The market remained volatile on November 30, and finally settled with moderate losses with the Nifty50 breaching the crucial 17,000-mark at close for the first time since August 30, 2021. However, the broader markets outperformed benchmark indices by a wide margin, as the Nifty Midcap 100 and Smallcap 100 indices have gained 0.46 percent and 1.83 percent, respectively.

The BSE Sensex was down 195.71 points at 57,064.87, while the Nifty50 fell 70.80 points to 16,983.20 and formed a bearish candle on the daily charts. Banking & financials, Auto, and Metal stocks witnessed selling pressure.

"A small negative candle was formed on the daily chart with long upper shadow. Technically, this pattern signals sell-on-rise type action. Nifty showing lack of strength at the highs signals weak upside bounce in the market and one may expect Nifty to reverse down again and reach the lows of 16,782 levels in the short term," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said the negative chart pattern of lower highs and lower lows is intact on the daily chart and Tuesday's high of 17,324 could be considered as a new lower high of the sequence.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,834.84, followed by 16,686.47. If the index moves up, the key resistance levels to watch out for are 17,228.13 and 17,473.07.

Nifty Bank

The Nifty Bank corrected 281.15 points to close at 35,695.30 on November 30. The important pivot level, which will act as crucial support for the index, is placed at 35,223.06, followed by 34,750.83. On the upside, key resistance levels are placed at 36,470.86 and 37,246.43 levels.

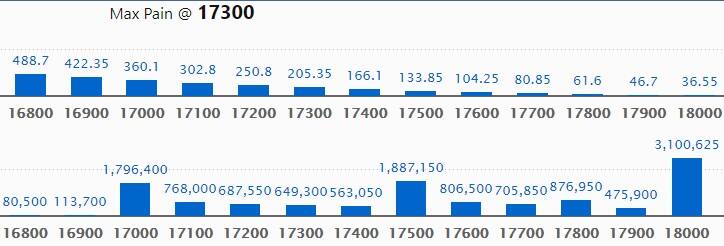

Call option data

Maximum Call open interest of 31 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17,500 strike, which holds 18.87 lakh contracts, and 17,000 strike, which has accumulated 17.96 lakh contracts.

Call writing was seen at 17,100 strike, which added 3.78 lakh contracts, followed by 17,200 strike which added 1.4 lakh contracts, and 17,800 strike which added 1.3 lakh contracts.

Call unwinding was seen at 17,500 strike, which shed 50,550 contracts, followed by 17,000 strike which shed 30,000 contracts.

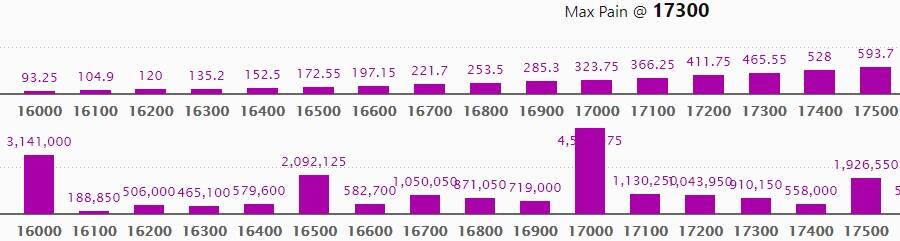

Put option data

Maximum Put open interest of 45.66 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the December series.

This is followed by 16,000 strike, which holds 31.41 lakh contracts, and 16,500 strike, which has accumulated 20.92 lakh contracts.

Put writing was seen at 16,700 strike, which added 3.39 lakh contracts, followed by 17,100 strike which added 3.29 lakh contracts and 17,000 strike which added 1.55 lakh contracts.

Put unwinding was seen at 17,600 strike, which shed 91,850 contracts, followed by 17,700 strike which shed 22,950 contracts, and 17,800 strike which shed 4,600 contracts.

