The market after the initial hour of gains remained rangebound and closed with moderate losses on November 2 as traders and investors look cautious ahead of the Federal Reserve meeting conclusion, dented by select IT, FMCG, Pharma and Metal stocks.

The BSE Sensex was down 109.40 points at 60,029.06, while the Nifty50 shed 40.70 points to 17,889 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"A small negative candle was formed on the daily chart, which signals breather of recent upmove. The positivity created after a sharp upside bounce recently is still intact and further upside from here is likely to negate the short term negative chart pattern. Tuesday's small range candle was formed near the crucial overhead resistance of 18,050, as per the concept of change in polarity," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Though Nifty declined marginally on Tuesday, the overall market breadth was positive and the outperformance was seen in the broad market indices. This is a positive indication, he feels. The Nifty Midcap 100 and Smallcap 100 indices gained 0.83 percent and 1.02 percent respectively.

Overall, "the underlying trend of Nifty remains positive and the immediate resistance of 18,050 is expected to be taken out on the upside soon. A sustainable upmove above the immediate hurdle could pull Nifty towards the next resistance of 18,300 levels," said Shetti.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,820.27, followed by 17,751.63. If the index moves up, the key resistance levels to watch out for are 17,984.87 and 18,080.83.

Nifty Bank

The Nifty Bank climbed 174.65 points to 39,938.40 on November 2. The important pivot level, which will act as crucial support for the index, is placed at 39,650.2, followed by 39,362.0. On the upside, key resistance levels are placed at 40,167.1 and 40,395.8 levels.

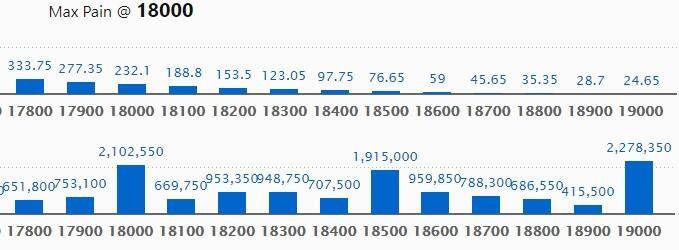

Call option data

Maximum Call open interest of 22.78 lakh contracts was seen at 19000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18000 strike, which holds 21.02 lakh contracts, and 18500 strike, which has accumulated 19.15 lakh contracts.

Call writing was seen at 17900 strike, which added 2.1 lakh contracts, followed by 18000 strike, which added 1.91 lakh contracts and 18500 strike which added 1.22 lakh contracts.

Call unwinding was seen at 17800 strike, which shed 1.38 lakh contracts, followed by 17700 strike which shed 75,550 contracts and 17600 strike which shed 15,450 contracts.

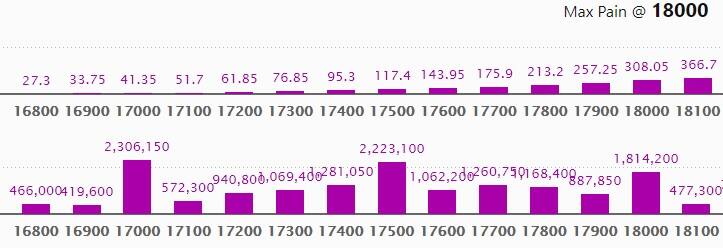

Put option data

Maximum Put open interest of 23.06 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the November series.

This is followed by 17500 strike, which holds 22.23 lakh contracts, and 18000 strike, which has accumulated 18.14 lakh contracts.

Put writing was seen at 17900 strike, which added 2.24 lakh contracts, followed by 17000 strike which added 1.4 lakh contracts and 17500 strike which added 1.15 lakh contracts.

