The market snapped four-day losing streak and bounced back with half a percent gain on November 23, supported by buying in Metal, Pharma, PSU Bank, select banking & financials, Auto and FMCG stocks. It was partly led by short covering in the beaten down stocks.

The BSE Sensex rose 198.44 points to 58,664.33, while the Nifty50 was up 86.80 points at 17,503.30 and formed bullish candle on the daily charts as the closing was higher than opening levels.

"Nifty has formed a bullish candle on the daily chart representing a pullback rally along with a short covering at lower levels. Any sustainable move above 17,550 may extend the rally towards the 17,650-17,750 resistance zone. However, supply pressure around this resistance zone cannot be ruled out," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further says Nifty is trading below 20 and 50-day SMA (simple moving average) representing near-term bearish bias. According to him, if Nifty sustains below 17,550 then it may slip further towards 17,600-16,700 in the near term while on the higher side 17,700-17,800 levels are likely to act as stiff resistance for any pullback in near future.

One should use any pullback towards 17,650-17,750 as a selling opportunity with a stop loss of 17,850, Palviya advised.

The broader markets also rebounded quite sharply after steep fall in past few sessions. The Nifty Midcap 100 and Smallcap 100 indices gained 1.76 percent and 1.91 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,295.03, followed by 17,086.77. If the index moves up, the key resistance levels to watch out for are 17,632.63 and 17,761.96.

Nifty Bank

The Nifty Bank was up 144 points at 37,272.80 on November 23. The important pivot level, which will act as crucial support for the index, is placed at 36,797.33, followed by 36,321.87. On the upside, key resistance levels are placed at 37,598.53 and 37,924.27 levels.

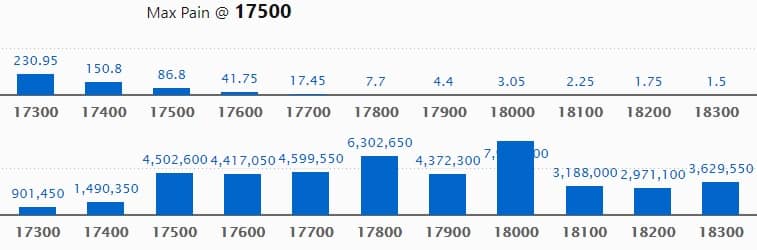

Call option data

Maximum Call open interest of 79.39 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the November series.

This is followed by 17800 strike, which holds 63.02 lakh contracts, and 17700 strike, which has accumulated 45.99 lakh contracts.

Call writing was seen at 17500 strike, which added 11.99 lakh contracts, followed by 17200 strike, which added 1.35 lakh contracts and 17100 strike which added 1.1 lakh contracts.

Call unwinding was seen at 18200 strike, which shed 12.43 lakh contracts, followed by 18300 strike, which shed 12.23 lakh contracts, and 18100 strike which shed 7.78 lakh contracts.

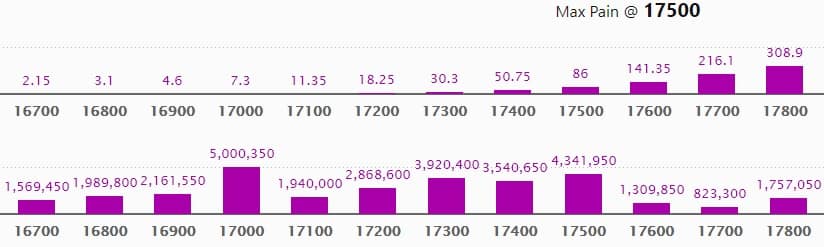

Put option data

Maximum Put open interest of 50 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the November series.

This is followed by 17500 strike, which holds 43.41 lakh contracts, and 17300 strike, which has accumulated 39.20 lakh contracts.

Put writing was seen at 17500 strike, which added 20.43 lakh contracts, followed by 17300 strike which added 11.7 lakh contracts and 17000 strike which added 10.12 lakh contracts.

Put unwinding was seen at 17700 strike, which shed 4.03 lakh contracts, followed by 17800 strike which shed 3.49 lakh contracts, and 18000 strike which shed 2.29 lakh contracts.

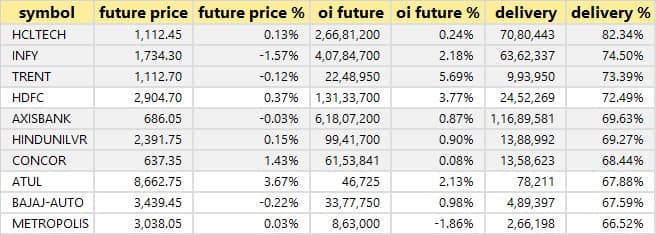

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

77 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

5 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 5 stocks in which long unwinding was seen.