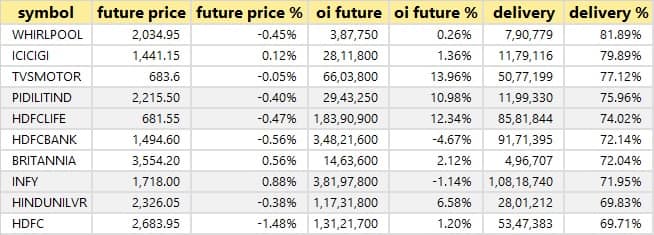

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

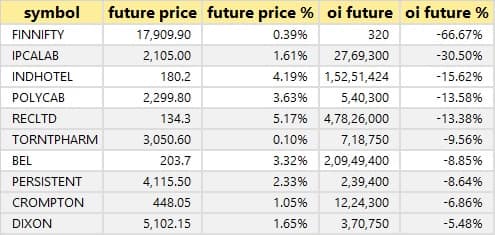

52 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

26 stocks saw long unwinding

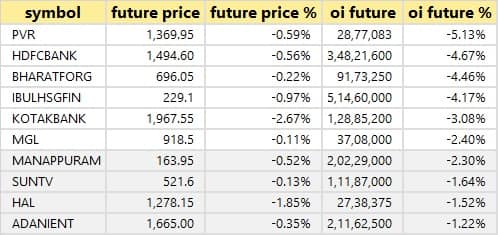

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

65 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

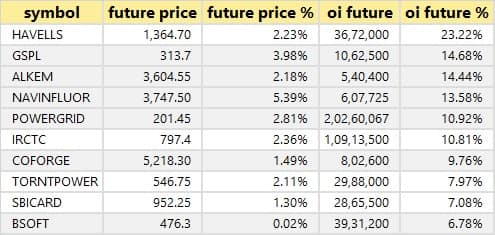

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

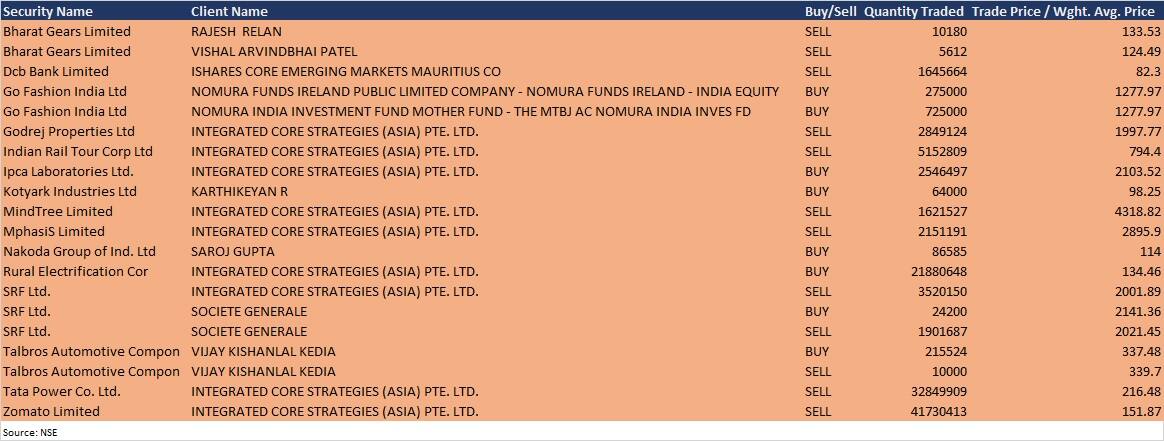

Bulk deals

DCB Bank: iShares Core Emerging Markets Mauritius Co sold 16,45,664 equity shares in the company at Rs 82.3 per share on the NSE, the bulk deal data showed.

Go Fashion India: Nomura Funds Ireland Public Limited Company - Nomura Funds Ireland - India Equity bought 2.75 lakh equity shares and Nomura India Investment Fund Mother Fund - The MTBJ AC Nomura India Inves FD acquired 7.25 lakh equity shares at Rs 1,277.97 per share on the NSE, the bulk deal data showed.

Godrej Properties: Integrated Core Strategies (Asia) Pte Ltd sold 28,49,124 equity shares in the company at Rs 1,997.77 per share on the NSE, the bulk deal data showed.

Indian Rail Tourism Corporation: Integrated Core Strategies (Asia) Pte Ltd sold 51,52,809 equity shares in the company at Rs 794.4 per share on the NSE, the bulk deal data showed.

Ipca Laboratories: Integrated Core Strategies (Asia) Pte Ltd acquired 25,46,497 equity shares in the company at Rs 2,103.52 per share on the NSE, the bulk deal data showed.

MindTree: Integrated Core Strategies (Asia) Pte Ltd sold 16,21,527 equity shares in the company at Rs 4,318.82 per share on the NSE, the bulk deal data showed.

