The market remained highly volatile throughout the session and finally settled with more than six-tenth of a percent lower on November 16, dragged by banking & financials, FMCG, Metals, and Pharma stocks. However, Auto, and select IT stocks bucked the trend.

The BSE Sensex dropped 396.34 points to 60,322.37, while the Nifty50 closed tad below crucial 18,000 mark, falling 110.30 points to 17,999.20, and formed bearish candle on the daily charts.

"A long negative candle was formed on the daily chart, which indicates downward correction in the Nifty within a broader high low range of 18,200-17,800 levels. Monday's high of 18,210 could now be considered as a new higher top of this positive sequence. As per this pattern, one may expect Nifty to find support around 17,800-17,850 levels in the next few sessions as higher low formation," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

According to him, any weakness below 17,800 could retest the last swing low of 17,600 levels. "As long as the minor positive chart pattern of higher tops and bottoms is intact, there is a hopes of upside bounce from the lows," he said.

The broader markets saw a mixed trend for the second consecutive session. The Nifty50 Midcap 100 index was down 0.27 percent and Smallcap 100 index gained half a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,927.77, followed by 17,856.33. If the index moves up, the key resistance levels to watch out for are 18,101.66 and 18,204.13.

Nifty Bank

The Nifty Bank fell more than the benchmark index Nifty50, declining 395.20 points or 1 percent to 38,307.10 on November 16. The important pivot level, which will act as crucial support for the index, is placed at 38,103.9, followed by 37,900.7. On the upside, key resistance levels are placed at 38,617.5 and 38,927.9 levels.

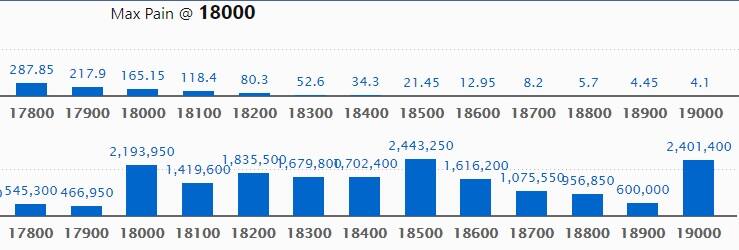

Call option data

Maximum Call open interest of 24.43 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the November series.

This is followed by 19000 strike, which holds 24.01 lakh contracts, and 18000 strike, which has accumulated 21.93 lakh contracts.

Call writing was seen at 18000 strike, which added 3.66 lakh contracts, followed by 18100 strike, which added 3.54 lakh contracts and 18200 strike which added 3.24 lakh contracts.

Call unwinding was seen at 18700 strike, which shed 2.42 lakh contracts, followed by 19000 strike which shed 74,700 contracts and 18900 strike which shed 39,050 contracts.

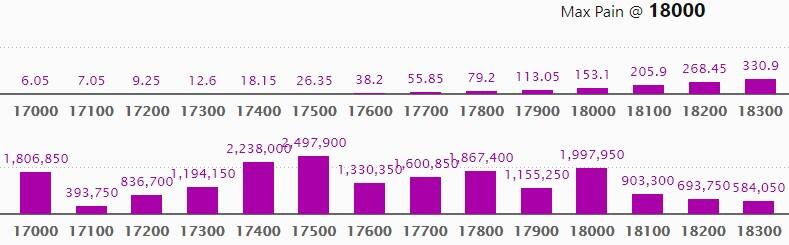

Put option data

Maximum Put open interest of 24.97 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the November series.

This is followed by 17400 strike, which holds 22.38 lakh contracts, and 18000 strike, which has accumulated 19.97 lakh contracts.

Put writing was seen at 17400 strike, which added 3.04 lakh contracts, followed by 17700 strike which added 1.24 lakh contracts and 17600 strike which added 1.13 lakh contracts.

Put unwinding was seen at 17300 strike, which shed 1.23 lakh contracts, followed by 18200 strike which shed 87,850 contracts, and 18100 strike which shed 55,500 contracts.