Put unwinding was seen at 17800 strike, which shed 1.27 lakh contracts, followed by 17700 strike which shed 68,750 contracts, and 17400 strike which shed 19,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

51 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

34 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

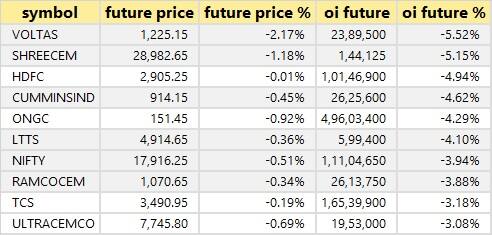

64 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

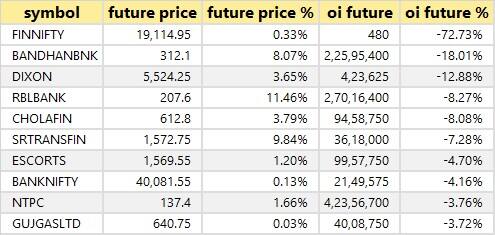

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

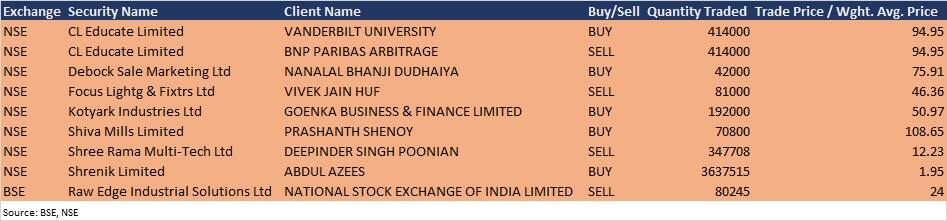

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting & Results Calendar

November 3: State Bank of India, Eicher Motors, Aditya Birla Fashion and Retail, Bata India, DCM Shriram Industries, GPT Infraprojects, Grindwell Norton, Gujarat State Petronet, Gujarat Alkalies & Chemicals, Likhitha Infrastructure, Pfizer, RattanIndia Power, Sharon Bio-Medicine, and Uflex will release September quarter earnings on November 3.

GE Power India: The company's officials will meet investors and analysts on November 3 to discuss financial results.

Syngene International: The company's officials will meet Arohi Asset Management on November 3.

Infibeam Avenues: The company's officials will meet Motilal Oswal Securities on November 3.

Bharat Heavy Electricals: The company's officials will meet analysts and investors on November 9 to discuss financial results.

Havells India: The company's officials will participate in a group conference meeting arranged by BofA Securities India on November 10.

OnMobile Global: The company's officials will meet investors and analysts on November 10 to discuss its performance.

Godrej Consumer Products: The company's officials will meet investors and analysts on November 11 to discuss Q2FY22 results.

Tech Mahindra: The company's officials will meet investors in its Investor Day 2021 on November 11.

Galaxy Surfactants: The company's officials will meet investors on November 11.

Stocks in News

Infosys: Infosys Finacle and IBM collaborated to help banks accelerate cloud transformation journeys.

Wipro: Wipro partnered with TEOCO to develop next-generation network solutions for communication service providers.

eClerx Services: The company reported a sharply higher profit at Rs 100.7 crore in Q2FY22 against Rs 61.4 crore in Q2FY21, revenue jumped to Rs 523.2 crore from Rs 360.7 crore YoY.

Century Plyboards: The company reported a sharply higher profit after tax of Rs 99 crore in Q2FY22 against Rs 50.2 crore in Q2FY21. Revenue spiked to Rs 813.6 crore from Rs 522.2 crore YoY.

Minda Corporation: The company reported a higher profit at Rs 39.1 crore in Q2FY22 against Rs 25.8 crore in Q2FY21; revenue climbed to Rs 731.3 crore from Rs 656.1 crore YoY.

Bharti Airtel: The telecom operator reported a higher profit at Rs 1,134 crore in Q2FY22 against Rs 283.5 crore in Q1FY22; revenue rose to Rs 28,326.4 crore from Rs 26,853.6 crore YoY.

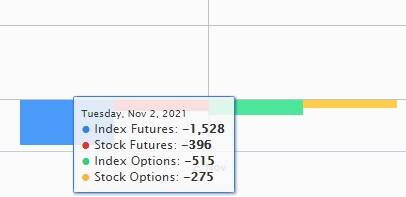

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 244.87 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 6.00 crore in the Indian equity market on November 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Punjab National Bank and Escorts - are under the F&O ban for November 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!