communications, Tata Investment Corporation, Tejas Networks, Trident Texofab, and TT Limited will release quarterly earnings on January 19.

GE Power India: The company's officials will meet Nippon Life India Trustee on January 19.

CL Educate: The company's officials will meet Samatva Investments, Seraphic Management, Drone Capital, and Ogma Research on January 20.

PCBL: The company's officials will meet investors and analysts on January 20 to discuss financial performance.

Supriya Lifescience: The company's officials will meet investors and analysts on January 21 to discuss financial performance.

IDBI Bank: The company's officials will meet analysts on January 21 to discuss financial results.

CSB Bank: The company's officials will meet investors and analysts on January 24, to discuss financial results.

APL Apollo Tubes: The company's officials will meet investors and analysts on January 25 to discuss Q3FY22 earnings.

Apollo Pipes: The company's officials will meet investors and analysts on January 27 to discuss Q3FY22 earnings.

Blue Star: The company's officials will meet investors on February 3 to discuss financial results.

Stocks in News

ICICI Prudential Life Insurance Company: The company reported higher profit at Rs 310.62 crore in Q3FY22 against Rs 305.55 crore in Q3FY21; net premium income rose to Rs 9,073.97 crore from Rs 8,970.84 crore YoY.

Bajaj Finance: Profit after tax for Q3FY22 increased by 85% to Rs 2,125 crore from Rs 1,146 crore in Q3FY21. Net interest income increased by 40 percent to Rs 6,000 crore as against Rs 4,296 crore YoY.

Alok Industries: The company reported consolidated loss at Rs 0.09 crore in Q3FY22 against loss of Rs 35.12 crore in Q3FY21; revenue jumped to Rs 2,129.60 crore from Rs 1,201.80 crore YoY.

L&T Technology Services: The company reported sharply higher consolidated profit at Rs 249.6 crore in Q3FY22 against Rs 186.9 crore in Q3FY21. Revenue jumped to Rs 1,687.5 crore from Rs 1,400.7 crore YoY. The company bagged a $45 million EV (electric vehicle) deal from US Auto Tier 1.

DCM Shriram: The company reported higher consolidated profit at Rs 349.79 crore in Q3FY22 against Rs 253.45 crore in Q3FY21. Revenue rose to Rs 2,790.78 crore from Rs 2,158.74 crore YoY.

Shalimar Paints: Hella Infra Market, the parent company of Infra.Market, will invest Rs 270 crore through a combination of equity and debentures in Shalimar Paints.

Tata Elxsi: The company reported higher profit at Rs 150.95 crore in Q3FY22 against Rs 105.20 crore in Q3FY21. Revenue jumped to Rs 635.41 crore from Rs 477.09 crore YoY.

Fund Flow

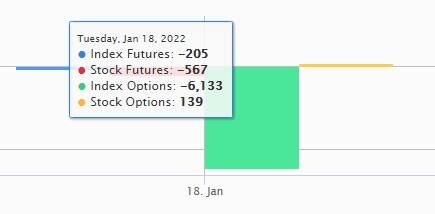

Foreign institutional investors (FIIs) net sold shares worth Rs 1,254.95 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 220.20 crore in the Indian equity market on January 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - BHEL, Escorts, Granules India, Indiabulls Housing Finance, Vodafone Idea, and SAIL - are under the F&O ban for January 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!