MphasiS: Integrated Core Strategies (Asia) Pte Ltd offloaded 21,51,191 equity shares in the company at Rs 2,895.9 per share on the NSE, the bulk deal data showed.

Rural Electrification Corporation: Integrated Core Strategies (Asia) Pte Ltd bought 2,18,80,648 equity shares in the company at Rs 134.46 per share on the NSE, the bulk deal data showed.

SRF: Integrated Core Strategies (Asia) Pte Ltd sold 35,20,150 equity shares in the company at Rs 2,001.89 per share, and Societe Generale sold 18,77,487 equity shares in the company at Rs 2,021.45 per share on the NSE, the bulk deal data showed.

Talbros Automotive Components: Vijay Kishanlal Kedia bought 2,05,524 equity shares in the company at Rs 337.48 per share on the NSE, the bulk deal data showed.

Tata Power: Integrated Core Strategies (Asia) Pte Ltd sold 3,28,49,909 equity shares in the company at Rs 216.48 per share on the NSE, the bulk deal data showed.

Zomato: Integrated Core Strategies (Asia) Pte Ltd sold 4,17,30,413 equity shares in the company at Rs 151.87 per share on the NSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Themis Medicare: The company's officials will meet Lucky Securities on December 1.

Anupam Rasayan India: The company's officials will attend KIE's India Chemical Forum during December 1-3.

Globus Spirits: The company's officials will attend Motilal Oswal Ideation Conference on December 1.

CreditAccess Grameen: The company's officials will attend Motilal Oswal, Conference on December 1.

UltraTech Cement: The company's officials will meet Arga Investment Management LP, Public Sector Pension Investment Board, & Theleme Partners on December 1.

Jubilant Ingrevia: The company's officials will participate in 'Kotak - India Speciality Chemicals Forum' during December 1 - December 3.

TCS: The company's officials will meet Fidelity Management & Research (FMR) Hong Kong on December 2, and attend BNP Paribas India Virtual Investors Day on December 14.

Krsnaa Diagnostics: The company's officials will attend Motilal Oswal Ideation Conference on December 2.

Escorts: The company's officials will meet Wellington Management on December 2.

Delta Corp: The company's officials will attend Motilal Oswal Ideation Conference during December 1-3.

Stocks in News

Maruti Suzuki India: The company is expecting an adverse impact on vehicle production in December 2021 in both Haryana and its contract manufacturing company, Suzuki Motor Gujarat (SMG) in Gujarat, owing to a supply constraint of electronic components due to the semiconductor shortage situation. Though the situation is quite dynamic, it is currently estimated that the total vehicle production volume across both locations could be around 80-85 percent of normal production.

NTPC: Unit-4 of 250 MW capacity of Nabinagar Thermal Power Project (4X250 MW) of subsidiary Bhartiya Rail Bijlee Company is declared on commercial operation. With this, the commercial capacity of NTPC group will become 67,907.5 MW.

Hathway Cable & Datacom: The company has acquired balance 3.64% shares of subsidiary Hathway Kokan Crystal, for Rs 54,880. Now Hathway Kokan Crystal has become a wholly-owned subsidiary of the company.

Strides Pharma Science: SBI Funds Management sold 66,400 equity shares in the company via open market transactions on November 29, reducing shareholding to 5.42% from 5.50% earlier.

Rail Vikas Nigam: The company signed MoU with Economic Policy Research Institute of KYRGYZ Republic, Government of Kyrgyzstan, for development of railway corridor projects in Kyrgyz Republic specially to connect from Bishkek to Karakechenskoye.

NMDC: The company has fixed the price of lump ore (65.5%, 6-40mm) at Rs 5,200 per tonne, and fines (64%, -10mm) at Rs 4,560 per tonne.

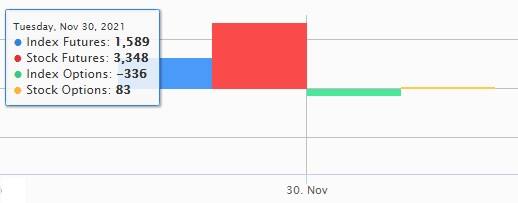

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 5,445.25 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 5,350.23 crore in the Indian equity market on November 30, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Indiabulls Housing Finance - is under the F&O ban for December 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!