The market had another strong session on October 5 as the benchmark indices seem to have started recouping losses seen in previous week. Buying in IT, select banking & financials, and auto stocks supported the market.

The BSE Sensex climbed 445.56 points to 59,744.88, while the Nifty50 jumped 131 points to 17,822.30 and formed a bullish candle on the daily charts for the second consecutive day.

"The market remained optimistic ahead of the start of the earnings season even as global cues were not supportive. On daily charts, based on post reversal formation, the index has formed uptrend continuation formation while on intraday charts it has formed promising higher high and higher low series formation which clearly support further uptrend," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

He further said 17,750 would be the key support level for the trend following traders. "If the index rises above the same, the uptrend texture is likely to continue up to 17,880-17,900 levels. On the flip side, below 17,750, it may trigger quick intraday correction up to 17,710."

The broader markets also continued uptrend with the Nifty Midcap 100 and Smallcap 100 indices gaining 0.4 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,697.67, followed by 17,573.03. If the index moves up, the key resistance levels to watch out for are 17,890.17 and 17,958.03.

Nifty Bank

The Nifty Bank jumped 161.35 points to close at 37,741 on October 5. The important pivot level, which will act as crucial support for the index, is placed at 37,475, followed by 37,209. On the upside, key resistance levels are placed at 37,896.8 and 38,052.6 levels.

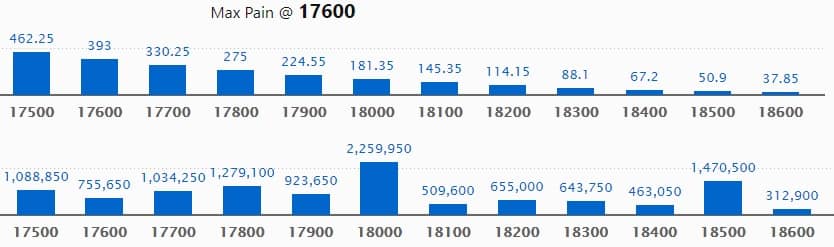

Call option data

Maximum Call open interest of 22.59 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the October series.

This is followed by 18,500 strike, which holds 14.70 lakh contracts, and 17,800 strike, which has accumulated 12.79 lakh contracts.

Call writing was seen at 17,800 strike, which added 1.43 lakh contracts, followed by 18,300 strike, which added 1.1 lakh contracts and 18,000 strike which added 72,350 contracts.

Call unwinding was seen at 17,700 strike, which shed 1.15 lakh contracts, followed by 17,600 strike, which shed 85,550 contracts, and 17,500 strike which shed 38,000 contracts.

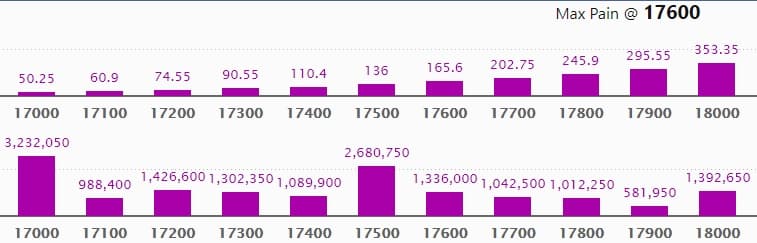

Put option data

Maximum Put open interest of 32.32 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the October series.

This is followed by 17,500 strike, which holds 26.80 lakh contracts, and 17,200 strike, which has accumulated 14.26 lakh contracts.

Put writing was seen at 17,800 strike, which added 1.61 lakh contracts, followed by 17,500 strike which added 1.29 lakh contracts and 17,900 strike which added 49,350 contracts.

Put unwinding was seen at 17,000 strike, which shed 79,200 contracts.

