The bulls were back in action. The market snapped a two-day losing streak, with the benchmark indices rising 1.56 percent on the back of support from all sectors on December 7, ahead of RBI monetary policy and after easing of Omicron concerns.

The BSE Sensex surged 886.51 points to 57,633.65, while the Nifty50 jumped 264.40 points to 17,176.70 and formed a bullish candle on the daily charts.

"The daily price action has formed a sizable bullish candle forming higher high-low compared to the previous session indicating positive bias. This buying was observed from the past 3-4 sessions with multiple support zones of 16,800-16,900 levels, which remains a crucial support zone in the near term," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further says any sustainable move above 17,250 levels may cause upside momentum towards 17,400-17,500 levels. On the flip side, "any violation of 17,100 may cause further weakness towards 17,000-16,800 levels. Nifty is trading below 20,50 and 100-day SMA representing near-term bearish bias."

Rajesh Palviya expects the index to consolidate within a broad range from 17,600 to 16,800 levels in the coming sessions with mixed bias, along with high volatility.

The broader markets also joined the bulls' party as the Nifty Midcap 100 and Smallcap 100 indices climbed over 1 percent each.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,025.77, followed by 16,874.83. If the index moves up, the key resistance levels to watch out for are 17,289.66 and 17,402.63.

Nifty Bank

The Nifty Bank outperformed benchmark Nifty50, rising 882.50 points or 2.47 percent to 36,618.40 on December 7. The important pivot level, which will act as crucial support for the index, is placed at 36,147.96, followed by 35,677.53. On the upside, key resistance levels are placed at 36,954.77 and 37,291.13 levels.

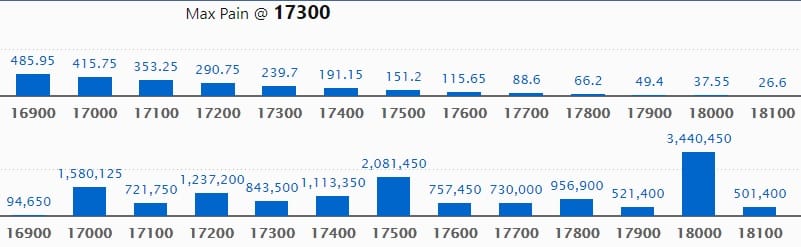

Call option data

Maximum Call open interest of 34.40 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 20.81 lakh contracts, and 17000 strike, which has accumulated 15.80 lakh contracts.

Call writing was seen at 17100 strike, which added 1.66 lakh contracts, followed by 17200 strike which added 1.37 lakh contracts, and 18100 strike which added 62,150 contracts.

Call unwinding was seen at 17300 strike, which shed 1.05 lakh contracts, followed by 17400 strike which shed 99,700 contracts and 17800 strike which shed 44,100 contracts.

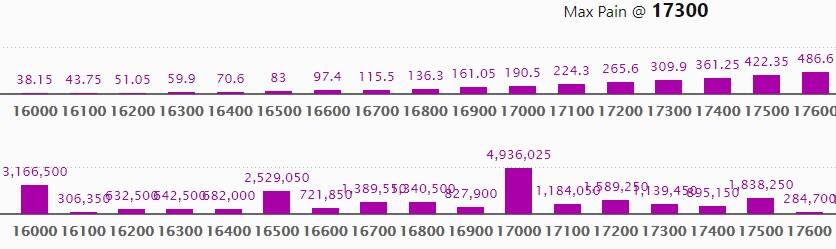

Put option data

Maximum Put open interest of 49.36 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the December series.

This is followed by 16000 strike, which holds 31.66 lakh contracts, and 16500 strike, which has accumulated 25.29 lakh contracts.

Put writing was seen at 17200 strike, which added 3.26 lakh contracts, followed by 17100 strike which added 2.66 lakh contracts and 17000 strike which added 1.73 lakh contracts.

Put unwinding was seen at 16000 strike, which shed 2.25 lakh contracts, followed by 16700 strike which shed 2.04 lakh contracts and 17400 strike which shed 1.32 lakh contracts.

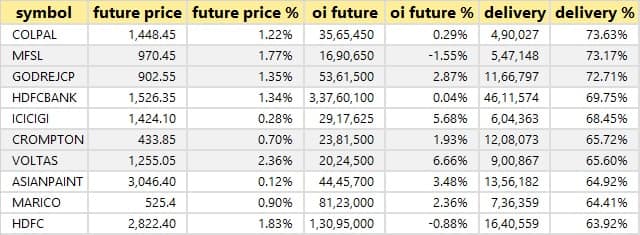

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

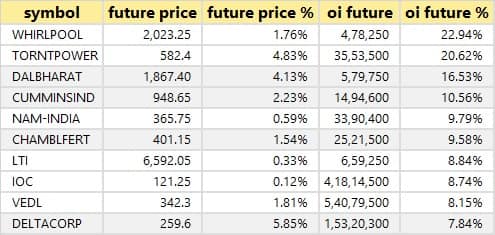

76 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

One stock saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here is a stock in which long unwinding was seen.

