The market ended the volatile session on a positive note, continuing an uptrend for the fourth consecutive day on October 12, supported by Reliance Industries, select banking and financials, and FMCG stocks.

The benchmark indices as well as broader markets ended at record closing highs. The BSE Sensex remained strongly above the 60,000 mark, rising 148.53 points to 60,284.31, while the Nifty50 hit the 18,000 mark for the first time on Tuesday, climbing 46 points to close at 17,992.

"It was a volatile session for the markets but bulls gained strength in late trades as Nifty once again breached the 18,000 mark before ending a tad lower below the psychological mark. On daily and intraday charts, Nifty has formed a promising higher bottom formation," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

He further said the intraday structure suggests 17,850 could be the trend decider level for the bulls. "Above the same, the uptrend formation is likely to continue up to 18,050-18,125 levels. On the flip side, below 17,850, the uptrend would be vulnerable," he noted.

The Nifty Midcap 100 and Smallcap 100 indices gained 0.55 percent and 0.8 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,901.63, followed by 17,811.37. If the index moves up, the key resistance levels to watch out for are 18,045.43 and 18,098.96.

Nifty Bank

The Nifty Bank rose 227.70 points to close at 38,521.50 on October 12. The important pivot level, which will act as crucial support for the index, is placed at 38,240.87, followed by 37,960.23. On the upside, key resistance levels are placed at 38,705.87 and 38,890.23 levels.

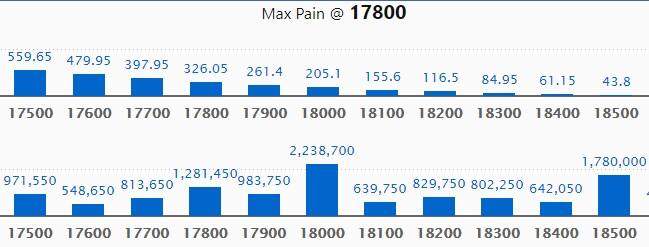

Call option data

Maximum Call open interest of 22.38 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the October series.

This is followed by 18500 strike, which holds 17.80 lakh contracts, and 17800 strike, which has accumulated 12.81 lakh contracts.

Call writing was seen at 18100 strike, which added 90,800 contracts, followed by 18000 strike, which added 67,850 contracts and 18500 strike which added 24,000 contracts.

Call unwinding was seen at 17800 strike, which shed 2.76 lakh contracts, followed by 18400 strike, which shed 81,900 contracts, and 18200 strike which shed 74,050 contracts.

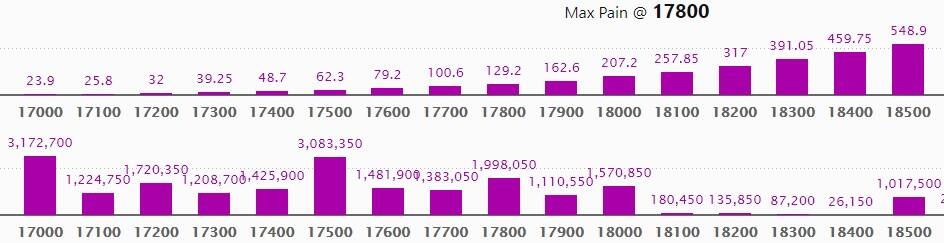

Put option data

Maximum Put open interest of 31.72 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the October series.

This is followed by 17500 strike, which holds 30.83 lakh contracts, and 17800 strike, which has accumulated 19.98 lakh contracts.

Put writing was seen at 17400 strike, which added 1.42 lakh contracts, followed by 17200 strike which added 92,850 contracts and 17100 strike which added 68,300 contracts.