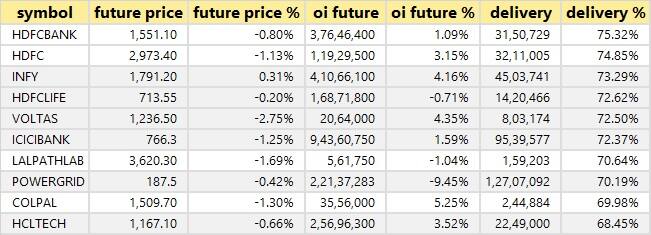

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

31 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

47 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

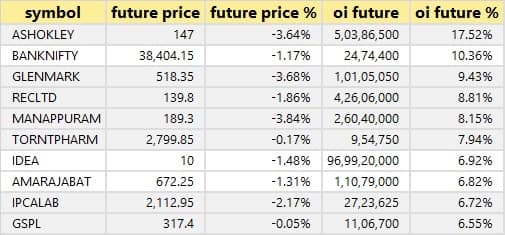

78 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

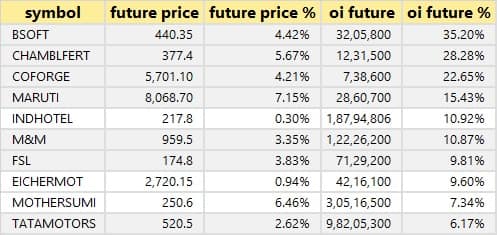

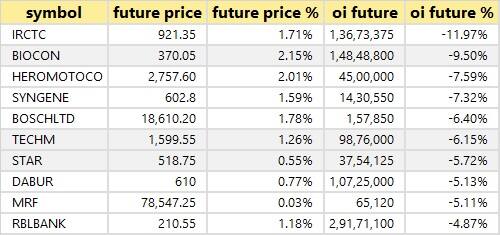

34 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

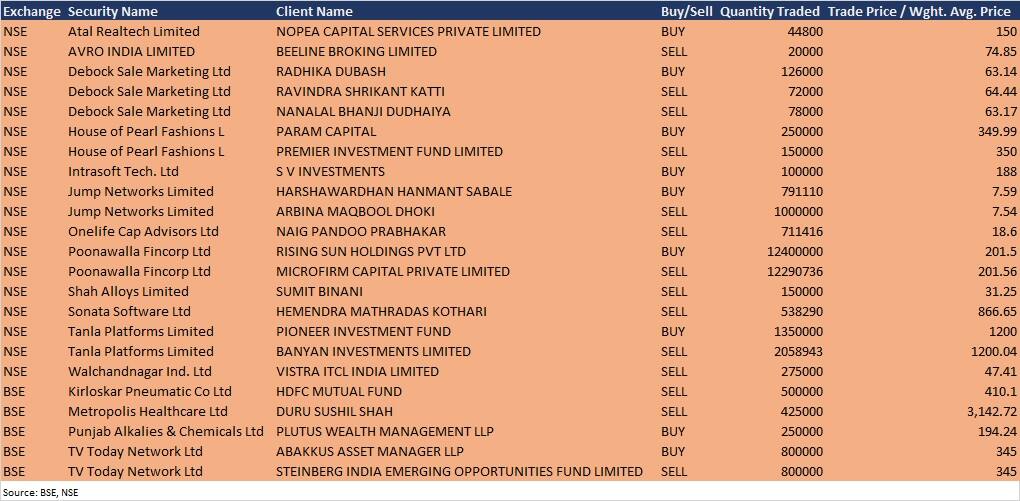

Bulk deals

House of Pearl Fashions: Param Capital acquired 2.5 lakh equity shares in the company at Rs 349.99 per share, however, Premier Investment Fund sold 1.5 lakh shares in the company at Rs 350 per share on the NSE, the bulk deal data showed.

Intrasoft Technologies: S V Investments bought 1 lakh equity shares in the company at Rs 188 per share on the NSE, the bulk deals data showed.

Onelife Capital Advisors: Promoter Naig Pandoo Prabhakar sold 7,11,416 equity shares in the company at Rs 18.6 per share on the NSE, the bulk deals data showed.