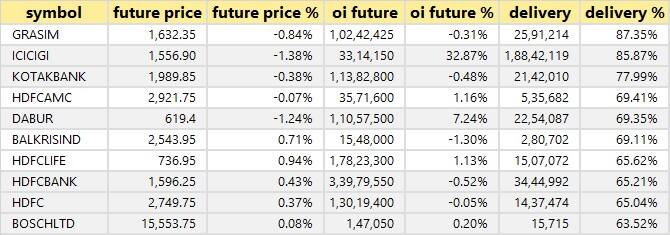

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

72 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

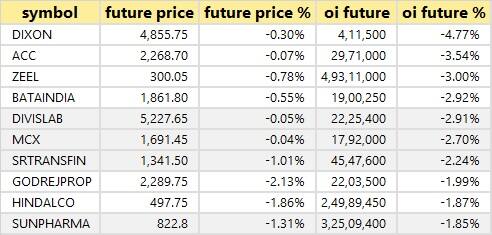

21 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

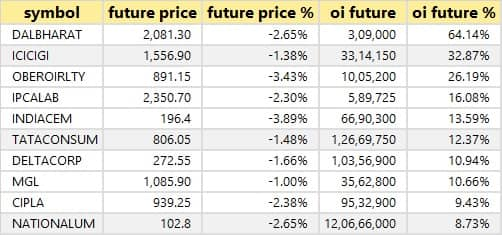

50 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

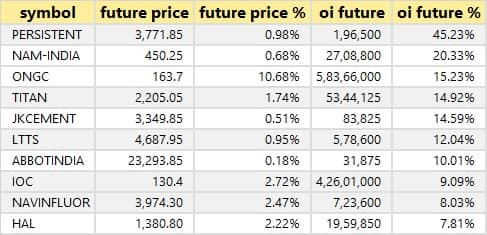

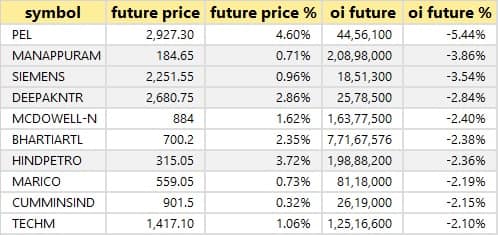

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

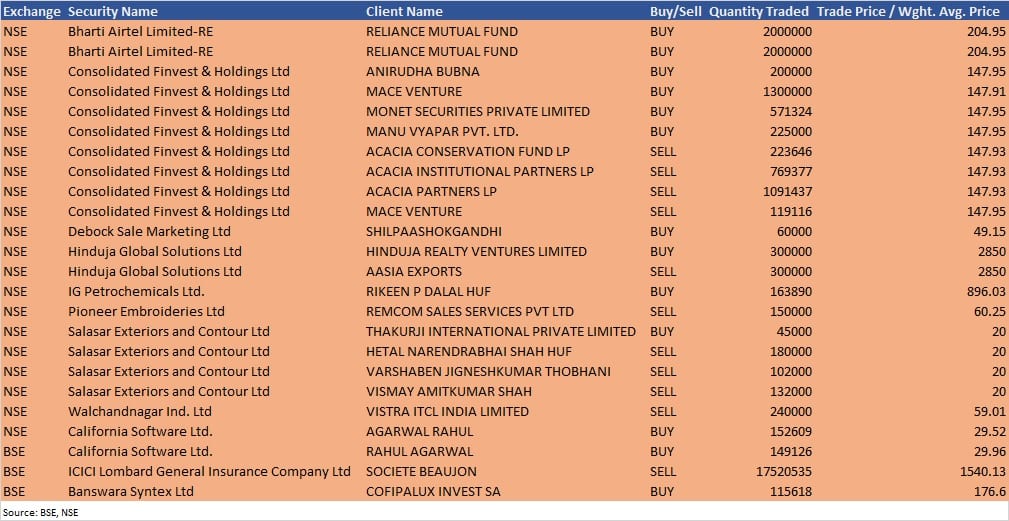

Bulk deals

Bharti Airtel (Rights Entitlement): Reliance Mutual Fund acquired 20 lakh shares each at Rs 204.95 per share via two bulk deals on the NSE.

Consolidated Finvest & Holdings: ACACIA Conservation Fund LP sold 2,23,646 equity shares, ACACIA Institutional Partners LP 7,69,377 equity shares and ACACIA Partners LP sold 10,91,437 equity shares in the company at Rs 147.93 per share on the NSE. However, Anirudha Bubna acquired 2 lakh equity shares at Rs 147.95 per share, Mace Venture net bought 11,80,884 equity shares at Rs 147.91 per share, Monet Securities purchased 5,71,324 equity shares at Rs 147.95 per share and Manu Vyapar Pvt Ltd bought 2.25 lakh shares at Rs 147.95 per share on the NSE, the bulk deals data showed.

IG Petrochemicals: Rikeen P Dalal HUF bought 1,63,890 equity shares in the company at Rs 896.03 per share on the NSE, the bulk deal data showed.

California Software: Rahul Agarwal acquired 1,52,609 equity shares in the company at Rs 29.52 per share on the NSE, and 1,49,126 shares at Rs 29.96 per share on the BSE, the bulk deal data showed.

ICICI Lombard General Insurance Company: Societe Beaujon sold 1,75,20,535 equity shares in the company at Rs 1,540.13 per share on the BSE, the bulk deal data showed.

Banswara Syntex: Cofipalux Invest SA acquired additional 1,15,618 equity shares in the company at Rs 176.6 per share on the BSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

HSIL: The company's officials will meet Dolat Capital Market on October 6.

Radico Khaitan: The company's officials will meet Tokio Marine Asset Management on October 7.

Tata Coffee: The company's officials will meet analysts on October 19 to discuss financial results.

Stocks in News

Phillips Carbon Black: The company closed its qualified institutional placement issue and raised Rs 400 crore by issuing over 1.63 crore shares at Rs 244 per share.

Gateway Distriparks: Amansa Holdings & Amansa Investments sold over 4.79 lakh equity shares in the company via open market transactions on October 1, reducing shareholding to 6.31% from 6.69% earlier.

Marico: Revenue growth in September 2021 quarter was in the low twenties, with volume growth close to double-digits on a 2-year CAGR basis. The International business delivered double digit constant currency growth as the company witnessed positive trends in all markets, except Vietnam.

Godrej Consumer Products: In India, the company expect close to a double-digit sales growth, driven largely by volume growth and calibrated price increases in Q2FY22. It witnessed broad-based sales growth in home care and personal care categories. In Indonesia, it expects a marginal decline in constant currency sales, impacted by challenging macroeconomic variables, a gradual recovery in the Air Fresheners category, and high competitive intensity in the Wet Wipes category.

Future Retail: The company terminated Master Franchise Agreement with 7-Eleven stores, citing the inability to meet the target of opening stores and payment of franchisee fees.

Jammu & Kashmir Bank: the Reserve Bank of India extended the term of R K Chhibber, Chairman and Managing Director of the bank by a further period of six months.

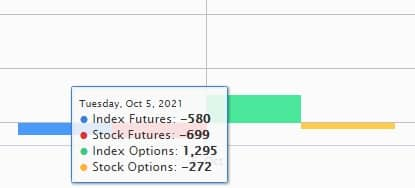

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,915.08 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,868.23 crore in the Indian equity market on October 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - NALCO - is under the F&O ban for October 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!