The market snapped a two-day losing streak and closed nearly a percent higher on December 21, partly backed by a bit of short covering and value buying, as well as positive global cues.

The BSE Sensex rallied more than 1,000 points intraday, but due to profit booking at higher levels, it closed off day's high. The index was up 497 points or 0.89 percent to close at 56,319, while the Nifty50 rose 156.60 points or 0.94 percent to 16,770.80 and formed Doji pattern on the daily charts.

"The Nifty opened on a positive note after positive cues coming from the international markets and moved higher and tested a high of 16,930, post which the bears took control of the trend and pushed the prices lower. The index finally ended the session with a Doji candle pattern," said Karan Pai, Technical Analyst at GEPL Capital.

He further said, "The price action of the day suggests that the index is facing rejection near the higher levels. Going ahead, the 17,000 level is going to act as a key resistance level. As long as the prices remain below the 17,000 mark the gates towards the 16,200 remain open."

The broader markets also joined the party and outperformed benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices have gained 1.28 percent and 1.25 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,660.53, followed by 16,550.27. If the index moves up, the key resistance levels to watch out for are 16,908.73 and 17,046.67.

Nifty Bank

The Nifty Bank rose 168 points to close at 34,607.85 on December 21. The important pivot level, which will act as crucial support for the index, is placed at 34,315.2, followed by 34,022.5. On the upside, key resistance levels are placed at 34,975.3 and 35,342.7 levels.

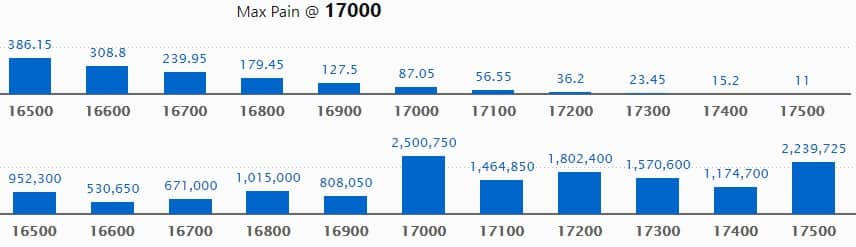

Call option data

Maximum Call open interest of 25 lakh contracts was seen at 17000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 22.39 lakh contracts, and 17200 strike, which has accumulated 18.02 lakh contracts.

Call writing was seen at 17400 strike, which added 54,100 contracts, followed by 17100 strike which added 50,100 contracts, and 16300 strike which added 2,400 contracts.

Call unwinding was seen at 16600 strike, which shed 3.86 lakh contracts, followed by 16500 strike which shed 2.35 lakh contracts and 16700 strike which shed 1.6 lakh contracts.

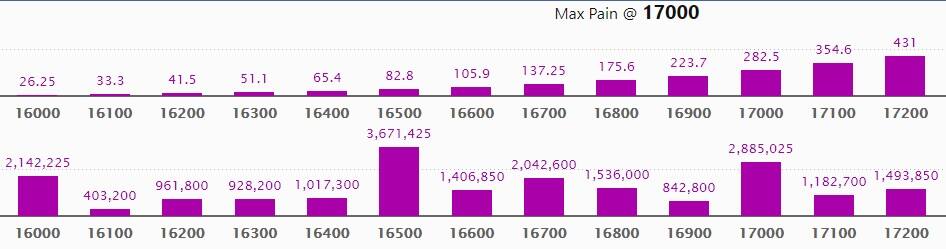

Put option data

Maximum Put open interest of 36.71 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the December series.

This is followed by 17000 strike, which holds 28.85 lakh contracts, and 16000 strike, which has accumulated 21.42 lakh contracts.

Put writing was seen at 16500 strike, which added 4.71 lakh contracts, followed by 16700 strike which added 3.23 lakh contracts and 16900 strike which added 1.19 lakh contracts.

Put unwinding was seen at 17000 strike, which shed 3.55 lakh contracts, followed by 17100 strike which shed 2.11 lakh contracts and 16300 strike which shed 1.35 lakh contracts.