Poonawalla Fincorp: Rising Sun Holdings Pvt Ltd acquired 1.24 crore equity shares in the company at Rs 201.5 per share, whereas Microfirm Capital Private Limited sold 1,22,90,736 equity shares in the company at Rs 201.56 per share on the NSE, the bulk deals data showed. Both are promoters.

Sonata Software: Investor Hemendra Mathradas Kothari sold 5,38,290 equity shares in the company at Rs 866.65 per share on the NSE, the bulk deals data showed.

Tanla Platforms: Pioneer Investment Fund bought 13.5 lakh equity shares in the company at Rs 1,200 per share, however, Banyan Investments sold 20,58,943 equity shares in the company at Rs 1,200.04 per share on the NSE, the bulk deals data showed.

Kirloskar Pneumatic: HDFC Mutual Fund sold 5 lakh equity shares in the company at Rs 410.1 per share on the BSE, the bulk deals data showed.

Metropolis Healthcare: Promoter Duru Sushil Shah sold 4.25 lakh equity shares in the company at Rs 3,142.72 per share on the BSE, the bulk deals data showed.

Punjab Alkalies & Chemicals: Plutus Wealth Management LLP acquired 2.5 lakh equity shares in the company at Rs 194.24 per share on the BSE, the bulk deals data showed.

TV Today Network: Sunil Singhania-owned Abakkus Asset Manager LLP bought 8 lakh equity shares in the company at Rs 345 per share, whereas Steinberg India Emerging Opportunities Fund was the seller on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

NIIT: The company's officials will meet investors at Spark Capital's Annual CHAMPS Conference on November 17.

Nuvoco Vistas Corporation: The company's officials will meet Nirmal Bang & Dolat Capital Research and Development on November 17.

Mold-Tek Packaging: The company's officials will meet Ashmore & Kotak MF on November 17.

UltraTech Cement: The company's officials will meet GAM Investments, & attend HSBC Virtual Asia Credit Tour conference on November 17.

Neuland Laboratories: The company's officials will attend B&K Securities - Periscope Conference 2021, & Spark Capital Conference on November 17.

Jindal Stainless: The company's officials will meet Centrum Broking and B&K Securities India on November 17.

Somany Ceramics: The company's officials will attend B&K Securities - Periscope Conference 2021 on November 17.

Gujarat Pipavav Port: The company's officials will meet Bajaj Allianz Life Insurance Company, L&T Mutual Fund, Birla Sun Life Insurance Company, Canara HSBC Life Insurance Company, and BNP Paribas India on November 17.

Matrimony.com: The company's officials will attend Batlivala & Karani Securities India Pvt. Ltd - Periscope Conference 2021 on November 18.

CRISIL: The company's officials will meet Monarch Networth Capital Limited on November 18.

Stocks in News

Parag Milk Foods: Investcorp Infrastructure Fund 1 (formerly IDFC Infrastructure Fund 3) sold 2% stake in the company via open market transactions, reducing shareholding to 3.29% from 5.29% earlier.

Biocon: Subsidiary Biocon Biologics, and Viatris launched interchangeable biosimilars SEMGLEE (insulin glargineyfgn) injection, a branded product, and Insulin Glargine (insulin glargine-yfgn) injection, an unbranded product, to help control high blood sugar in adult and pediatric patients with type 1 diabetes and adults with type 2 diabetes, in the US.

Grindwell Norton: The company has made an investment of Rs 15 lakh in Cleanwin Energy Three LLP towards power purchase.

Tourism Finance Corporation of India: The company, on November 22, will consider the issuance of Non-Convertible Debentures to be issued on private placement basis.

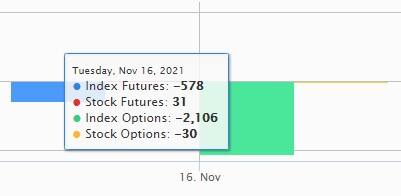

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 560.67 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 577.34 crore in the Indian equity market on November 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Seven stocks - BHEL, Indiabulls Housing Finance, IRCTC, NALCO, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for November 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!