The continued buying interest for the third consecutive session helped the benchmark indices close near a two-month high on January 11. Technology, and select banking and financials stocks supported the market.

The BSE Sensex rallied 221 points to 60,617, while the Nifty50 climbed 52.50 points to 18,056, the highest closing level since November 15, 2021, and formed a bullish candle on the daily charts.

"The daily price action has formed a small bullish candle forming higher High-Low compared to the previous session, and for the second consecutive session, the index is sustaining above 18,000 psychological mark on a closing basis indicating strength in the near term," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He feels that the overall short to medium-term trend is still bullish.

Rajesh Palviya advised that traders should trail stop-loss towards 17,800 levels for all long positions with an upside towards 18,200-18,300 levels, and short term traders and investors should book partial profits near the supply zone of 18,200-18,300 levels as any violation of 17,800 levels may cause short-term profit booking.

The Nifty Midcap 100 and Smallcap 100 indices settled higher by 0.09 percent and 0.06 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,986.4, followed by 17,917. If the index moves up, the key resistance levels to watch out for are 18,103.2 and 18,150.6.

Nifty Bank

The Nifty Bank rose 94.30 points to close at 38,442.20 on January 11. The important pivot level, which will act as crucial support for the index, is placed at 38,147.8, followed by 37,853.4. On the upside, key resistance levels are placed at 38,620.61 and 38,799 levels.

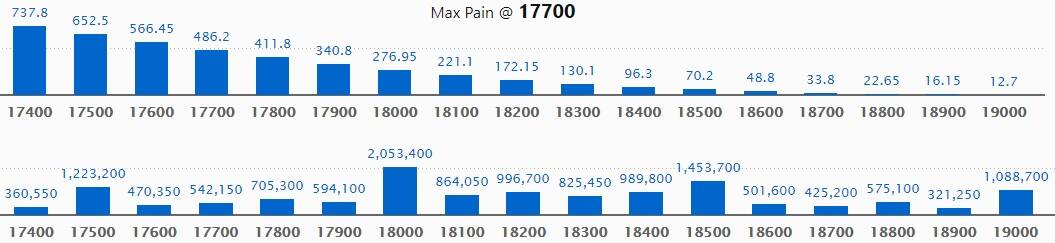

Call option data

Maximum Call open interest of 20.53 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the January series.

This is followed by 18500 strike, which holds 14.53 lakh contracts, and 17500 strike, which has accumulated 12.23 lakh contracts.

Call writing was seen at 18900 strike, which added 1.03 lakh contracts, followed by 18100 strike which added 82,500 contracts, and 18500 strike which added 59,100 contracts.

Call unwinding was seen at 17800 strike, which shed 1.75 lakh contracts, followed by 17500 strike which shed 75,650 contracts and 17900 strike which shed 53,000 contracts.

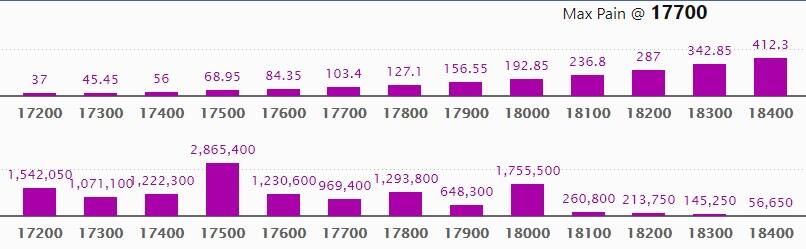

Put option data

Maximum Put open interest of 28.65 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the January series.

This is followed by 18000 strike, which holds 17.55 lakh contracts, and 17200 strike, which has accumulated 15.42 lakh contracts.

Put writing was seen at 18000 strike, which added 2.99 lakh contracts, followed by 18100 strike, which added 1.41 lakh contracts, and 18200 strike which added 82,550 contracts.

Put unwinding was seen at 17200 strike, which shed 49,800 contracts, followed by 17500 strike which shed 43,050 contracts, and 17800 strike which shed 35,600 contracts.