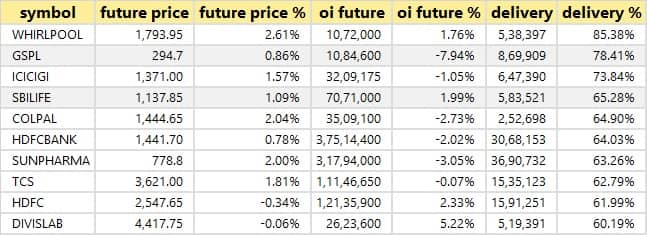

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

76 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

11 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

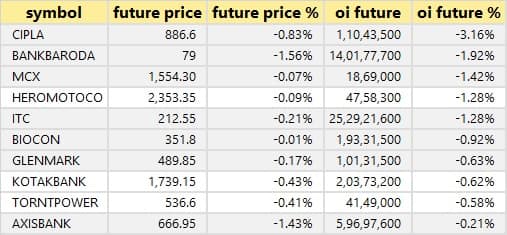

17 stocks saw short build-up

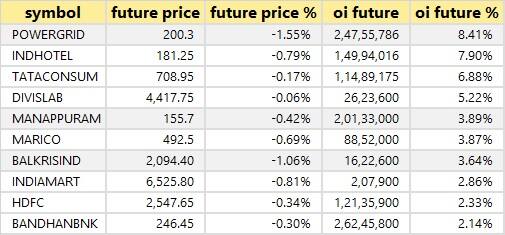

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

86 stocks witnessed short-covering

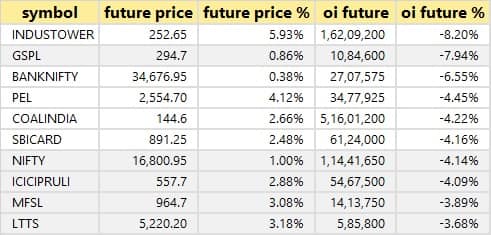

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

C E Info Systems (MapmyIndia): Fidelity Investment Trust Fidelity Series Emerging Markets Fund acquired 3,18,100 equity shares in the company at Rs 1,404.47 per share, and Goldman Sachs Funds - Goldman Sachs India Equity Portfolio bought 3,76,708 equity shares at Rs 1,392.99 per share on the NSE, the bulk deals data showed.

Filatex India: Nirmal Kumar Bathwal acquired 18,96,948 equity shares in the company at Rs 84.76 per share. However, investor Penguin Trading & Agencies sold 28,81,000 equity shares in the company at Rs 81.3 per share on the NSE, the bulk deals data showed.

Lancer Container Lines: Aviator Global Investment Fund bought 1.75 lakh shares in the company at Rs 205 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Krsnaa Diagnostics: The company's officials will meet Nippon India Mutual Fund on December 22.

Tata Elxsi: The company's officials will meet Prabhudas Lilladher on December 22.

Gland Pharma: The company's officials will meet Arihant Capital on December 22.

Insecticides (India): The company's officials will meet institutional investors and analysts on December 22.

Bajaj Electricals: The company's officials will meet investors on December 22.

Antony Waste Handling Cell: The company's officials will meet investors and analysts on December 22.

Tiger Logistics (India): The company's officials will attend an investor meeting on December 22.

Brigade Enterprises: The company's officials will meet Franklin Templeton Mutual Fund on December 23.

Stocks in News

Metro Brands: The company will make its debut on the bourses on December 22. The final issue price is Rs 500 per share.

Visagar Polytex: The company on December 24 will consider the proposal for raising funds by issue of equity shares to the existing shareholders through a rights issue.

India Cements: Radhakishan S Damani & Others acquired 2.03 percent stake in the company via open market transaction, increasing shareholding to 22.76 percent from 20.73 percent.

IndiaMART InterMESH: The company has indirectly through its wholly owned subsidiary, Tradezeal Online, agreed to acquire 4,784 compulsorily convertible series A preference shares and 100 equity shares aggregating to 26.01 percent of Edgewise Technologies.

Bal Pharma: ICRA upgraded credit rating outlook from Stable to Positive.

IRB Infrastructure Developers: Subsidiary Chittoor Thachur Highway has now executed Concession Agreement with National Highways Authority of India.

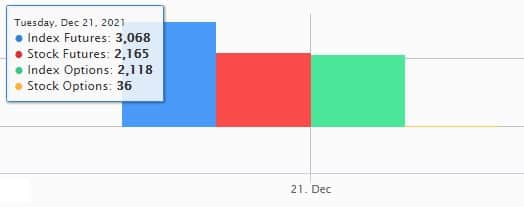

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,209.82 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,404.89 crore in the Indian equity market on December 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Indiabulls Housing Finance, and Zee Entertainment Enterprises - are under the F&O ban for December 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!