23 stocks saw short build-up

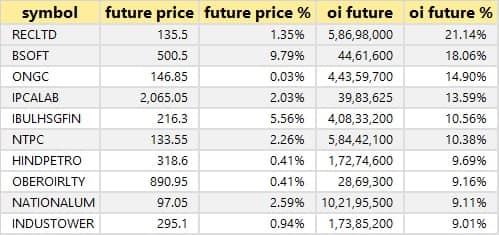

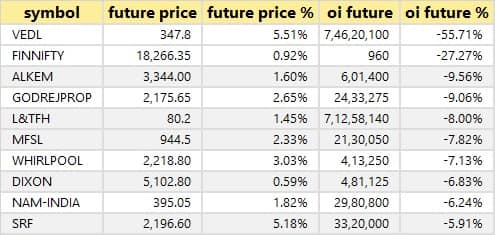

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

83 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

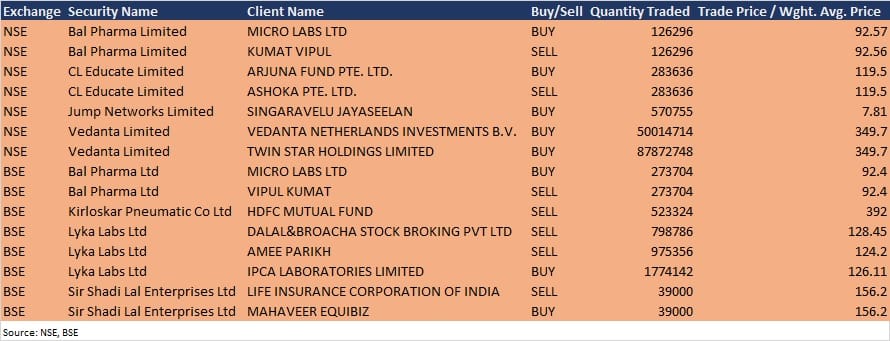

Bulk deals

Bal Pharma: Micro Labs acquired 1,26,296 equity shares in the company at Rs 92.57 per share, however, Kumat Vipul sold same number of shares, at Rs 92.56 per share on the NSE. Micro Labs bought 2,73,704 equity shares in the said company at Rs 92.4 per share, however, Vipul Kumat sold same number of shares at same price, the bulk deals data showed.

Vedanta: Promoters Vedanta Netherlands Investments B.V. acquired 5,00,14,714 equity shares and Twin Star Holdings bought 8,78,72,748 equity shares in the company at Rs 349.7 per share on the NSE, the bulk deals data showed.

Kirloskar Pneumatic: HDFC Mutual Fund sold 5,23,324 equity shares in the company at Rs 392 per share on the BSE, the bulk deals data showed.

Lyka Labs: Ipca Laboratories acquired 17,74,142 equity shares in the company at Rs 126.11 per share, however, Dalal&Broacha Stock Broking sold 7,98,786 equity shares at Rs 128.45 and Amee Parikh offloaded 9,75,356 equity shares at Rs 124.2 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Nuvoco Vistas Corporation: The company's officials will meet BNP Paribas MF, and Elara Securities on November 24.

UltraTech Cement: The company's officials will meet Aditya Birla Sun Life Insurance, and Point 72 Asset Management on November 24.

Gokaldas Exports: The company's officials will meet SBI MF on November 24.

Banswara Syntex: The company's officials will meet analysts and investors on November 24.

Radico Khaitan: The company's officials will meet Capital Investment Trust Fuh Hwa Investment Sparx Asset Management on November 25.

Stove Kraft: The company's officials will meet analysts and investors on November 25.

Butterfly Gandhimathi Appliances: The company's officials will meet IDFC Mutual Fund on November 25.

Blue Star: The company's officials will meet Hillfort Capital & IIFL Securities on November 25, and Capital Global on November 30.

IIFL Finance: The company's officials will meet Phillip Capital on November 26.

Agro Tech Foods: The company's officials will meet investors and analysts on November 30.

Infosys: The company's officials will participate in Jefferies India ESG Summit 2.0 on December 2.

Stocks in News

Himadri Speciality Chemical: ICRA has downgraded the long-term rating to A+ from AA-, and also downgraded the short term rating to A1 from A1+. The outlook on the long-term rating has been revised to Stable from Negative.

Poonawalla Fincorp: Sanjay Chamria, Executive Vice Chairman of the company has stepped down from the board of directors of the company after serving as the co-founder since inception of the company.

Polo Queen Industrial and Fintech: The company approved sub-division of one equity shares of face value of Rs 10 each into five equity shares of face value of Rs 2 each.

Srikalahasthi Pipes: National Company Law Tribunal approved the Scheme of Amalgamation of the company with Electrosteel Castings with effect from the appointed date of October 1, 2020.

Balaji Amines: Production in the DMF plant has started after carrying out all the rectifications. On October 6, the DMF plant was shutdown because of a minor incident.

Coal India: The board meeting of the company will be held on November 29 to consider and approve payment of interim dividend for 2021-22, if any.

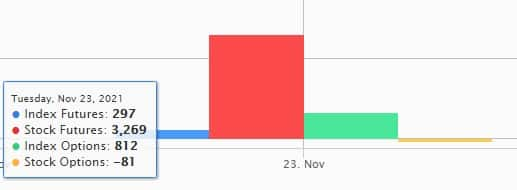

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 4,477.06 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,412.05 crore in the Indian equity market on November 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Escorts, and Vodafone Idea - are under the F&O ban for November 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!