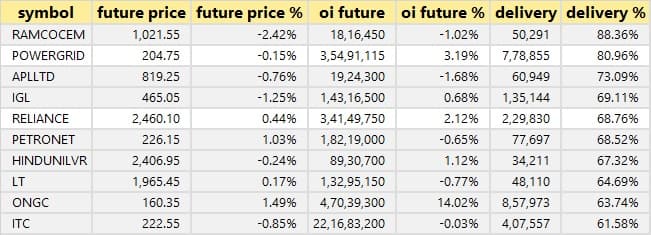

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

36 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

49 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

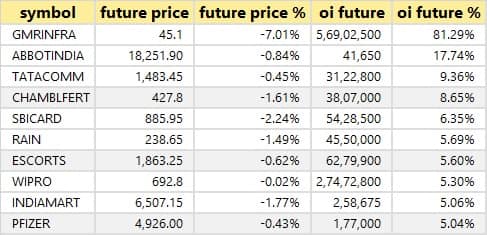

69 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

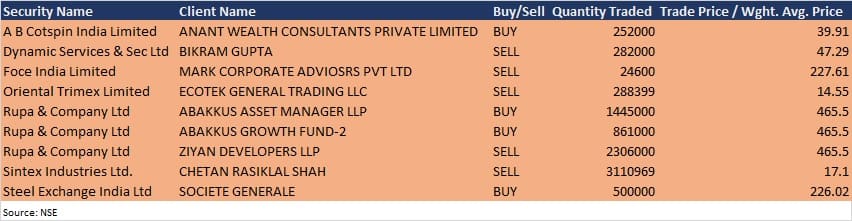

Bulk deals

Rupa & Company: Abakkus Asset Manager LLP acquired 14.45 lakh equity shares in the company at Rs 465.5 per share and Abakkus Growth Fund-2 bought 8.61 lakh equity shares at Rs 465.5 per share. However, Ziyan Developers LLP sold 23.06 lakh shares at Rs 465.5 per share on the NSE, the bulk deals data showed.

Steel Exchange India: Societe Generale bought 5 lakh shares in the company at Rs 226.02 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 12

Results on January 12: Infosys, Tata Consultancy Services, Wipro, Indbank Merchant Banking Services, Ind Bank Housing, KD Leisures, Kome-On Communication, NB Footwear, Pradhin, Roselabs Finance, Tinna Rubber and Infrastructure, and Virinchi will release quarterly earnings on January 12.

Deepak Fertilisers: The company's officials will meet Motilal Oswal Asset Management on January 12.

Cipla: The company's officials will attend the 40th Annual J.P. Morgan Healthcare Conference on January 12.

Radico Khaitan: The company's officials will meet Myriad Asset Management on January 12.

Vedanta: The company's officials will attend Investec ESG 2.0 Conference: Decarbonization & More, on January 12.

GTPL Hathway: The company's officials will meet analysts and investors on January 17, to discuss unaudited financial results.

Torrent Pharmaceuticals: The company's officials will meet analysts and investors on January 25, to discuss financial results.

Stocks in News

DLF: The company clocked sales worth Rs 1,500 crore for its initial offering in ONE Midtown, a newly launched luxury residential project in New Delhi.

UltraTech Cement: The company announced the commissioning of Line II of the Bara Grinding Unit in Uttar Pradesh, having a cement capacity of 2 mtpa (million tonnes per annum). The Line I was earlier commissioned in January 2020 and is already operating at a capacity utilisation in excess of 80 percent.

Delta Corp: The board has approved the appointment of advisors, bankers and other intermediaries by subsidiary Gaussian Networks (GNPL), engaged in the online gaming business, to explore a potential public issue and listing of equity shares of GNPL. The company reported a higher consolidated profit at Rs 70.38 crore in Q3FY22 against Rs 1.28 crore in Q3FY21, revenue jumped to Rs 247.22 crore from Rs 120.82 crore YoY.

RITES: The company signed a memorandum of understanding (MoU) with SMEC Group to cooperate and explore infrastructure projects.

Vikas Lifecare: The company reported consolidated profit at Rs 2.82 crore in Q3FY22 against Rs 0.06 crore in Q3FY21; revenue jumped to Rs 106.74 crore from Rs 9.43 crore YoY.

PI Industries: Life Insurance Corporation of India acquired 72,000 equity shares in the company via open market transactions on January 10, increasing shareholding to 5.03 percnt from 4.98 percent earlier.

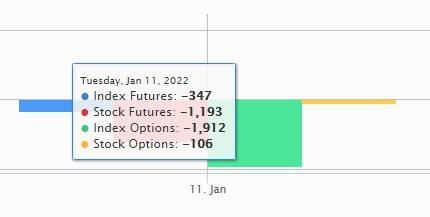

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 111.91 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 378.74 crore in the Indian equity market on January 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Delta Corp, Indiabulls Housing Finance, Vodafone Idea, and RBL Bank - are under the F&O ban for January 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!