![]()

12 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

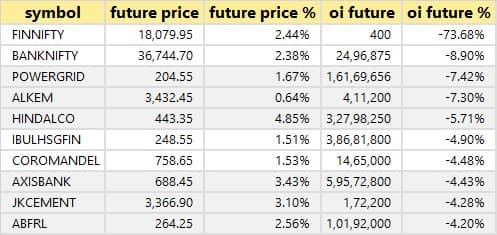

100 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

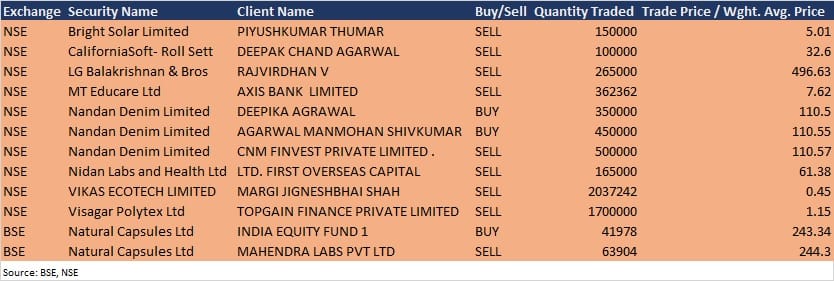

Bulk deals

Natural Capsules: India Equity Fund 1 acquired 41,978 equity shares in the company at Rs 243.34 per share. However, Mahendra Labs Pvt Ltd sold 63,904 equity shares in the company at Rs 244.30 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Xelpmoc Design and Tech: The company's officials will meet several investors via virtual conference on December 8.

Nazara Technologies: The company's officials will meet Altrinsic Advisors on December 8, Federated Investors on December 9, and B&K Securities on December 10.

Gujarat Fluorochemicals: The company's officials will meet investors and analysts at Edelweiss Emerging Ideas Conference 2021 on December 9.

GMM Pfaudler: The company's officials will interact with analysts and investors on December 8 and 9.

Garment Mantra Lifestyle: The company's officials will meet analysts and investors on December 8.

Krsnaa Diagnostics: The company's officials will meet Dalal & Broacha Stock Broking on December 8.

Indo Count Industries: The company's officials will participate in Edelweiss PCG Conference on December 8.

Can Fin Homes: The company's officials will attend Emerging Ideas Conference 2021 on December 8.

Krishna Institute of Medical Sciences: The company's officials will meet Axis Mutual Fund on December 8.

Tube Investments of India: The company's officials will meet IIFL Capital and WhiteOak Capital on December 8.

Stocks in News

California Software: The company has signed a Memorandum of Understanding (MoU) to acquire a majority stake in Pratsware Technologies which owns botbaba, which is a WhatsApp Chatbot Platform. This acquisition will make Calsoft a global leadership in the sphere of e-commerce and Point of Sale (PoS) solutions.

NHPC: The company has approved a proposal for monetisation by securitisation through a bidding process of return on equity (RoE) of Chamera-I power station (3 X 180 MW), Himachal Pradesh and further to monetise the RoE of one or more power stations for 05/10/15 years in one go or rollover.

Reliance Industries: Abu Dhabi Chemicals Derivatives Company RSC (TA’ZIZ) and Reliance Industries have agreed to launch ‘TA’ZIZ EDC & PVC’, a world-scale chemical production partnership at the TA’ZIZ Industrial Chemicals Zone in Ruwais. The new joint venture will construct and operate a Chlor-Alkali, Ethylene Dichloride (EDC) and polyvinyl chloride (PVC) production facility, with an investment of more than $2 billion.

Polyplex Corporation: PT Polyplex Films Indonesia, a wholly owned subsidiary of Polyplex (Thailand) Public Company (PTL), Thailand, (51 percent subsidiary of the company) has commenced operations. of a 10.6-metre BOPP film line with a capacity of 60,000 tonnes per annum.

Hindustan Zinc: The company approved an interim dividend of Rs 18 per equity share on a face value of Rs 2 per share for FY22.

Brightcom Group: The company has entered into a definitive agreement to acquire 100 percent of Vuchi Media, operating under the brand name of MediaMint.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,584.97 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,605.81 crore in the Indian equity market on December 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Indiabulls Housing Finance - is under the F&O ban for December 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!