Put unwinding was seen at 17800 strike, which shed 1.33 lakh contracts, followed by 18100 strike which shed 38,100 contracts, and 18000 strike which shed 37,750 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

59 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

22 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

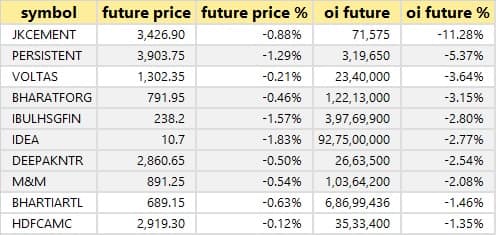

47 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

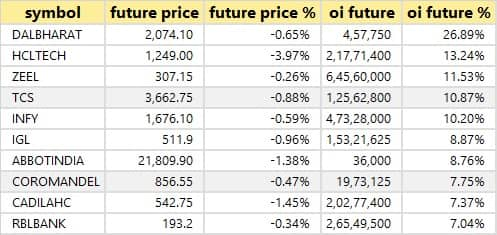

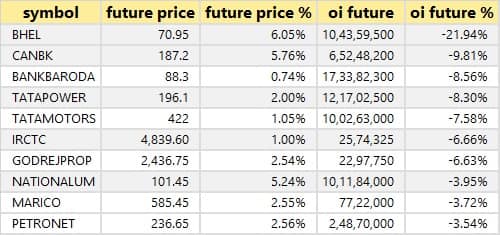

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

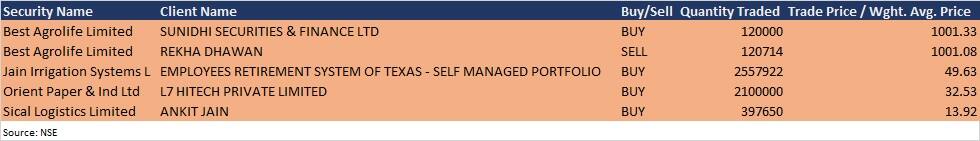

Bulk deals

Jain Irrigation Systems: Employees Retirement System of Texas - Self Managed Portfolio acquired 25,57,922 equity shares in the company at Rs 49.63 per share on the NSE, the bulk deals data showed.

Orient Paper & Industries: L7 Hitech acquired 21 lakh equity shares in the company at Rs 32.53 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting & Results Calendar

Results on October 13: Infosys, Wipro, Mindtree, Advik Laboratories, Aditya Birla Money, Morarka Finance, National Standard, Perfect-Octave Media Projects, Plastiblends India, Raghav Productivity Enhancers, SDC Techmedia, Sanathnagar Enterprises, Stratmont Industries, and Unistar Multimedia will release quarterly earnings on October 13.

Fermenta Biotech: The company's officials will meet analysts and institutional investors on October 13 to discuss the investor presentation.

ICICI Prudential Life Insurance Company: The company's officials will meet analysts and investors on October 19 to discuss the performance of the company for H1-FY2022.

Gateway Distriparks: The company's officials will meet investors and analysts on October 21 post quarterly earnings.

Agro Tech Foods: The company's officials will meet analysts and investors on October 22 post financial results.

Apar Industries: The company's officials will meet analysts and investors in the earnings call for Q2 FY22 results on November 2.

Stocks in News

Tata Motors: The company approved incorporation of a wholly owned subsidiary (TML EVCo), to undertake its passenger electric mobility business; and execution of a Securities Subscription Agreement with India Markets Rio Pte Ltd, an entity affiliated with TPG Rise Climate which will invest Rs 7,500 crore in TML EVCo.

Choice International: The company acquired the mutual fund distribution business of Centcart Money Services by the company's step-down subsidiary Choice Wealth.

Centrum Capital: The Reserve Bank of India issued a licence to Unity Small Finance Bank, a step-down subsidiary of the company, to carry on small finance bank business.

Power Finance Corporation: The Government of India granted Maharatna Status to Power Finance Corporation.

Bajaj Finserv: Trustee company under the name of Bajaj Finserv Mutual Fund Trustee Limited has been incorporated as a wholly owned subsidiary of the company.

IndusInd Bank: The bank has been authorised by the RBI to collect Direct and Indirect Taxes, on behalf of the Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes and Customs (CBIC).

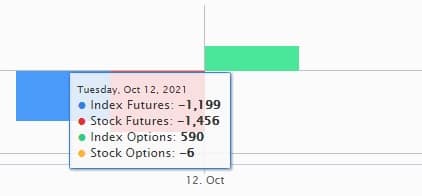

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 278.32 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 741.22 crore in the Indian equity market on October 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Seven stocks - Bank of Baroda, Indiabulls Housing Finance, IRCTC, NALCO, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for October 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!